“Insanity is doing the same thing over and over and expecting different results” – not Albert Einstein as I always thought but actually Rita Mae Brown

2019 represented my first full year of FIRE, albeit with a slip-up back to FI during the year, which was then later corrected. Despite a lot of my pre-FIRE posts being financial in nature finances actually occupied very little of my mind through 2019. Having my wealth increase by £148,000 and my spending, albeit profligate, significantly less than this certainly helped here.

What did occupy a lot of my mind, as regular readers will be well aware, was the psychological, emotive and decompression elements of FIRE. So let’s start here first and take a snap shot of where I find myself.

Nearly 14 months into my decompression I would have to say that while the days are getting easier I am still very much deep in the decompression mud. There are still many unanswered questions and much soul searching (or is that naval gazing) going on. To help with that I’ve tried to continue with the human being while changing only one thing at a time theme I started mid-year. One conclusion I’ve come to, and started to accept, is that it’s unlikely that I have a “silver bullet” single purpose in me and I’m really ok with that. My purpose doesn’t have to occupy 60 hours per week, like my previous job, so why I was thinking that is beyond me. Instead I’m starting to take great joy in many small “successes” that without FIRE I wouldn’t have been able to do. That extra 3 miles of hiking into the forest, seeing something new, because I have the time… That 3 hour lunch with a loved one that builds a stronger bond because I have the time…

The one change I have made is that an old friend asked me to help with a very short term very temporary job. I never expected it to be purposeful (so it’s a job and not work) but I did think it would be interesting so took it on. I just hope that is helping with my decompression and not clouding it.

Where we are struggling is with our current location in the South East of England, which is pretty much the same location as pre-FIRE. Having experienced a coastal Mediterranean lifestyle we are now finding our location difficult. The weather, despite having experienced the coldest and wettest winters Cyprus had ever seen in late 2018, is terrible which doesn’t help. On top of that we are also struggling with the busyness along with the constant noise that comes with that. We also now find the people very individualistic (possibly coming from being time poor) which then brings a certain level of coldness with it. In the last quarter we’ve also had a meaningful friend emigrate for pastures new – thanks Brexit! I’m not sure they’re the type of person the UK actually wanted to lose but that’s for another day as Monevator does a much better Brexit rant than me…

With that in mind Mrs RIT and I are starting to conclude that this is not a place we want to call our FIRE home. Now we’re not insane, so are not going to pack up and leave again quickly, but what we have done is applied for the visa we’ll need to relocate to the country hinted at in a few previous posts. It would give us similar weather to Cyprus, access to some meaningful friends/family and we think lifestyle wise fall somewhere between Cyprus and the UK. The reason we’ve applied now is that the approval process can take many months, even years, so it would be useful to have that in hand when we make our final conclusion rather than to then have to impatiently wait. The only downsides were it took a long time to provide what was required (that’s ok, I have time) and cost many thousands of pounds (that’s ok, I have money and this just might be something we’ll value greatly).

On the subject of money let’s now take a brief look at how 2019 played out.

SPEND SENSIBLY

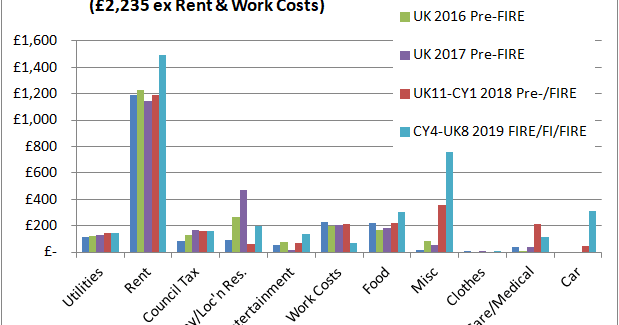

Spending in 2019 probably could be described as insane at a huge £45,500. Although, if I net the move costs to and from Cyprus plus the visa mentioned above from that total spending falls to the mid-£20k’s. Better but not an excuse. Of that spending I ‘only’ had to drawdown £28,700 from my wealth with the remainder being covered by the jobs mentioned.

Measured against my planned 2019 drawdown of £25,872 it’s still a small blow out although not something to start panicking about as £28,700 represents 89% of the dividends received over 2019 and 2.0% of my wealth at year end.

Click to enlarge, RIT Spending

Spending Sensibly score: Fail. Trying to figure out where in the world we want to live and renting while we do it is expensive!

INVEST WISELY

Some of the great bloggers I follow have already posted some pretty impressive returns for 2019. FvL started us off with an impressive 2019 annual return of 22.7%! John over at diy investor then weighed in with 21.9%. Then finally The Accumulator revealed the Slow and Steady passive portfolio’s more humble 16.3%.

In comparison I managed a derisory 13.8% (05 January 2019 to 04 January 2019). At the headline level it warranted a recheck of the numbers and a deeper look as that is a lot of underperformance. FvL runs a bit of leverage, has active elements (angel investing for example) and frankly is a much better investor than I’ll ever be so I always expect to see him(?) outperform me. We used to always compare ourselves as we had similar strategies but John in recent times has now moved his portfolio to one that is 100% environmentally conscious. I 100% applaud why he’s done this but it’s not something I am yet prepared to do as I want the broadest diversification I can get. I’m therefore also not surprised to see John diverge (in either direction) from me. The one I was surprised about was the Slow and Steady passive portfolio as that’s a very similar strategy to what I’m all about.

In the end it is easily explained if I split my wealth into two. The first piece is the portfolio of equities, bonds, gilts, REIT’s, gold and cash that funds my FIRE. Crunching the numbers and that portion returned 17.0% which is close to the Slow and Steady passive portfolio. The second piece is the portfolio of cash, P2P and Index Linked Savings Certificates that will fund my eventual home purchase. That returned 2.0%. In comparison home prices in our new most likely FIRE location increased 0.6% over 2019. That now relaxes me somewhat. My passive diversified by asset type and country portfolio is on par with a ‘similar’ passive portfolio and my home purchase fund has kept pace with house prices.

Living off just the dividends remains an important part of my overall FIRE plan. 2018 total dividends were £28,693. In comparison 2019 ended up at £32,398 which is a healthy 12.9% increase.

Click to enlarge, RIT Annual Dividends

For completeness this is what my asset allocation looks like today.

Click to enlarge, Current RIT Asset Allocations

I continue to invest as tax efficiently as possible with my tax efficient holdings from a UK perspective now consisting of:

- 45.7% (was 43.5% at end 2018) held within low expense SIPP Wrappers

- 8.2% (was 8.7% at end 2018) held within the no longer available NS&I Index Linked Savings Certificates (ILSC’s)

- 17.2% (was 14.6% at end 2018) held within a low expense Stocks and Shares ISA.

Tax efficiency score: Pass. As I spend from non-tax efficient areas of the portfolio and bed-and-ISA from the same areas I expect to see the SIPP and ISA percentages increase until I am as tax efficient as possible. If the portfolio then gains more than the NS&I return I’d also expect that to decrease.

Investment expenses also continue to be considered the enemy. 2018 finished with expenses at 0.22% and even with Vanguard lowering some of their expenses 2019 only finished at 0.21%.

Minimise expenses score: Pass. It’s continues to now pretty much be an autopilot story unless a current provider moves unfavourably or a new cost competitive appropriate product appears on the market.

In the scheme of a lifetime of investing this year is insignificant. I’m all about time in the market and not timing the market so let’s zoom out and look at my performance since I started down this DIY road. My long run nominal is 6.7% which is a real (using RPI) return of 3.9%. The chart below tells the story. Note that the chart assumes a starting sum of £10,000 which was not my portfolio balance at that time but is instead simply a nominal chosen sum to demonstrate performance.

Click to enlarge, RIT Portfolio Performance vs Benchmark vs Inflation

Long term investment return score: Pass. My whole investment strategy since 2007 has been about generating a long term annualised real return of 4% with 3.9% after 12 years being right in the hunt.

RETIRE EARLY

Wealth as I write this sits at £1,433,000 which, even after inflation and spending, is a long way from the £1,304,000 when I first FIRE’d in November of 2018. My complete journey is shown in the chart below.

Click to enlarge, RIT Progress Towards Retirement and In Retirement

My drawdown plan continues to be based on spending the lesser of a ‘safe’ withdrawal rate (SWR) of 2.5% or 85% of the dividends received. In 2019 my SWR, ex investment expenses and ignoring the wealth allocated for the home purchase, ended up targeting £25,872. Let’s increase that by inflation giving £26,454 for 2020. In comparison 85% of the £32,398 worth of dividends becomes £27,538 for 2020. So for 2020 target spending is driven by the SWR and becomes £25,872.

Given we expect to be renting for a large portion, if not all, of 2020 that just might be a difficult ask but let’s see how we get on. We’re certainly not going to sacrifice spending on things that gives us true value to hit that number given wealth is currently buoyant and with planned home ownership (which we have the funds for) within a couple of years which should take the pressure right off the spending.

Piecing everything together and we end up with the drawdown tracker below. The spending explosion caused by the Cyprus relocation and sunnier climes visa application is clearly evident but through 2020 they’ll fall out of the numbers. Even with them in and assuming I didn’t earn any money via jobs or work in 2019 it’s still ‘only’ a withdrawal rate of 3.2% (plus investment expenses) of current wealth, which is still less than the much talked about 4% Rule. I’m ok with that.

Click to enlarge, RIT’s Drawdown Tracker

While 2019 has at times been difficult I am so glad I’ve managed to experience it warts and all. I’ve learnt a lot about myself than I otherwise would have and I think I’m a better person for it. The top level plan for 2020 is to continue my decompression by ‘human being’ not ‘human doing’ while continuing to change one thing at a time. Then let’s see what happens about getting a bit more permanent sunshine and meaningful friends/family in our lives in the back half of 2020.

This FIRE lark really is an adventure and it looks like it’s not going to stop for the foreseeable future. I’m grinning from ear to ear.

As always please do your own research.