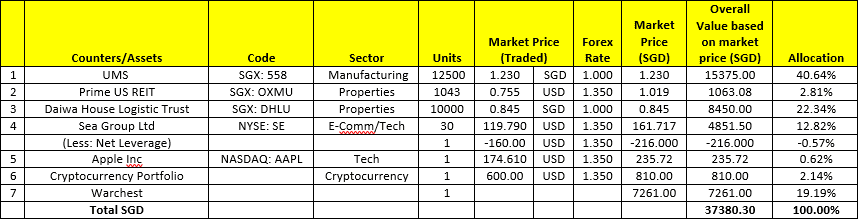

Portfolio (2Q2022 – 03 July 2022)

(Note:

Share price and Forex as at 03 July 2022; Cryptocurrency is volatile

and I have rounded down to lowest 50 USD)

Performance

Some commentary on my portfolio

- Portfolio is down a good 16% from 1Q2022. Ouch.

Transactions and Dividends

- Bought 15 units of Sea Group Ltd (NYSE: SE) at 78 USD each

(b) Dividend Summary

- Receive SGD 250 from UMS (SGD 0.02 per share)

Thoughts

Current sentiment is a reality check. Perhaps this is what separates the good investors from the lucky ones?

Given the multiple rounds of interest rate hike, maybe this is the time I consider redirecting capital injection towards building up my cash reserves instead. I appreciate that my fixed rate bank loan has got a good 3.5 years remaining before it turns floating rate, and should it remain elevated beyond reasonable level (think above HDB Concessionary Loan interest rate level) in 2025, then that’s probably the signal for me to pay it down.

Also did some self-reflection on the career and personal side of things. With me having my own family, I need to focus my energy on building better career prospect so retirement planning can remain on track. Self-care is also important, ensuring one does not burn out.