Dear Mr. Market:

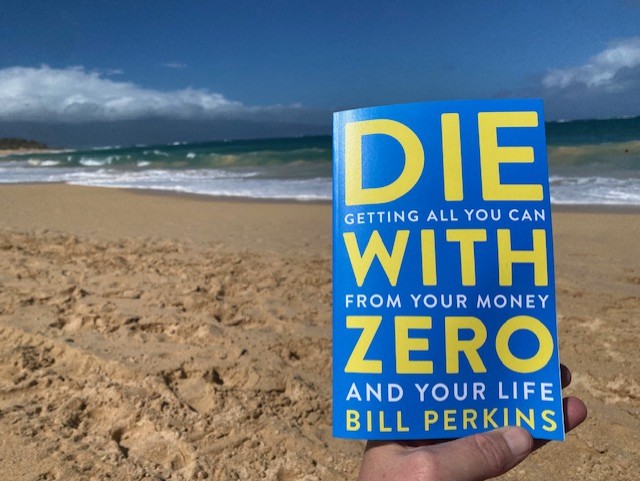

A few weeks ago I took a long weekend for a getaway with my wife to our favorite place. As empty nesters we have this opportunity every once in a while so after spending a serene few days on the beaches of Maui, I finally took the opportunity to dive into Die with Zero by Bill Perkins. As someone deeply entrenched in financial planning and chronologically standing on the threshold of pre-retirement, the book was more than just a leisure read—it was a revelation.

Let me first admit—finding the time to read for leisure is a rarity for me. My reading list is usually dominated by stock market noise, economic reports, and client-related materials. This short vacation was one of the few opportunities I’ve had to step away from my daily grind and open a book purely for personal enrichment. Choosing Die with Zero for this rare indulgence turned out to be a profound decision.

Perkins, a hedge fund manager turned lifestyle philosopher, proposes a provocative idea: that the ultimate goal of wealth is not to hoard it for an ambiguous “someday,” but to spend it on meaningful experiences that maximize your life’s enjoyment. While the premise might sound counterintuitive to those who have spent decades espousing financial discipline and planning (myself included), the arguments he presents are hard to ignore, especially with the sounds of Maui waves washing onto the beach.

Key Takeaways

- Time is the Ultimate Currency:

Perkins’ core philosophy revolves around recognizing the diminishing value of experiences as we age. The book pushes readers to identify and pursue what Perkins calls their “consumption curve”—the periods in life when certain experiences will hold the most meaning. For example, a hike through Haleakalā at 35 will feel vastly different than at 75. - Invest in Memory Dividends:

This concept, which resonated deeply during my brief island escape, is about creating lasting memories that pay emotional dividends over time. Perkins argues that experiences, not possessions, provide these dividends. It made me reflect on the many trips postponed or scaled back in favor of “more savings.” - Optimizing Giving to Children and Charities:

One of the book’s most thought-provoking ideas is the concept of giving wealth to children—or charities—now, when it can make the biggest impact. Perkins argues that waiting until late in life (or death) to pass on wealth often diminishes its utility. For children, receiving financial support during their prime working and family-building years can open doors that would otherwise remain closed. Think about when most people die and their kids receive an inheritance. What is more impactful; receiving a million or more dollars when you’re in your early 30s when you likely need it the most or when you’re in your 60s and probably (hopefully) already financially established? It’s the adage of better to “give a warm hand than a cold one”. Similarly, giving to charities while alive allows you to see and shape the difference your contributions make.This idea stood out to me as both a parent and a financial planner. How often do we advise clients to leave sizable estates while overlooking the profound, immediate impact those same funds could have? Perkins reframes this not as a sacrifice but as an opportunity to enhance relationships, influence outcomes, and create shared joy.

How it Impacts Financial Planning

From the perspective of a financial planner, Die with Zero isn’t a rejection of planning; it’s a reframing. Perkins isn’t advocating reckless spending but instead encourages a purposeful allocation of wealth to maximize fulfillment. The key lies in carefully understanding when to save, when to spend, and when to let go.

Reading this with my clients in mind, I saw opportunities to integrate some of Perkins’ ideas into their plans. For instance, creating a “life experiences fund” as part of retirement planning could be a game-changer for those who fear outliving their money but still want to live richly now.

A Personal Reflection

Getting a mild sunburn while reading on a beach in Maui, I found myself reevaluating my own financial trajectory. The book challenged me to think beyond spreadsheets and account balances, to consider what moments I might be missing in pursuit of an overly cautious future.

Conclusion: A Paradigm Shift Worth Considering

Die with Zero isn’t just a book—it’s a mindset shift. While it may not resonate with every reader or every financial planner, it serves as a valuable counterbalance to the prevailing narrative of endless accumulation. It’s especially impactful for those of us approaching retirement, standing at the crossroads of legacy and life.

For anyone seeking to align their wealth with their values—and maximize the joy of their remaining years—this book is a must-read. If you’re a client of My Portfolio Guide, LLC and think this book may be of interest to you or someone you care about, please reach out and we’ll send you a copy. Mahalo!