Infrared image in Canby, OR.

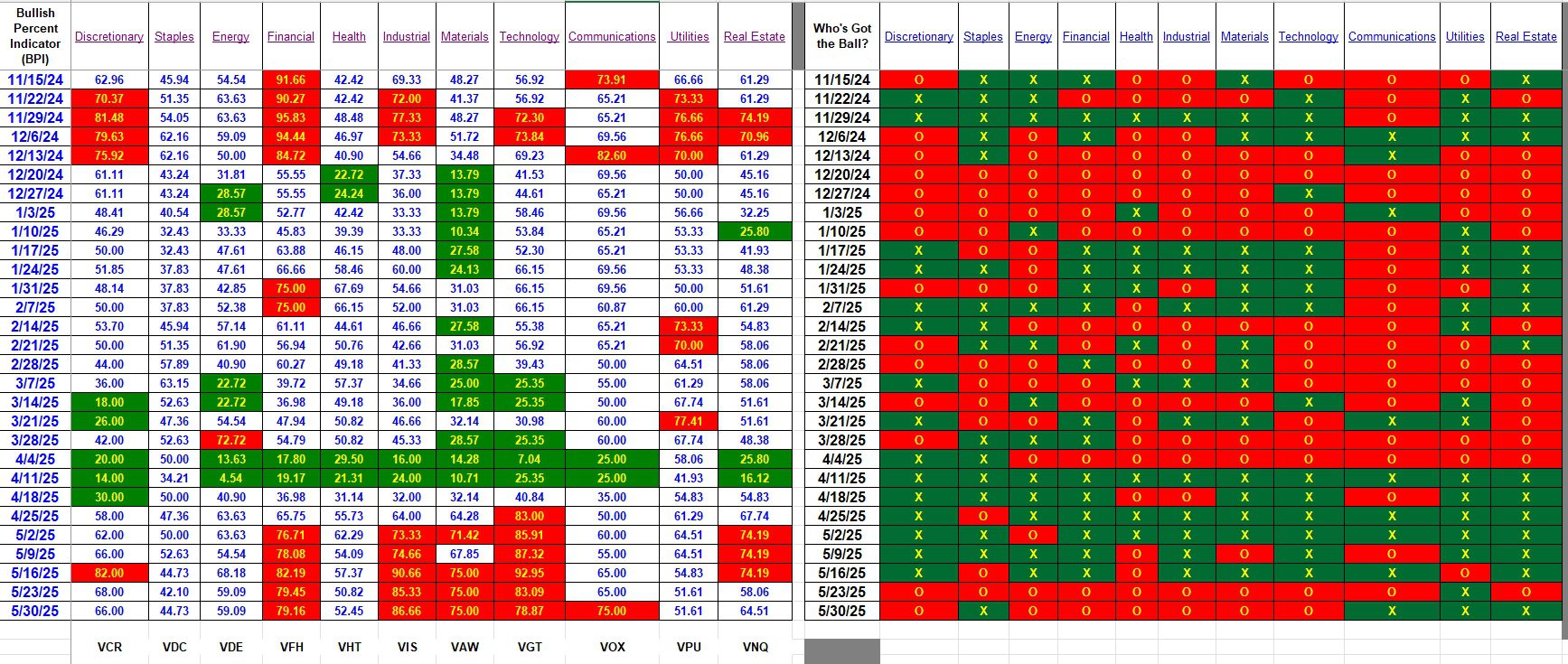

It has been several weeks since I last posted Bullish Percent Indicator (BPI) data. No changes were recommended during this period, but this week the Communications sector moved into the overbought zone. Portfolios holding VOX were alerted to sell. With a 75% bullish percentage I placed 2.5% Trailing Stop Loss Orders (TSLOs) under VOX in the three Sector BPI portfolios. If your broker does not permit decimal TSLOs, then set the percentage at 3.0%.

Overall, gains this week were minor.

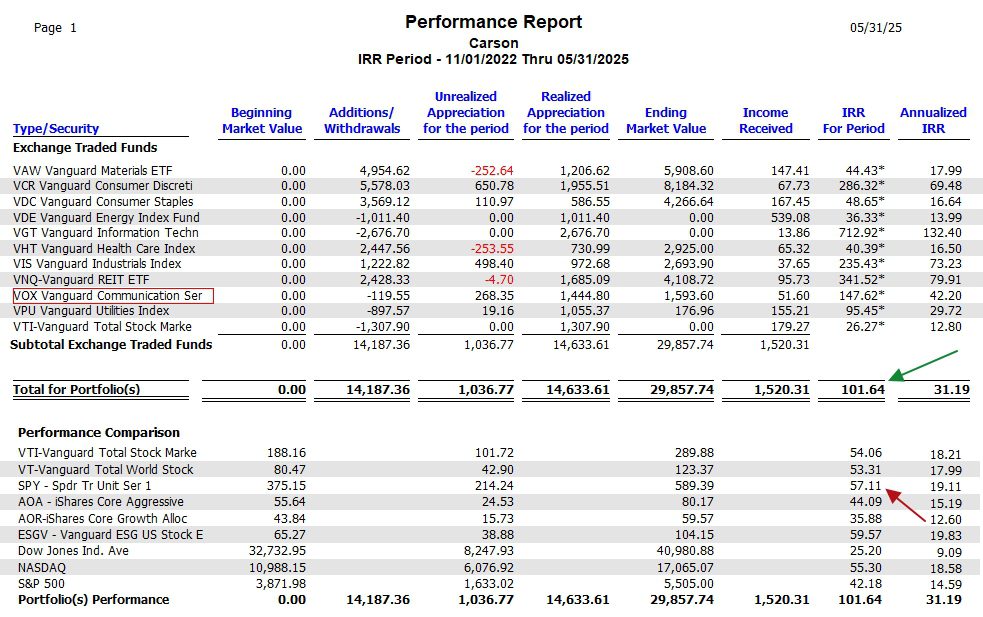

The third and final screenshot in this blog post shows the sector performance data for the Carson, the longest running Sector BPI portfolio. Come November the Sector BPI investing model will observe its third anniversary. While this is a relatively short period, it does cover several volatile market periods. We are beginning to see the benefits to this investing model.

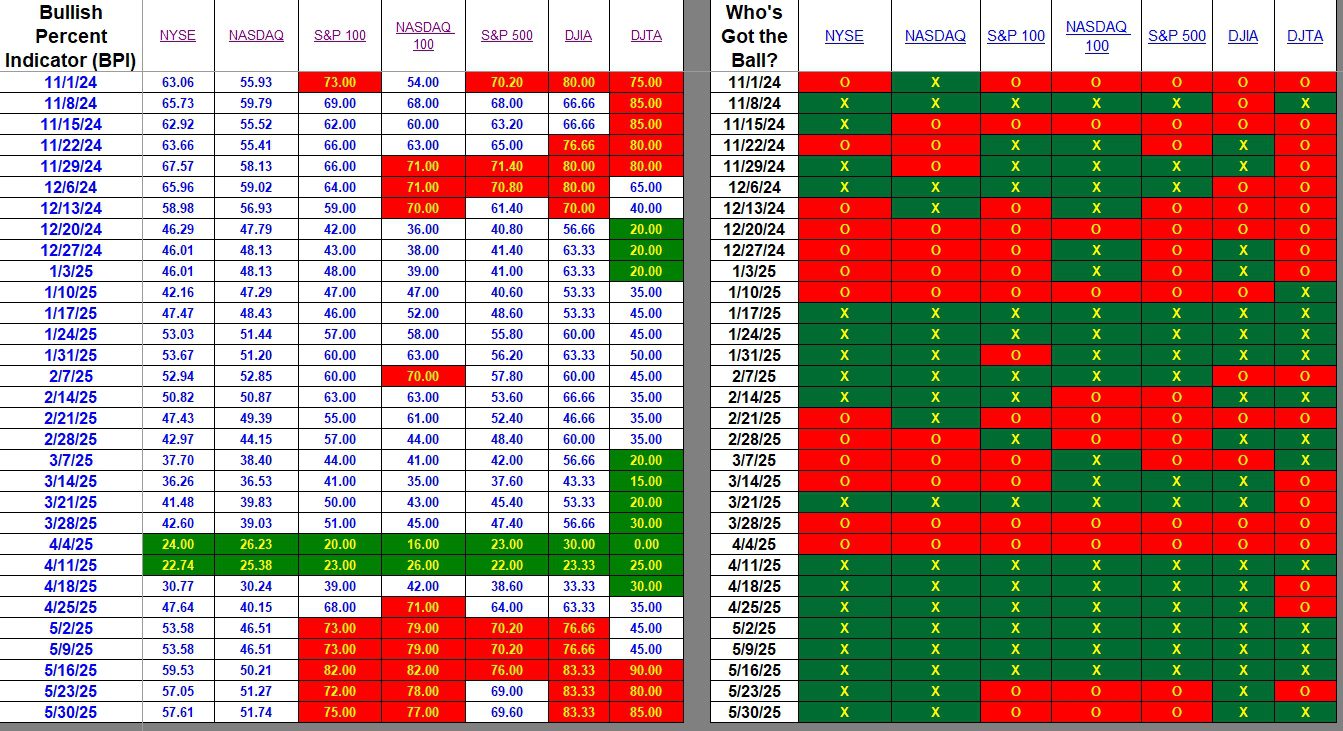

Index BPI

In general, large- and mega-cap stocks are overbought. Slight gains showed up in the NYSE and NASDAQ indicating possible minor improvement in some of the smaller cap stocks. The gains also might come from larger cap stocks. Hard to distinguish where the gains are coming from.

Sector BPI

The single change this week is the Communications sector move into the overbought zone. TSLOs are in place to sell all shares of VOX. We already have TSLOs in place to sell VCR, VFH, VIS, VAW, and VGT (already sold).

In normal times available cash would be reinvested in VOO. Due to major market uncertainty I’ve been investing available cash in SHV, a short-term treasury. If interested on the Sector BPI investment model, follow the Carson, Franklin, or McClintock portfolios.

Carson Sector Performance Since 11/1/2022

The following data comes out of the Investment Account Manager software. We are looking at the sector holdings within the Carson, the longest running Sector BPI portfolio. Over the past 31 months sector ETFs held by the Carson returned nearly 102% while the S&P 500 (SPY) returned 57.1%. Based on this data, the Sector BPI investing model is working very well. The logic behind this approach to portfolio management is more than meeting expectations.

Explaining the Hypothesis of the Sector BPI Model

(Visited 7 times, 7 visits today)

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.