A refresher post on my investment strategy is long overdue (thanks for prompting me, @Curlew 🙂 ), seeing as the last update was back in 2021. A fair bit has happened since then! Apologies, as with the previous post, this one will be long-winded and waffly.

I can’t say that I’ve kept meticulous tracking of buying and selling (not that I do so much selling in any case) and need to collate the info from various disjointed spreadsheets.

Why don’t I keep such records?

Probably because I’m not comparing myself to anyone or anything, no benchmark so I don’t feel like I need to know. Would it matter if I knew my portfolio was doing better or worse than some benchmark? Does it matter if I made X% profit or loss on a trade?

I have a graph that goes up and down showing the value of my FF and that’s all I need to know really. Oh and my monthly ISA dividends. I also know the annualised returns of my entire portfolio and I feel that’s enough info for me.

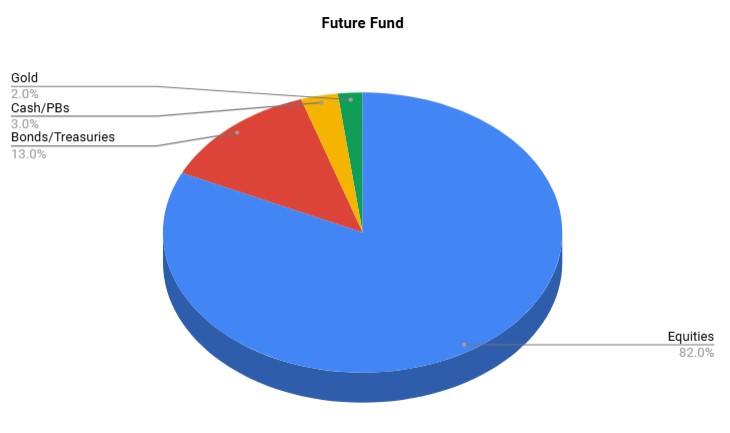

So a reminder, my Future Fund (FF) is made up of investments in my ISAs, SIPPs, employer DC pension, my cash ISA and premium bonds, and is intended to provide me with income when I retire from full-time work. It is not a net worth number and does not include my DB pension, cash emergency fund or property.

The fund is intended to give me a financial bridge from when I pull the plug on work to when I can draw down on my DB pension and then the state pension – these latter two alone should provide me with a basic minimum income floor.

What’s my FF made up of?

Broadly speaking:

Yes, at some point, some gold sneaked in there, but I’ll cover that a bit later. So, I’m currently 82% in equities and I’m fine with that right now.

The equities/investment portfolio (blue bit of the pie) is made up of index tracker ETFs, investment trusts and some individual shares.

Here’s the basic breakdown of my equities:

ETFs make up 72%, investment trusts 22% and individual shares 6%.

When it comes to drawdown/early retirement, I’ll be selling the ETFs for capital income, whilst taking dividend income from the ITs and individual shares (although I do own a small number of growth shares).

What ETFs?

I originally set up my ETF portfolio after reading Tim Hale’s Smarter Investing book, combined with Monevator’s Lazy Portfolio post.

I created my own Portfolio for All Seasons, one with equities and bonds, which would supposedly weather all kinds of stock market shenanigans and which suited my own appetite for risk. It didn’t do too badly during the ‘pandemic panic’ and I was also able to sleep well during the recent markets see-sawing following Trump’s tariff announcements.

My allocations have changed slightly since I reset them in 2021:

Just need to shift a bit more into the bond/treasuries and gold parts and I’m pretty much there.

I re-balance via new monthly contributions, very rarely selling to buy, although I did sell the so-called ‘defensive’ ITs (eg Personal Assets, Capital Gearing, Ruffer), which I bought when I was a bit fearful of negative bond yields a couple of years ago.

These just didn’t do what I thought they would (namely act defensively!) so over time, I swapped them for a mix of money market funds, more global trackers, a bit of gold (because I didn’t have any) and stocks in Rolls Royce.

The latter came about after I happened across an article about their small modular reactor technology a couple of years ago – I liked what I read, so chucked in some money when the shares were around £2. Since then, with defence and government projects in the pipeline, the shares have rocketed to £10. Yes, of course I should have bought more when they were cheap as chips but I think my average price is around £4 and it seems like a solid growth share that I’d like to keep hold of. The future is nuclear!

And finally, why ETFs and not funds, like Vanguard Lifestrategy? The fees are cheaper for ETFs on the platforms I use, although I am still drawn to the Lifestrategy funds for simplicity, so never say never.

Eere are my main ETF holdings:

Global: Vanguard All World ETF (VWRL/VWRP)

Bond: iShares Ultrashort Bond ESG ETF (UESD)

Gold: Gold Bullion Securities (GBSS)

UK: Vanguard FTSE 100 ETF (VUKE)

Property: iShares Developed Markets Property Yld ETF (IWDP)

Emerging Markets: iShares Emerging Markets Equity Tracker (EMIM)

UK Mid: Vanguard FTSE 250 ETF (VMID)

Global Small Co: SPDR MSCI World Small Cap ETF (WOSC)

These are my majority holdings but I have other similar ETFs (legacy ones sitting in HL and AJ Bell) which are insignificant amounts (all less than £1k). I also have a few smaller (more specialised) holdings in other ETFs which are just lumped into my ‘global’ allocation, for example iShares Global Water ETF (IH2O) and iShares Ageing Population ETF (AGES) for a further bit of diversification.

In time, it’s likely I will ultimately whittle these ETF allocations down to just 4 core holdings for simplification. Or if I may just sell the whole lot and put it all in Lifestrategy 80% or 60%. There’s always a possibility.

Dividend Income Portfolio

I wanted a part of my portfolio which I would just hold and never sell and which would generate regular dividend income. This would be made up of investment trusts (ITs), individual shares and a perhaps the odd ETF.

I built up a basket of ITs, a mix including so-called ‘dividend heroes’ (paying increasing dividends over many consecutive years), diversifying across different sectors.

Using the AIC Income Finder, I researched and picked ITs that paid a decent yield (generally >4%), whilst trying to avoid ones that paid huge dividends as those seemed too good to be true and likely unsustainable.

Here are my IT investments broken down by sector:

While I was tossing out the defensive ITs, I took the opportunity to whittle down some of the investments in this income portfolio, with iShares UK Dividend ETF (IUKD) and Henderson Far East Income (HFEL) falling by the wayside and the funds from their sale just spread across the existing holdings.

Might I add more sectors to this pie or just continue to build on the smaller slices of the pie? I’m tempted to just do a one in, one out system and indeed I did just that this month; European Assets Trusts will be wound up so I sold my entire holding. Didn’t find anything similar to replace so went for something completely different, opening an investment in Schroder Japan Trust (SJG), Japan being a sector I had no previous exposure to.

Click here to see all my ITs and shares (inc growth shares).

I’m fine spreading the risk across many different ITs rather than a concentrated few, although it does mean there are more to keep tabs on and I have to be honest, there are a more than few of them which I haven’t looked at since I did the initial research on them years ago. As long as the dividends are still getting paid and not cancelled or cut and there’s no negative press about them, I’m happy to stay invested.

In 2020, I received around £1.8k in income from my IT and share ISA portfolio.

In 2024, I received £4.3k, which has surpassed my original goal of £4k a year.

Getting an average £400 a month in divi income would cover most of my utility bills so I’m pretty much there with my goal now.

Question – why have income paying investments while I’m still accumulating?

Mainly because I need to see that I can actually generate a certain amount of income from my investments – I don’t want to pull the FIRE plug, only to find out belatedly that my portfolio didn’t provide me with the income I thought it would. Or to suddenly have to decide what growth investments to sell and what income investments to buy with the funds from the sale. I’ve done all most of my homework already, the income is ready for me to take now even, if I wanted to.

Of course, dividends are not guaranteed but thus far, I’ve only experienced a very small number of my holdings cancelling or reducing their dividends, and only one cancelled during COVID.

Cash

Cash/premium bonds makes up just 3% of my Future Fund.

This needs to be a lot bigger.

SIPP or ISA?

All of my savings/investments are ‘tax efficient’, ie either in my SIPPs or my ISAs.

ISAs offer more flexibility and hopefully, Reeves won’t mess about with them too much. I currently have more in my SIPPs but that’s fine, considering I can already access them should I wish because yes, I am that old 😀

Last leg of my journey

So, serious knuckling down to make sure my investments do their best before I retire.

As I approach the last leg of my FIRE journey, will I be considering different decumulation builds and changing the allocations of my portfolio? Other than abovementioned 4 core ETFs or Lifestrategy funds, not really. I don’t have the mental strength for that currently.

So that’s my investments right now.

As mentioned earlier, I’m not trying to beat any sort of benchmark – my annualised returns since I started tracking my investments in 2014 is around 7.2%.

This might be decent or rubbish compared to some other investors but I’m not in a competition so it doesn’t matter. Me sleeping well is all that matters.

Of course, I’m certainly not 100% confident that my strategy is the best one for me – however, as a generally optimistic person, so I guess I’m cautiously confident of what I’m doing, but all I can do is wait and see, keep calm and carry on investing!