June 2025 was marked by heightened geopolitical and macroeconomic tensions that influenced both Indian and global markets. The most significant global development was the military escalation between Israel and Iran, triggered by Israeli strikes on Iranian nuclear facilities and followed by a large-scale missile and drone retaliation from Iran on June 13.

The Nifty index reflected this uncertainty, dipping around the middle of the month before rebounding toward the end.

Back home, regulatory action dominated headlines with SEBI barring U.S.-based quant trading firm Jane Street from Indian markets. Accused of index manipulation and unlawful gains worth ₹4,746 crore (~$570 million), the firm was directed to disgorge profits and cease operations in India. While this action stirred short-term concerns about foreign institutional participation, the market reaction was surprisingly contained. Analysts view it as a clean-up effort rather than a systemic risk to foreign inflows, and broader indices held steady despite the news.

Globally, the U.S. continued to dominate the macro narrative. Former President Donald Trump escalated trade tensions by announcing plans to impose sweeping tariffs ranging from 10% to 70% on major trading partners starting August 1, unless new deals are struck by July 9. As a result, tariff revenues surged to $28 billion in June—up over 200% month-on-month—indicating that businesses are absorbing costs for now.

This also caused the Federal Reserve to pause its rate-cut plans, with Chair Jerome Powell citing tariff-driven inflation concerns. Despite the uncertainty, U.S. markets ended the month strong, buoyed by solid jobs data and resilient consumer sentiment.

From an investment perspective, June called for cautious optimism. Indian equities remained resilient, with IPO markets remaining active and benchmarks up ~14% YTD, though valuations appear stretched.

Investors should remain watchful of key events in early July—particularly U.S. tariff deadlines and any emerging trade deals with India or the EU—that could shape the direction of markets in Q3. Knowing the uncertainty around Trump’s behaviour, nothing can be ruled out!

Randomdimes Youtube

Alternative Investments, Defaults, and Delays

We have created a table to make it easy for everyone to track the latest status of ongoing delays and delays on various platforms and the current updates around them.

| Name | Deal | Status | Update |

|---|---|---|---|

| Growpital | Platform Freeze | SEBI Freeze | – SEBI needs to finalize escrow repayment mechanism |

| Altgraaf | Arzoo | Partial Repayment | – Litigation Process against Arzoo initiated |

| Tapinvest | Melorra Asset Leasing/ Growpital Leasing Gensol |

Early Asset Buyback for Melorra, growpital asset stuck Gensol ID partial repayment |

-Resolution ( Final Payoff Pending) -Growpital Assets identified in Barmer – ED froze Gensol acccounts |

| Gripinvest | Bigspoon

AGS |

Partial Repayment

Partial Repayment |

– 25% asset recovery pending.

– 90% recovery through asset redeployment |

| kredx | Multiple deals

BIRA bonds |

Litigation | – Delay in multiple deals such as TCS, Dairy Power, CBRE etc

Bira Interest delay |

| Tradecred | Bizongo

Clensta |

tradecred files complaint | – INR 69 cr fraud complaint filed on Bizongo |

| Bonds | Trucap

AGS Transact Satin Credit Midland Sammunati, Moneyboxx,,Spandana,Finkurve,Satin, Criss Capital,Dvara KGF |

Trucap downgrade to BBB- Stable AGS defaults in few obligation NPA covenant breached for Satin Loss Covenant breached Midland – Covenant Breached(NPA, PAT etc) |

– Coupon increased to 13% ,5 months remaining for repayment. – Grip Monitoring SDI of AGS – Coupon increased by 2% – Investors to vote on decision as they requested waiver |

| Betterinvest | Studio Green | Partial Repayment | – Payment expected by March End for few – Few people got the payment with option to extend deal to June Few more people got repayment |

| Leasify | Sharepal | Partial Repayment | – Last tranche delayed |

Currently, below are the key new updates on the various delays across Alternative Investment platforms.

- Tradecred Bizongo Complaint

- Grip AGS Transact

- Growpital Update

Tradecred Bizongo Complaint

Gripinvest has been one of the best platforms in terms of communicating with investors on the status of deals. They have recovered almost 90% the principal from this deal, which is commendable!

Below are some excerpts from the latest communication from Gripinvest

Growpital Update

The Growpital case is still stuck in limbo with the rescheduling of dates for the SEBI and Growpital case. The money has been lying in an escrow for more than 1.5 years, losing interest that people could have earned on it.

In the 13th June Court proceeding, the date was again scheduled for 15th July. Its unlikely any concrete decision would be taken on that date too.

Bonds Risk Status Update

Some recent bond covenant breaches are

- Sammunati

- Spandana Spoorthy

- Moneyboxx

- Trucap

- Finkurve

- Criss Financials

- Dvara KGF

- Lendingkart

- Satin

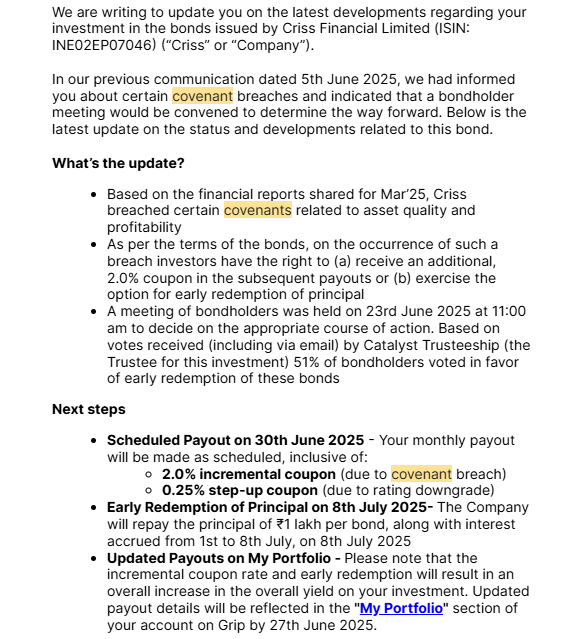

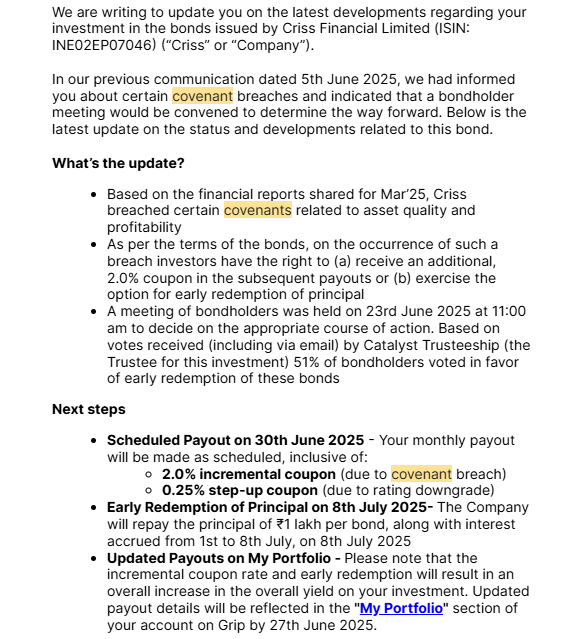

Most of the breaches have been in either microfinance or unsecured lending. Please note that covenant breach does not mean default; it means that some checks in the deal terms have been breached, hence investors get some additional benefit or rights to make an informed decision.

These breaches could be because of higher NPA, profitability dips, etc. For instance, in the case of Criss Financial, there is going to be an early redemption!

Alternative Investment Portfolio Updates

In our endeavour to enhance the knowledge around the Alternate Investment Funds in India, we covered sessions with experts on 2 Funds. We recently arranged a webinar with the experts also.

- Neo Special Credit Opportunity Funds

- Bharat Bhoomi Fund

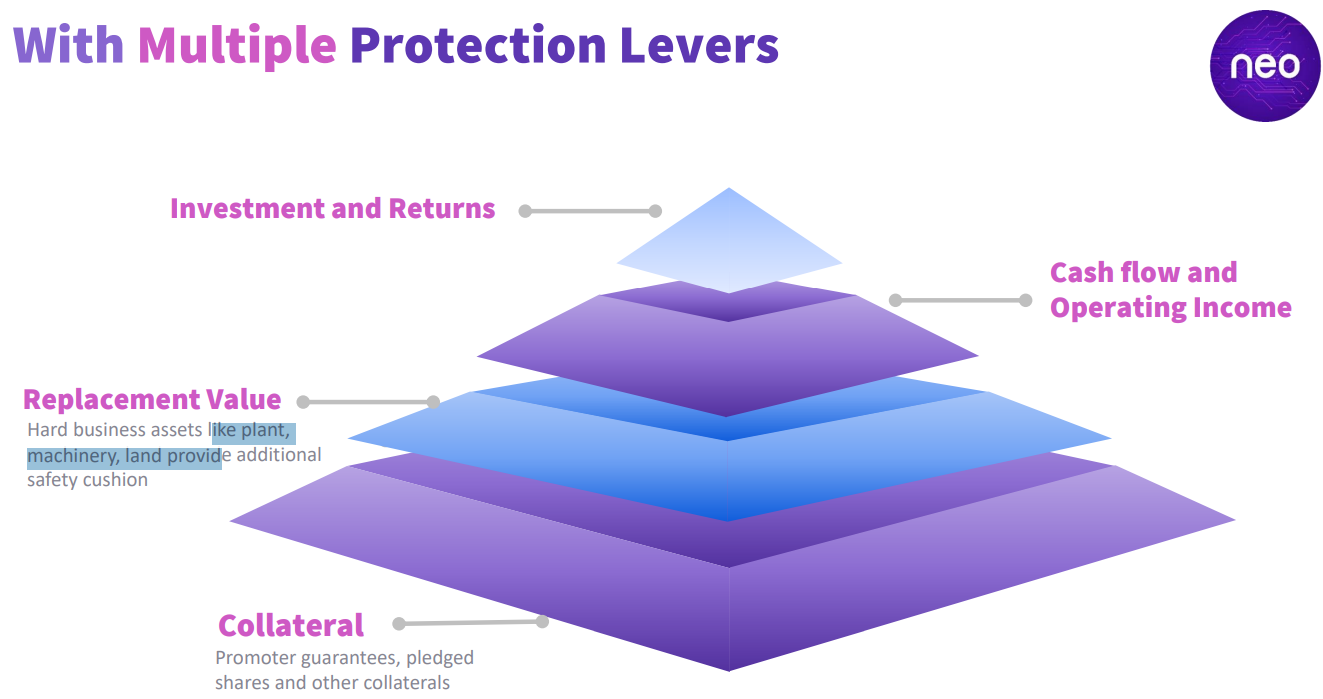

Neo Special Credit Opportunities Fund

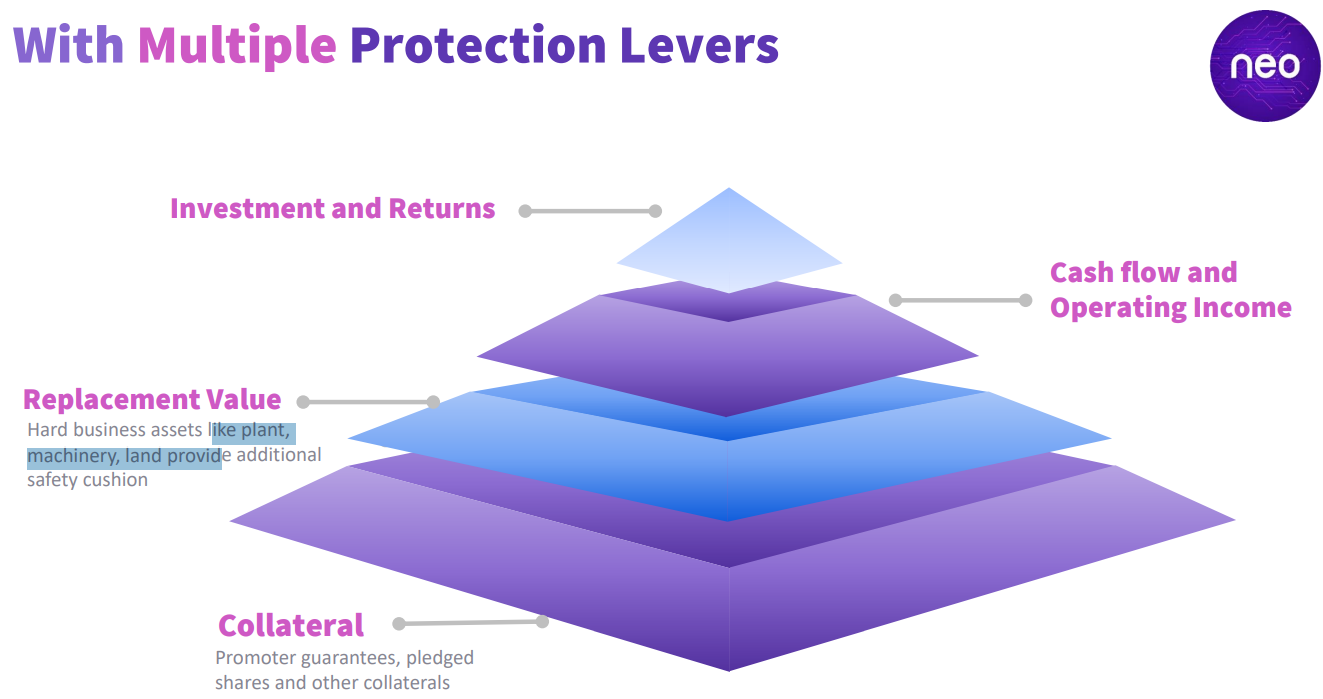

The fund is positioned as a high-yield, mid-market private credit vehicle, offering structured, collateral-backed lending to companies in need of tailored capital solutions. With an experienced team, substantial fundraising, and early deployment momentum, it targets attractive risk-adjusted returns (~22–24% gross) over a 5-year horizon. It suits investors seeking yield-rich, private debt exposure, with an emphasis on security and active management, but comes with meaningful illiquidity and execution risks.

Fund Overview

-

Category: SEBI‑registered Category II AIF

-

Maiden fund launched by Neo Asset Management Pvt Ltd.

-

Target fund size: ₹2,000 cr; successfully closed at ₹2,575 cr from HNIs and MFOs over ~15 months

-

Objective: Provide customized credit to mid‑market corporates facing special-situation funding needs, aiming for portfolio diversification and yield enhancement.

Return Profile & Term

-

Target gross IRR: ~22–24% p.a.; cash coupon: ~14–16% p.a. over 5-year tenor

-

Tenure: ~5 years.

-

Fund structures drawdowns and deploys capital via 3–4 scheduled drawdowns over a 12-month deployment phase

Investment Strategy

-

Focus on operating, EBITDA-positive, mid-market companies requiring bespoke credit — e.g., capex, acquisition, working capital, bridge, mezzanine/holdco financing

-

Investments are secured, often with collateral, including inventory, receivables, fixed assets, and personal guarantees.

-

Preference for strong promoters and structured risk mitigation: rigorous due diligence, strong documentation, external oversight, and active asset monitoring.

Fund Activity & Track Record

Investment Team

-

Led by CIO Puneet Jain, CEO Hemant Daga, and Chairman MD Nitin Jain, backed by >100 years of combined experience in structured credit and private debt.

-

The team’s track record includes successful exits and strong performance (e.g. ≥8000 cr deployed across prior vehicles, 13–16% IRRs, zero defaults).

Risk & Disclaimer Highlights

-

Fund carries high risk, including the potential for total capital loss.

-

IRR figures are gross, before fees, carry, taxes,a expenses

-

Investments are long-term, illiquid, and target sophisticated investors only.

You can register below to get access to the webinar and details about the product

Bharat Bhoomi Fund

Fund Structure: Category II AIF (Alternative Investment Fund)

-

Target Corpus: ₹1,000 Cr with ₹1,000 Cr green-shoe option

-

Fund Tenure: 5.5 years + 2 extensions (1 year each)

-

Target Returns: ~22% pre-tax IRR p.a.

-

Minimum Investment: ₹1 Cr

-

Drawdowns: 20% upfront, remainder in 3–4 tranches

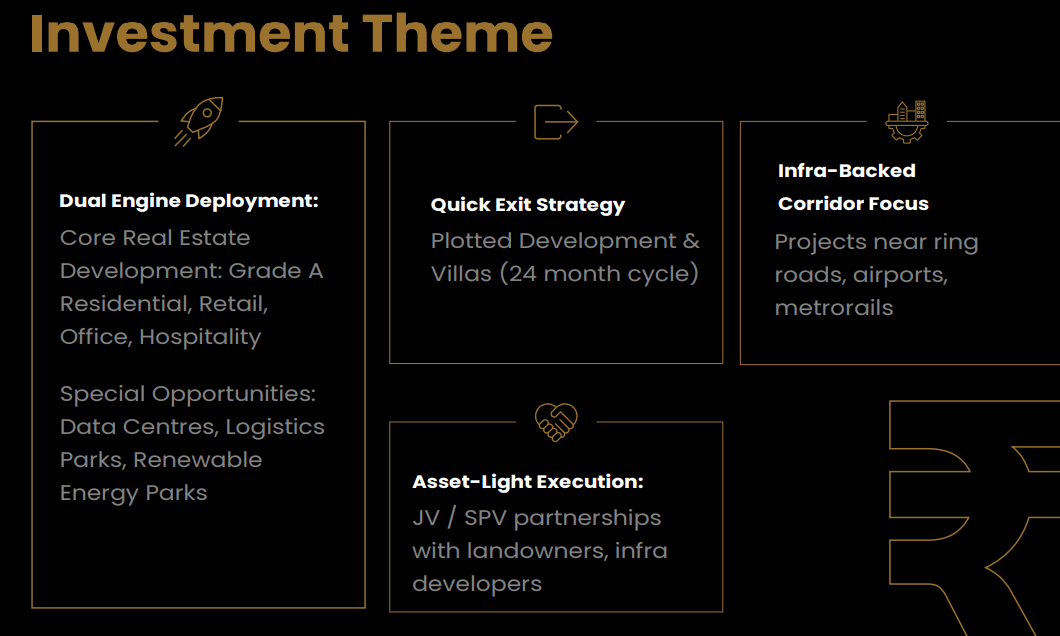

Theme & Opportunity

-

Focused on urban land transformation & infra-backed development

-

Leverages India’s National Infrastructure Pipeline (₹100+ lakh Cr) and real estate formalization

-

Addresses demand in luxury villas, wellness homes, and integrated townships

-

ESG-aligned with green buildings, low AQI zones, and energy-efficient construction

Core Investment Strategy

Geographical Focus

Investment Process

-

Deal Sourcing via proprietary networks

-

Screening & Due Diligence (legal, technical, financial)

-

IC Approval & Term Sheet

-

Documentation & Structuring

-

Post-Investment Monitoring

-

Exit via refinancing, sale, or cash flows

Sample Deal Pipeline

| City | Project | Land | IRR | Amount |

|---|---|---|---|---|

| Pune | Plotted Dev. | 282 acres | 40% | ₹125 Cr |

| Chennai | Plots | 8 acres | 40% | ₹50 Cr |

| Hyderabad | Plots | 150 acres | 40% | ₹160 Cr |

| Pune | Plots & Villas | 700 acres | 40% | ₹120 Cr |

| MMR | Plots | 5 acres | 40% | ₹60 Cr |

| Pune | Mixed Use | 4 acres | 35% | ₹300 Cr |

Key Leadership

-

Madhu Lunawat – Founder of The Wealth Company; co-founder of Pantomath Group

-

Rakesh Kumar – Real estate veteran; ex-Jio, Walmart, Shell; led ₹25,000 Cr asset divestment

-

Prasanna Pathak – 22+ years in asset management (Franklin Templeton, UTI, Taurus MF)

-

Bhavya Bagrecha – CA, CS, ICWA; ₹2,500 Cr managed; real estate & REIT structuring expert

If interested in talking to their team, they can register below or ping us, and we can share details.

Telegram channel for *the Latest Alternative Investment News

Real Estate Investments

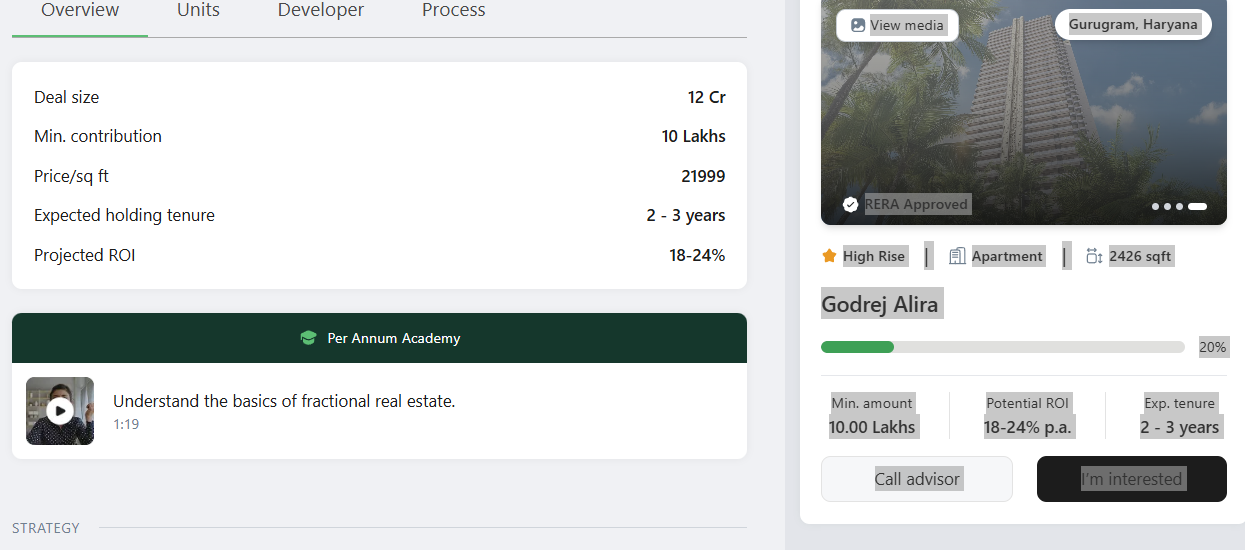

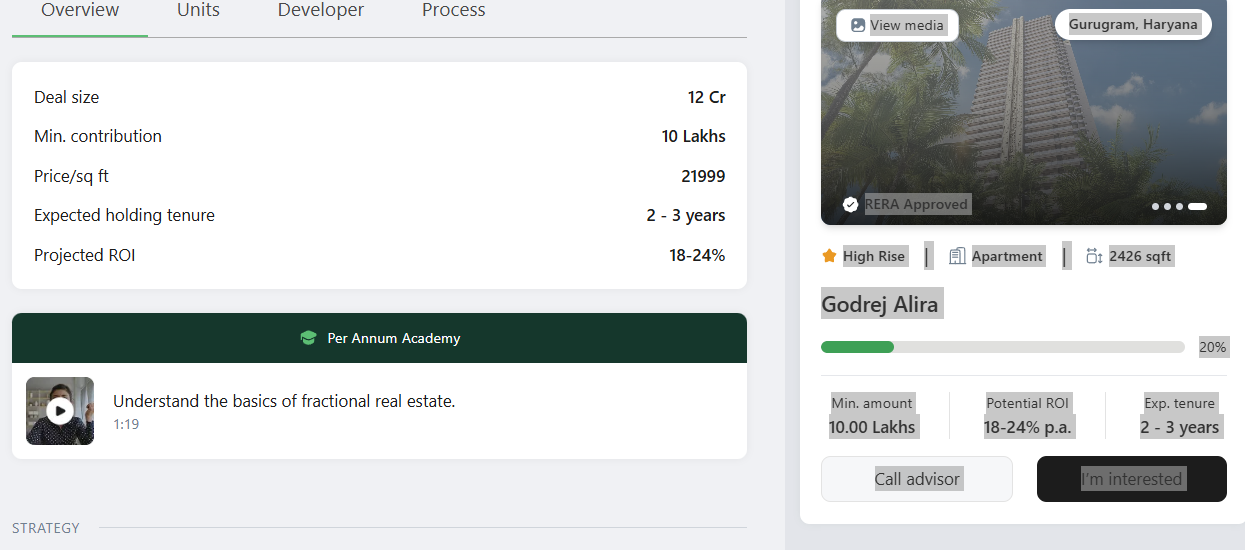

Per Annum Godrej Opportuity

There is a Godrej opportunity available in Gurgaon, a high-end township with a unit cost of INR 6 Cr. The minimum investment per investor is INR 5 Lakh. Estates generally tie up with reputed builders as these builders’ inventory is always in demand.

We did a detailed article on Estates – How does Estate work?

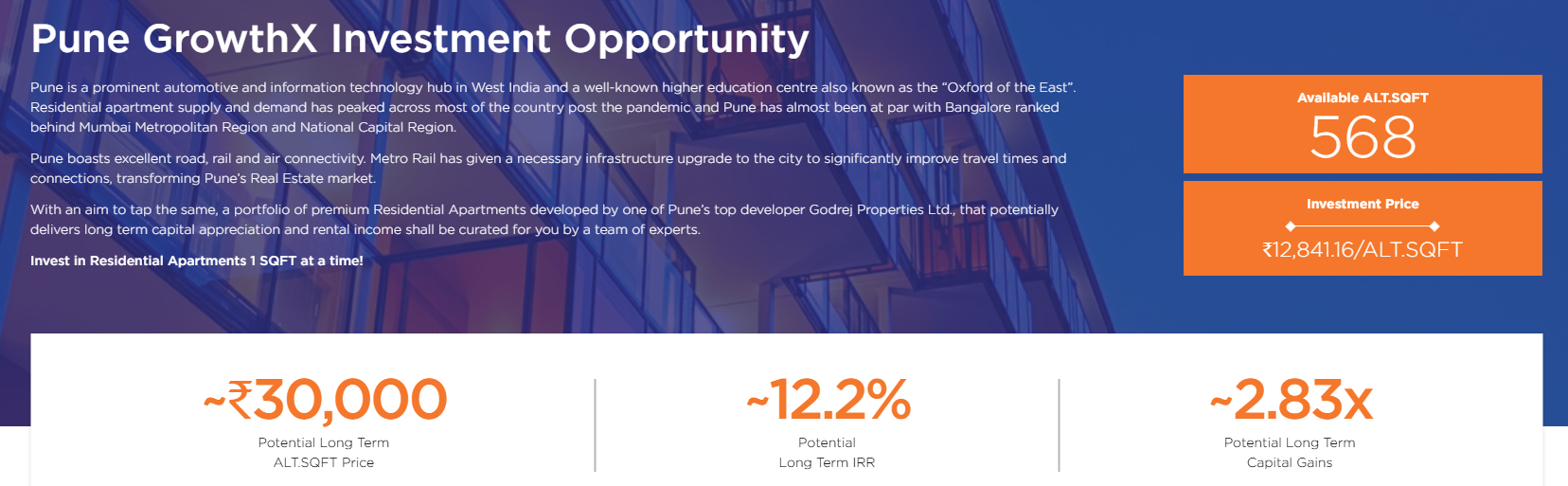

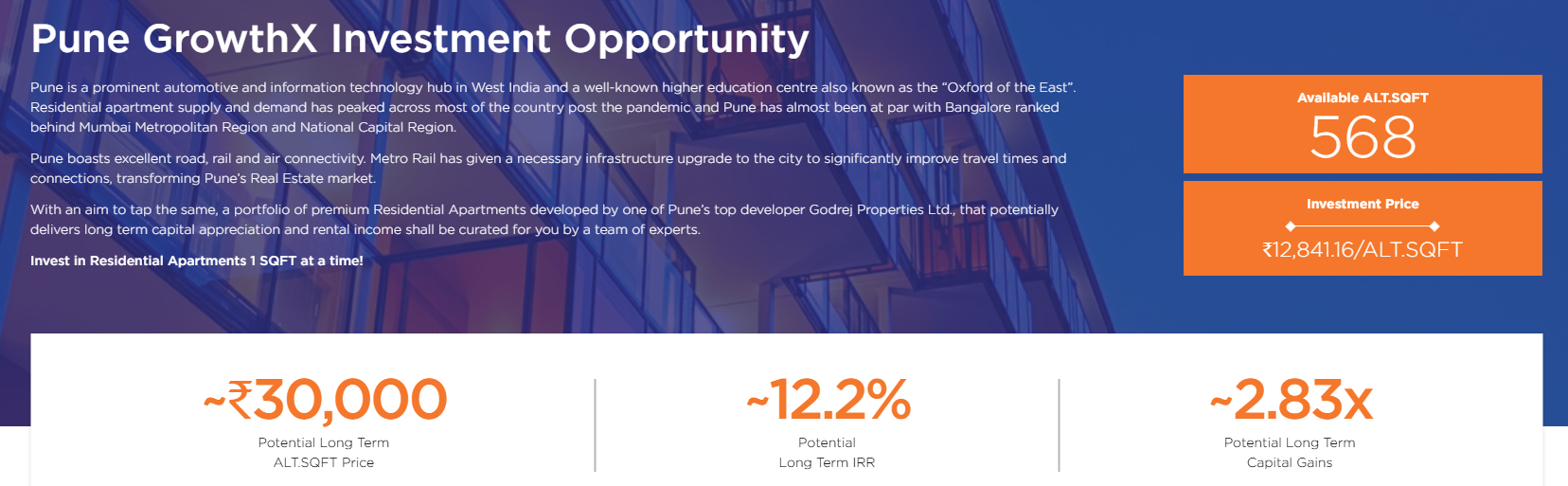

Alt DRX Bulk Opportunity

AltDRX has reduced the minimum investment to INR 2.5 Lakh for bulk Tradex investment for all Randomdimes investors. The platform has land opportunities, Holiday Homes, Residential homes, along with an under-construction gated community.

Altdrx also has the Pune Godrej project, which is an interesting opportunity for investors looking to benefit from the price differential between under-construction and completed projects.

Bond Investment

Below are the top-listed and unlisted bonds currently available in the market. We try to get the best rates from the platforms and funds selling these bonds. For the listed bonds, you can use the link below to buy. For the unlisted, please add your details in the form, and we will connect you to the seller.

Listed Bonds List

For listed bonds, you can check the bonds from the link below. Best yields in the market!

| Issuance | Rating | Coupon | Yield (XIRR) | Issuance Date | Maturity Date |

| AKARA CAPITAL ADVISORS PRIVATE LIMITED | ICRA BBB | 9.85% papm | 15.00% | 30-Apr-2025 | 30-Oct-2026 |

| Indel Money Limited | CRISIL BBB+ | 11% papm | 13.95% | 11-Apr-2025 | 11-Nov-2026 |

| Indel Money Limited | CRISIL BBB+ Stable | 11.00% papm/11.57% XIRR | 13.95% | 7-Mar-2025 | 7-Oct-2026 |

| Satya Microcapital Limited | ICRA BBB+ | 10.40% papm | 13.00% | 23-Aug-2024 | 23-Feb-2026 |

| Spandana Sphoorty Financial Limited | CARE A+ | 9.84% papm/10.30% XIRR | 12.75% | 12-Sep-2024 | 28-Jun-2026 |

| RDC Concrete Limited | IND A– | 11% papm | 12.75% | 2-Apr-2025 | 2-Apr-2028 |

| RDC Concrete Limited | IND A– | 11% papm | 12.75% | 12-Mar-2025 | 12-Mar-2028 |

| Criss Financial Limited | IND A | 10.50% papm/11.02% XIRR | 12.60% | 30-Aug-2024 | 30-Aug-2026 |

| Satin Finserv | ICRA A– | 10.80% papq/11.25% XIRR | 12.60% | 20-Sep-2024 | 20-Sep-2026 |

| Navi Finserv Limited (“Navi”) | CRISIL A (Stable) | 10.60% papm | 11.70% | 21-Feb-2025 | 21-May-2027 |

Unlisted bonds List

| Issuance | Rating | Coupon | Yield(XIRR) | Issuance Date | Maturity Date |

| True Credits Private Limited | CRISIL BBB | 11.71%papm | 18.00% | 4-Apr-25 | 09-Apr-26 |

| Branch International Financial Services Private Limited | Acuite BBB- | 10% papm | 17.50% | 4-Mar-25 | 9-Mar-26 |

| True Credits Private Limited | CRISIL BBB | 11.71%papm/ 12.36% XIRR | 17.50% | 8-Nov-2024 | 13-Nov-25 |

| Smartpaddle Technology Private Limited (Bizongo) | Unrated | 11.50% papm/12.12% XIRR | 17.50% | 22-Feb-2024 | 22-Feb-2026 |

| Akara Capital | ICRA BBB | 9.85% papm | 16.40% | 30Apr25 | 30Oct26 |

| Hella Chemical | IND A- | 11.80% papm/ 12.46% XIRR | 15.00% | 28-Feb-2025 | 28-Feb-2028 |

| Evernest Infratech Private Limited (“Strata”) | Unrated | 13.50% papm/14.37% XIRR | 15.00% | 5-Sep-2024 | 5-Sep-2026 |

| Si Creva Capital Services Private Limited | CRISIL BBB+ | 10.40% papm/10.91% XIRR | 14.80% | 29-Jul-2024 | 3-Aug-2025 |

Register to get details of unlisted bonds

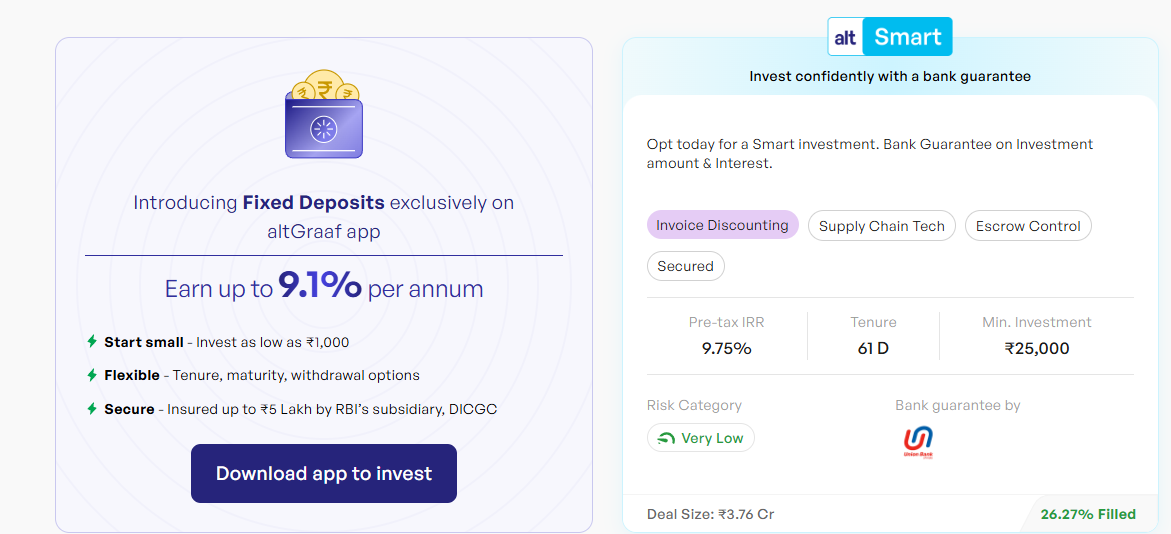

Short-Term Investments

| Platform | Returns | RD NPA | Total NPA |

| Grip Invest | 10-12%(Post-Tax) | 0.00% | 0.30% |

| Jiraaf (altgraaf) | 12-15% | 0.00% | 0.25% |

| Afinue(Upcide) | 13%(Post Tax) | 0.00% | 0.00% |

| Thepolicyexchange | 12-14%(Tax Free) | 0.00% | 0.00% |

| Leafround(Tapinvest) | 15-18% | 0.00% | 0.40% |

| Altifi | 12.50% | 0.00% | 0.00% |

| Betterinvest | 16%-18% | 0.00% | 0.00% |

| Tradecred | 11.50% | 0% | 0% |

| Lendzpartnerz (Monytics) | 13.00% | 0% | 0% |

- Currently invested in 2 Invoice deals on Tapinvest

- Invested in 1 deal on Betterinvest. We share the latest deal details on Telegram.

- 1 SDI on Gripinvest

- Invested in 1 deal on Amplio

- Invested in Altsmart (bank Guarantee deal) on Altgraaf

Crypto Investing

In June 2025, the crypto market sustained strong momentum with Bitcoin holding above $107K and Ethereum rallying over 10%, fueled by institutional inflows via spot ETFs and renewed interest in altcoins and NFTs. Regulatory clarity surged as the U.S. Senate passed the GENIUS Act for stablecoins, Circle IPO’d at $6.9B, and the EU finalized MiCAR norms. AI-powered investing gained traction, while hacks and geopolitical crypto events made headlines. With market cap crossing $3 trillion and investor sentiment rising, crypto showed resilience despite seasonal slowdowns and shifting regulatory landscapes.

An early Bitcoin wallet that had been dormant for over 14 years suddenly came back to life this week, transferring all 10,000 BTC, now worth $1.09 billion, in a single transaction.

The wallet first acquired these coins on April 3, 2011, when Bitcoin traded at just $0.78 per token, representing a staggering 140,000x return that transforms a modest $7,800 investment into millions.

Investors can either Hardware Wallets on Etherbit or buy Bitcoin ETF on Stockal.

P2P Investment

Current allocation:

- India P2P – 35%

- I2IFunding- 48%

- Lendbox -17%

| Platform | Loans Selected | Yield | NPA |

| I2IFunding(Restarted) | Urban Clap Loans | 13.80% | 4.4% |

| IndiaP2P | Only Women Borrower Loans, Branch-based p2p lending | 13% | 5.5% |

| Lendbox Per Annum | Paused | 11.50% | 0.50% |

- There has been no change in I2Ifunding (Referral code discount50@i2i) as it is already following direct borrower lending. The returns have been around 14% to date. Now they are focusing on only one category, i.e, Urban Clap Loans.

- There was some delay in I2I, but it has been mostly resolved in the last week, and according to the platform that complete payment will happen this month.

Equity Market

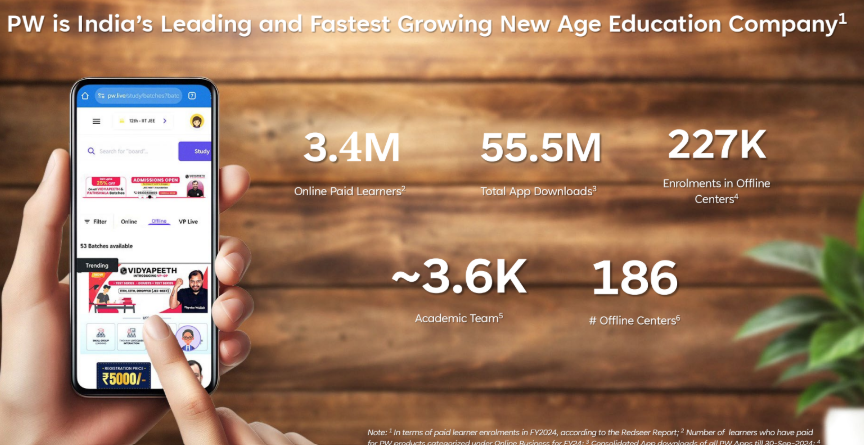

Pre-IPO Stocks

Listed Stocks

We recently did an article on how tactical leverage can improve returns of portfolio

Option Trading

June was a great month with total returns of 2%. The impact of Jane Street going out has to be seen now. While overall spikes might go down but if liquidity drops, that can create other problems for traders.

Quantinsti is also one of the top quant trading course providers in India. Planning to cover a few more excellent trading courses.

Below is the video as part of the series on top traders.

Starters can explore tradetron as it requires a minimum learning curve and marketplace to copy or Bigul if they want to develop their own strategies.