Private assets, be they equity or debt, are booming. They promise diversification to traditional asset classes and the potential for higher returns. As with all emerging alternative asset classes, the question is whether these diversification benefits are real. This is where a comprehensive study of private equity and venture capital by Michelle Xuan Mi and Rumi Masih comes in handy.

Let’s start with the good news. Both private equity and venture capital returns are resilient to economic and financial shocks in the long run. If you wait long enough, returns will recover, and there is little chance of long-term impairment of these asset classes.

The chart below shows the reaction of private equity returns to a system-wide shock like the financial crisis or the pandemic. The chart is normalised to a positive shock of one standard deviation.

Reaction of private equity to a system-wide shock

Source: Mi and Masih (2024)

Such a system-wide shock is immediately reflected in private equity prices and grows in the first four quarters after the shock. This is different from the reaction of venture capital, where the shock is largest at the start and dissipates over time. Shocks are being ‘leveraged’ in private equity because many private equity investments use leverage internally to boost returns. And in a system-wide crisis, bond markets tend to freeze as well creating major issues for private equity firms to refinance maturing debt or buy new assets using borrowed money.

The good news, however, is that the shock dissipates over time, though it takes a long time. It only fully dissipates after about 20 quarters, which is (I know you can do the maths yourself, but anyway) five years. Hence, only now have private equity and venture capital investments fully digested the pandemic shock and are back to business as usual.

That is, of course, until another shock comes along. And while the resilience of private equity and venture capital is a good thing, we need to be aware that they are not immune to all kinds of shocks. In particular, shocks in equity markets and bond markets quickly pass through to private equity returns, which increases their return with these asset classes just when you need low correlation the most.

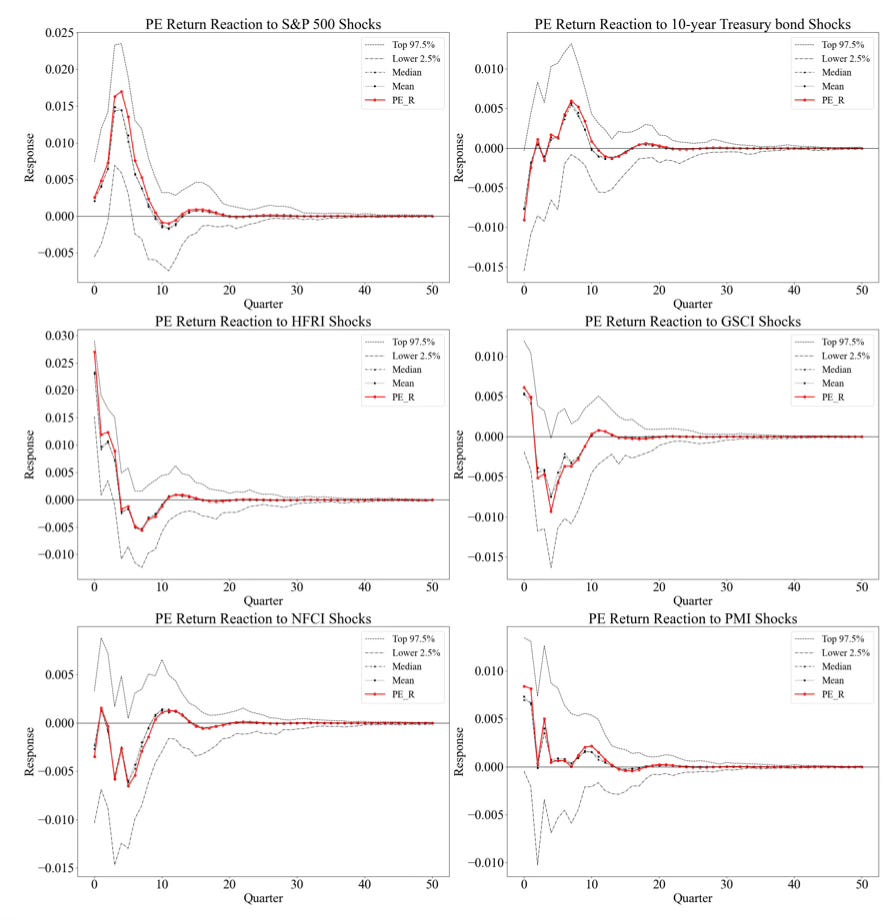

The chart below shows the passthrough of shocks in all kinds of asset markets as well as the economy to private equity. Note, that shocks to the S&P 500 have a delayed impact on private equity returns with a lag of about four quarters. Meanwhile, shocks in 10-year Treasury bonds immediately filter through to private equity returns due to the ubiquitous use of leverage.

Also noteworthy is that shocks in the hedge fund world (HFRI; second row, left chart) are felt immediately in private equity returns. This is hard to explain but could be because hedge funds and private equity funds tend to increasingly use similar investment strategies in private assets.

Reaction of private equity to a different asset and market shocks

Source: Mi and Masih (2024)

In summary, then, we can say that private equity and venture capital returns are not immune to shocks in other asset classes and are more correlated than many investors may expect in a time of crisis. But at least they are resilient in the long term, and after five years or more, investors should be able to see the true long-term performance of these asset classes come through.