In 2021, I wrote about Condor Gold when its share was trading at 46 pence. My research report highlighted the London-listed gold exploration and development company as a potential takeover target with 3x upside.

Instead, the stock dropped by two-thirds due to US sanctions on Nicaragua and concerns the project couldn’t be financed. No bid emerged.

I stuck to my guns, and in late 2023 called to aggressively average down. At the time, the share price was trading between 15-22 pence.

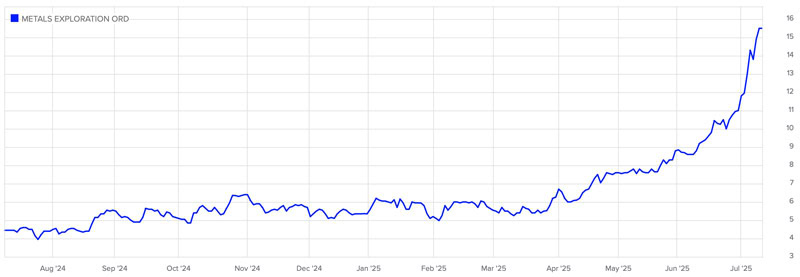

Fast-forward to late 2024, and a takeover bid by Metals Exploration changed the story. Shares of the newly merged company are now trading at an equivalent price of 85 pence for Condor Gold, a 4-bagger from my 2023 recommendation.

It’s remarkable how quickly the share price took off.

Why did it go vertical? Could there be more gains to come – and which other stocks might also prove to be lucrative late bloomers?

Metals Exploration.

The saga of Condor Gold

In the history of Undervalued-Shares.com, there are a few research reports where you could say I was stubborn.

Eventually, your name gets closely associated with a company – for better or worse!

In the case of Condor Gold, I did go in rather deep. It wasn’t so much stubbornness but what I perceived to be a fact-based analysis and solid reasons to stay invested even at times when the market did not agree with me.

Condor Gold was working to develop a gold resource in Nicaragua. I had been following the company since the late 2000s, and been to the country several times.

Additionally, its CEO happened to be one of my neighbours in Sark. We have joint friends, and I even know some of his family.

This long-standing, broad exposure to the subject matter gave me confidence. Everything seemed aligned for me to make an informed call on the company’s fortunes.

However, as happens, the stock market did not initially agree. The share was trading at 46 pence when I published my in-depth research report for Undervalued-Shares.com Lifetime Members in January 2021. It subsequently went up to 63 pence but then trended lower, eventually at 15 pence due to an open offer to all shareholders, allowing them to participate in a financing at a low share price.

In December 2023, I made no secret of my belief that it was the right time to double down (or even triple down).

The takeover saga then dragged on AGAIN, because an expected bid from a Canadian mining company did not materialise.

Instead, another London-listed junior miner spotted its opportunity to make a move: Metals Exploration (ISIN GB00B0394F60, UK:MTL) launched a bid that offered 9.9 pence of cash, 4.0526 shares of Metals Exploration, and up to 11 pence in additional cash subject to certain key performance indicators being met by the newly merged company (“contingent value rights”, CVRs). At the time, this added up to 44 pence per share of Condor Gold.

Not bad, but it was merely the price at which I initially wrote about Condor Gold. It did not yet include a payoff for the time investors had waited, and I felt strongly that it didn’t reflect the potential cash flow from exploiting the gold reserve/resource in Nicaragua.

Last but not least, the shares of Metals Exploration seemed cheap relative to the cash flow that the company was generating from its existing mine in the Philippines.

“Why sell now?“, I thought – and told everyone to stick to their guns.

I am so glad I did.

The share price of Metals Exploration recently soared in a way that is remarkable, even when compared to the increased gold price. Trading volume has been notably heavy, indicating something may be afoot.

Why did the share take off in quite such a way, and could there be more gains to come?

Adding to its potential – and then some

When Metals Exploration made a move on Condor Gold, it did seem a bit like an act of desperation.

The company had turned around the Runruno gold mine in the Philippines, but that mine’s gold reserves were about to run out in 2027.

To stay in business, Metals Exploration needed a new resource.

With Condor Gold, it purchased a gold district in Nicaragua that had a reserve of 2.4m ounces of gold and an initial production target of 145,000 ounces of gold annually. Its reserve could increase further if additional exploration work turned out successful.

Condor Gold, in turn, had spent years not only exploring this resource but also engaging the local community, securing permits to construct and operate the mine, acquiring land, and completing a bankable feasibility study. What it lacked was the funding or the experience to bring it into production.

Joining forces with Metals Exploration intuitively appeared to be the right decision. Condor Gold’s CEO had negotiated a deal that yielded a bid at a 70% premium to the 20-day volume weighted average price of the company’s share price prior to the announcement in late 2024. The upfront consideration was approximately GBP 70m. Condor Gold shareholders received 30% in cash immediately and 70% in shares of Metals Exploration, i.e. 34% of the combined company. In addition, the CVRs payment totals up to GBP 22m payable on gold production and for the discovery of additional ounces of gold, providing Condor Gold shareholders with exposure to the project’s upside.

After combining the businesses, Metals Exploration gave a convincing presentation to shareholders. The beauty of the deal was that Metals Exploration had no debt, produced 80,000 ounces of gold p.a. in 2024, forecast USD 220-250m in EBITDA for the next two years and could finance the upfront capital costs of a new mine at La India without shareholder dilution. The market took note, a new mine was fully funded.