The electric vehicle (EV) industry is caught in a high-stakes tug-of-war. U.S.-China trade tensions are jolting the battery supply chain after President Trump imposed a hefty 93.5% U.S. tariff on Chinese graphite, sending shockwaves through the market. It comes just days after China announced new export controls on critical battery technologies, tightening its grip on global supplies.

For EV titan Tesla (TSLA) and rising U.S. rare earth producer MP Materials (MP), these moves reshape the playing field. As costs climb and opportunities emerge, investors face a pivotal choice: stick with Tesla’s turbulent ride or bet on MP Materials’ upward surge. Here’s why investors might consider dumping TSLA and buying MP.

Tesla’s Tariff Troubles

Tesla, one of the world’s leading EV manufacturers, relies heavily on Chinese graphite for its battery anodes, with China supplying nearly all its refined graphite needs. The 93.5% tariff could add $7 per kilowatt-hour to battery cell costs – potentially $1,000 or more per vehicle – threatening Tesla’s profit margins, already strained by competitive pricing.

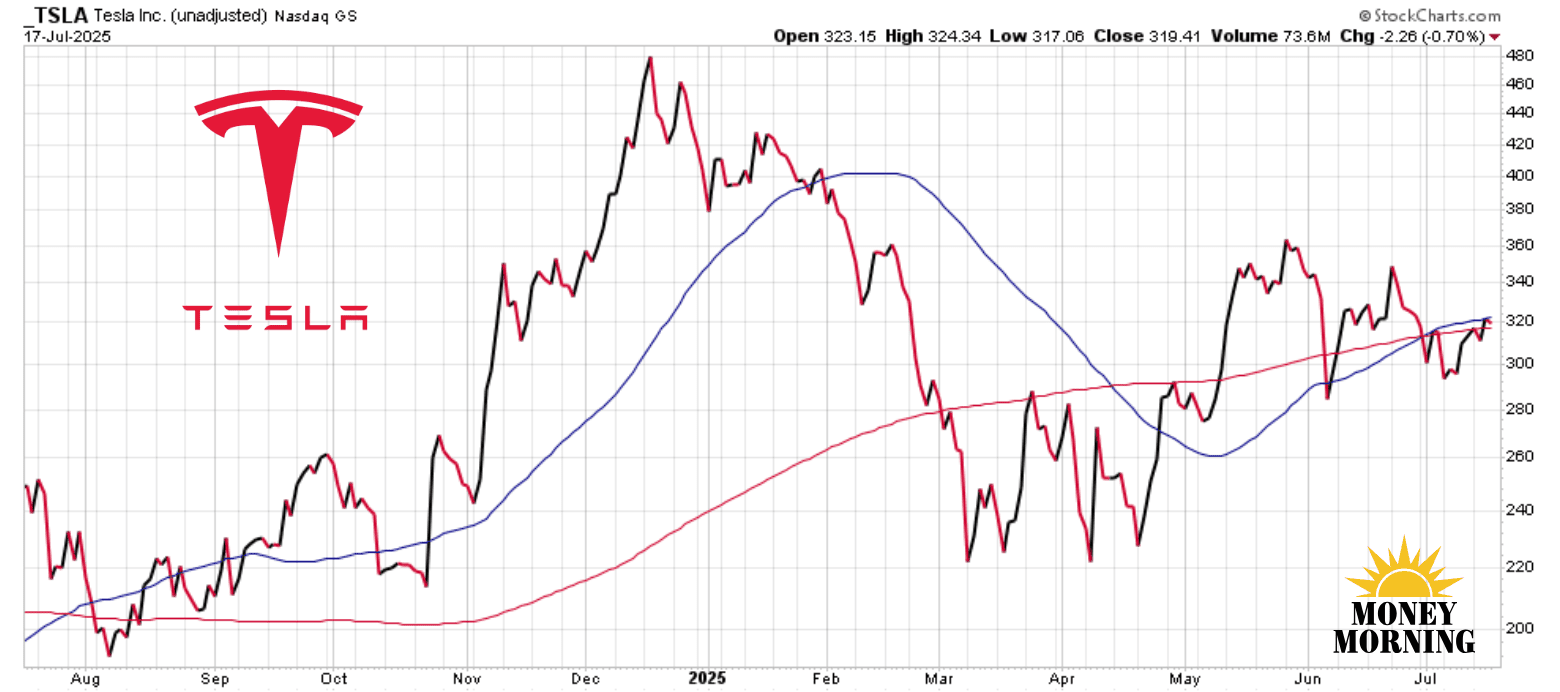

TSLA stock dropped by $4 per share, or almost 1.5% at one point, reflecting investor concerns. Tesla opposed the tariff, arguing it harms operations without spurring domestic graphite production. It has said U.S. graphite producers currently lack the technical ability to produce battery-grade graphite at the required quality and volume.

China’s export controls on lithium iron phosphate (LFP) batteries and lithium technologies further complicate Tesla’s supply chain, particularly for its Shanghai factory, which relies on Chinese suppliers like CATL. Combined with earlier restrictions China imposed on graphite in 2023, these measures could disrupt supplies and raise costs.

While Tesla is shifting to U.S. sources to meet EV tax credit rules (excluding Chinese materials by 2027), domestic producers, including MP Materials, still can’t meet the demand for quality and volume. Other potential Trump administration policies, such as 60% tariffs on Chinese goods or reduced EV subsidies, add further risks, threatening Tesla’s profitability and market share.

MP Materials’ Golden Opportunity

MP Materials, however, stands to benefit from Trump’s hefty tariff and China’s export controls. The tariff shields MP from Chinese “dumping” of low-cost graphite, boosting demand for its anode materials. MP stock jumped over 5% at first before closing up 3% for the day. In just the past month MP is up 180% and now has a $9.85 billion market cap.

China’s restrictions on lithium and LFP technologies push U.S. manufacturers toward domestic alternatives, and MP, part of the American Active Anode Material Producers group that advocated for the tariff, is well-positioned to fill this gap. The company’s Mountain Pass facility in California is a key source of rare earths, and it is expanding into anode material production, including graphite.

A recent $400 million Department of Defense (DoD) investment, announced July 10, further bolsters MP’s prospects. The DoD’s 15% stake and commitment to buy magnets from MP’s new 10X Facility, set for commissioning in 2028, strengthen its role in reducing U.S. reliance on China.

However, scaling production to meet EV industry standards remains a challenge, as U.S. graphite capabilities lag behind China’s high-purity output. The tariff and DoD support provide a critical window for MP to develop its capabilities, potentially aided by government incentives under U.S. protectionist policies.

Broader Market Dynamics

The U.S.-China trade war is reshaping the EV landscape. China’s 67% share of global graphite and 70% of lithium processing underscores its dominance, but its export controls signal a strategic push to maintain leverage.

The U.S. tariff aims to foster domestic supply chains, but it risks short-term pain for Tesla while offering long-term gains for MP Materials. With global EV sales projected to hit 17 million units in 2025, according to the International Energy Agency, demand for battery materials remains robust, favoring MP’s growth trajectory.

The Bottom Line

Tesla faces significant headwinds from the new graphite tariff and China’s export controls, risking higher costs, supply disruptions, and margin pressure. Its stock’s volatility could worsen if trade tensions or subsidy cuts intensify.

Conversely, MP Materials is a compelling investment, fueled by the tariff, China’s restrictions, and DoD backing. While scaling challenges persist, MP’s $60 per share stock price and government support signal strong growth potential.

Investors seeking exposure to the U.S. push for supply chain independence should dump Tesla and buy MP Materials – the trade war has tilted the scales in MP’s favor.