The banking and finance industry is undergoing a semantic transformation, driven by the relentless advancements of artificial intelligence (AI). What was once a sector built on legacy systems, manual processes, and reactive strategies is now rapidly evolving into a data-driven, intelligent ecosystem. The role of AI in banking and finance is more than just supporting the industry; it’s foundational.

As the global financial institutions race to maintain their competitive edge, the AI applications in banking have moved far beyond automating the backend tasks. Today, we see that AI has the potential to power some key functions, starting from real-time fraud detection to dynamic credit scoring and conversational interfaces with integrated generative AI in banking sector.

According to Deloitte, more than 85% of financial services firms have already embedded some form of AI into their operations, and this number continues to increase as AI in finance proves its return on investment in cost reduction, efficiency, and risk management.

This article will explore 19 different and very impactful AI use cases in the banking and finance sector, each mapped to a hypothetical, yet real-world scenario, and a transformative AI solution. As a leader, the following use cases will help you understand how AI in banking and finance can add tangible value of artificial intelligence across financial services.

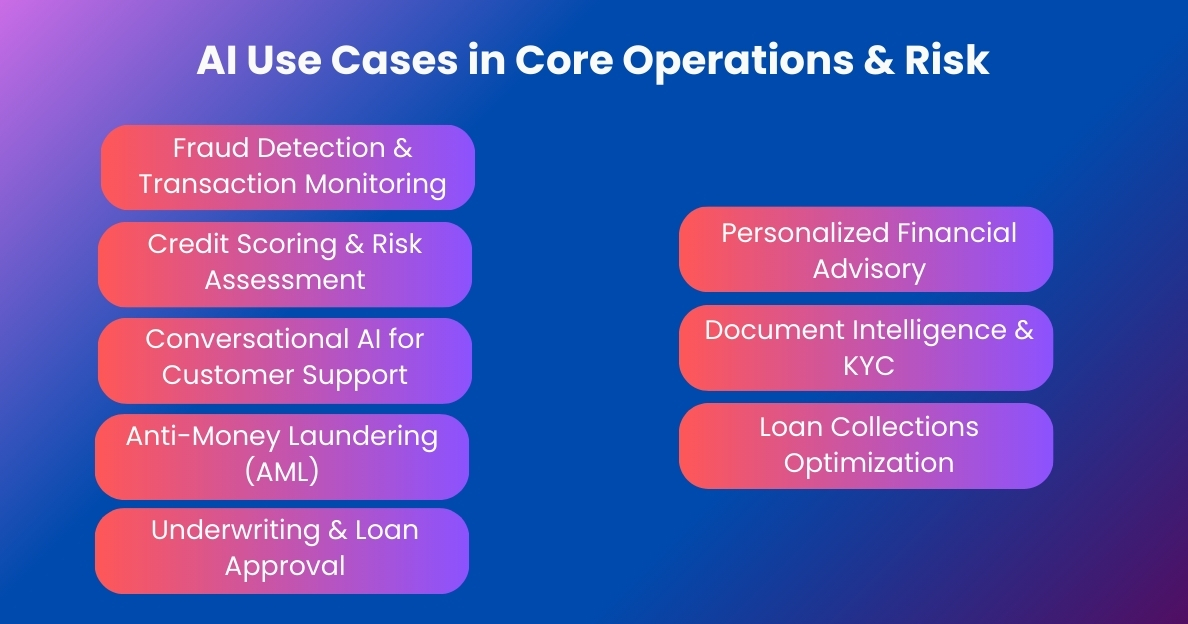

19 AI Use Cases in Banking and Finance

1. Fraud Detection & Transaction Monitoring

Scenario

A mid-size retail bank experiences a rise in fraudulent transactions such as unauthorised logins, unusual money transfers, and cloned cards. It’s traditional, or rather outdated, fraud detection system floods compliance teams with false positives, delaying response times, and risking customer trust.

Solution with AI in Banking

The organization can use machine learning models trained on historical transaction patterns. These ML models use behavioural analytics and anomaly detection to flag genuine threats in real time. Such AI applications in banking reduce false positives, detect complex fraud rings, and continuously improve through feedback loops. AI in digital banking can uncover hidden gaps between accounts to surface organized fraud networks.

This represents one of the most widely adopted applications of AI in banking and finance, providing a direct solution to operational risks and cybercrime.

2. Credit Scoring & Risk Assessment

Scenario

A digital lending platform struggles with assessing “thin-file” customers who lack traditional credit histories. As a result, many creditworthy applicants are denied loans, while high-risk borrowers slip through, leading to increased defaults.

Solution with AI in Banking

AI-driven credit scoring models combine conventional data (like income and credit history) with alternative data sources, such as mobile phone usage, utility payments, and transaction behavior. Integration of such models offers a more accurate and inclusive view of creditworthiness. Additionally, explainable AI (XAI) or generative AI in banking can ensure transparency and regulatory compliance, giving both lenders and customers confidence in the decision-making process.

As AI in financial services evolves, intelligent risk assessment systems are becoming central to building inclusive lending ecosystems.

3. Conversational AI for Customer Support

Scenario

A commercial bank receives thousands of customer queries daily, and they can range from balance checks to card replacements. The call centers are overwhelmed, leading to long wait times and customer dissatisfaction.

Solution with AI in Banking

One of the best ways to implement AI in the banking industry is by introducing conversational AI, powered by NLP (natural language processing). Such AI in banking and finance sector ensures the deployment of multilingual chatbots and virtual assistants that handle routine customer requests 24/7. These AI bots understand context, verify identity securely, and escalate complex issues to human agents only when necessary.

Generative AI in banking enhances this experience further by enabling natural, personalized dialogues.

This use case demonstrates how conversational AI in the banking industry not only reduces operational costs but also enhances the customer experience, which is key to an effective banking strategy.

4. Anti-Money Laundering (AML) Compliance

Scenario

A multinational bank’s compliance team spends an overwhelming amount of time in reviewing flagged transactions, of which many are false positives. Manual investigations slow down reporting and lead to compliance risks.

Solution with AI in Banking

AI models built for AML compliance use anomaly detection, behavioral profiling, and historical patterns to identify truly suspicious activities. These systems can rank alerts by risk level, reducing noise and enabling teams to prioritize high-threat cases. AI in financial services helps to uncover shell companies and hidden ownership structures. Natural Language Processing (NLP) can also automate parts of SAR (Suspicious Activity Report) generation.

With the amalgamation of AI and banking, financial institutions can drastically improve their AML capabilities, boosting speed, accuracy, and regulatory readiness.

5. Underwriting & Loan Approval

Scenario

A lending company receives thousands of loan applications each day. Manual underwriting is slow, subjective, and inconsistent, leading to bottlenecks in disbursal and dissatisfied borrowers.

Solution with AI in Banking

AI-powered underwriting automates the assessment of income stability, employment history, spending behavior, and even macroeconomic factors. These models evaluate risk in real time, enabling lenders to approve or reject loans within minutes. Generative AI in banking can summarize borrower profiles and explain approval logic to meet compliance needs.

As AI in digital banking accelerates, intelligent underwriting becomes a key differentiator in delivering fast, personalized, and secure financial services.

6. Personalized Financial Advisory (Robo-Advisors)

Scenario

A wealth management firm wants to serve millennial and Gen Z clients, who expect affordable, on-demand investment advice. Scaling traditional advisor teams is cost-prohibitive and inefficient.

Solution with AI in Banking

Robot advisors powered by generative AI in banking analyze users’ financial goals, risk appetite, life stage, and market conditions to provide real-time, custom investment strategies. AI financial services learn continuously from client behaviour and offer personalised nudges, rebalancing alerts, and smart tax planning.

Compliance is maintained via transparent audit trails and explainable decision logs. This reflects the broader benefits of AI applications in the banking and finance sectors, such as scaling personalization while reducing human resource dependency.

7. Predictive Analytics for Portfolio Management

Scenario

A fund manager struggles to keep pace with shifting market conditions, investor sentiment, earnings reports, and macroeconomic trends, making timely, data-informed portfolio adjustments nearly impossible.

Solution with AI in Banking

AI in banking and finance has models trained on historical market behavior, news sentiment, technical indicators, and alternative data sources that generate accurate asset forecasts. These systems provide early signals for rebalancing portfolios, adjusting exposure, and identifying undervalued assets. Generative AI in banking can summarize earnings call transcripts and analyst insights in real time, allowing fund managers to act faster.

This is a powerful demonstration of AI in finance, where intelligent systems drive proactive investment decisions instead of reactive guesswork.

8. Document Intelligence & KYC Automation

Scenario

Customer onboarding delays are common due to manual Know Your Customer (KYC) document checks, often requiring repeated submissions and staff intervention.

Solution with AI in Banking

AI in digital banking powers document analysis by using Optical Character Recognition (OCR) and Natural Language Processing to extract and validate information from ID proofs, utility bills, and financial documents. These systems cross-verify data with third-party sources, flag anomalies (e.g., expired documents or tampering), and auto-fill onboarding forms. Face verification and e-signature workflows further streamline the process.

This is one of the most valuable AI applications in banking, especially for improving the speed and security of onboarding in retail banking and beyond.

9. Loan Collections Optimization

Scenario

A lending firm wants to reduce Non-Performing Assets (NPAs), but its manual collections process lacks segmentation, personalization, and efficiency.

Solution with AI in Banking

AI in the banking industry can analyze borrower behavior, payment history, credit trends, and communication responsiveness to score repayment likelihood. Based on these insights, the artificial intelligence in finance automates personalized reminders by choosing the right channel (email, SMS, calls), optimal time, and tone of message. It can even recommend flexible repayment options.

As part of offering scalable solutions by integrating AI and banking, AI in financial services has collection of tools to improve recovery rates and customer experience while reducing operational overhead.

10. Contract Analysis

Scenario

A commercial bank is overwhelmed with reviewing thousands of legal documents—loan agreements, vendor contracts, and client onboarding forms—for clauses, deadlines, and compliance obligations. Manual reviews are slow, error-prone, and resource-intensive.

Solution with AI in Banking

AI financial services can have contract intelligence tools, use NLP and domain-specific models, extract key clauses, highlight risks, and identify anomalies such as missing terms or deviations from standard templates. Generative AI in banking can summarize large legal documents, highlight obligations by party, and even compare documents across versions for faster decision-making.

This represents a strategic application of artificial intelligence in finance, improving legal risk management while accelerating operations.

11. Automated Financial Report Generation

Scenario

Financial analysts at an investment bank spend days compiling quarterly summaries, earnings breakdowns, and performance analytics—manually pulling data from siloed systems.

Solution with AI in Banking

AI in the banking industry can have intelligent agents automating the end-to-end process of financial report generation, from data ingestion to visual dashboards and narrative insights. LLMs (Large Language Models) generate human-like summaries, comparisons (e.g., QoQ, YoY), and detect financial trends automatically. Templates can be set up for real-time reporting, synced with live data sources.

As part of broader AI in banking and finance, this use case exemplifies how intelligent automation enhances productivity in high-stakes reporting functions.

12. Streamlined Regulatory Compliance

Scenario

A regional bank struggles to keep up with evolving regulations such as Basel III, GDPR, and Dodd-Frank. Compliance teams manually track regulatory updates and perform time-consuming audits.

Solution with AI in Banking

Systems equipped for delivering solutions with artificial intelligence in finance can ingest regulatory documentation and automatically map requirements to existing internal policies. NLP algorithms highlight gaps in compliance, recommend controls, and monitor regulatory updates in real time. Generative AI in banking can draft reports and risk disclosures while ensuring auditability through explainable decision logic.

This showcases how AI in financial services enables “compliance by design,” transforming regulatory burden into a strategic advantage.

13. Confidential Computing for Secure AI Processing

Scenario

A private wealth management firm wants to leverage client data for AI training but must comply with strict data privacy regulations, especially when using cloud-based AI infrastructure.

Solution with AI in Banking

Confidential computing allows encrypted data to be processed inside secure, hardware-based enclaves (e.g., Intel SGX, AMD SEV). Artificial intelligence in finance can train and infer directly on this encrypted data without ever exposing it, even to the cloud provider. This ensures end-to-end security while enabling the use of sensitive financial data.

As artificial intelligence in finance advances, confidential computing is emerging as a cornerstone for privacy-preserving, regulatory-compliant AI in banking.

14. Predictive Maintenance for IT Operations

Scenario

An enterprise bank’s IT infrastructure is aging, with frequent system downtimes due to unforeseen failures in legacy applications and servers, impacting customer transactions and compliance.

Solution with AI in Banking

AI in digital banking integrates models that analyze logs, telemetry, and system health indicators to detect anomalies and predict potential failures. These predictive maintenance systems alert IT teams before issues escalate, enabling proactive remediation. Generative AI in the banking industry can even recommend code-level fixes or escalate issues with contextual summaries.

AI in banking and finance sector, predictive maintenance boosts uptime, reduces tech debt, and ensures service continuity in high-frequency financial environments.

15. Sentiment Analysis for Market & Customer Insights

Scenario

A corporate bank wants to understand how customers and investors perceive its services, especially across social media, earnings calls, and product reviews.

Solution with AI in Banking

AI and Banking, when put together, use NLP and machine learning. AI tools analyze structured and unstructured text, such as social posts, call transcripts, and news articles, to identify sentiment trends.

This helps banks to adjust their marketing, product development, and risk strategies in real time. Visual dashboards surface insights by region, product line, or customer segment.

This use case reflects the potential of AI in digital banking to transform raw data into actionable customer intelligence.

16. AI in Human Resources & Talent Management

Scenario

A large retail bank faces high recruitment volume and attrition rates. Screening thousands of applications manually slows down hiring, while reactive retention strategies fail to identify turnover risks in time.

Solution with AI in Banking

AI in the banking industry streamlines recruitment by screening resumes, ranking candidates, and predicting job fit using NLP and historical hiring data. Post-hiring, AI tracks productivity metrics, sentiment in employee feedback, and behavioral patterns to anticipate attrition and optimize engagement strategies. Personalized onboarding and learning recommendations also support faster integration.

These AI applications in banking go beyond customer-facing tools, improving internal efficiency and building agile, future-ready teams.

17. AI-Powered Algorithmic Trading

Scenario

An investment bank struggles to react to volatile market movements in real time, limiting its ability to execute high-frequency trades with precision.

Solution with AI in Banking

Algorithmic trading platforms powered by machine learning analyze large volumes of market data, news sentiment, and historical trends to autonomously execute trades within milliseconds. These AI financial services systems constantly learn and adapt, improving performance in volatile environments. Generative AI in banking also aids in summarizing economic insights for quick decision-making.

With a clear edge in AI financial services, algorithmic trading demonstrates how artificial intelligence in finance enables split-second decisions with minimal human intervention.

18. Digital Twin for Operational Optimization

Scenario

A global bank wants to test new operating models and policy changes but lacks a safe and scalable environment to simulate impact before real-world implementation.

Solution with AI in Banking

A digital twin—a virtual replica of the bank’s operations—is powered by AI to simulate real-time scenarios. From branch network performance to customer service flows and credit risk policies, banks can visualize outcomes, identify bottlenecks, and stress-test strategies. AI-powered analytics make these simulations precise and actionable.

This exemplifies how AI in banking shifts operations from reactive to proactive, driving innovation without risking disruption.

19. AI-Augmented Strategy & Decision Support

Scenario

The executive board at a multinational financial institution struggles to keep up with fast-moving market shifts, regulatory changes, and competitive intelligence.

Solution with AI in Banking

Generative AI in banking and decision intelligence platforms synthesize internal and external data—financial reports, regulatory updates, macroeconomic indicators—and present contextual recommendations. AI-generated insights help leadership teams anticipate market trends, allocate capital efficiently, and respond to risks faster.

This use case perfectly demonstrates the strategic potential of AI in banking and finance, where AI evolves from a tool into a trusted decision-making co-pilot for the C-suite.

AI Implementation Challenges in Banking and How to Overcome Them

While the transformative impact of AI in banking and finance is undeniable, successful implementation is far from the final goal. Financial institutions face several operational, technical, and cultural barriers that must be addressed to realize the full value of AI in finance.

Below are the most common challenges and how leading banks are overcoming them:

1. Legacy Systems & Data Silos

The Challenge:

Many banks still operate on decades-old infrastructure, with fragmented databases and outdated codebases. Integrating a modern AI financial services model into these legacy environments is complex and risky.

The Solution:

- Adopt middleware and APIs to bridge new AI layers with core systems.

- Invest in cloud migration for scalable compute resources.

- Leverage RPA and AI in banking to automate processes without disrupting core architecture.

2. Talent Shortages in AI & Data Science

The Challenge:

Building internal AI teams is expensive and time-consuming. There’s a global shortage of data scientists, ML engineers, and AI strategists with domain knowledge of AI in finance.

The Solution:

- Use strategic AI partners with domain-specific expertise in banking.

- Upskill existing teams through AI literacy programs and cross-functional collaboration.

- Adopt low-code/no-code AI platforms for faster adoption.

3. Data Privacy, Ethics & Regulatory Compliance

The Challenge:

AI in finance handles highly sensitive personal and financial data. Any misstep in privacy, bias, or transparency can lead to regulatory scrutiny, reputational damage, or both.

The Solution:

- Implement explainable AI (XAI) to meet audit and regulatory standards.

- Use confidential computing to process encrypted data in secure enclaves.

- Involve legal and compliance teams early in AI development to ensure alignment with evolving data laws.

4. Lack of Strategic Alignment

The Challenge:

Many AI projects start as innovation pilots but fail to scale due to unclear business value, poor stakeholder buy-in, or misalignment with enterprise strategy.

The Solution:

- Establish a centralized AI governance framework.

- Tie each AI use case to measurable KPIs (e.g., reduction in fraud, faster onboarding, improved NPS).

- Position AI as a core enabler of business transformation, not just an IT initiative.

5. Resistance to Change

The Challenge:

AI often changes workflows, reduces manual tasks, or challenges long-standing expertise, leading to fear or resistance across departments.

The Solution:

- Position AI as an augmentor, not a replacement.

- Involve employees in AI training and feedback loops.

- Highlight wins from early projects to build trust and momentum.

Implementing AI in financial services requires more than just deploying technology—it demands a cultural shift, a clear strategy, and long-term commitment. The banks that succeed are those that treat AI not as a tool, but as a core pillar of their digital transformation.

Conclusion: Embracing the Future of Banking with AI

From frontline services to back-office processes, and from customer engagement to executive strategy, AI in banking and finance is no longer a futuristic concept—it’s a competitive necessity. As this blog has demonstrated through 19 distinct, real-world scenarios, artificial intelligence in finance has the power to enhance operational efficiency, reduce costs, personalize customer experiences, and support high-stakes decision-making.

C-suite leaders in the banking sector are now tasked with a critical mandate: move from exploring AI in isolated pilots to embedding it across the enterprise. The institutions that scale responsibly, invest in AI governance, and prioritize explainability will not only meet today’s expectations—they’ll define the future of AI in finance.

Also Read : AI Use Cases in the Construction Industry