This sounds relatively simple but it’s actually a more complicated problem than that as I actually have my wealth and earnings sitting in four buckets which have differing rules, including the age with which I can gain access. These are:

- £225,000 sitting in savings accounts ready for a home purchase. This is accessible now.

- £521,000 sitting in savings accounts, NS&I index linked savings certificates (ILSC’s) as well as bonds, gold, listed property and equities within trading account and ISA wrappers. This is also accessible now.

- £578,000 sitting in bonds, gold, listed property and equities within pension wrappers. This currently cannot be accessed until age 55.

- A State Pension promise according to my latest forecast of £5,353 per annum. The current government promise is this is accessible at age 67.

So all in that’s wealth £1,324,000 and a government ‘promise’ of £5,353 annually at some point in the future. Let’s look at each of these in turn.

£225,000 Home Purchase

We are currently renting but intend to buy and the money sitting in savings accounts ready for the purchase has no access restrictions. The risk I carry here is if house prices rise at a rate greater than the interest after tax I can earn then I’m losing housing opportunity. If my interest after tax is greater then I’m winning. I see this approach as a less risk than if I invested this wealth into bonds, listed property or equities as the likely erosion should be gradual when compared to what bond and equity markets can do over a relatively short period. That said I don’t want to wait too long. From where I sit today there are no negatives to buying as if house prices fall we still have the home where if they rise we are losing quality of life that will come from our dream home. We’ll therefore be buying as soon as we find a region to call home. That might be Cyprus but we won’t know that for a few more months.

So far so good. I have enough wealth to buy a home.

£521,000 Trading Account and ISA Wrappers

If I’m spending £24,000 per annum then with wealth of £521,000 my withdrawal rate is actually 4.6% which is much higher than my withdrawal rate assumption of 2.5%. It’s also higher than the much hyped 4% Rule. Luckily though this doesn’t have to carry me until in perpetuity but instead needs to at least carry me until I can get access to the next pension bucket, which is at age 55, which is less than 9 years away based on the current rules. Rules that the government has form in changing. Not that many years ago age 55 was age 50 and even less years ago it was intimated that it would change to 57 in 2028 then stay 10 years below State Pension Age. As the rules have a habit of changing I’m assuming this bucket needs to as a minimum carry me until age 60. So the critical question is do I have enough to carry me to the pension bucket?

The wealth in this bucket is currently allocated into the following asset classes:

- 7% Cash

- 26% Bonds which includes the NS&I ILSC’s

- 4% Property

- 9% Gold

- 54% Equities

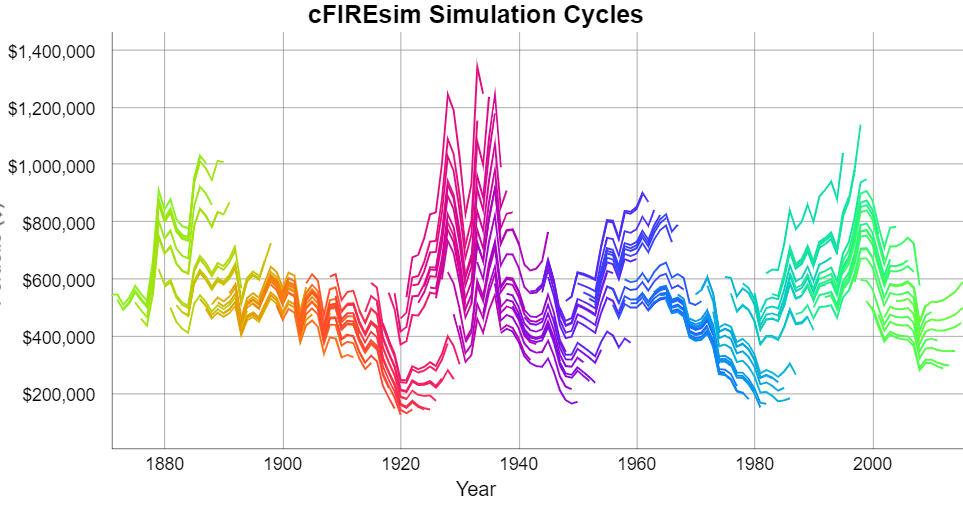

Now of course nobody knows the future so let’s look if historical worst sequence of returns would have been successful. For that analysis I’m going to use cFIREsim which uses US data so may be bullish and where I’ll just interchange all $’s with £’s for simplicity, a duration of 14 years, wealth of £521,000, the asset allocation shown above, annual investment expenses of 0.25%, annual rebalancing of my asset allocation and annual spending of £24,000. The historic sequence of returns for that looks like this:

Click to enlarge, Historic sequence of returns bridging to private pension access

So the worst case sequence sees my £521,000 turned into £127,000 during a period which included World War 1. Importantly, even through that bad time the portfolio would have carried me to my next bucket without reducing spending or needing to get a job.

In 2018 the £521,000 also spun off £13,100 in dividends. A keen eye will notice that my annual spending of £24,000 is not being covered by these dividends let alone 85% of them. I put the living off of 85% of dividends rule in place largely for psychological reasons. I knew I would struggle to sell down my wealth on day 1 of retirement let alone during a bad bear market when wealth was down 40, 50 or even 60%. So when thinking about this rule I actually include the dividends being spun off within my pension wrappers as well. Including those 2018 dividends these were £28,597 which puts spending at 84% of dividends.

Click to enlarge, RIT annual dividends including those within pension wrappers

In doing this what will happen in reality is that I’ll be selling down non-pension wealth to eat until I can access my pension bucket but at the same time I’ll be buying what I’ve sold down within the pension wrappers. So with time my non-pension dividends should fall while my pension dividends should rise by an equivalent amount. I can live with that.

So far so good. I have enough wealth to buy a home, enough wealth to historically get me to private pension access and if I squint I’m spending less than 85% of my annual dividends.

£578,000 Pension Wrappers

UK pension wrappers are tax favourable for a couple of key reasons. Firstly, the 25% tax free lump sum is attractive and secondly, they are a tax deferral strategy meaning you are taxed on the way out rather than the way in. The penalty for these benefits is a multitude of restrictions including access age and continual government meddling.

Another of those restrictions that I’ve carefully monitored is what is known as the Lifetime Allowance (LTA) which is a limit on the amount of wealth you can accrue in the pension before they lose a lot of lustre due to extra tax charges. Young FI Guy wrote an excellent post on the topic. The Lifetime Allowance is currently £1,030,000 and the current rules see that amount increased by inflation (CPI) annually. The limit is then tested periodically via what are known as Benefit Crystallisation Events which Young FI Guy also explained well, including with the use of this table:

Click to enlarge, Pension benefit crystallisation events

My first event will be what is known as BCE1. It will occur when I first put my pension into drawdown which could be as early as age 55 but again I’ll assume the rules get changed and it will be more like 60. So will my pension lose its lustre? To calculate this I’ve assumed inflation of 2.3% and a nominal investment return of 6.2% which is my historic investment return to date.

Click to enlarge, Nominal assumed change in pension wealth

If I can get access to my pension at age 55 I’m well under the LTA which by then would be £1,269,484 with inflation increases and even at age 60 I have a small margin of error.

So far so good. I have enough wealth to buy a home, enough wealth to historically get me to private pension access age and not too much pension that the tax efficiency is largely lost. Now the critical question becomes do I have enough wealth to ensure I run out of life before I run out of wealth.

To calculate this I add the non-pension wealth to the pension wealth excluding the home purchase to arrive at wealth of £1,099,000. Importantly, with annual spending of £24,000 that’s a starting withdrawal rate 2.2% which is below my planned 2.5% withdrawal rate. This wealth is currently allocated into the following asset classes:

- 4% Cash

- 25% Bonds which includes the NS&I ILSC’s

- 10% Property

- 5% Gold

- 56% Equities

Plugging this wealth and these asset allocations into cFIREsim along with annual investment expenses of 0.25%, annual rebalancing of my asset allocation, annual spending of £24,000 and this time a duration of 40 years by which time I’ll be age 86 yields the following:

Click to enlarge, Historic sequence of returns for a 40 year retirement period

Worst case over a 40 year period that £1,099,000 has turned into a real £1,548,000 with a mean of £3,865,000 and a median of £3,038,936. Historically the future is bright which is great as I might live longer than 86, Mrs RIT might live longer than me after which a very healthy legacy is likely to appear.

So far so good. I have enough wealth to buy a home, enough wealth to historically get me to private pension access age and enough wealth to ensure I historically run out of life before I run out of wealth. So what about that State Pension.

£5,353 State Pension

Unlike the majority of the population I look at the State Pension differently. We’ve just seen that historically it’s likely I am going to end up with a lot of spare wealth. We also know that government debt is continually heading ever upwards and that the State Pension is not backed by anything except future tax revenues and/or further debt. I’m therefore assuming that at some time in the future the government will either continue to raise the State pension Age and/or means test it. I therefore assume I will receive a State Pension of exactly £0 and instead turn it into an insurance policy. I will continue to pay voluntary National Insurance contributions to ensure I build a full State Pension entitlement. That way if future sequence of returns are much worse than historic I can still eat. Mrs RIT is doing the same from a State Pension perspective. If it doesn’t get means tested and someday we can access our State Pensions then our wealth drawdown will reduce meaning we will likely end up with an even bigger wealth legacy. A problem I can accept.

In conclusion during the accrual phase of my FIRE planning I built enough secure wealth for a home purchase early in retirement, enough wealth to bridge me historically to private pension age, enough wealth to historically grow slightly during my full retirement and an insurance policy against it all going horrible wrong. Now it’s time to drawdown. How are you planning for FIRE?