Image by kibri_ho / Shutterstock.com

In July 2024, I wrote about stocks that would benefit from the reconstruction of Ukraine.

At the time, the mere possibility of a peace deal for Ukraine was a non-consensus viewpoint.

Since then, a lot has happened.

The possibility for peace in Ukraine is now in the news almost daily.

Following a deal, hundreds of billions in foreign aid will go towards private companies.

What are the options for getting exposure?

The wisdom of the crowd

Growing Internet traffic for a particular subject is a good indicator that something is afoot.

Traffic to my July 2024 Weekly Dispatch “Ukraine reconstruction – which stocks will benefit?” recently spiked.

The article had already generated a lot of interest when it was first published eight months ago, which in itself is a valuable indicator.

The fact that it’s now received renewed interest is a remarkable tell. A few weeks ago, investors started researching how to benefit from a potential modern-day Marshall Plan.

As I wrote last year (abridged):

“All wars come to an end eventually. When the shooting is over, the rebuilding begins.

An intense discussion about Ukraine’s reconstruction is guaranteed to happen, for all the obvious reasons:

- The native population that remained in Ukraine will want to rebuild their country.

- For many Western leaders, securing Ukraine’s future is a high-priority item, supported by at least a significant part of the electorate.

- A reconstruction would be a financial bonanza unlike few before. It represents an opportunity for a massive wealth redistribution from Western taxpayers to those involved with the reconstruction. Corporate lobbyists in Brussels and elsewhere will go into overdrive mode to make it happen.

The numbers are going to be staggering.

When Zelensky spoke about reconstruction in July 2022, he mentioned that a USD 750bn reconstruction plan was required.“

More recent reporting also confirmed that the numbers involved will be absolutely staggering. Companies (and empires) will be built on the back of Ukraine’s reconstruction.

Source: The Week, 6 February 2025.

There are other indicators, too.

E.g., a journalist formerly working for Bloomberg and The Associated Press, Adam Brown, recently relaunched Ukraine Rebuild Newswire. He has been beefing up his news operation in anticipation of a need for a central hub of information about this coming multi-decade project.

Obviously, all sorts of hurdles remain.

Trump promised to finish the war within 24h of taking office, but he failed to deliver. So far, he has spoken to Putin, and a summit in Saudi Arabia is being prepared. It remains to be seen how all this progresses – if it progresses at all. If it does progress, it still remains to be seen if the deal is implemented successfully.

Source: Polymarket.

Also, Ukraine will at least for quite a few more years be a place where investors have to deal with significant corruption. The country was ranked among the Western world’s worst cases of corruption before the war, and the situation is not likely to have improved of late.

Never mind the difficult logistics of a country that has had a significant percentage of its infrastructure taken out by missiles.

Still, there is a growing sense that a deal to stop the shooting in Ukraine is now a matter of “when” and “how”, rather than “if”.

99 stock ideas

Most people will probably be surprised about the sheer number of available options, and their broad scope.

Oddly, reporting about this subject is still somewhat of a hot potato. To suggest that a deal will be done with Putin is seen as treasonous by some. There remains some reluctance to talk about it, and as a result, only a limited amount of reporting is available.

At this stage, even just listing out the different options has value.

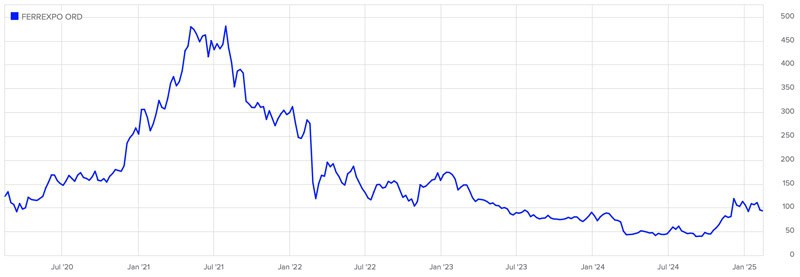

Undervalued-Shares.com Members already received an in-depth research report on such an option: Ferrexpo (ISIN GB00B1XH2C03, UK:FXPO), a Swiss-domiciled and London-listed Ukrainian producer of iron ore pellets. After the report was published in November 2024, the stock nearly doubled in a matter of week.

Ferrexpo.

Indeed, many Ukraine plays have since gained in value rather significantly, showing once again how the stock market anticipates news before it happens. A subset of Ukrainian stocks that are listed on the Warsaw Stock Exchange has just regained its pre-war level. This includes the Ukrainian agriculture stocks that I had featured in an April 2022 Weekly Dispatch, at a time when these stocks had completely fallen out of favour.

So, what else is available and where can you still find upside?

Anyone with an interest in the subject can use the following list as a starting point for their own research.

At the end of the article, I’ll name one investment that may be the single-best way for betting on this entire trend – and without having to go to great research lengths!

I am sure there are ideas that I’ve missed. If you can think of any, please send them over!

The reconstruction bonanza

After a hot war, the immediate tasks at hand include rebuilding residential real estate, roads, bridges, and energy infrastructure. This translates into an obvious opportunity for construction and civil engineering companies. As it were, this is also a sector that offers investors plenty of options for engagement.

Ukrainian companies are going to be part of this, but other European countries will likely get the lion’s share. Companies from countries such as Austria, Germany, and France don’t just have the know-how, but they will also be favoured because of funding for reconstruction from their respective governments. In Europe, in particular, large companies are often intertwined with government interests. There is a reason why Brussels, the headquarter of the EU, has no less than 33,000 corporate lobbyists. Neighbouring Poland is also of particular interest because of its proximity and close involvement with Ukraine.

Rebuilding energy and transportation infrastructure will be a major theme, given the physical damage the war has caused. However, there will also be the aspect of rebuilding things better or replacing them with a new option. Funding from the Eurozone will probably push Ukraine towards building a “net zero”-type infrastructure, provided this theme survives the next few months of ongoing political changes around the world. Rebuilding affordable housing and adding altogether new housing will be another major theme. There is a multitude of potential subthemes, whether it’s bathroom fittings, insulation material, or building security.

Several investment banks have already provided an overview of the companies that are set to benefit:

- As far back as April 2023, Austria’s Erste Group published “Rebuild Ukraine – Opportunities? More a when than an if!“. This seminal report was premature, but its list of investment ideas remains just as relevant today and is thus included in the table below. As Henning Esskuchen, head of CEE equity research at Erste Group, told me: “Currently we are working on an update, most likely focusing on the biggest risk for Ukraine, which is a fragile and imposed agreement, not addressing their needs and not providing a secure framework for rebuilding.“

- Over the past weeks, Bank of America Securities (BofA) and Goldman Sachs both recommended their clients to buy a basket of European stocks if they wanted to get broad exposure. On 13 February 2025, BofA clients participated in a call with Ukraine’s Deputy Minister of Economy, Oleksii Sobolev, covering “the state of the Ukrainian economy, key sectors for reconstruction, growth reforms and government programs for foreign direct investments and eventual EU accession.“

The following table provides a summary of these investment bank baskets. Please note that the reference to Erste Group is based on its 2023 report, whereas the references to BofA and Goldman Sachs are hot-off-the-press.