Service in China

If you are managing an Asset Allocation (AA) portfolio this blog is for you as I am going through the rebalancing process when managing an AA portfolio. If you are not completely sure what an AA portfolio looks like follow portfolios such as the Gauss, Millikan, Einstein, Bethe, Bohr, etc. In this blog post I am using the Millikan portfolio as the example for several reasons. I recently expanded the number of asset classes so several contain no holdings. How to handle these in the future is part of the analysis I’ll go through in this rebalancing update.

Millikan Asset Allocation Example

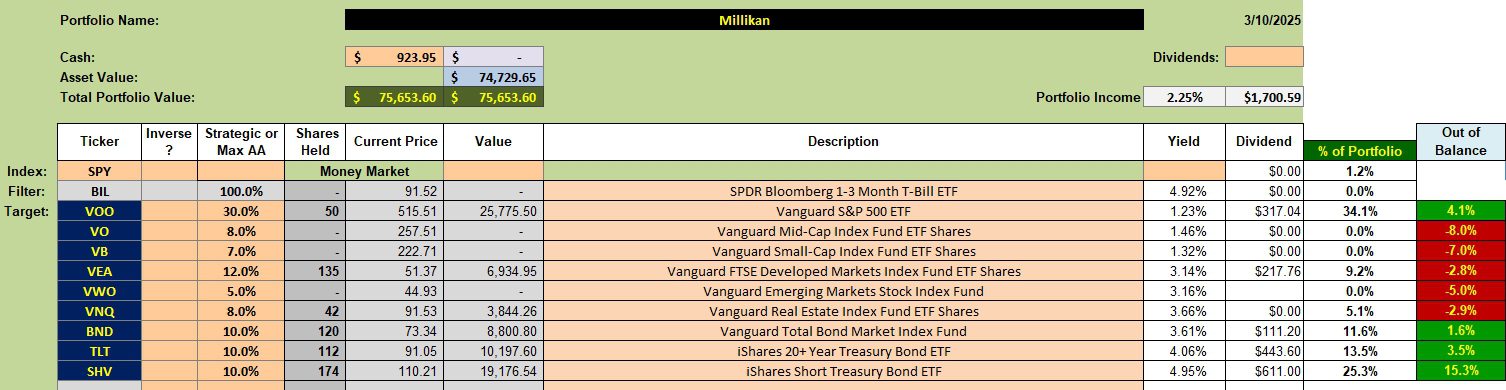

Below is the latest asset allocation for the Millikan portfolio. I added mid-and small-cap equities (VO & VB) plus emerging markets (VWO). This gives the owner nine asset classes with a stock/bond ratio of 70%/30%. For some investors this might be a tad aggressive, but this owner is willing to take on the added potential risk. 70/30 is not far off the basic 60/40 ratio.

Millikan Strategic Settings

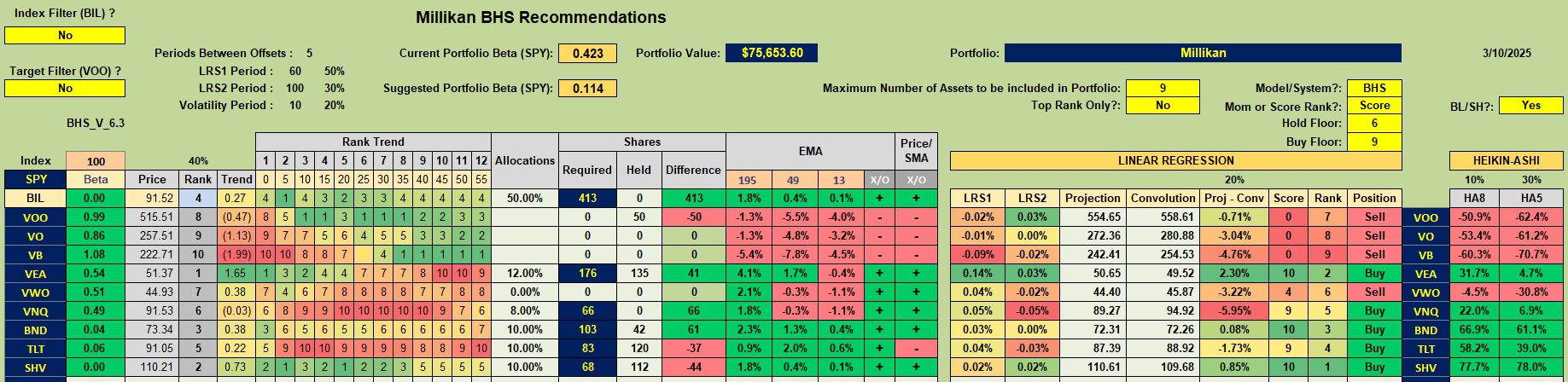

It has been many weeks since I posted this particular worksheet from the Kipling spreadsheet. Note that I am using the BHS investing model. With the market down, this model is quicker to respond to a potential rebound. It may take weeks, months, or even a few years to get back to normal, but the hope is this will eventually happen.

Also pay attention to the LRS1 and LRS2 periods. I think these are the percentages that came out of a research projects a few years ago. The current beta is very low and the suggested one is extremely conservative.

With these settings the Kipling spreadsheet identifies VEA, VNQ, BND, TLT, and SHV as a Buy.

Millikan Rebalancing Strategy

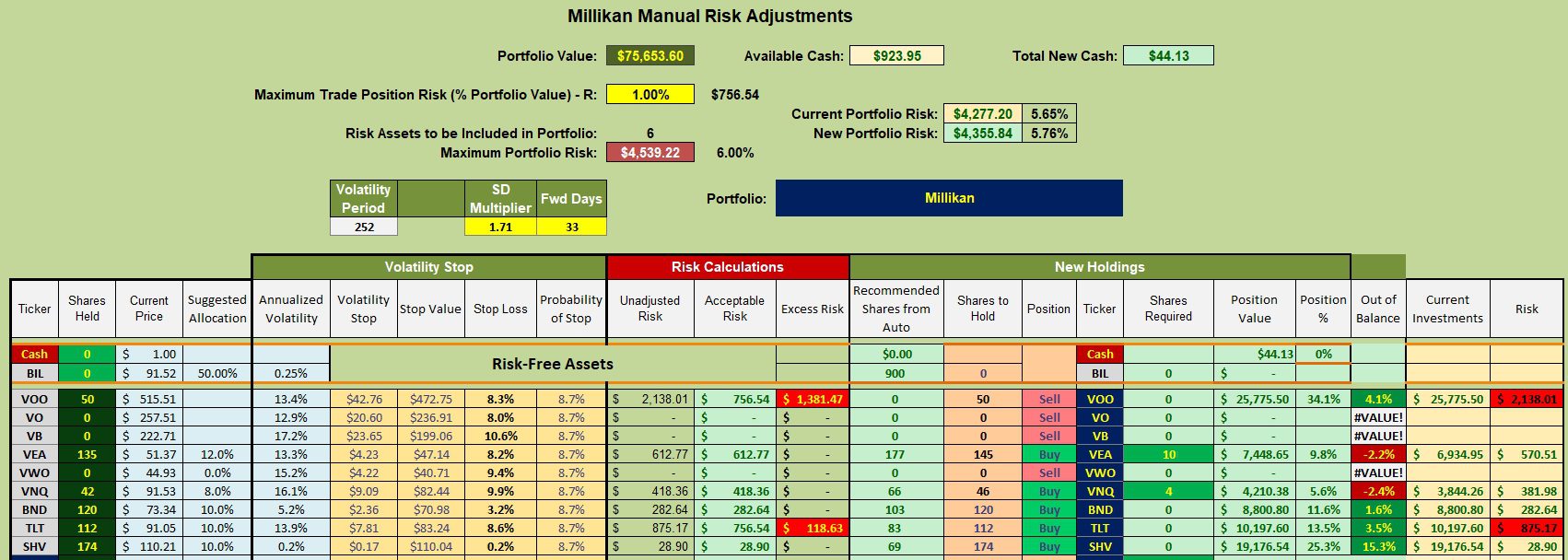

Now we get to the crux of the rebalancing process. Here are the general rules for rebalancing Asset Allocation portfolios.

- If the ETF/(asset class) is a Sell, do nothing. Let the current holdings run. VOO is the example.

- If the ETF/(asset class) shows up as a Hold, also do nothing. Continue to hold the existing shares. No ETF is showing up as a Hold.

- If the ETF/(asset class) is a Buy and the current holding is above target, do nothing. BND, TLT, and SHV are current examples in the Millikan.

- If the ETF(asset class) is a Buy and the current holding is below target, then use the available cash to add more shares to the ETF. VEA and VNQ are the examples in the Millikan portfolio.

New infusions of cash and dividends are used to bring asset classes below target up to their target percentage.

Questions or Comments related to portfolio rebalancing are welcome.

(Visited 16 times, 1 visits today)

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.