Molalla River with Mt Hood in the distance.

Kepler is the small portfolio up for review this morning. The owner is rebuilding this portfolio as it looks like all educational expenses are in the rear view mirror. As readers will see in the following update, this portfolio is finally coming into balance. In other words, the various assets are closing in on the target percentages.

With inflation on the rise and unwarranted tariffs in the offing, expect bonds to dip and real estate to rise. While I don’t intend to alter the asset allocations, the 14% set up with bonds will most likely not offer much help for the overall return. At least this is the expectation over the next six to 12 months.

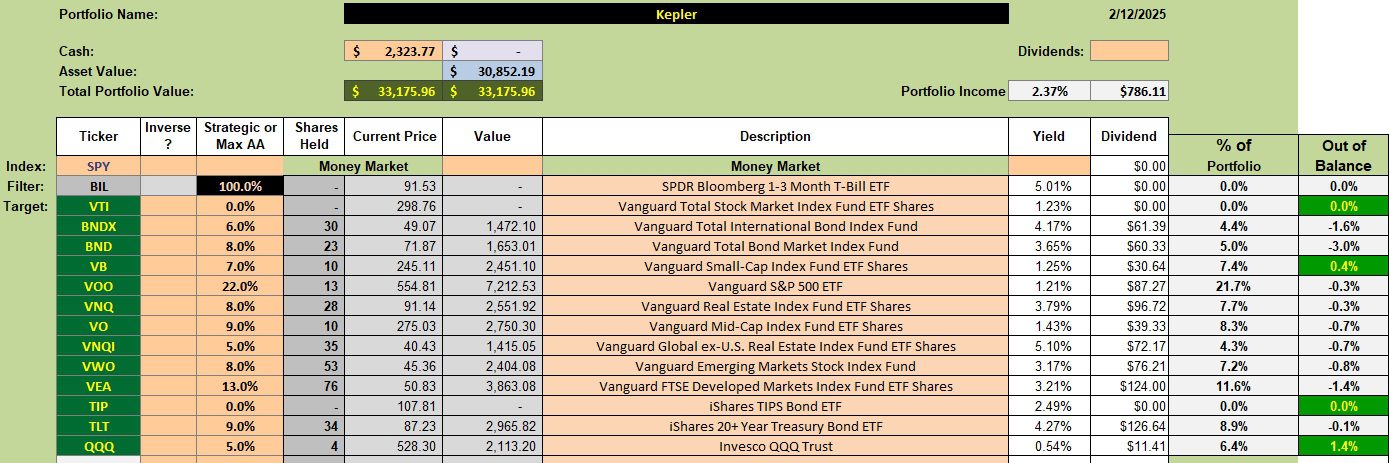

Kepler Asset Allocation

The goal is to keep each asset class within one percentage point of the target. Asset classes outside this target range to the downside are: U.S. Bonds (BND), International Bonds (BNDX), and Developed International Equities (VEA). There is sufficient cash to bring all three asset classes back into balance and limit orders are in place to do so. QQQ is above target and will be allowed to continue to run without any interference. This is to reduce the chance of adding to the tax burden.

For larger portfolios (> $100,000) the target goal is reduced to 0.5% target limits.

Check the yield column to see which Exchange Traded Funds (ETF) are throwing off the highest dividends.

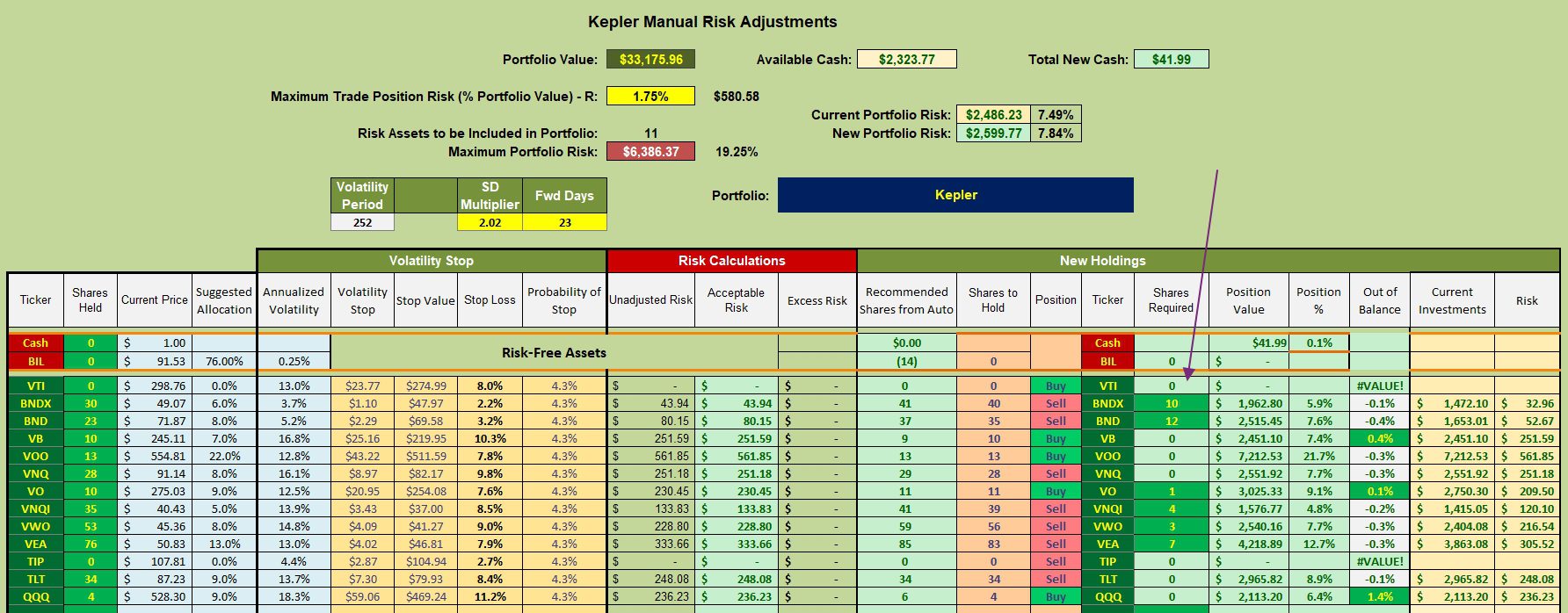

Kepler Recommended Rebalancing

The purple arrow points to the number of shares on order to bring the various asset classes closer to target. The Kepler is fast closing in on being in balance.

If new money is added before the next update I plan to increase the number of shares of VNQ and VNQI as these two ETFs should benefit from the anticipated inflation increase.

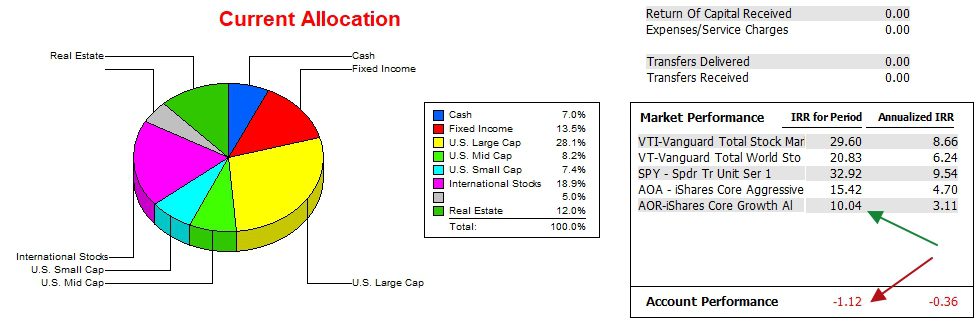

Kepler Performance Data

The following data comes from the commercial portfolio tracking program, Investment Account Manger. As mentioned on the blog many times, serious investors accurately track their portfolio and benchmark the same. Otherwise one is running on self-deception.

The Kepler is an example of a portfolio under-performing its benchmark, AOR. And it is woefully behind the S&P 500 (SPY).

Kepler Risk Ratios

The Kepler has been using the Asset Allocation investment model for less than one year. The anniversary will arrive this coming April. Over the past 10.5 months the Jensen Alpha increased, but tailed off this winter. The next year will be a good test of the Asset Allocation model. The good risk news is that the slope of the Jensen is positive.

It will be interesting to see how the Copernicus, Schrodinger and other asset allocation portfolios behave during what portends to be a period of chaos.

Comments and questions are encouraged.

(Visited 18 times, 1 visits today)

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.