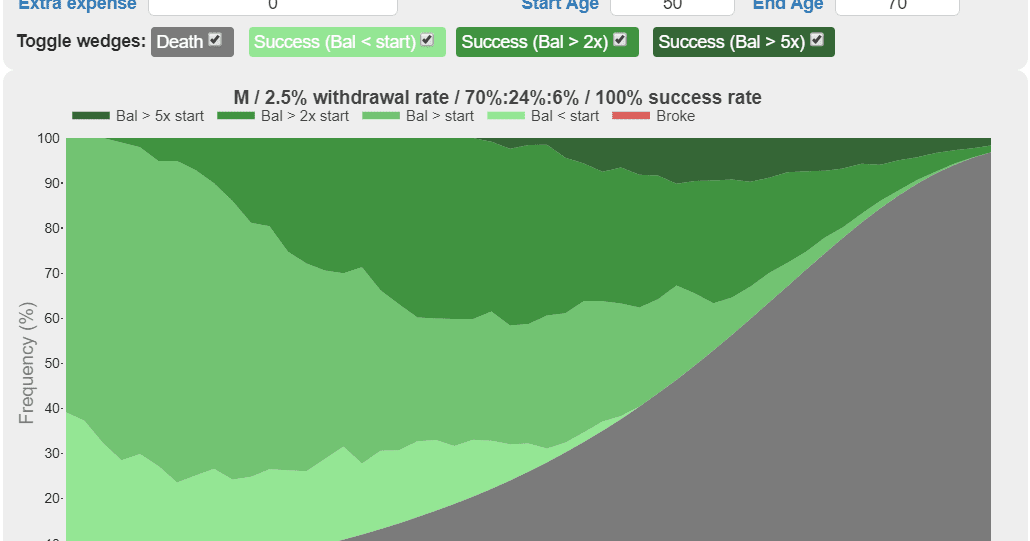

Click to enlarge, Is the risk running out of money or running out of life

Reflecting on this I think a few themes are emerging…

Firstly, some people can learn by brainstorming or thinking while some people learn by trystorming or doing. I now see that I learn the best when I can do the second. So going forwards I need to always find ways of experimenting before going all in.

Secondly, I deliberately went back to a similar role that I had done a number of years previously which at the time I felt was the highest level of meaningful work I had ever experienced. Living it again enabled me to see that the role, my industry and my own needs had changed beyond recognition and at some point, much like the boiled frog, my meaningful work / career had actually predominantly become just a job with me just not noticing.

Reflecting on this change… I originally pursued FIRE as back in 2007 I saw some changes starting to occur that made me think my job at the time would eventually be outsourced to a low cost country. Faced with no job I came up with the choices of FIRE or retrain into a new career. I took on FIRE. Looking now at what had forced many of the changes to my industry, making me also now incompatible, it was largely driven by what I initially saw. That is globalisation requiring extreme cost reduction and reduced quality achieved by investment reduction, partly achieved by outsourcing, while at the same time ramping expectations far faster than answers could be found. So while the changes occurring didn’t directly take my job directly by the time I FIREd they certainly helped reduce the level of meaningful work.

I have also changed a lot. Having achieved financial independence I no longer need a job and having been FIRE’d for 6 months I also came back into the game with fresh eyes. I guess it’s much like a battery chicken knows no different but if they were able to try free range life they would I expect look upon a return to the battery very differently. My needs had clearly changed and I suspect even if the work had been unchanged it is still likely it wouldn’t have provided the same motivation levels that it once did.

My big learning in all this is for any readers out there who say I love my work and so I never intend to retire I’d now say great but it’s still worth pursuing financial independence as either that work or you might change in the future making it not so meaningful.

Thirdly, the ermine who is far more experienced at this early retirement lark than myself has in the past made a good point which I’m now buying into. To paraphrase – only make one major change at a time and let that stabilise before doing another. My first attempt at FIRE had me leave my job, leave my home and leave my country all within the space of a few days. This time around I’m going to follow his good advice. Instead of now figuring out how to now get closer to meaningful friends / family quickly I’m just going to enjoy what’s left of the British summer and be a ‘human being’ rather than a ‘human doing’ for a while. After that it’s off to visit some meaningful friends and family to do some extended trystorming.

The past 9 months has seen a lot of change in the RIT family. Let’s now look at how this has affected the personal finances. The short answer is that between proliferate spending since FIRE, a short job experiment and Mr Market wealth is up £78,000 since I retired the first time to the end of June 2019. Let’s look at the details since I closed out 2018.

SPEND SENSIBLY

Half 1 2019 spending has been crazy averaging £3,935 per month. Not unsurprising when you move from Cyprus back to temporary accommodation transitioning to longer term rented accommodation in the South East of England. You can see the overspend play out in the rental and miscellaneous categories in the chart below.

Looking forward I see this reducing greatly in the back half of 2019 to something like £2,400 per month which will still be higher than what I have planned to spend in FIRE which is more like £2,000 per month (£24,000 per annum). There is no need to panic here though as I can see that this will be solved with a home purchase either in the UK or in one of two other locations. This time around we think we’ll be looking for the location with the most meaningful friends and family as that’s now risen to one of our highest priorities.

Click to enlarge, RIT Spending

Spending Sensibly score: Fail. Spending far higher than planned but I have been saved by the work experiment. Net salary from that minus spending over plan results in a positive number so while it’s a fail no financial harm has actually been done.

INVEST WISELY

2019 (05 January 2019 to 06 July 2019) investment return closed at +10.3%.

Investment wise the portfolio continues to be positioned for FIRE drawdown. Cash and cash like holdings (NS&I Index Linked Savings Certificates predominantly) for a non-mortgaged home purchase and to give me a few years of cash buffer as I enter FIRE now sit at £320,000 (was £342,000 at the end of 2018). The difference is largely explained by a decision to fill my stocks and shares ISA for 2019/20 rather than draw the dividends from it. Depending on where we finally purchase I may need to extract that as cash again.

Living off just the dividends remains important. My drawdown plan was based on spending the lesser of a ‘safe’ withdrawal rate (SWR) of 2.5% or 85% of the dividends received. 2018 total dividends were £28,704 which drove the £24,000 annual spending plan. In contrast the 2.5% SWR would have allowed £30,000. Positively, dividends in 2019 are shaping up to be closer to £32,000 meaning under the dividend rule I can now be spending closer to £27,200.

Click to enlarge, RIT Annual Dividends

For completeness this is what my asset allocation looks like today.

Click to enlarge, Current RIT Asset Allocations

I continue to invest as tax efficiently as possible with my tax efficient holdings from a UK perspective now consisting of:

- 44.5% (was 43.5% at end 2018) held within SIPP’s

- 8.1% (was 8.7% at end 2018) held within the no longer available NS&I Index Linked Savings Certificates (ILSC’s)

- 16.9% (was 14.6% at end 2018) held within a Stocks and Shares ISA.

Tax efficiency score: Pass. At the end of 2017 this was 66.3% and at the end of 2018 was 66.8%. Today it’s 69.6%. If we stay in the UK I’d now expect this to gradually improve as I tax efficiently spend down non-tax efficient investments, continue to try to bed and ISA where possible before finally starting to spend down my ISA which will eventually lead to spending down my pension once that’s available.

Investment expenses also continue to be treated like the enemy. 2018 finished with expenses at 0.22% and today they are slightly lower at 0.21%.

Minimise expenses score: Pass. A small reduction that has come about by reinvesting dividends in low expense investment products. Additionally my pension expenses are now capped at £100 and £200 per annum respectively so any wealth growth dilutes this cost. 0.01% doesn’t sound like much but given my current wealth it now means £142 a year staying in my pocket. I’ll take that.

In the scheme of a lifetime of investing this year is insignificant. I’m all about time in the market and not timing the market so let’s zoom out and look at my performance since I started down this DIY road. My long run nominal is 6.7% which is a real (using RPI) return of 3.9%. The chart below tells the story. Note that the chart assumes a starting sum of £10,000 which was not my portfolio balance at that time but is instead simply a nominal chosen sum to demonstrate performance.

Click to enlarge, RIT Portfolio Performance vs Benchmark vs Inflation

Long term investment return score: Pass. My whole investment strategy since 2007 has been about generating a long term annualised real return of 4%. A real 3.9% is right on the money. The big question now is will this sustain. Some news recently doesn’t sound very bullish and that’s before I talk about Donald Trump and Boris Johnson. Only time will tell.

RETIRE EARLY

Wealth as I write this sits at £1,425,000 which is up a little from the £1,304,000 when I first FIRE’d. My complete journey is shown in the chart below which is now segmented to show my whipsawing in and out of FIRE. From where I sit today I am so glad I did my One More Year(s) and didn’t go into a lean FIRE scenario requiring geographic arbitrage. That extra buffer feels really good as I wrestle with purpose knowing we have enough wealth to experiment including living near one of three groups of meaningful friends and family as a next step.

Click to enlarge, RIT Progress Towards Retirement and In Retirement

Piecing everything together and we end up with the drawdown tracker below. The spending explosion of quarter 4 2018 and quarter 1 2019 can be clearly seen but positively it only culminated in an annual drawdown of 3.2% of current wealth which is still less than the much talked about 4% Rule even after I consider my investment expenses.

Click to enlarge, RIT’s Drawdown Tracker

My first 9 months of FIRE has been quite eventful, brutal and brilliant all at the same time. I’m looking forward to what I learn over the rest of this year as I become more of a ‘human being’ while trying to experiment more. That should lead us into a plan for 2020 as the year closes out.

As always please do your own research.