Entrepreneurs and executives must balance out the short and long term. At times, short and long-term do converge. At other times, they seem to diverge.

A business model is always in transition, as it operates in a dynamic context, which might be more or less stable depending on a set of external factors.

For instance, as we speak, many incumbents (Google, Meta, Apple, Microsoft, Salesforce) are all transitioning their business models to fit the new developing context.

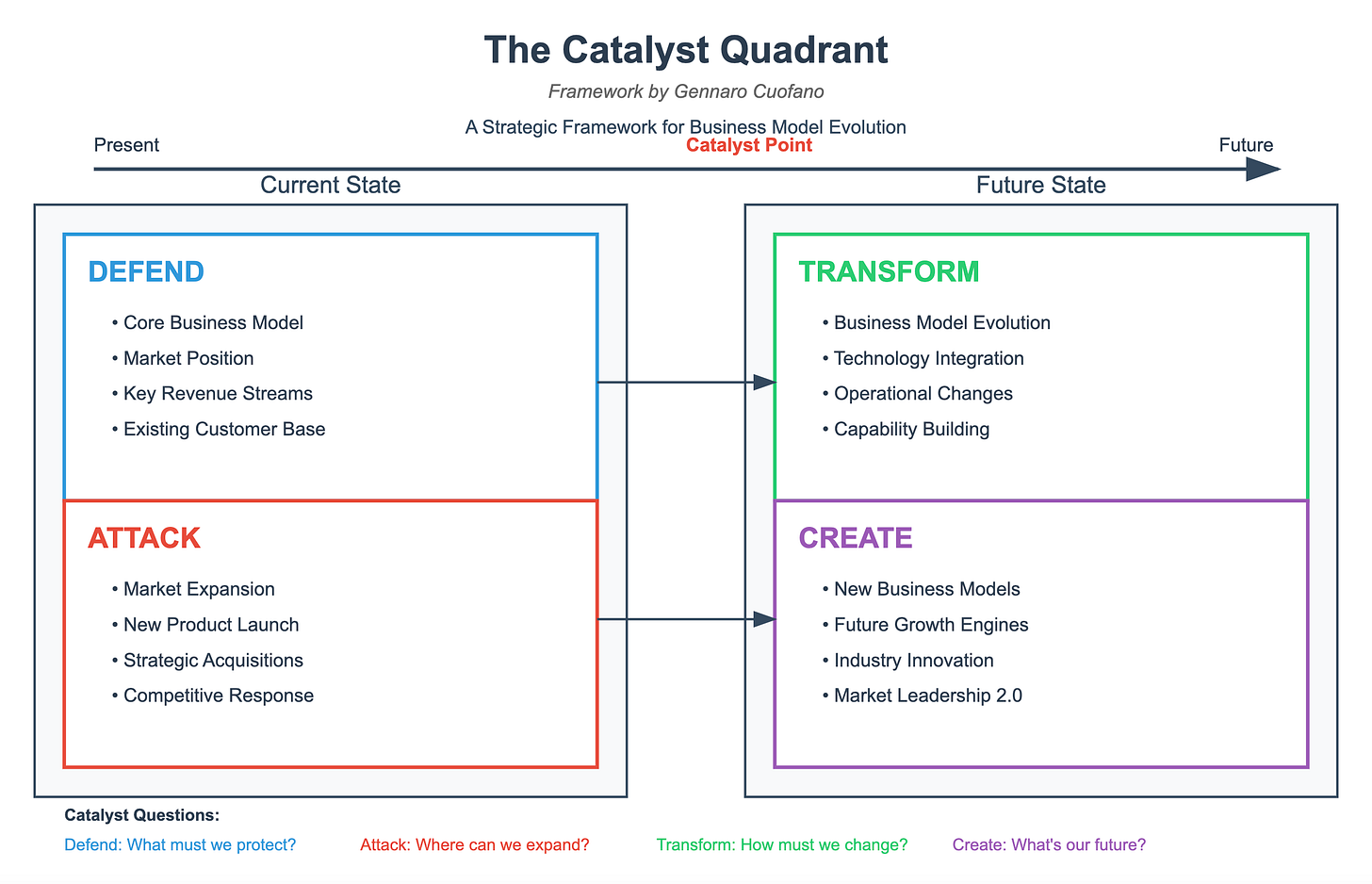

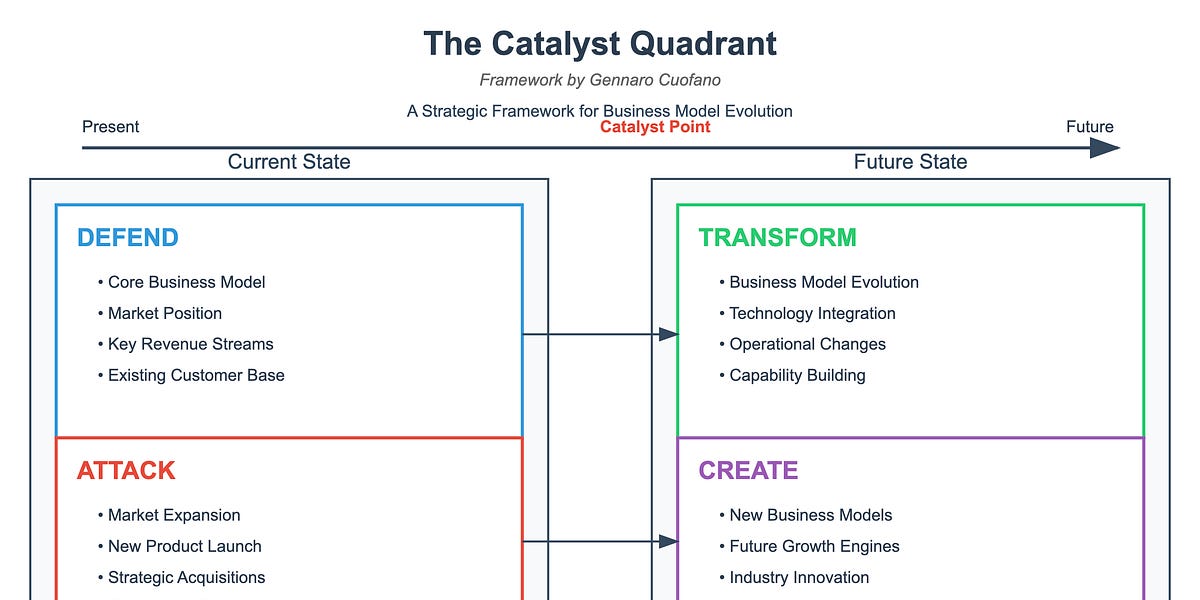

The interesting take is that no one knows yet what that context will look like, yet everyone needs to be carefully betting on it, with a “four-pronged approach” that combines defense-attack on the one end and transform-create on the other end.

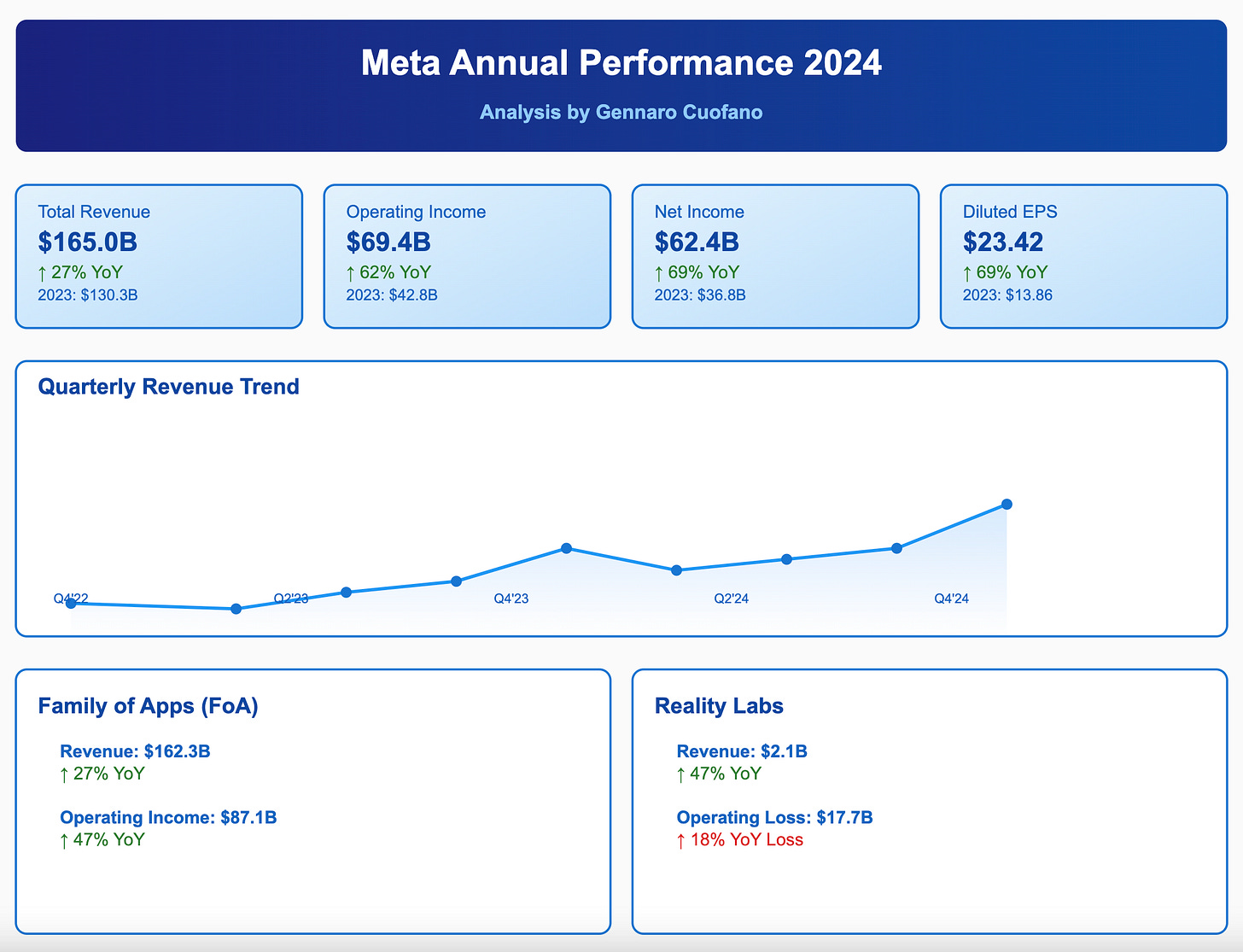

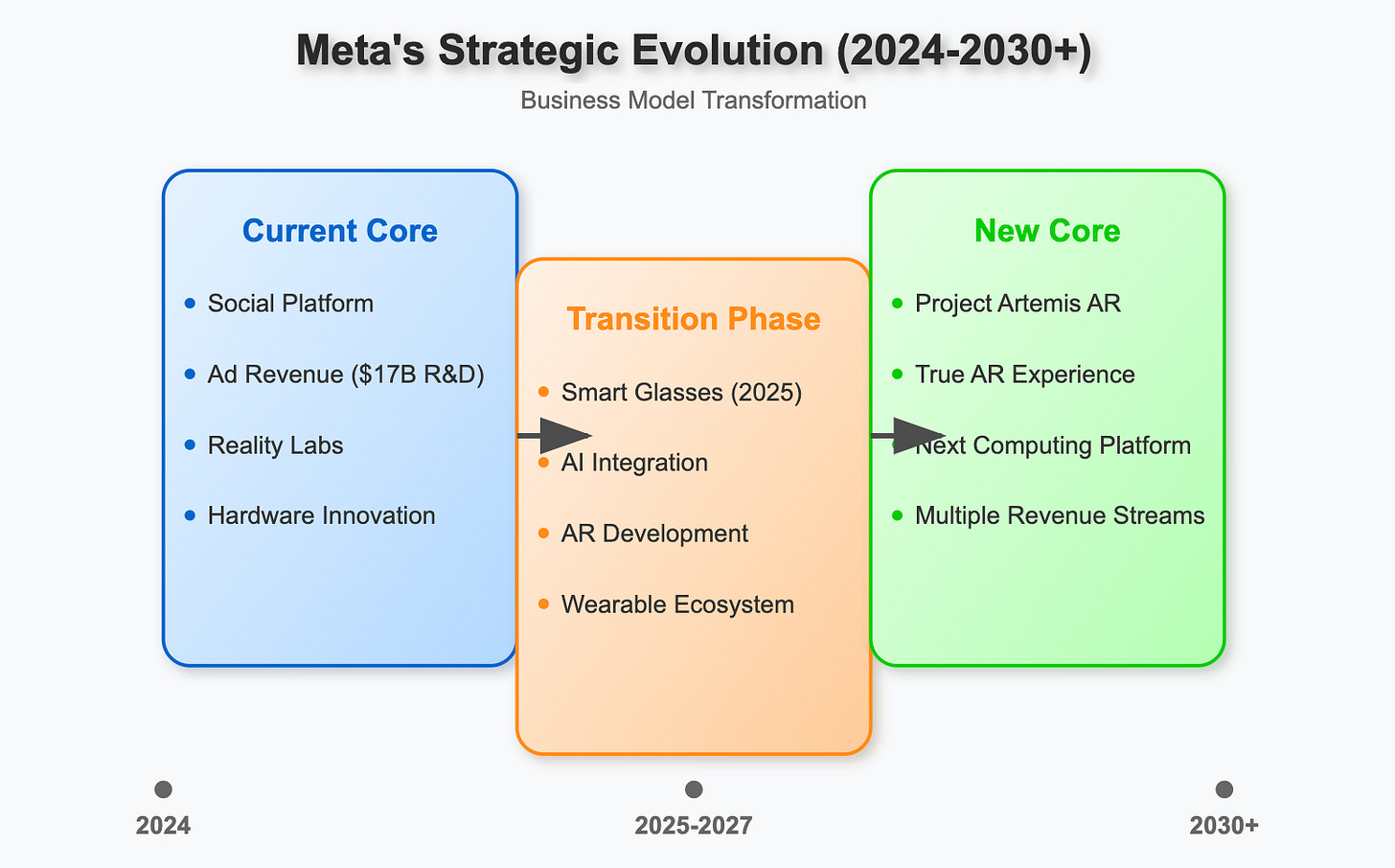

One example is Meta, which has just come out with its financials for 2024.

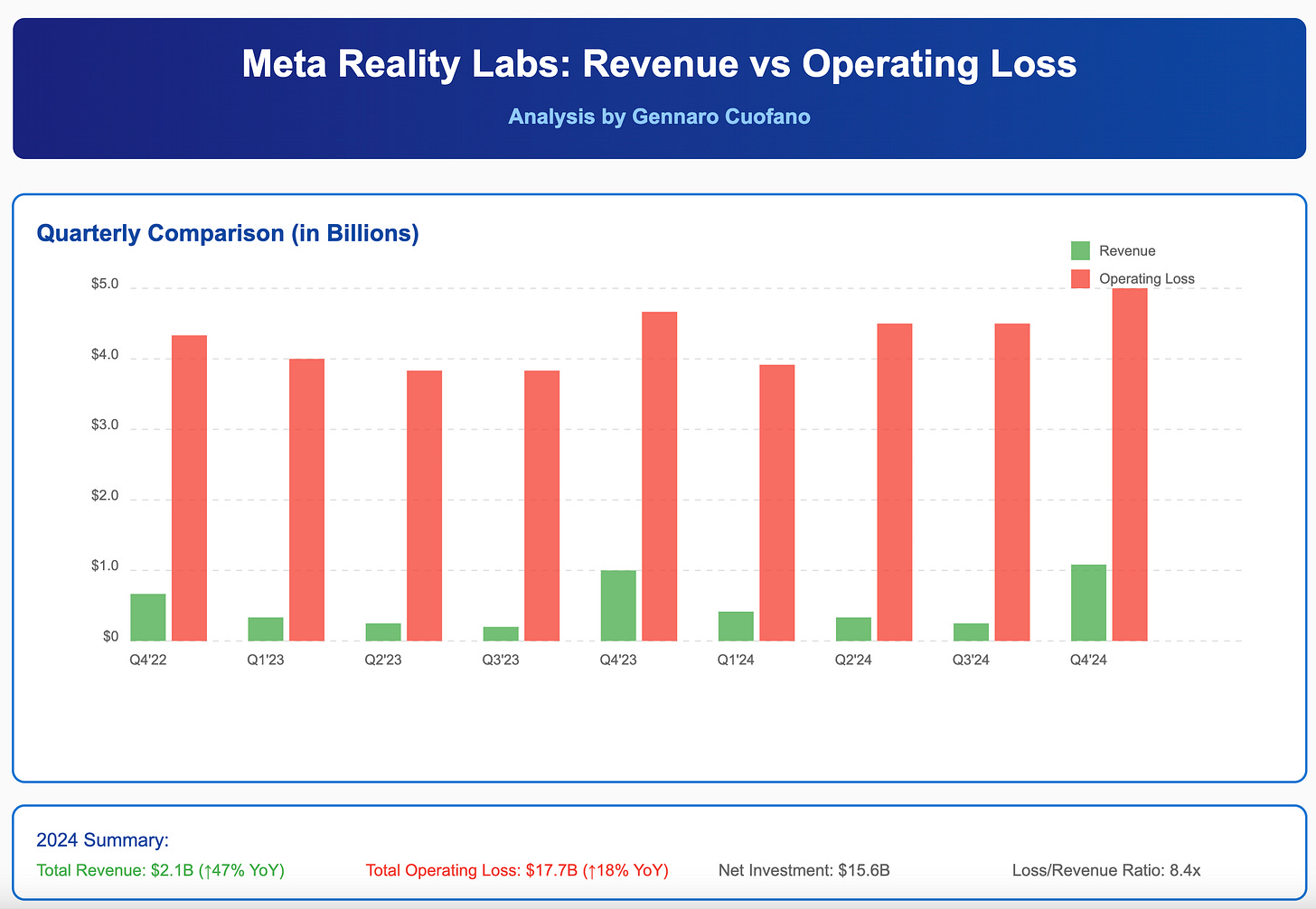

While numbers look impressive, when you drill down into the Reality Labs segment, its losses amounted to over $17 billion in 2024.

I’ve argued that in the previous years, that money was “wasted” on a flawed vision, which in Zuckerberg’s mind was all about VR.

That money is well spent, as the company has announced a complete reorg around AR.

In other words, Meta is just undergoing a massive transition of its core.

And it’s not an easy one.

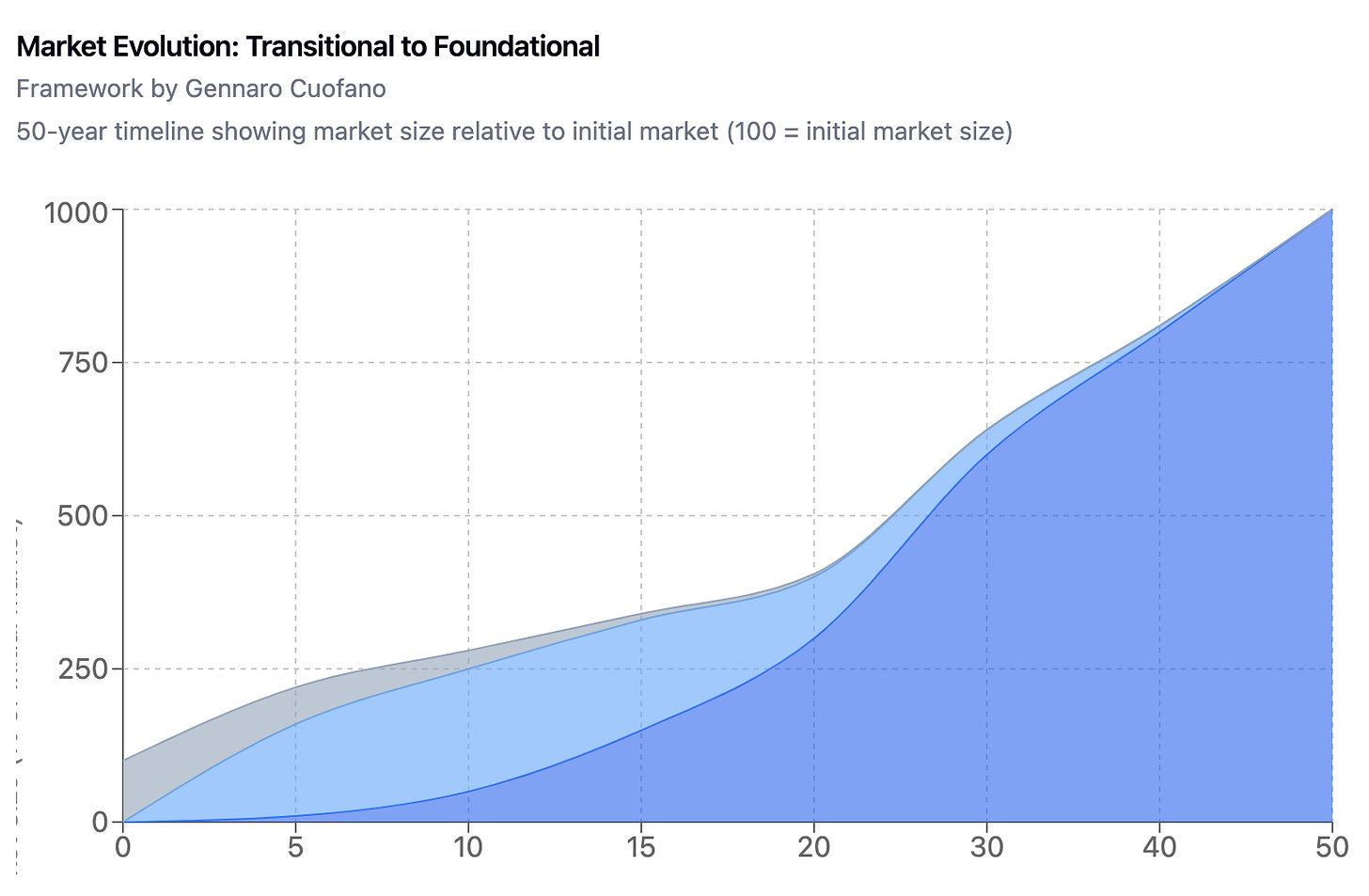

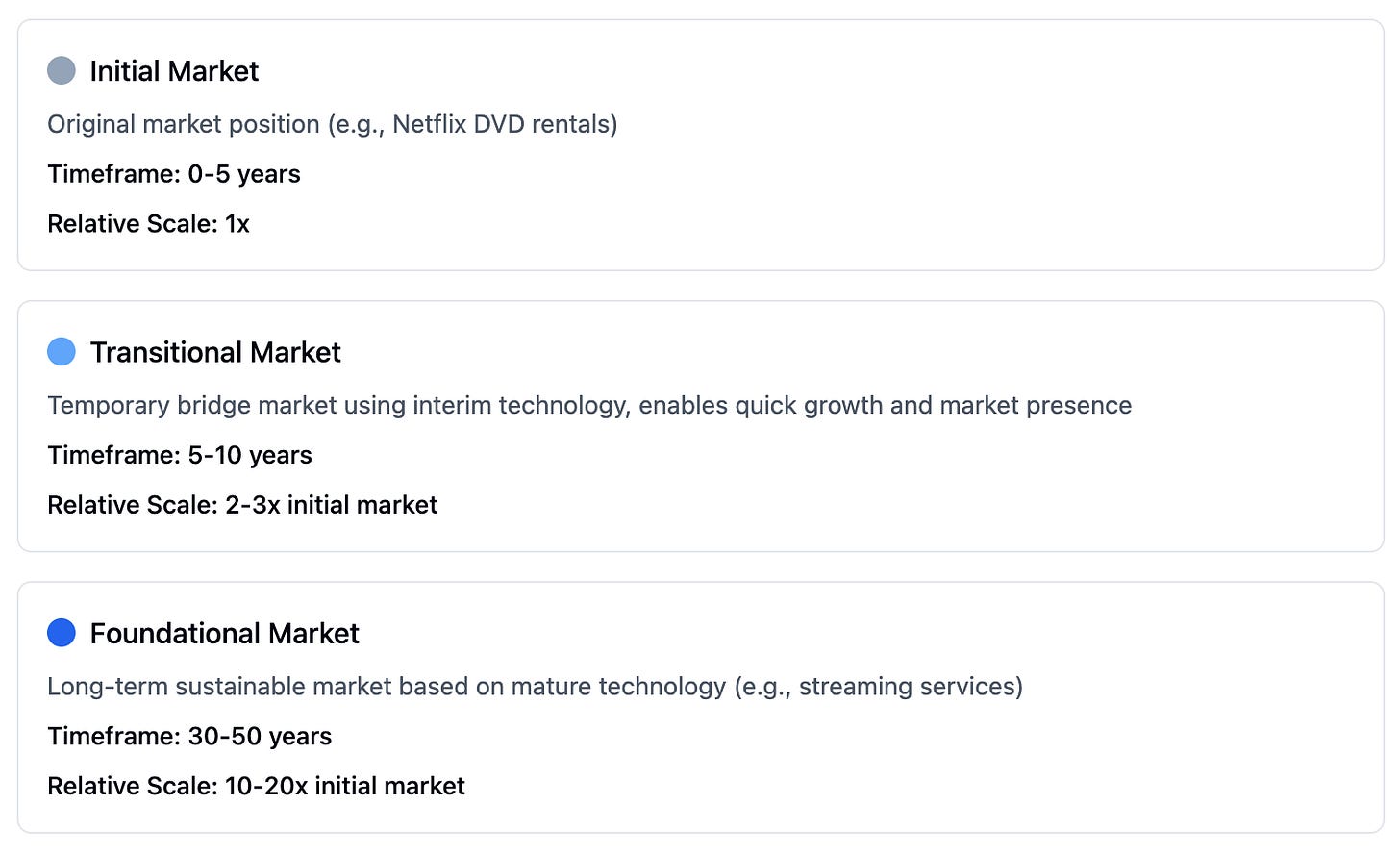

This is all coming together as part of the Transitional Market Dilemma.

How do you make sure that the short-term positively converges with the long-term vision of your business?

A concept I developed as I dived into various business models over the years is “transitional business models.”

To me, that has been a transformative concept, as it has removed the apparent conflict between the short and long term as a whole.

This concept changed my view of the business world.

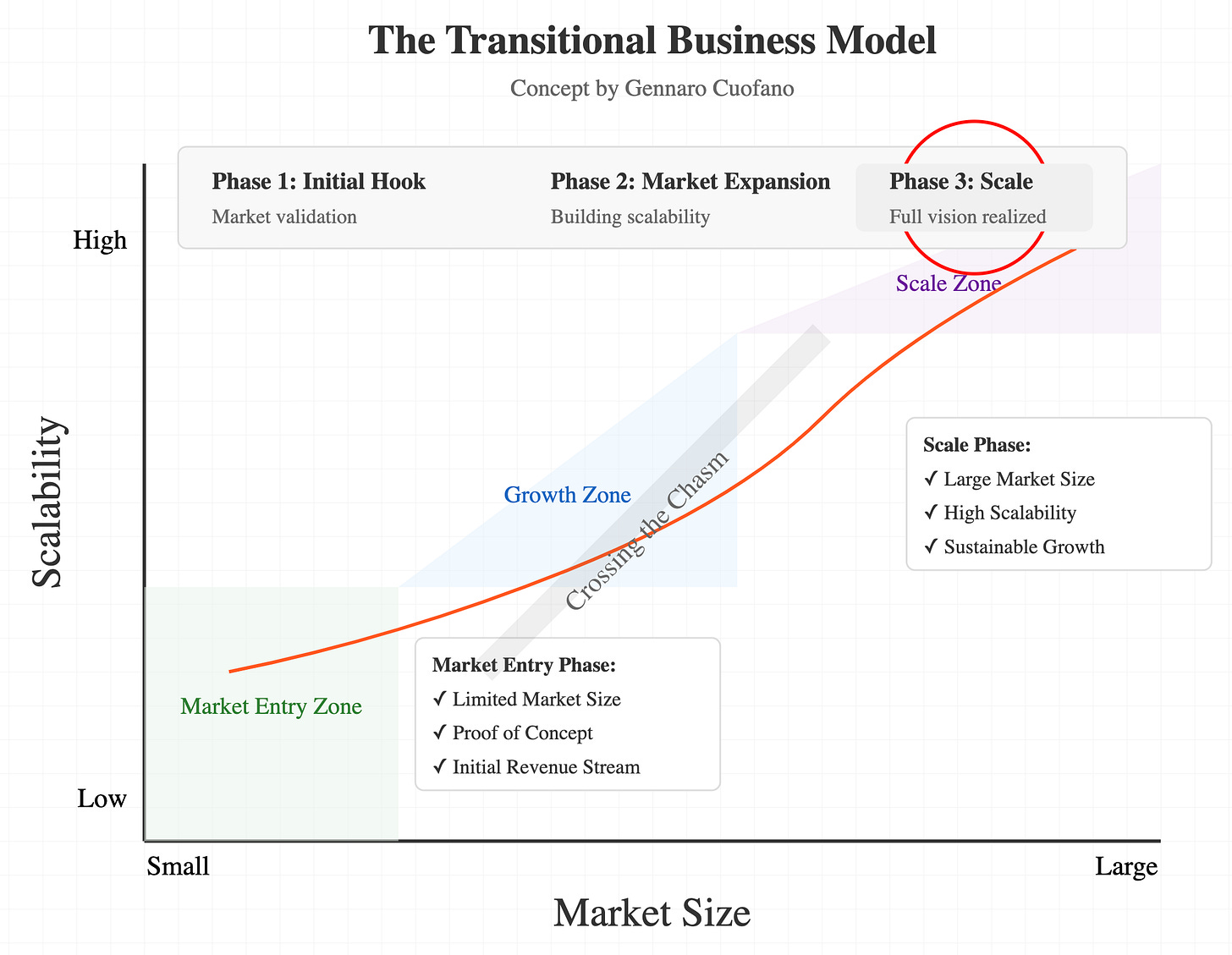

The Transitional Business Model is a “temporary market hook” that works for the first phase of market validation and scalability to create options to scale, creating a much larger market opportunity.

It comprises three phases:

-

Phase 1: Initial Hook (Market Validation)

-

The product or technology enters a small, limited market for early adoption.

-

Companies focus on proof of concept, traction, and generating initial revenue to validate feasibility.

-

-

Phase 2: Market Expansion (Building Scalability)

-

Growth accelerates as the business refines its model and crosses the chasm to reach a broader audience.

-

Companies focus on scalability, optimizing operations, and expanding market share.

-

-

Phase 3: Scale (Full Vision Realized)

-

The technology or business reaches large-scale adoption, high scalability, and sustainable growth.

-

It transitions into a foundational business model with mass-market appeal.

-

Key transition zones are:

-

Market Entry Zone: Testing viability with a niche market.

-

Growth Zone: Scaling efforts to reach mainstream users while finding footing in a “foundational business model.”

-

Scale Zone: Achieving long-term growth as the transition is completed.

This is part of an Enterprise AI series to tackle many of the day-to-day challenges you might face as a professional, executive, founder, or investor in the current AI landscape.

How?

When companies like Netlifx, Meta, and Tesla start rolling out their business models, they go through a phase called the “transitional business model.”

A transitional business model is used to gain traction in a market that is not necessarily big or initially scalable.

If we break down business strategy into three core parts:

For any company, fully rolling out this strategy (depending on the industry) might take at least a decade.

A transitional business model is a model that will serve the purpose of gaining initial traction and market validation.

Therefore, it will help with market entry and shape the long-term vision as rolled out.

A transitional business model might seem obsolete in hindsight, yet that is the same model that proves the idea’s viability while keeping it alive.

A transitional business model might not be scalable.

Yet, that model will help create an initial positioning and get the funding (revenues or capital) needed to roll out the scalable business model.

A transitional business model might not have a long-term vision, yet it will help shape it.

Thus, a transitional business model works in the short term to validate the market and enable the technology and its ecosystem to mature while still having a reality check.

This is the core premise of a renewed business playbook that doesn’t just rely on growth capital.

It moves by (also) securing growth capital and then validates the market step by step.

There are plenty of examples of transitional business models:

-

Facebook’s initial transition to scale, a former college social network, would open up to anyone just later on as it gained substantial traction.

-

Netflix’s initial transition to scale moved from a DVD rental company to a streaming platform only much later.

-

Google’s initial transition to scale, before building the most powerful advertising machine ever built, sold advertising through its salespeople.

The basic premise of the transitional business model is that it will sit on a temporary market that will serve as a launch ramp and transform it into a scaled-up version.

Yet, as technologies mature often in parallel with others, as a company, you can’t control that, and it’s hard to predict when that “fundamental shift” will happen.

For the sake of it, the transitional business model will help keep a hook with the current market context, finance the business model in short, and keep it alive long enough to also have the financial resources to experiment with the fundamental paradigm shift as it becomes viable.

I’ll tackle the transitional market in the upcoming issue.

As I’ve explained in previous issues, the convergence of AI with many other technologies will create a paradigm shift, which is just starting to show its potential.

A business model is always in transition, as it operates in a dynamic context, which might be more or less stable depending on a set of external factors.

For instance, as we speak, many incumbents (Google, Meta, Apple, Microsoft, Salesforce) are all transitioning their business models to fit the new developing context.

Thus, again the convergence of AI with other technologies will create a paradigm shift that will work to create a whole new market in the coming years.

Now, the thing is, this transition will start from the outer layer of the business ecosystem (the last to develop), which is the web.

That will create massive pressure on the incumbents that have dominated it, which, while in the short-term might seem to dominate this paradigm (“incumbent paradox”), in the longer term, if not embracing it, these will be threatened to their core.

That’s where we are!

If Meta doesn’t figure out what the next major platform shift is happening, with AI emerging, that might completely threaten its core advertising business model.

Therefore, it will be critical for Meta, just like other incumbents, to go through a “transitional business model” again, sitting on top of their core one to find a new mass scalable market on top of which they’ll build the new core.

Meta is embarking on a massive AI-driven transformation, introducing a wave of AI-based hardware products while integrating AI deeply into its ecosystem.

Among the highlights are Oakley-branded smart glasses for athletes, slated for 2025, alongside high-end glasses with built-in displays that showcase advanced technology.

Meta is also revisiting its smartwatch project and developing camera-equipped earbuds as an AirPods rival.

The company’s first AR glasses, codenamed “Artemis,” represent a leap into true augmented reality, with a planned release in 2027.

These initiatives reflect Reality Labs’ leadership and Meta’s dedicated division for hardware innovation, signaling the company’s ambition to dominate the AI and wearable technology markets.

AI integration will be central to all these devices, transforming their functionality and user experience.

With this pivot, Meta appears poised for a potential reorganization, similar to shifts seen at Google and Microsoft, as it aligns more closely with its AI strategy and hardware ambitions.

This move is, therefore, part of a broader transformation to fit into the new business landscape.

Will that succeed?

-

Meta is undergoing a major transition from a VR-focused vision to augmented reality (AR).

-

Reality Labs reported over $17 billion in losses in 2024, but the company sees AR as the future.

-

Meta is launching AI-driven products, including smart glasses, AR glasses (codename “Artemis”), and AI-integrated wearables.

-

A transitional business model is a temporary market strategy that helps companies gain initial traction before scaling.

-

It consists of three phases: Market Validation, Market Expansion, and Full Vision Realized.

-

This model helps businesses navigate industry shifts, securing short-term survival while preparing for long-term growth.

-

Even incumbents, when there’s a paradigm shift, need to use a beginner’s approach to tackle again a new market that develops.

-

Facebook: Started as a college social network before expanding globally.

-

Netflix: Transitioned from DVD rentals to a streaming giant.

-

Google: Initially sold ads through a sales team before automating ad placements.

-

Businesses must align short-term success with long-term vision.

-

Major tech incumbents (Google, Meta, Apple, Microsoft, Salesforce) are adapting to new AI-driven markets.

-

The challenge is predicting when foundational technology shifts occur.

-

Meta is restructuring around AI and AR to compete in a changing landscape.

-

AI-powered personalization will drive future Meta products.

-

The company’s success depends on navigating this transition effectively.

Ciao!

With massive ♥️ Gennaro Cuofano, The Business Engineer

This is part of an Enterprise AI series to tackle many of the day-to-day challenges you might face as a professional, executive, founder, or investor in the current AI landscape.