Weekend Reading – Sequence of Returns Risk

Hey Folks!

Welcome to some new Weekend Reading about an important subject: sequence of returns risk. This subject is essential to understand if you are considering semi-retirement like I am or full-retirement at any age.

I’ll highlight a few considerations as part of this edition thanks to a recent reader email instead of my usual links/updates.

First up, a recent read on my site – a new income milestone was realized in 2024! Whoot!

Weekend Reading – Sequence of Returns Risk

There is already so much on this subject (more at the end) but I’ll summarize the challenges and mitigations I personally see in combating some sequence of returns risks in this edition – including what I intend to do.

I welcome your comments and thoughts as always…

OK, to start, investing can work both ways:

- You retire, markets go up for a few years during retirement.

- You retire, markets go down for a few years during retirement.

The former is easy, right?

Everyone can live with 7-10% returns year-after-year.

At least they should.

The greatest investor of our time is happy with 7-10% returns so you and I need to be as well.

The problem is, while stock markets do go up about 70% of the time, sometimes they go down – and they can go down and stay down for a bit too.

Experienced investors don’t need tons of charts to tell you this is true. Check out the link above for the data and research if you haven’t experienced a major market meltdown yet.

Timing in life and with your retirement income plan – matters

I don’t have 100% cash in my portfolio and I bet you don’t either. Since a retirement portfolio is not just cash savings alone, you can appreciate that if your portfolio drops a lot in value, while you are taking money of your the portfolio at the same time, that can scramble your retirement income plan and leave you with less money to spend as you age.

For anyone drawing down their portfolio in retirement, I believe a bad set of market returns can be a admirable foe to fight.

Any portfolio down in value, without a cash wedge as just one mitigation tactic, will be a double-whammy if you consider inflation:

- You are forced to withdraw from your portfolio when asset values are down, and/or

- You are forced to withdraw from your portfolio when inflation could be higher – eating into any purchasing power.

(#1 is bad enough but when combined with #2 it can be disastrous.)

In your asset decumulation years, timing is everything. If the market is down and you must drawdown your retirement assets the longevity of your portfolio might be in question.

Consider this: if the initial returns are positive after you retire it’s clear sailing: capital can grow and yes all of us including Warren Buffett can live with ~ 10% returns.

But an investor who experiences a series of negative early returns in retirement must confront at least two issues if not three:

- capital must be sold for income needs,

- the smaller capital account that remains will compound less, and depending on inflation,

- you have less aforementioned purchasing power.

Let’s look at an example using two different worst-case 10-year market scenarios.

Under both scenarios, the returns are identical, except in reverse order.

Take notice of the negative returns in years 1 and 2 at the start of retirement in Scenario B.

1. Practice portfolio diversification and rebalacing. From the successful retirees I know, follow, and have learned from, most of them do not have 100% of their porfolios in stocks. Successful retirees at least consider some bonds or some bonds via a balanced 60/40 all-in-one ETF. This of course depends on their income streams. Bonds are like parachutes for a stock portfolio – they cushion the blow when stocks fall in price. Also, when taking your income from a portfolio for retirement living expenses, you can consider rebalancing your portfolio at the same time.

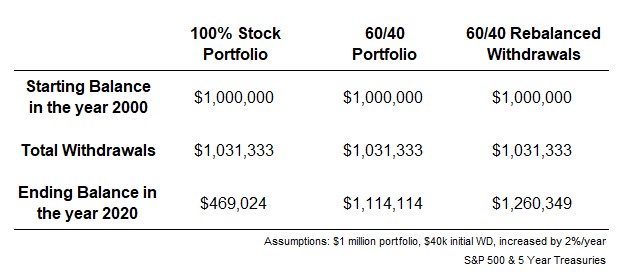

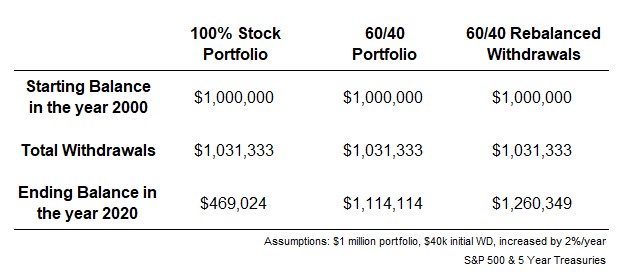

Thanks to A Wealth of Common Sense for this example:

“Let’s assume instead of pulling money from both stocks and bonds in their 60/40 proportions (as we did in the last example), instead you intelligently rebalance based on the performance of each asset class.

In a relatively good year for the stock market, you take your distribution from stocks, and in a relatively good year for bonds, you take your distribution from bonds.

Now you ended up with almost $1.3 million by 2020, having still spent more than $1 million.1″

2. Take CPP and OAS early / take government benefits at a traditional retirement age. I’m a huge fan of deferring CPP and OAS benefits into later in life (for the highest, gurananteed, inflation-protected income to be gained via these government benefits) but the flipside is, by taking either Canada Pension Plan or Old Age Security, or both, as soon as you can – you can mitigate the impacts to your personal portfolio.

With this guaranteed income flowing to you, earlier in life / right at the time of retirement, you’re earning steady government income. Bad stock market timing, mistakes made related to personal portfolio withdrawals from your RRSPs/RRIFs for example are buffered.

3. Use a Variable Percentage Withdrawal (VPW) Approach. Like CPP and OAS deferrals, I’m also a huge fan of using VPW – I’m very likely to employ part of this for my retirement income planning.

I previously wrote about VPW here, but this is the Coles Notes version. This approach works because:

- It combines the best ideas associated with constant-dollar withdrawal and constant-percentage withdrawal strategies (e.g., the 4% rule).

- It adapts your withdrawals to market/portfolio returns so effectively you don’t drawdown your portfolio too quickly.

- It uses a variable, and an increasing percentage to determine withdrawals so effectively you don’t hoard your money “until the end”. Spending is always variable and not linear.

- This is one of the best approaches I’ve seen that allow you to essentially:

- increase your spending in “good years” and,

- decrease your spending in “bad years” therefore giving investors psychological ease.

Here are some free retirement tools related to VPW.

4. Scale back. Maybe not your favourite, I know, but it is a tactic! If you don’t have some of these other options available to you, you simply may want to consider dialing down retirement income spending at any age. Basically, anything you can do to avoid selling investments when the market is down could potentially benefit your portfolio in the months or years ahead. Scaling back means putting off major expenes for a period of time.

5. Use the cash wedge / establish a cash buffer. This is the cornerstone of our retirement income plan.

Whether you decide to build your cash wedge now (to help you in your asset accumulation years), or later, as you enter semi-retirement or retirement, I believe it’s an important approach to consider to navigate uncertain market waters that will always persist.

In my asset accumulation years, our cash position was really a high-interest savings account emergency fund.

Now, it’s much more.

In your asset decumulation years, a typical cash wedge construction could be:

- Year 1 – a year (or so) of expenses in cash and/or in a combination of cash and a money market fund that is highly accessible. This is the bucket where you draw your retirement income from.

- Years 2 and 3 – this is a portion of your retirement portfolio that is allocated into short-term investments, such as a 1- or 2-year Guaranteed Investment Certificate (GIC), some bonds or some fixed-income funds. On maturity when using GICs in this example, these investments are used to replenish your cash wedge (Year 1).

- Years 4+ – the rest of your portfolio is left to grow, as a diversified equity portfolio, providing growth for future years. Hopefully by years 4 or even 5, the equity markets have rebounded a bit as you sell some of this portfolio to feed your near-term spending.

Check out this post about various Cash Wedge construction approaches here.

I’ve included a good visual for you below:

You can download this simple 1-pager for your reference too!

We’re planning to keep at least 1-years’ worth of expenses in cash/cash equivalents entering semi-retirement now.

Semi-retirement means I will still work just not full-time.

In full retirement, not working at all for any income, I’m very likely to own some GICs in my corporation and/or more cash ETFs, more money market funds in our RRSPs/RRIFs, LIRAs/LIFs specifically to cover MUCH more than 1-years’ worth of expenses; potentially 2 years’ worth.

I’ll keep you posted when I’m no longer working at all…but that won’t happen right away.

Weekend Reading – Sequence of Returns Risk Summary

Early retirees, DIY investors like myself striving for semi-retirement and even individuals seeking to retire at more traditional ages of age 65, face sequence of returns risk issues. However, you have options in one or more of the following to combat this issue in my opinion:

- Manage a balanced portfolio in retirement – since stocks and bonds should counteract.

- Take CPP and OAS early – to reduce personal portfolio/RRSP withdrawals and those impacts.

- Follow VPW – spend more in good years, spend a bit less in bad stock market years.

- Scale back – defer major spending where possible.

- Set-up a cash wedge – for at least 1-year, if not multiple years since cash/cash equivalents to draw from in bad stock market years is smart.

I will be using a combination of #3 and #5 specifically, and I will consider other options above as needed to navigate any sequence of returns risk.

I want to thank my reader for his question and an opportunity to frame this content as part of our own retirement income planning.

I have more reader questions in my inbox since the new year and I’ll try and get to those in the coming weeks. Keep them coming!

Lastly, I encourage all readers, retirees, and asset accumulators alike to share their thoughts on this post. I welcome your contributions for ongoing learning on this free site to everyone.

Have a great weekend!

Mark

Closing thoughts – when it comes to investing:

“Good markets and bad markets never last forever,

Bad markets can and do happen which can be painful, but

Good markets usually prevail over investing time.” – My Own Advisor.

Related Reading / Deep Dives:

On the other side of the spectrum, for extensive details, check out Dr. Karsten Jeske (aka Big ERN, from the U.S.) from the Early Retirement Now blog who goes into multiple rabbit holes in this 50+ part series: The Safe Withdrawal Rate Series. Big ERN concludes in most of these posts, that any safe withdrawal rate starting out in retirement is usually somewhere in the 3.25%-3.5% range. He’s put hundreds of hours into this series – check it out if you want to dive as deep as possible into withdrawal rates and sequence of returns risks. Hope all is well, Karsten.