Reinsurance broker Gallagher Re has reported that it estimates the March 13th to 16th severe convective storm (SCS) and tornado outbreak in the United States will be the costliest severe weather event of 2025 so far, with an estimate for insurance industry losses of up to $3 billion.

More than 106 tornadoes have been confirmed, with 3 reported to be at EF4 strength and 10 at EF3 intensity.

While large hail large hail exceeding 2 inches (5.0 centimeters) in diameter is estimated to have affected 28,000 people across parts of the states of Alabama, Kentucky, Louisiana, Missiouri, Mississippi, and Texas.

Gallagher Re commented, “Most of the wind and hail-related damage from the outbreak was expected to be covered by

insurance, with losses for the private insurance industry initially anticipated in the range of USD1 billion to USD3 billion.”

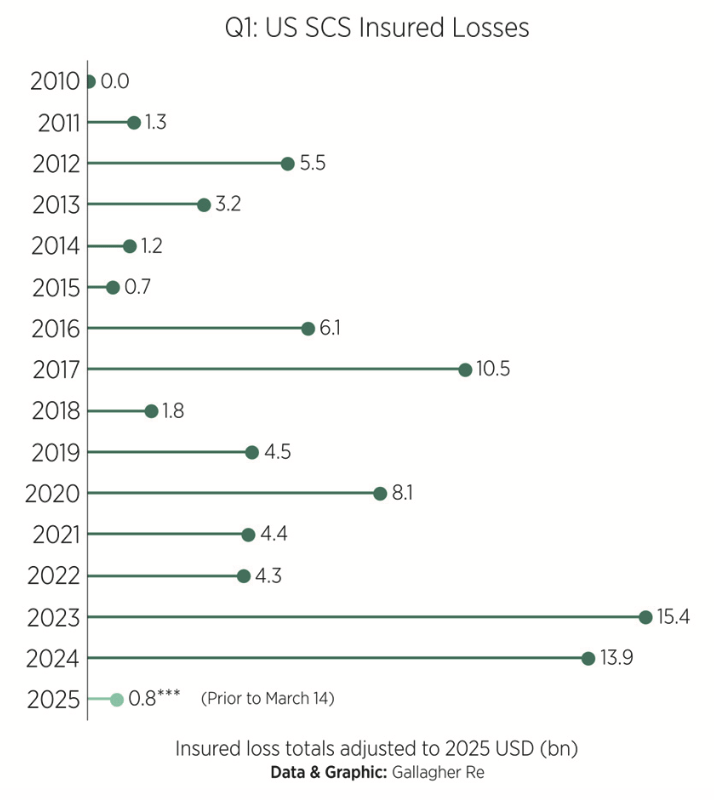

Adding that, “Prior to this event, the US had seen a relatively benign start to 2025 for severe convective storm losses with the aggregate total at roughly USD1 billion.”

Within that estimate for up to $3 billion of insurance industry losses, the reinsurance broker is only including the severe thunderstorm related impacts, of tornadoes, hail and SCS winds.

“The most considerable losses to homes, commercial assets, automobiles, and agriculture were seen in parts of notably populated areas of the Midwest, Southeast, and along the East Coast. This would mark the first billion-dollar US SCS event of the year.

“Additional non-negligible losses resulting from an outbreak of wildfires in parts of Oklahoma and Kansas that were ignited due to very high non-thunderstorm driven winds,” Gallagher Re further explained.

Steve Bowen, Chief Science Officer and Meteorologist at Gallagher Re commented, “As we head into the historical peak of US SCS season (April thru June), the question becomes whether 2025 activity will accelerate and continue the 15+ year trend of more damaging events driving considerable aggregate loss costs for the peril.

“Both 2023 and 2024 each resulted in 10 individual multi-billion-dollar US SCS events; a record.”

Gallagher Re further explained, “The rising financial cost of US severe thunderstorms has become a major topic of conversation in the insurance industry as underwriters seek to improve combined ratio performance with the peril. After a challenging year in 2023, US market combined ratios were improved in 2024.

“The SCS peril has transitioned to a ‘new normal’ in which annual nominal insured losses are now regularly exceeding USD40 billion.”

At up to $3 billion, this SCS and tornado outbreak does have the potential to be a catastrophe loss that further erodes some aggregate deductibles in the catastrophe bond space, although given the wide area affected it is unlikely to be a particularly meaningful event for any aggregate structures in the cat bond and retrocession space on its own.

Whether aggregate cat bonds, or retro arrangements, that have seen their deductibles severely eroded by the wildfires earlier this year, make it to the end of their risk periods at the mid-year without attaching remains to be seen. More billion dollar events occurring will begin to threaten some, although there is some location dependence to where the losses occur for some of the eroded cat bonds.