Iris

Franklin is the Sector BPI portfolio up for review. Included in this blog post is evidence of the viability of the Sector BPI investing model. Based on all the uncertainty surrounding the current administration I will be making some slight changes in what to do if no sectors are included for investment or if there is excess cash available. Follow along with this analysis as I am making a few minor changes in the model.

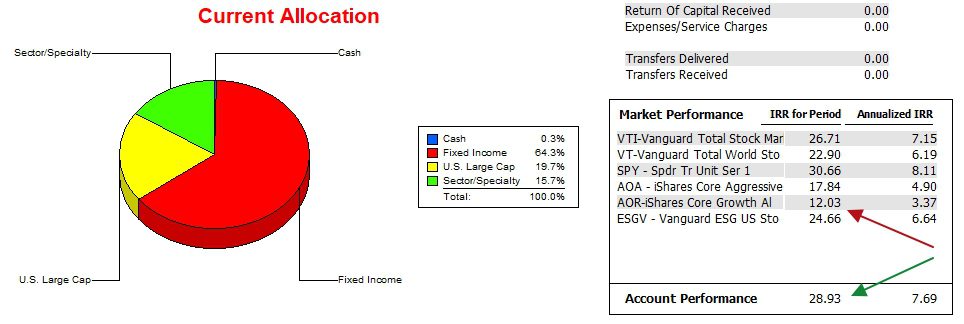

Franklin Security Holdings

Below are the current holding for the Franklin. Several sectors were sold since the last review and the cash was reinvested in SHV. This is where one change is taking place. Heretofore excess cash was invested in VOO. While the Franklin continues to hold 10 shares of VOO, instead of adding to this position with the cash that became available do to selling overbought sector ETFs, I am now moving that money into the short-term treasury, SHV as I consider it to be a safer investment during this erratic administration.

Franklin Performance Data

Since early 2022 the Franklin has outperformed the AOR benchmark by a significant margin and is nearly matching the S&P 500. Note how difficult it is to outperform the S&P 500 (SPY).

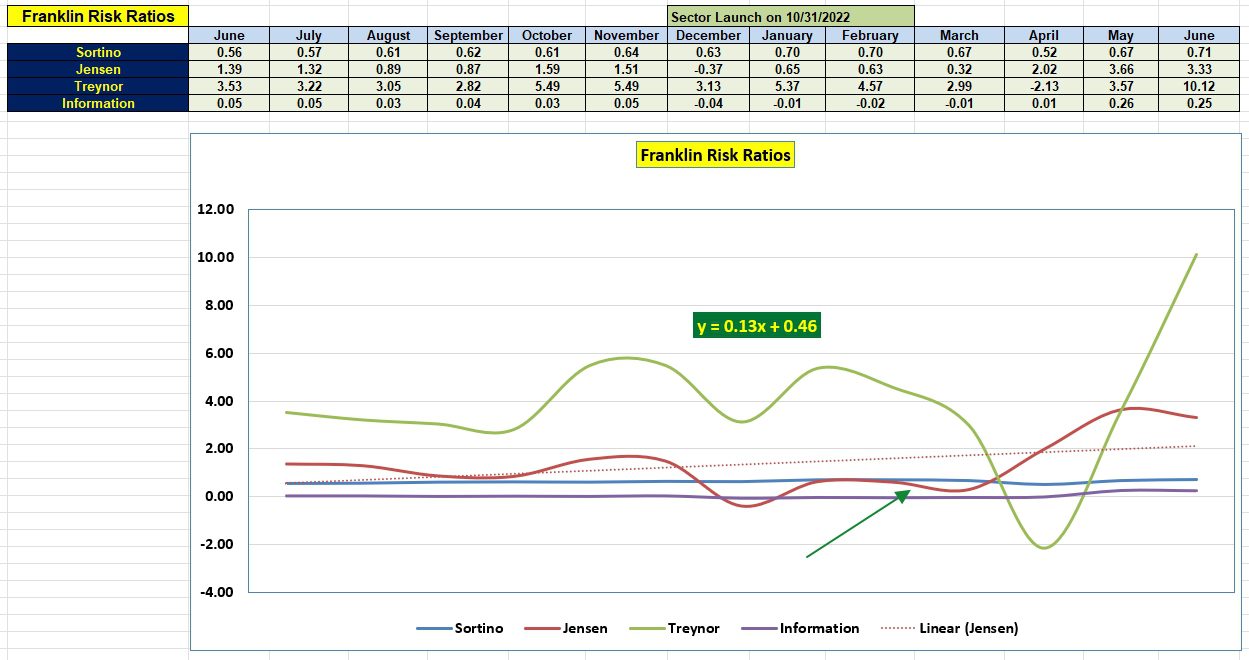

Franklin Risk Ratios

Increasing holdings in SHV lowered the portfolio beta and that caused the Treynor to soar. The reason I rank the Treynor at the bottom of the four risk measurements is that it is much too dependent on the portfolio beta. Of more importance is the behavior of the Jensen Alpha or Jensen Performance Index. We see improvement in the Jensen since last year and the slope is positive. All good signals.

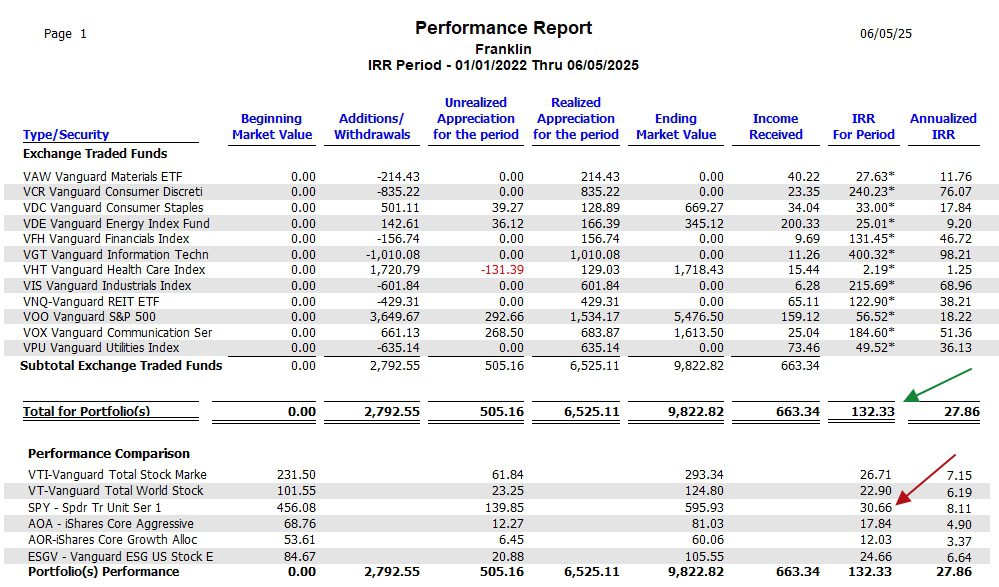

Sector Performance

The following data is evidence the Sector BPI model is working as laid out in the hypothesis many months ago. We are looking at the performance of the sector ETFs and VOO over the past 3.5 years. If VOO is removed from the list the IRR is even higher.

When the Bullish Percent Indicator (BPI) for a sector dips to 30% or lower we purchase the ETF that mirrors that sector. When the BPI rises to 70% or higher we place a Trailing Stop Loss Order of 3% under the sector ETF. This simple investing model is crushing the S&P 500, a goal of the model.

This data comes from the Investment Account Manager software, a commercial product.

Comments are always welcome. Share the URL of this blog with family and friends. It is free to all readers. Sign up as a Guest to have access to all blog posts.

(Visited 8 times, 8 visits today)

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.