by Scott Ronalds

To state the obvious, these are unsettling times. Our relationship with our closest friend and ally is on the rocks. The White House’s tariffs, policy flip-flops, and strong rhetoric are impacting our economy and even threatening our sovereignty. Other countries are just as worried, and the world’s trust in America is waning—a trust that is tough to win back.

Investors are concerned. The U.S. market experienced a correction last month (defined as a 10% decline from its peak) but has since recovered some ground. Tech stocks have seen sharp selloffs, there are mounting fears about the global economy, business leaders are anxious, and there’s talk that the American market’s long run of “exceptionalism” is coming to an end.

Yet, there is a silver lining. Canada is taking measures to remove internal trade barriers and diversify our economic relationships. Europe is striving for greater unity. Companies are being driven to become more nimble in response to these challenges. And let’s not forget, markets often overreact, and the doomsday scenarios the media loves to hype rarely come true.

As Tom Bradley noted in a recent Globe and Mail article, “The emotion quotient is off the scale, which is generally not a good recipe for making dramatic changes [to your portfolio].” From an investing perspective, the key to navigating this political and economic uncertainty can be summed up in one word: diversification.

Steadyhand investors benefit from broad exposure to different countries, industries, currencies, and asset classes. Our Founders Fund offers a truly global investing experience, with holdings in France, Germany, Italy, the U.K., Japan, Singapore, Hong Kong, Australia, Uruguay and several other countries, in addition to Canada and the United States. Equally important, your investments span a wide array of industries, from healthcare and financial services to consumer products.

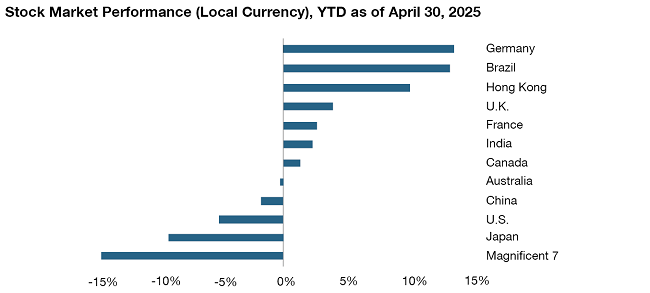

It’s this diversification that helps cushion market shocks. You might be surprised to learn that European stocks have held up relatively well this year amidst all the chaos, rising 6% (as of April 30). Hong Kong’s market is up 10%, and the Yen has appreciated 6% against the Canadian dollar, mitigating the declines of Japanese stocks in Canadian dollar terms. Further, industries such as healthcare and consumer staples are doing well.

As a client, your portfolio is much better diversified than investors who have narrowed in on one region or theme, such as American technology. And in our view, you’re better diversified than those who own the broad global market through an index-tracking fund or ETF, as such products have become U.S. and technology centric. For example, American stocks make up over 70% of the MSCI World Index, with technology companies comprising 25% (tech stocks make up nearly one-third of the S&P 500 Index). In contrast, American stocks constitute 32% of the equities in our Founders Fund, with tech companies making up 14%.

On the theme of technology, we’ve discussed in recent Quarterly Reports our limited exposure to U.S. mega-cap stocks, with Microsoft being our only holding among the Magnificent 7, due to concerns about their high valuations (and thus, greater downside risk). While this positioning held back our returns over the past few years, it has benefited you in 2025, as these stocks have seen some of the biggest pullbacks this year. Our managers have taken advantage of this volatility, purchasing Alphabet (the parent company of Google) after the stock fell 20% and adding to Microsoft.

All of this means that your portfolio hasn’t experienced the same declines as those with a greater focus on one country or industry. Your investments in European companies have provided stability through the recent turmoil, and many of your holdings in defensive industries are holding up well. Our Founders Fund is up 1% on the year while many less diversified portfolios are in the red.

We can’t predict how markets will react going forward. As the saying goes, ask three economists and you’ll get five answers. Nor can we guarantee that the American market, and the Magnificent 7, won’t roar back to life tomorrow. But we can tell you this: diversification has proven its value for investors throughout history. There’s no reason to believe it won’t continue to do so in today’s unpredictable world.

Management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The indicated rates of return are the historical annual total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns.

We’re not a bank.

Which means we don’t have to communicate like one (phew!). Sign up for our Newsletter and Blog and join the thousands of other Canadians who appreciate the straight goods on investing.