The number one thing for any investor or trader to learn in investing is “when to sell”. “When to Sell” is intrinsically linked to “Risk Management”.

It’s so easy to buy anything that we forget to sell and learn how to do it. And when things seem rosy, buying seems so easy. Especially if its a bull market. We assume, we have mastered investing and are the kings of the trade. Markets have ways to teach all of us a lesson. When we learn the lesson, we realize that forget about selling, we don’t even know when and what to buy right.

I write this within this context. The Fed (rate) induced the stock market crash of 2022 amidst the uncertainty of Russia Ukraine Geopolitical situation and made me realize that I was a student and just a beginner at that as far as investing is concerned. And to be successful, I have to read and learn. Read, Learn and Apply and “Educate in the process”, if I can.

Before the 2021 crash, I had assumed that I had learned quiet a bit of investing, was good at it, more so because I had managed my trades prior to COVID 20 crash pretty well, having sold a large portion of my positions and moved to cash before the crash.

But when 2022 hit, I froze not knowing what to do. I had no game plan and was hesitant in selling. So many of my assumptions were laid bare and one of them was that I hadn’t been buying right nor I knew when to sell. Not knowing the 2nd part is a crime in my opinion and anyone getting into investing should have that as the 1st chapter.

Knowing I hadn’t sold right I have tried to capture what I did with an example with NVIDIA stock which readers might find useful.

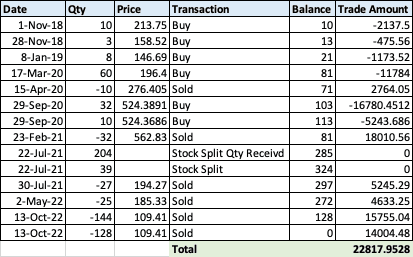

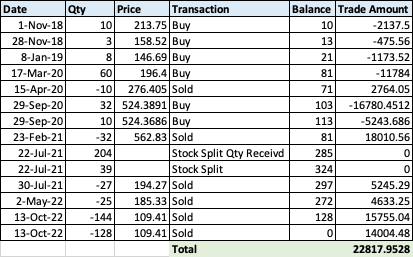

I bought NVIDIA for the first time in November of 2018. The summary of my trades is as below:

Over the last 5 years, I have made USD 22,817 which looks pretty good considering the small size I have been trading on this stock as part of my overall portfolio. Without any color to the above data, there is no way of knowing whether I made good decisions, bad decisions or horrible decisions. So, lets put some color to my trades with some data analysis.

For the purpose of my analysis, I had to factor in the NVIDIA 4:1 stock split in July 2021 and have assumed my stock balance to be 4 times prior to the split with the price 1/4th prior to the split for analysis purposes.

Although I ended up making a profit of USD 22,818 at the peak of Dec 2021, my profits (realized + unrealized) stood at USD 75,776 at a whopping 655% of my cost.

Between Jan 2022 to Sep 2022, I had given USD 49,699 of it away as I found myself numb and not knowing what to do; having finally sold all my stake at the bottom of the bear market for a return of USD 22,818. This was a pattern across my other trades. I had let my profits wither away without doing anything about it.

My portfolio looked like the below chart over this time period:

I had made substantial gains from my initial trades with my portfolio value in December 2021 hovering around USD 87K.

The profit scenario vis-a-vis my portfolio over this time period was as follows:

What was interesting to note was that during the COVID crash, my portfolio didn’t do badly which gave me a sense of wrong belief that I could manage downturns and market crashes. Between Dec 2021 and Sep 2022, my NVIDIA portfolio as well as my overall portfolio was down a whopping 62% and I had sold my entire at the bottom. Some wise man had said, “Buy Low, Sell High”. I wasn’t as wise after all since I didn’t know how.

If you want to get into investing, first learn to sell. Everything can follow after. — Santo @

Please do share your comments and thoughts. If you had similar experiences, please do share.

Disclaimer

All information in this article is provided for informational and educational purposes only and should not be construed as investment advice. I recommend reaching out to your Financial Advisor for advice regarding your personal circumstance.

Reach out to me at [email protected] or https://thetwigg.com

Happy Friday.