Applying Nature’s Rules of Survival to Your Investment Portfolio

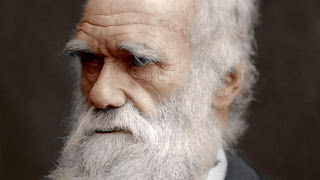

Be it the rules which govern the wondrous celestial objects which cir

culate above our heads, or the natural selection processes of the di

verse life forms that both live and reproduce closer to home, nature’s

mandate of rewarding the fittest, and most adaptive, appears to be

repeated wherever one seems to look.

These rules are so clearly defined that they permeate all facets of our

daily lives, and exist as a universal constant in our ever-increasing un

derstanding, and expanding knowledge base, of the very nature of

existence, itself.

With the weight of this evidence being so overwhelming, it would seem

asinine for one to willingly attempt to challenge it. If the rules which reg

ulate all physical phenomena favors these two characteristics, then

certainly those which dictate the outcomes of our minuscule invest

ment portfolios must adhere to them, as well, correct?

My charge for this week is to convert this universal constant into a

viable investment strategy, and to use its concrete truths to increase

the value of your portfolio. Within this attempt, I would hope that you

will resist the temptation to add another description to this list (which

it certainly should not be present in), but mistakenly tends to be added

whenever this topic comes up for discussion. Yes, nature’s rule book of

survival prioritizes those who are the fittest and most adaptive…but not

necessarily for being the largest.

Fiscally Fit

Machiavelli put it best when he stated “During times of plenty, a Prince

prepares for war.” and I often use this metric when evaluating the lead

ership of publicly traded companies. Great leaders have learned the im

portance of building their war chest during times of plenty, so that they

can be in dominant positions to take advantage when leaner periods

inevitably arrive. Doing so serves two distinctive purposes. First of all,

it fortifies their companies from being dependent upon banking institu

tions when demand for their products or services decreases, and

secondly, it provides them with the capital required to purchase succ

essful, but ill-prepared rivals (at the pricing of their choosing) during

prolonged periods of economic slowdowns. This fiscally fit objective

is a good indicator of companies that will not only survive during diff

icult financial situations, but will actually thrive within this environment.

As such, these names are likely to endure even the harshest if econom

ic conditions, and should therefore, hold standardized positions within

your investment portfolio.

Winning Adaptation

Another way of identifying companies which will endure during difficult

situations, is to evaluate how they adapt to their own success. One mis

take that larger entities tend to make, is to rest on their laurels when it’s

assumed that they’ve cornered the market on their sectors’ offerings.

Short-sighted leadership causes such companies to fail to continue to

innovate, which makes them ripe targets for aggressive upstarts (whom

they consistently ignore) while basking in the luxury of their positional

prominence. Interestingly, most of these companies are actually aware

of the newcomers, but because of their arrogance, refuse to take them

seriously until they’ve established a solid foothold. But by then, unfortu

nately, (or, according to nature, fortunately) inertia propels their new

(and now serious) rival to the point where they are either weakened, or

eventually replaced. When deciding which companies to add to your

portfolio, always pay attention to what dominant candidates are spend

ing on R&D (Research and Development), as it is a clear indicator of its

overall vision. It’s also good to note if they are expanding into other

types of businesses, in an attempt to diversify their holdings, and incr

ease shareholder value. As I mentioned earlier, being the largest is

distinctively different than being either the fittest or the most adaptive.

Which is why nature hold very little regard towards it being placed as

one of her primary tenets of survival.

When the dust settled on our planet, after the cataclysmic series of

maelstroms which wiped out the dinosaurs, 95% of all previous life had

been eradicated, and the prospect of it ever returning seemed nothing

more than a diminishing hope amidst the toxic, visible haze which en

compassed the once-lush landscape. It appeared, during this ultimate

test of survival, that only microbial life would ever occupy the Earth, and

that complex life forms had had their day, and would never again roam

wild and free, as thay did so previously.

Yet, even then, nature’s rules of survival proved resilient, as our mamma

llian ancestors used their intelligence, and skills of adaptation, to

forage an existence which would ultimately culminate in the develop

ment of stone-aged tools, the printing press, and today, artificial inte

lligence. Indeed, the awesome benefits of being the fittest and most

adaptive has accurately withstood the test of tome. And if properly

incorporated within your investment strategies, will certainly ensure

that your portfolio will do the same.

(Anthony Rhodes is the President and owner of wealth management

firm The Planning Perspective www.theplanningperspective.com)