Sampling “A Wee Dram” of Whisky at a Scottish Distillery

The Hawking Portfolio does not require a lot of attention as it is designed more as a Buy-And-Hold Portfolio to generate “Income” rather than to rely primarily on “growth” as required in more common equity portfolios. Although there may be exceptions to this, depending on how closely an investor might choose to monitor his or her portfolio, the only real action required is to withdraw money for “income” as required, or to re-invest the (monthly) distributions to generate “geometric” growth.

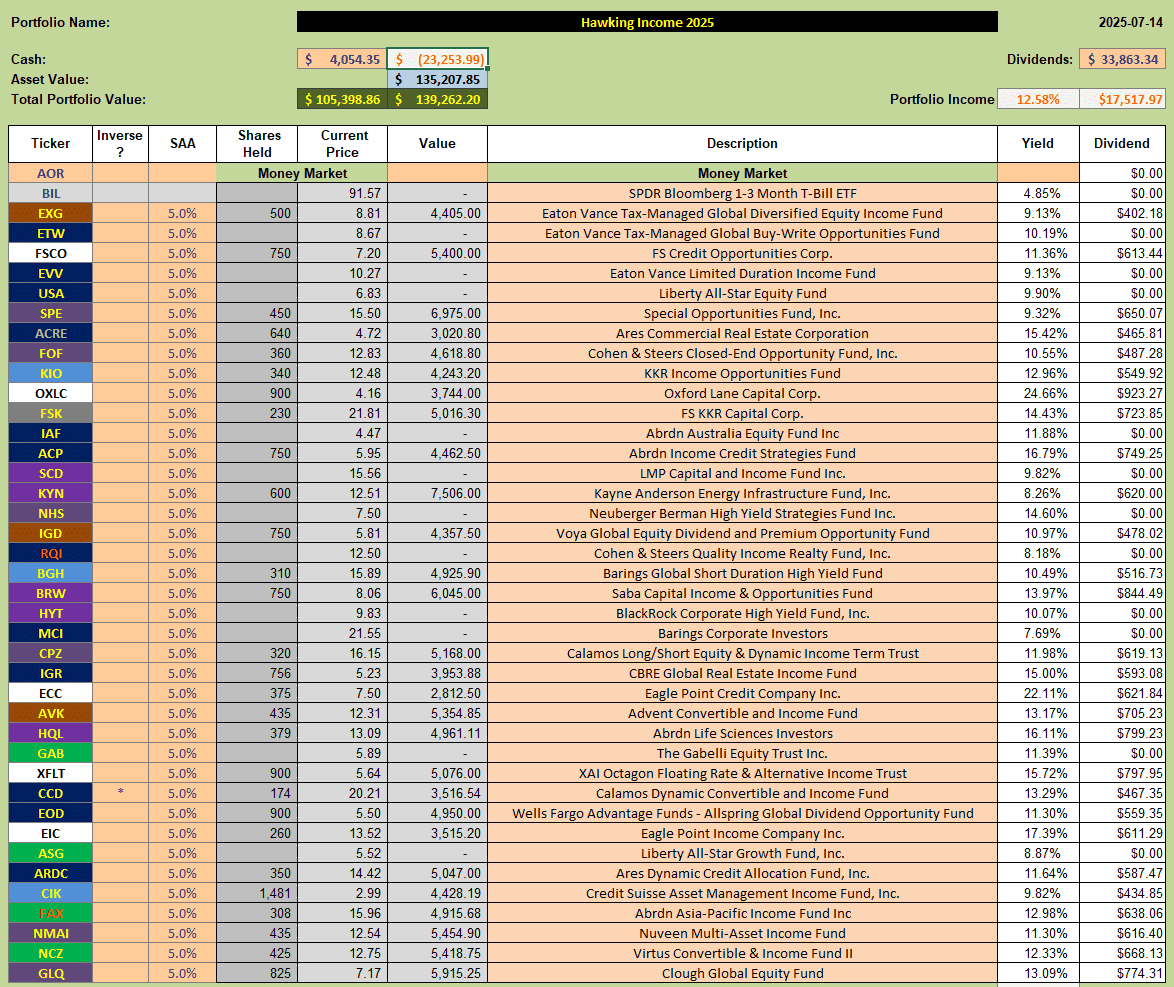

At the present time the Hawking Portfolio is holding the following 28 Closed-End-Funds (CEFs) with a nominal 3-4% of total portfolio held in each Fund:

As can be seen in the upper right of the screenshot, the portfolio is projected to generate ~12.5% return annually from (mainly) monthly distributions. The portfolio has been running for ~4.5 years at this point – since December 2020, and ~$52,000 has been received in distributions (Distributions from the first 2 years are not included in the Dividends box at top right) – this is an average of ~11.5% per year, in line with current predictions of 12.5% and includes 2022 where we saw a 20+% decline in market values.

As can be seen in the upper right of the screenshot, the portfolio is projected to generate ~12.5% return annually from (mainly) monthly distributions. The portfolio has been running for ~4.5 years at this point – since December 2020, and ~$52,000 has been received in distributions (Distributions from the first 2 years are not included in the Dividends box at top right) – this is an average of ~11.5% per year, in line with current predictions of 12.5% and includes 2022 where we saw a 20+% decline in market values.

If we add this $52,000 to the original $100,000 investment we get a total of $152,000 and, if we compare this to the current portfolio value of ~$139,000, we see a negative “growth” component of ~$13,000, or a little under 3% per year. So, although our total returns are good, if we just look at Fund prices we may see negative growth in some of the funds. The Funds do what they are designed to do and generate “income” – be this in the form of direct investment income or equity growth – some of which (the growth portion) is distributed as a Return of Investment that, effectively, reduces our cost base. If we do not need this “income” we can simply re-invest the distribution and let it “grow”.

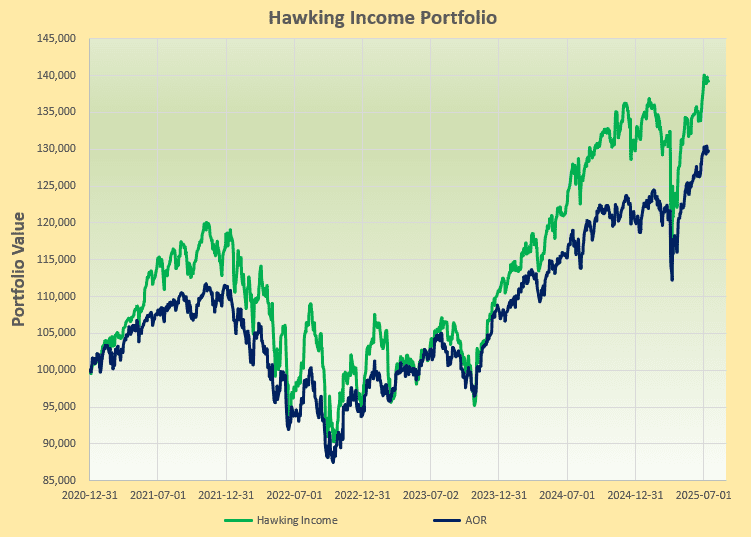

If we compare the returns generated by the portfolio to the performance of a benchmark equity/bond fund such as AOR (60/40 hybrid of global equities and bonds) we see the following:

where the portfolio has outperformed the benchmark by ~$10,000 over the 4.5 years since inception or a little over 2% per year.

where the portfolio has outperformed the benchmark by ~$10,000 over the 4.5 years since inception or a little over 2% per year.

Of course, in this example, no money has been withdrawn from the portfolio. However, if an investor were to withdraw $1,000 or 1% per month ($12k or 12% per year) as “income” he/she would still be left with a balance of ~$85,000 – not quite preserving 100% of the original capital, but close. An 8% ($8,000 per year) withdrawal rate would preserve the original $100,000 capital investment.

(Visited 8 times, 1 visits today)

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.