Just a few days back, Google officialized the acquisition of Wiz. From a qualitative standpoint, this deal represents a key change in an M&A market.

In fact, after peaking in the early 2020s, due to the massive flow of inflated capital during the pandemic, the M&A market had fallen back into oblivion.

Yet, it is finally getting hot again, and that is all about AI.

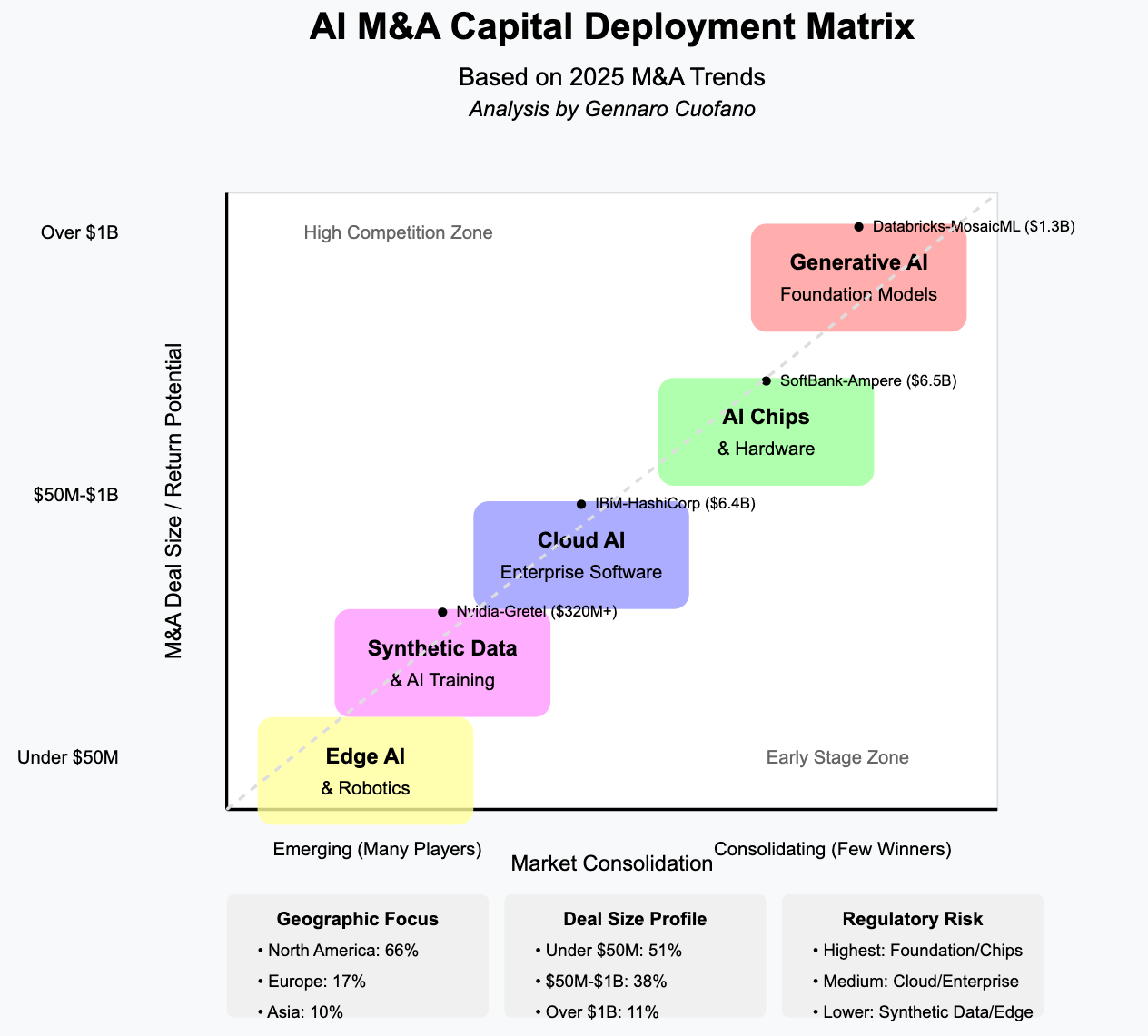

Still, a trend is quite clear there, as AI capital is moving pretty concentrated.

You can find some of this data at ChiefFinancialOfficerAI.

In recent years, the artificial intelligence (AI) sector has become one of the most dynamic areas for mergers and acquisitions (M&A).

Companies are racing to acquire AI capabilities, from cloud services to specialized AI chips and generative AI startups, to stay ahead of the competition.

In 2025, AI-related M&A activity is experiencing a resurgence following a temporary slowdown in 2022–2023.

The growing need for AI-powered automation, generative AI applications, AI chip innovation, and synthetic data solutions drives the momentum.

This article examines:

-

How does AI M&A activity in 2025 compare to previous years

-

Which AI industries are most consolidating (cloud AI, AI chips, generative AI, edge AI, etc.)

-

Trends in deal sizes, key acquirers, and geographic distribution

-

The impact of regulatory scrutiny on AI-related M&A

By analyzing these patterns, we can identify how the AI industry is reshaping itself through acquisitions and what this means for the future of AI development.

This analysis is based on publicly available data on AI-related mergers and acquisitions, financial reports, and expert commentary from industry analysts. Key sources include:

-

Data from investment research firms tracking AI M&A trends

-

Reports from financial institutions on technology sector acquisitions

-

Press releases from major companies involved in AI-related deals

-

Government and regulatory filings on blocked or approved transactions

-

Expert insights from AI industry analysts and venture capital firms

The research focuses on AI acquisitions from 2023 to early 2025, comparing deal volume, market trends, and regulatory factors to prior years.

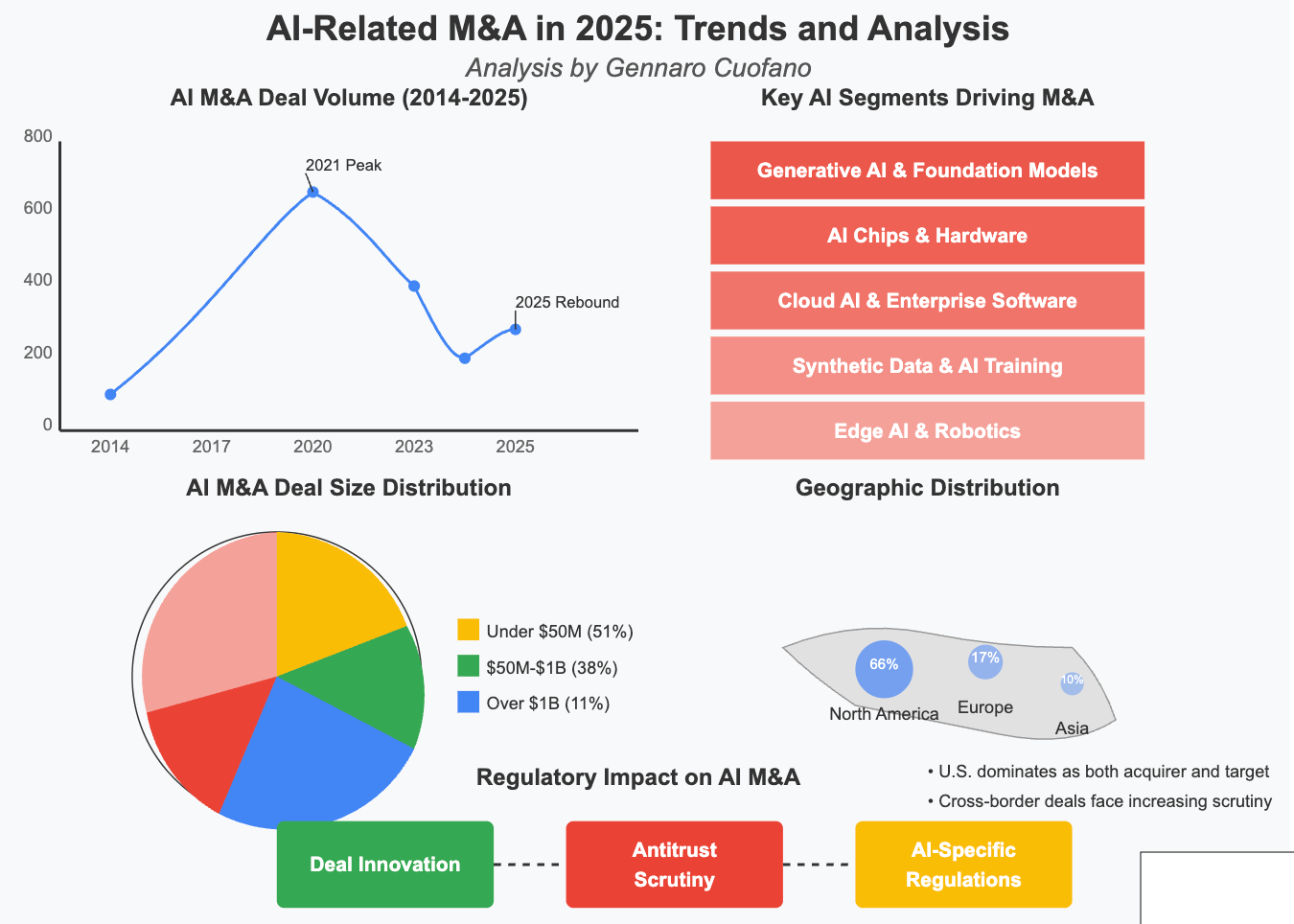

The AI M&A landscape has gone through major fluctuations in recent years:

-

2021 marked the peak of AI M&A, with 828 deals, driven by a surge of investments in AI startups.

-

2022–2023 saw a slowdown, with deal volume dropping by 40% from the 2021 peak due to economic uncertainty and rising interest rates.

-

2024 showed signs of recovery, with 326 AI-related M&A deals, thanks to renewed interest in generative AI and cloud AI acquisitions.

-

2025 is on track for further growth, with early indicators showing a 29% year-over-year increase in billion-dollar AI acquisitions.

-

Generative AI breakthroughs: Companies are acquiring AI startups specializing in large language models (LLMs) and generative AI to integrate these capabilities into their products.

-

AI chip competition: Tech giants are acquiring AI hardware expertise to enhance their AI computing stacks.

-

Cloud AI adoption: Enterprise software and cloud computing firms are expanding their AI-powered solutions through M&A.

Companies are aggressively acquiring AI startups to enhance their cloud and software services.

-

IBM acquired HashiCorp ($6.4 billion, 2024) to strengthen its AI-powered hybrid cloud automation capabilities.

-

Snowflake acquired Neeva (2023) to integrate generative AI search into its cloud data platform.

-

Thomson Reuters acquired Materia (2024) to bring AI-driven automation into its tax and legal research tools.

Cloud AI M&A reflects a shift toward AI-driven automation in enterprise software, where AI tools are becoming a must-have for cloud services and digital workflows.

With the rise of AI workloads, chipmakers are acquiring specialized AI chip firms to gain an edge in AI processing power.

-

SoftBank acquired Ampere Computing ($6.5 billion, 2025) to strengthen its AI semiconductor capabilities.

-

Nvidia acquired Excelero (2022) and is planning to acquire Run:AI ($700 million, 2024) to optimize AI workload orchestration.

-

AMD acquired Silo AI ($665 million, 2024) to integrate AI model training expertise into its chip portfolio.

AI chip consolidation is intensifying as tech companies aim to build full-stack AI computing solutions, from silicon to software optimization.

The generative AI boom has sparked a frenzy of M&A activity, with companies eager to acquire AI model developers and generative AI startups.

-

Databricks acquired MosaicML ($1.3 billion, 2023) to enhance its AI model training capabilities.

-

OpenAI acquired Rockset (2024) to integrate real-time data retrieval into its LLM ecosystem.

-

Microsoft made a $620 million deal with Inflection AI (2024) to secure generative AI talent and model licensing.

Every major tech firm is racing to incorporate generative AI capabilities, making this a hotbed for M&A.

With AI models requiring vast datasets, companies are acquiring synthetic data startups to generate training data at scale.

-

Nvidia acquired Gretel AI (2025, $320+ million) to enhance synthetic data generation for AI model training.

-

SAS Institute acquired Hazy (2023) to integrate AI-driven synthetic data into its analytics tools.

AI training data is becoming a bottleneck, and owning synthetic data generation capabilities is now a competitive advantage.

Companies are acquiring AI firms to bring intelligence to edge devices, from autonomous robots to smart networks.

-

Qualcomm has acquired multiple AI chip startups to improve on-device AI processing.

-

Tesla acquired DeepScale (2019) for automotive AI perception, showing long-term AI consolidation.

-

HPE attempted to acquire Juniper Networks ($14 billion, 2024) to enhance AI-driven networking, though regulators blocked the deal.

The shift toward AI at the edge (mobile devices, cars, robotics) is driving strategic M&A.

What are some of the key trends in deal sizes and geographic distribution?

-

Billion-dollar AI deals include Cisco’s $28 billion acquisition of Splunk (2024) for AI-powered cybersecurity and analytics.

-

The majority of AI deals (51%) are under $50 million, showing that most acquisitions target early-stage AI startups.

-

The U.S. leads AI M&A, with ~66% of acquirers headquartered there.

-

Europe is a growing AI M&A hub, with the UK, Germany, and France producing many AI startups.

-

Asia’s AI M&A is increasing, with Japan, India, and China making strategic AI acquisitions.

Governments and regulators are increasing scrutiny of AI acquisitions, fearing monopolization and national security risks.

-

Stricter antitrust enforcement: The U.S. DOJ blocked Nvidia’s $40 billion acquisition of Arm (2022) and prevented HPE’s $14 billion purchase of Juniper Networks (2025) due to AI competition concerns.

-

New AI regulations: The EU AI Act (2024–2025) imposes compliance requirements on AI companies, influencing M&A deal structures.

-

National security concerns: Foreign investment screening is limiting AI M&A involving Chinese and U.S. AI firms, especially in AI chips.

Big Tech acquisitions of AI startups are facing more regulatory resistance, making AI M&A more complex in 2025.

The AI M&A landscape in 2025 is highly dynamic.

-

AI M&A is rebounding after a slowdown in 2022–2023.

-

Generative AI, AI chips, and cloud AI are the biggest drivers of M&A deals.

-

Regulatory scrutiny is tightening, with antitrust authorities blocking some AI megadeals.

M&A will remain a core strategy for securing AI leadership, but companies will need to navigate increasing regulatory hurdles and shifting market conditions.

-

After a slowdown in 2022–2023, deal activity is accelerating again.

-

2021 saw a peak with 828 deals; 2024 recovered to 326 deals.

-

2025 is showing a 29% year-over-year increase in billion-dollar transactions.

-

Rapid advances in generative AI

-

Heightened demand for AI hardware and chips

-

Expansion of cloud AI and enterprise automation

-

Need for synthetic data to train large AI models

-

IBM acquired HashiCorp ($6.4B, 2024)

-

Snowflake acquired Neeva (2023)

-

Thomson Reuters acquired Materia (2024)

-

Focus: Embedding AI into automation, cloud, and data platforms

-

SoftBank acquired Ampere Computing ($6.5B, 2025)

-

Nvidia acquired Excelero (2022), pursuing Run:AI ($700M, 2024)

-

AMD acquired Silo AI ($665M, 2024)

-

Focus: Full-stack AI compute platforms from chips to model optimization

-

Databricks acquired MosaicML ($1.3B, 2023)

-

OpenAI acquired Rockset (2024)

-

Microsoft partnered with Inflection AI ($620M, 2024)

-

Focus: Language models, data retrieval, model training talent

-

Nvidia acquired Gretel AI ($320M+, 2025)

-

SAS acquired Hazy (2023)

-

Focus: Scalable training data generation and data privacy compliance

-

Tesla acquired DeepScale (2019)

-

Qualcomm acquired multiple AI chip startups

-

HPE’s attempted $14B acquisition of Juniper (2024) (blocked)

-

Focus: AI on mobile, in vehicles, and across distributed networks

-

Most AI deals (51%) are under $50 million

-

Large acquisitions still occur: Cisco bought Splunk for $28B in 2024

-

U.S. dominates AI M&A with 66% of acquiring firms headquartered there

-

Europe is rising, especially the UK, Germany, and France

-

Asia is expanding: Japan, India, and China increasing activity

-

Stricter antitrust enforcement in the U.S. and Europe

-

The EU AI Act (2024–2025) is introducing new compliance rules

-

Foreign investment screening is limiting U.S.–China deal flows

-

Deals by Big Tech are facing more resistance

-

Firms are using creative structures (minority stakes, licensing, talent deals)

-

Due diligence now includes AI ethics, data rights, and regulatory exposure

-

M&A will remain a core strategy for securing AI leadership

-

Generative AI, chips, and cloud platforms will continue to dominate acquisition targets

-

Non-tech firms will increase participation (e.g. finance, healthcare, legal sectors)

-

Regulatory and geopolitical dynamics will influence deal timing, size, and scope

With massive ♥️ Gennaro Cuofano, The Business Engineer

This is part of an Enterprise AI series to tackle many of the day-to-day challenges you might face as a professional, executive, founder, or investor in the current AI landscape.