Dear Mr. Market:

Are you enjoying the Senate confirmation hearings with all the theater, finger pointing, and viral media clips? From an investment standpoint there was one hearing to pay attention to on Wednesday and that was with President-elect Trump’s pick for Energy Secretary, Chris Wright. At first glance he certainly touts the “drill baby drill” narrative but Wright said he’s excited about geothermal (heat energy that comes from the Earth) as “an enormous, abundant energy resource below everyone’s feet.” Wright said he wants to accelerate the development of nuclear energy so it can meet a far greater share of the world’s demand for electricity.

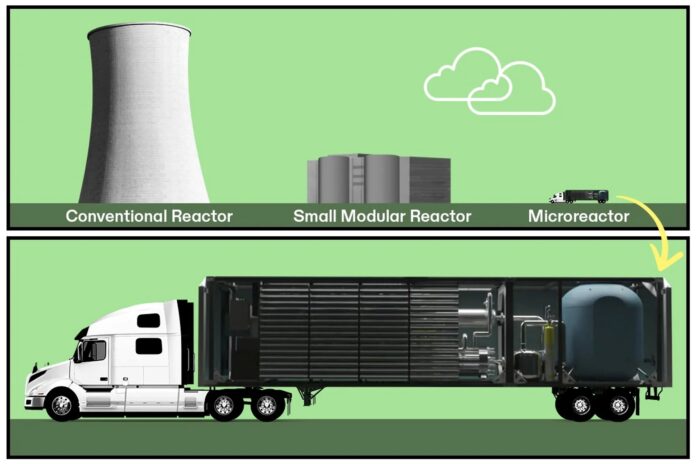

Have you also noticed how small things often pack a big punch? Microchips power our digital world, microplastics remind us of our environmental duties, and now microreactors are poised to redefine how we think about energy. Let’s dive into whether this is the investment opportunity of the century or just another overhyped promise in the energy space.

The Big Picture: What Are Microreactors?

Microreactors, also known as Small Modular Reactors (SMRs), are compact nuclear reactors that can produce anywhere from 1 MW to 300 MW of power. For context, that’s enough energy to power a small town or a military base. Unlike traditional nuclear reactors, which can take a decade to build and require enormous upfront capital, microreactors can be prefabricated, transported, and deployed in months—a potential game-changer for remote areas, disaster recovery, and even urban settings.

These aren’t just lab experiments anymore. Companies like NuScale Power and Oklo Inc. are already developing models that could be operational within the next few years. The big question is: can these technologies overcome regulatory hurdles, public skepticism, and competition from renewables?

A Brief History of Nuclear Energy

Nuclear power isn’t a new story. It boomed in the mid-20th century, promising limitless, clean energy. But Three Mile Island (1979), Chernobyl (1986), and Fukushima (2011) tempered that enthusiasm, highlighting the catastrophic risks associated with nuclear accidents. Since then, nuclear energy’s share of global electricity generation has stagnated, while renewables like solar and wind have surged ahead.

Enter microreactors. These smaller, inherently safer designs aim to revive nuclear energy’s reputation. Their passive safety features, reduced waste, and scalability could attract policymakers and investors looking for reliable clean energy alternatives. But will they?

Policy and the New Administration

Under the incoming administration, energy policies will pivot significantly. Historically, nuclear energy has had bipartisan support, and early indications suggest that advanced nuclear technologies, including microreactors, may see renewed federal backing. The incoming administration has also shown interest in energy independence and bolstering infrastructure, which could align with microreactor deployment in underserved areas. Moreover, with the administration’s focus on “America First” energy strategies, nuclear will still face competition from traditional fossil fuels and other renewables. While this energy sector may not have Trump’s eyes on it like oil, his administration will look at it more closely especially compared to solar and wind which he’s not as much a fan of. Additionally Chris Wright is the CEO of Denver-based Liberty Energy (LBRT) and also serves on the board of Oklo (OKLO) which is a developer of small modular nuclear reactors. (both are very interesting companies with potential upside).

All that said, potential headwinds remain. Regulatory processes are notoriously slow, and local opposition to nuclear installations could delay deployments. Moreover, with the administration’s emphasis on a balanced energy approach, nuclear will still face competition from increasingly efficient wind and solar technologies.

Investment Opportunities: The Top 5 Stocks to Watch

If microreactors are indeed the future, certain companies stand to benefit immensely. Here’s our initial top five stocks in this space that we like:

- NuScale Power (Ticker: SMR)

- Why It’s Hot: NuScale is a pioneer in SMR technology and recently received the first-ever U.S. Nuclear Regulatory Commission approval for its design. With a backlog of international interest, NuScale is at the forefront of this emerging sector.

- Risk: Execution remains a challenge; delays or cost overruns could erode investor confidence.

- Cameco Corp. (Ticker: CCJ)

- Why It’s Hot: As one of the largest uranium producers globally, Cameco will supply the fuel needed for microreactors. The shift to High-Assay Low-Enriched Uranium (HALEU) could create additional revenue streams.

- Risk: Commodity price volatility could affect its earnings.

- Fluor Corporation (Ticker: FLR)

- Why It’s Hot: Fluor owns a significant stake in NuScale and specializes in large-scale engineering projects, positioning it well to capitalize on SMR construction.

- Risk: Broad exposure to cyclical industries can dilute its nuclear-focused upside.

- Nano Nuclear Energy (Ticker: NNE)

- Why It’s Hot: Nano Nuclear Energy is laser-focused on developing microreactor solutions with scalable and mobile designs, making it a promising pure play in this space.

- Risk: As a newer entrant, the company faces execution risk and competition from established players.

- Constellation Energy (Ticker: CEG)

- Why It’s Hot: As a leading nuclear power producer in the U.S., Constellation could integrate SMRs into its operations to modernize its fleet and expand its footprint.

- Risk: Regulatory delays and capital expenditure requirements could weigh on returns.

Risks and Realities

While the narrative around microreactors is compelling, let’s not forget the hurdles:

- Regulation: Nuclear projects still face rigorous safety and environmental reviews.

- Public Perception: Fear of accidents and long-term waste storage issues persist.

- Competition: Rapid advancements in renewables and battery storage could outpace nuclear’s adoption.

- Execution Risk: Building and deploying microreactors at scale is uncharted territory.

Conclusion: A Measured Approach

The microreactor story is undeniably intriguing. It combines cutting-edge innovation with a compelling value proposition for clean and reliable energy. For investors, it’s not about betting the farm but allocating a portion of your portfolio to key players poised to benefit if this trend takes off.

If you don’t want to gamble on a single stock we always suggest considering an Exchange Traded Fund (ETF) as a way to gain exposure to several of them in this promising space. Diversification through ETFs like the Global X Uranium ETF (URA) or the VanEck Nuclear Energy ETF (NLR) could be a prudent way to gain exposure without concentrated risk. For the bold, individual stocks like NuScale Power or Cameco offer high-reward potential but come with corresponding risks.

As always, tread carefully. The future of energy may be small in size but could yield big opportunities for those who play it right. Either way, the energy game is changing.