In the last couple of weeks, I’ve tackled quite a few mental models to understand where we are and where we’re going.

Let me put everything in a single guide so you can get a feel for how it all fits together.

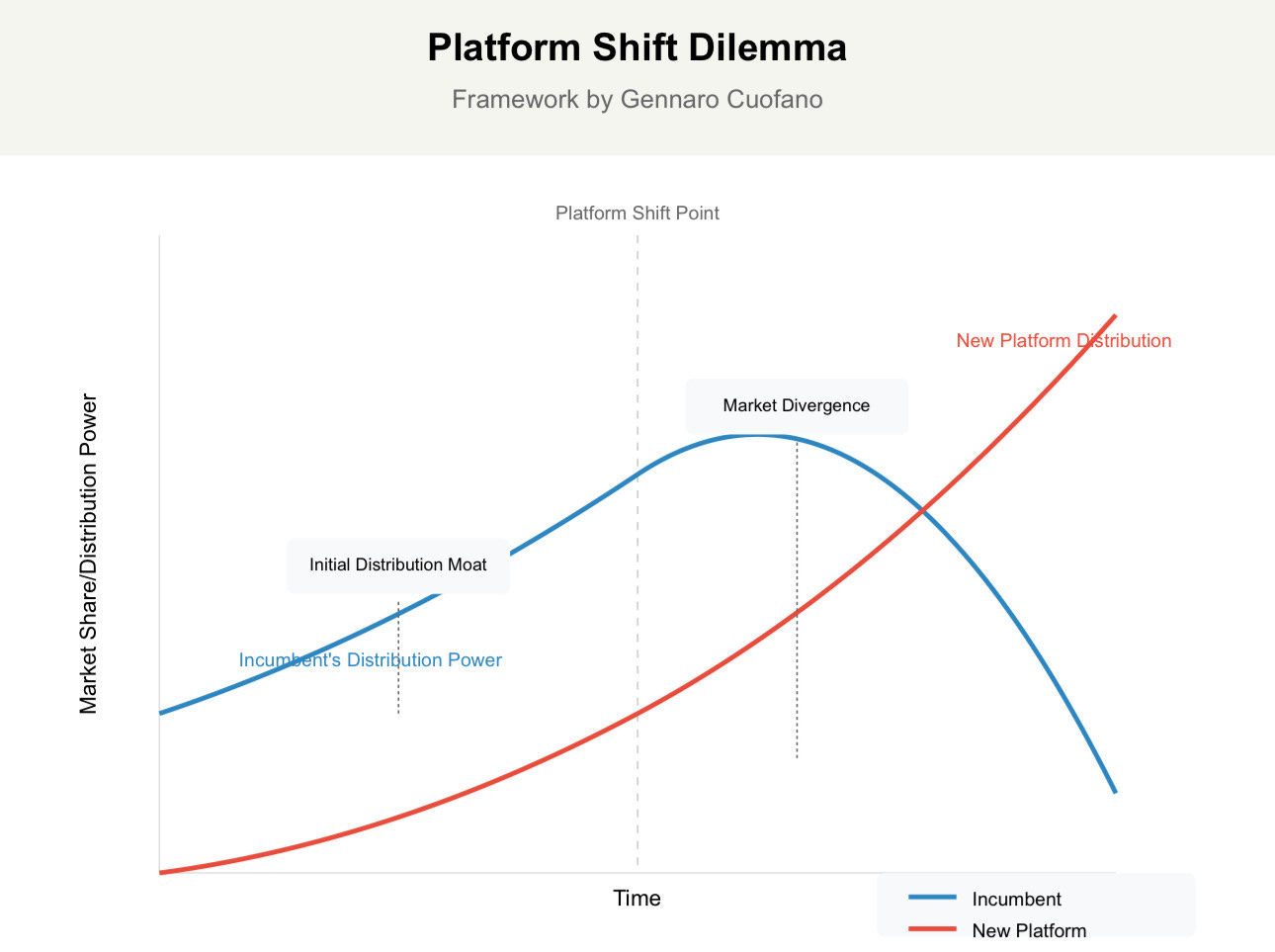

A platform shift is a fundamental transformation in which incumbents initially leverage established distribution moats to gain a short-term advantage in emerging markets but eventually struggle to adapt.

As new technology paradigms disrupt old business models, rapid shifts expose vulnerabilities, forcing companies to continuously evolve or risk losing competitive dominance in dynamic cycles.

Let’s review some of the key concepts that make this happen in the first place.

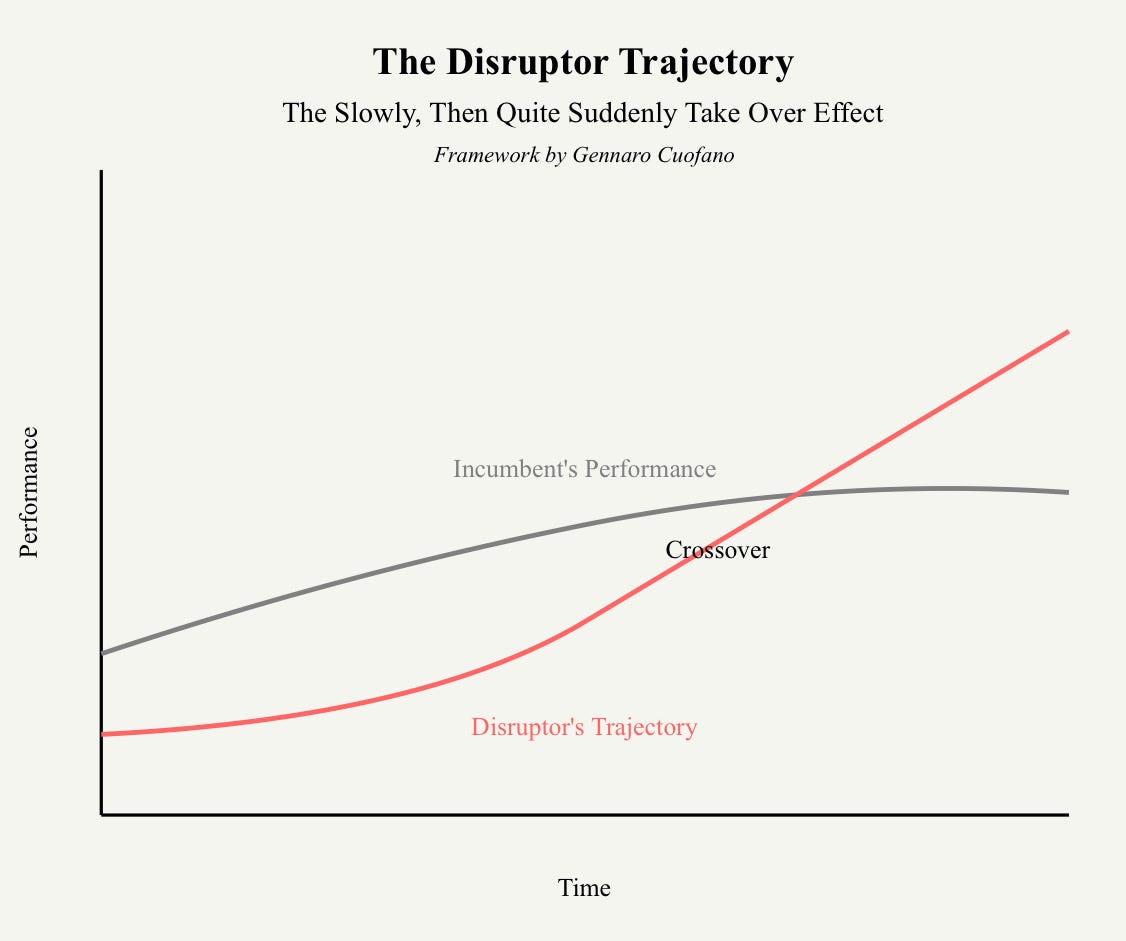

The incumbent paradox (where the incumbent gets a leg up in the short-term, which loses effectiveness slowly, then quite suddenly) acts as a short-term distribution moat, allowing an incumbent to gain an early advantage in a newly developing market during a platform shift.

That’s a period of major confusion among the practitioners and onlookers, as it’ll prevail the narrative of “the new tech is just making incumbents richer and more dominant.”

Yet, that is only temporary. Indeed, as the platform shift happens, the tech incumbent will actually be the most challenged in making a core transition of a business model that is quite fit with the previous paradigm.

In this phase, the incumbent leverages its distribution strength to get a leg up, and it works!

Until distribution on the old paradigm, “slowly, then quite suddenly,” no longer works as a moat.

Thus, once the shift gains momentum, the gap between the old and new market widens rapidly, and the new distribution model takes control.

At that stage, the incumbent loses its competitive moat unless it has successfully adapted to dominate the new paradigm and platform.

The Platform Shift Dilemma says that moats that have worked for decades suddenly don’t.

Many incumbents are experiencing this in a very weird time window. In the next decade, many of them might lose their core moats.

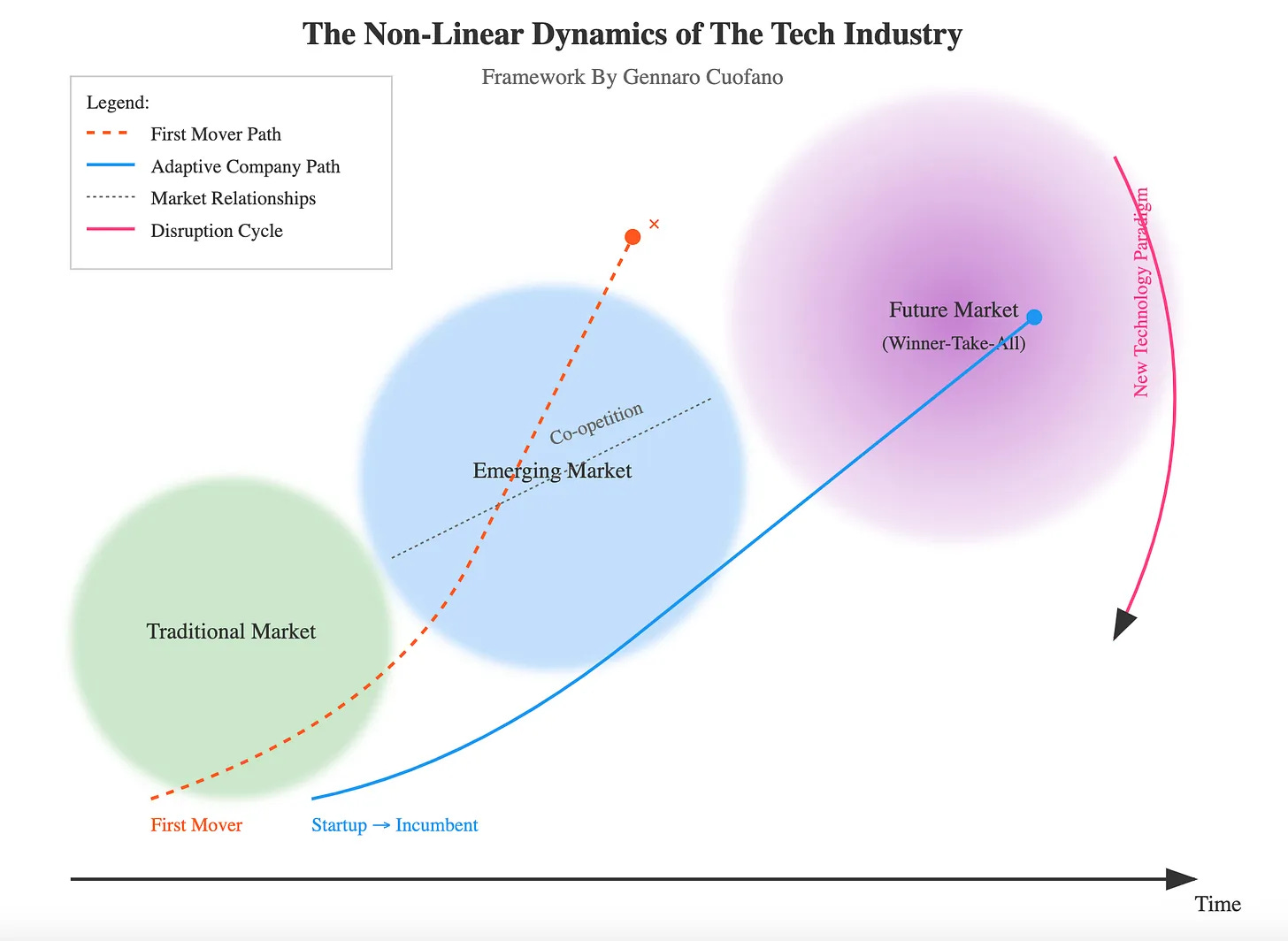

This dynamic, much slower in other industries, is instead the norm in a tech-driven business world.

The boundaries in the tech world are quite blurred as new markets develop continuously. It’s tough to predict which one will be the next to eat them all while expanding on top.

Therefore, a company operating in the tech industry must continuously transition its business model as it places bets on the future.

Indeed, the tech industry is highly competitive. Andy Grove meant this when he published “Only the Paranoid Survive” in the late 1980s.

Look at Intel today, the market leader only 30 years ago, now an acquisition target.

Technology, which seems such a cool sector today, is also quite a wild ride, where the first-mover, in most cases, doesn’t make it to the other end of a market it opened in the first place.

It’s also a place where, in new markets, co-opetition is the rule, as technology markets operate with very complex dynamics and blurred boundaries where friend and enemy turn into “frenemies.”

When the future market gets dominated by startups turned into incumbents that benefit from winner-take-all, make the rule of the game until a new technology paradigm eats up the whole industry to go full cycle again.

That’s a key lesson to remember in the world of AI as it develops!

A few axioms come out of this.

![The Platform Shift To A New Foundational Market [AI Hosts]](https://som2nynetwork.com/wp-content/plugins/phastpress/phast.php/c2VydmljZT1pbWFnZXM/mc3JjPWh0dHBzJTNBJTJGJTJGc29tMm55bmV0d29yay5jb20lMkZ3cC1jb250ZW50JTJGdXBsb2FkcyUyRnRodW1ic19kaXIlMkZjcm9wcGVkLWluZGV4NS1yMDczbjkwNDc5M3czejl4cndlbjJrdnR6ejllMnhkbnViYnVzcTV3emcuanBnJmNhY2hlTWFya2VyPTE3NTM5NzI1MDgtMjgzNCZ0b2tlbj1kNjViNjNiYWY1NjI4OGNi.q.jpg)

![The Platform Shift To A New Foundational Market [AI Hosts]](https://som2nynetwork.com/wp-content/plugins/phastpress/phast.php/c2VydmljZT1pbWFnZXMmc3JjPWh0dHBzJTNBJTJGJTJGc29tMm55bmV0d29yay5jb20lMkZ3cC1jb250ZW50JTJGd/XBsb2FkcyUyRnRodW1ic19kaXIlMkZMaWZlLUFmdGVyLVRlcm0tSW5zdXJhbmNlLUhvdy10by1QbGFuLWZvci1XaGVuLVlvdXItUG9saWN5LUV4cGlyZXMtcmFlcG44OWJ1OW1ha2V2NGNzYjRxbmNjenEzdzk3andxMm92dmZreDhjLmpwZyZjYWNoZU1hcmtlcj0xNzU2MDIyNjAwLTI1NDkmdG9rZW49N2Y2YWY5YTdlZDlkMzQ0YQ.q.jpg)