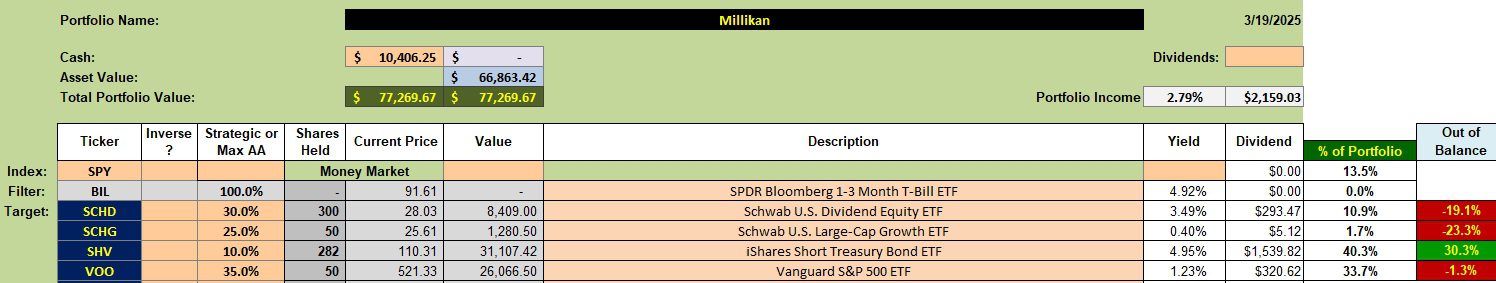

Investors with minimum available time for portfolio management will find the Millikan, as well as several other ITA portfolios, of interest when saving for retirement. This portfolio focuses on four ETFs. VOO is our standard ETF to track the S&P 500. SCHG is to add some growth punch while SCHD throws off dividends. These dividends are used to keep the various asset classes in balance.

Millikan Asset Allocation

Checking the MACD graph I see where the SCHG just gave a Buy signal. The Kipling has yet to reinforce that recommendation. With the available cash I have limit orders in place to purchase more shares of SHV and SCHG.

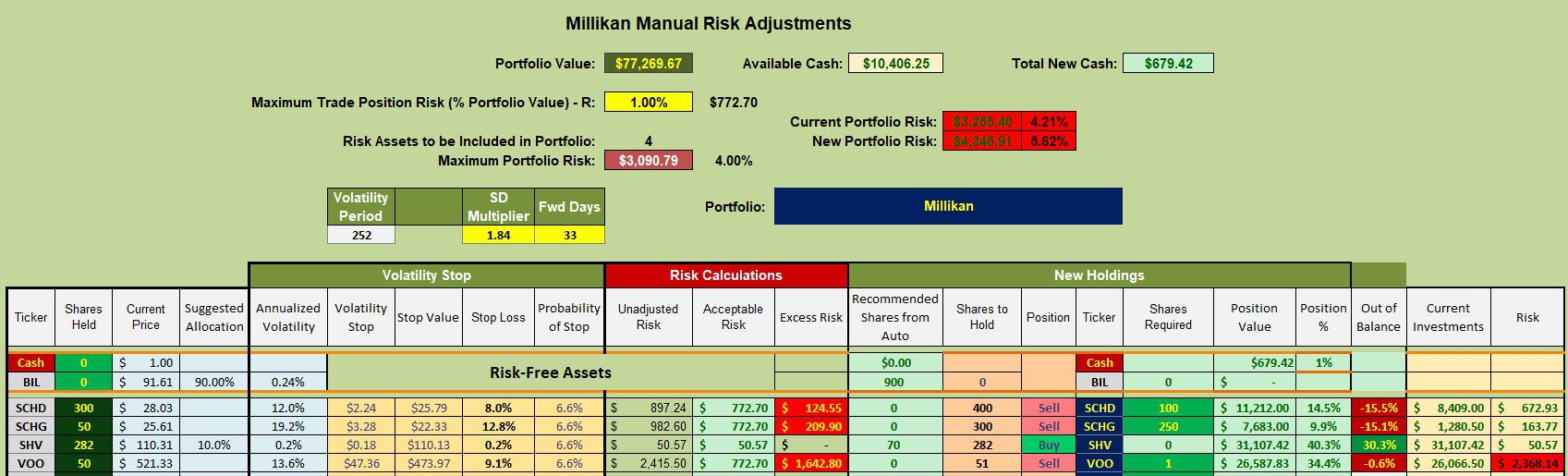

Millikan Rebalancing Recommendation

SHV is the only Buy recommendation so I am using it as a cash holding vehicle where the yield is 4.95%. When either SCHG or SCHC show up as a Buy based on the Kipling recommendation, I will sell shares of SHV and build SCHG and SCHD up to their recommended target percentages.

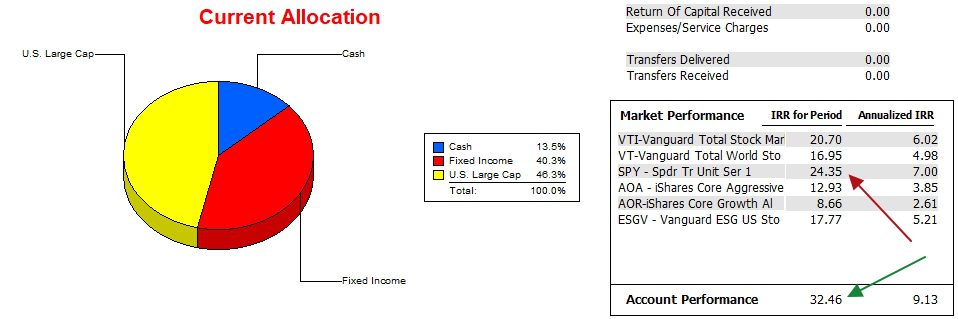

Millikan Performance Data

Since 12/31/2021 the Millikan has outperformed the S&P 500 ETF as well as all other potential benchmarks. AOR is the “weakest” of the six possible benchmarks.

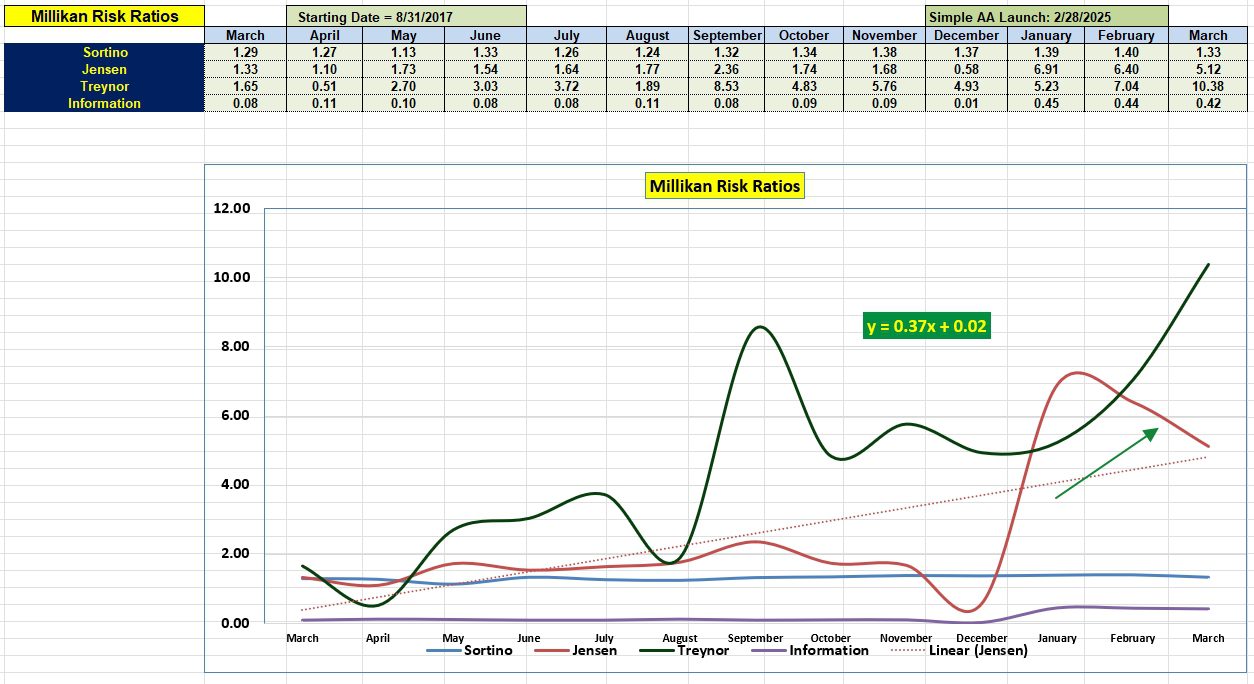

Millikan Risk Ratios

All four risk ratios are well above where they were a year ago, but have declined (Treynor is the exception) over the last few months. It will be many months before we have data showing how well this new asset allocation portfolio performs.

Within a month or so the Millikan should be set to ride out the future years of chaos.

(Visited 10 times, 1 visits today)

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.