Bridge over the River Cam in Cambridge, England

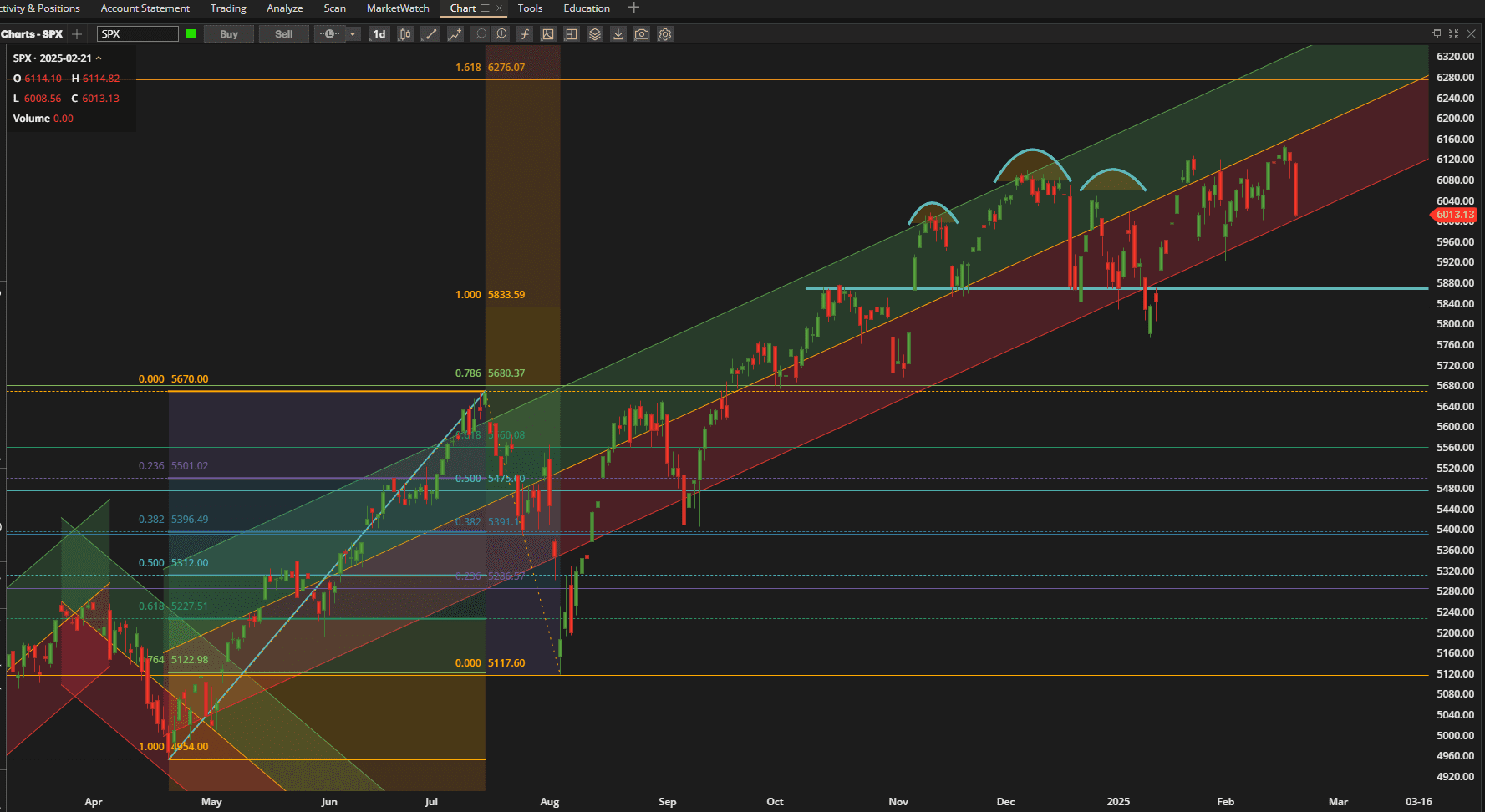

After hitting new all-time highs on Wednesday, US Equities collapsed on Friday with prices now sitting on the lower boundary of the longer-term uptrend channel:

Thus, we remain in the choppy sideways consolidation range that we have been in for the past 3 months. Now we might ask whether Wednesday’s high was a triple top – or do we bounce once again into the bullish channel?

Thus, we remain in the choppy sideways consolidation range that we have been in for the past 3 months. Now we might ask whether Wednesday’s high was a triple top – or do we bounce once again into the bullish channel?

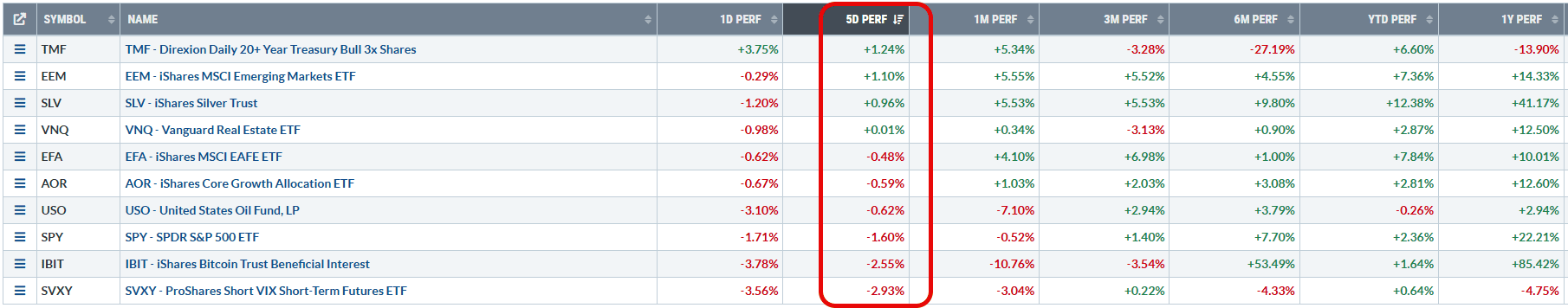

Relative to other asset classes, and, particularly relative to international equities, US equities did not fare well over the past week closing ~1.6% lower than last week’s close:

this remains the case relative to 1-month and 3-month performance.

this remains the case relative to 1-month and 3-month performance.

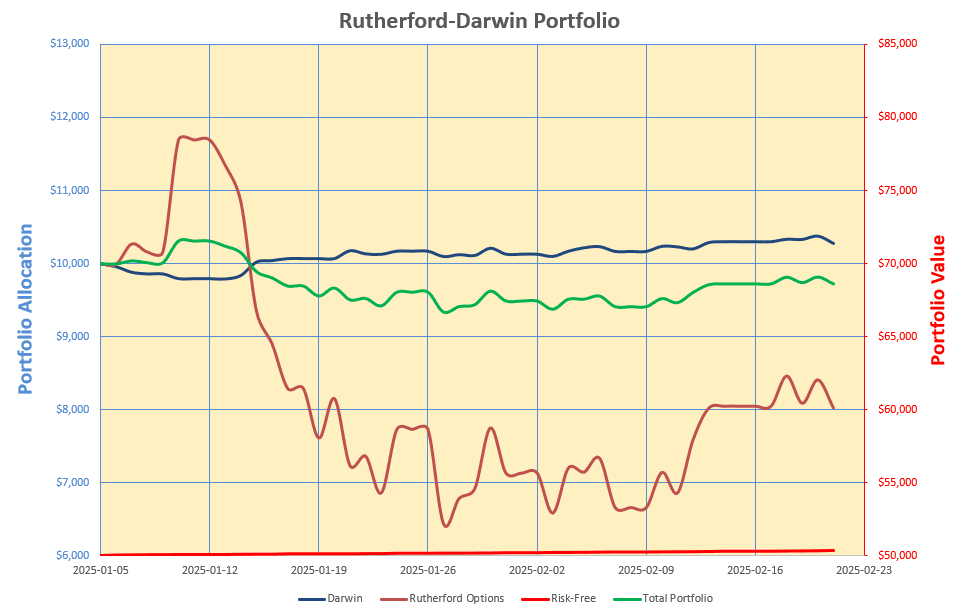

So, let’s take a look at how the Rutherford-Darwin portfolio fared.

First, the $50,000 that we have invested in T-Bills (BIL) and don’t have to worry about gained a few more dollars and now contributes $313 to the total returns.

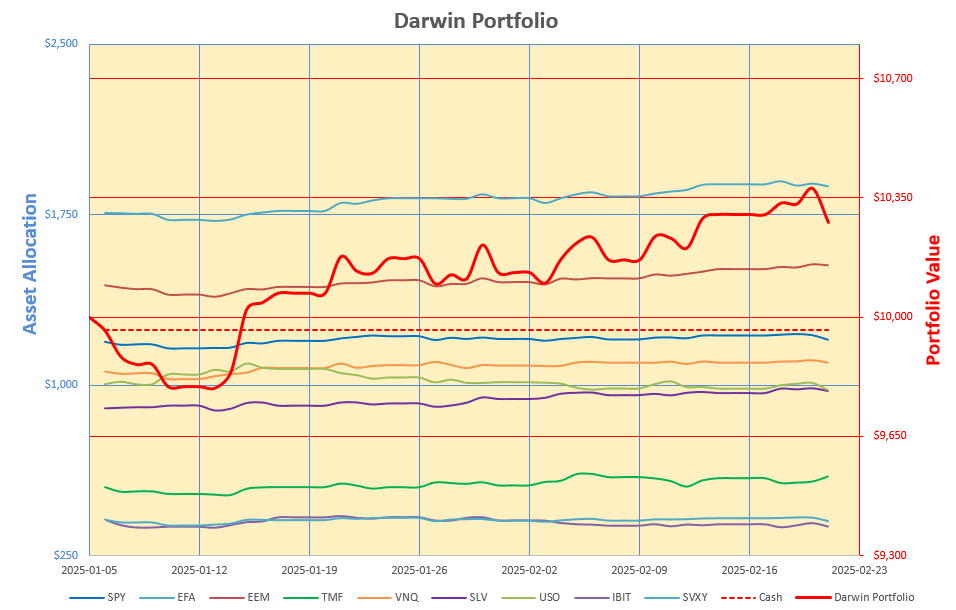

Secondly, the $10,000 diversified “Buy-And-Hold” Darwin portion of the portfolio gave up ~$23 (0.23%) so handled the volatility fairly well:

Volatility to date is running at ~7.7% – so very acceptable.

Volatility to date is running at ~7.7% – so very acceptable.

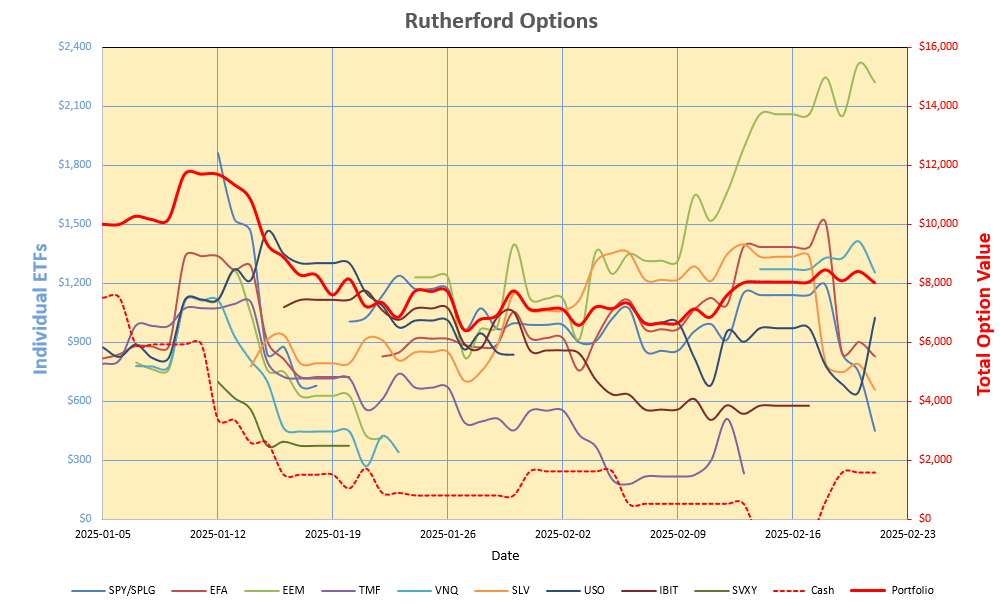

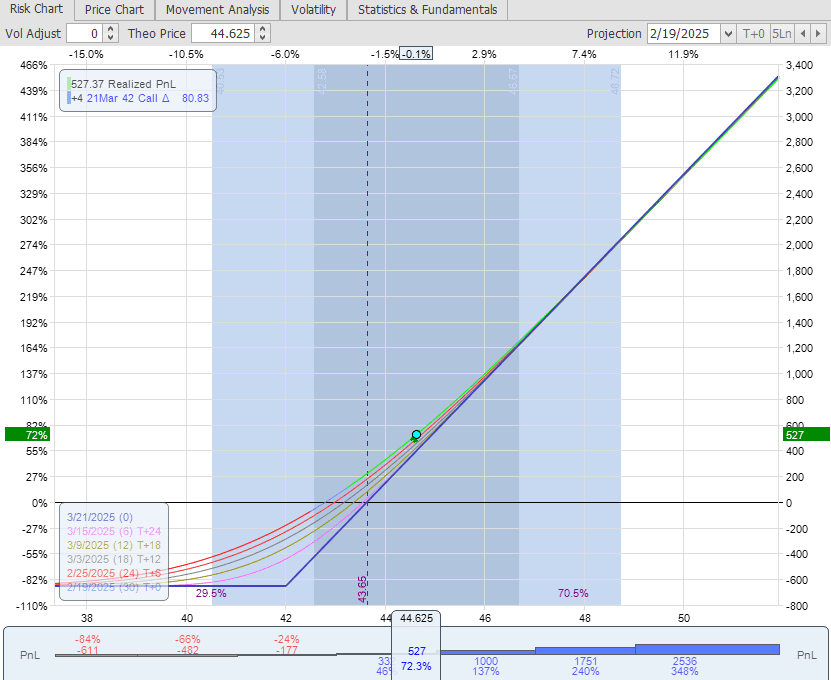

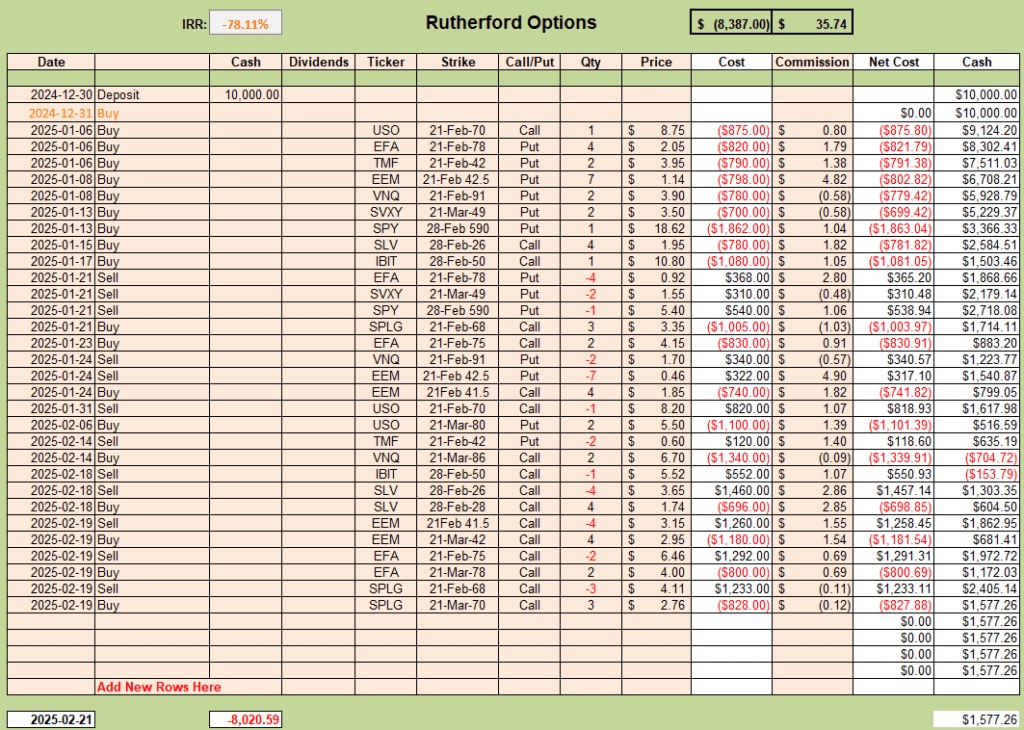

Then, of course, we come to the last $10,000 portion of the portfolio that is highly leveraged through Option derivatives:

where we see far more movement in the individual holdings with volatility running at 105% – but still only a $24 net loss (0.25%) on the week. Profits from the short (long Put) position in Oil (USO) largely offset losses in the equity ETFs.

where we see far more movement in the individual holdings with volatility running at 105% – but still only a $24 net loss (0.25%) on the week. Profits from the short (long Put) position in Oil (USO) largely offset losses in the equity ETFs.

Overall performance of the total portfolio looks like this:

with a volatility of 12.6% (green line).

with a volatility of 12.6% (green line).

As reported in my udates to last week’s review there were a number of adjustments this week as we approached the expiration date of many of the Options. This required that I exit positions or roll out to a new expiration date.

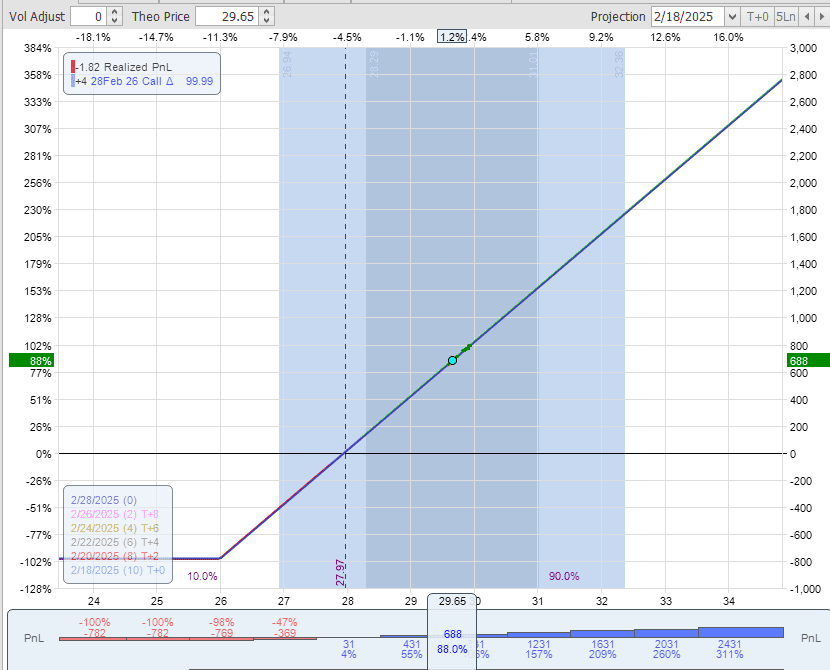

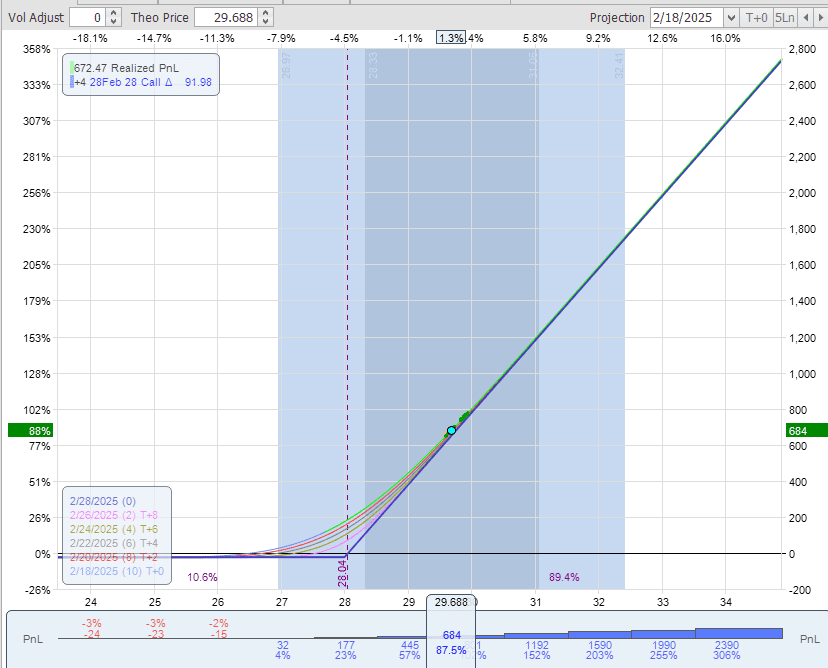

One adjustment that did not require rolling the position out in time (since expiration is not until 28 February – next week) was in Silver. SLV has moved up nicely so I rolled the position up in strike price from the $26 strike to the $28 strike with the same expiration date for a credit of $190 per contract – $760 total. The impact of this is shown below where we move from a position with ~$800 maximum loss:

to a position with essentially no risk of loss and having taken $760 risk off the table:

to a position with essentially no risk of loss and having taken $760 risk off the table:

This is one of the big advantages of trading Options rather than the underlying ETF – we can control losses a lot easier. The Long Call position is the equivalent of holding shares in the underlying ETF together with a long Put Option for insurance.

This is one of the big advantages of trading Options rather than the underlying ETF – we can control losses a lot easier. The Long Call position is the equivalent of holding shares in the underlying ETF together with a long Put Option for insurance.

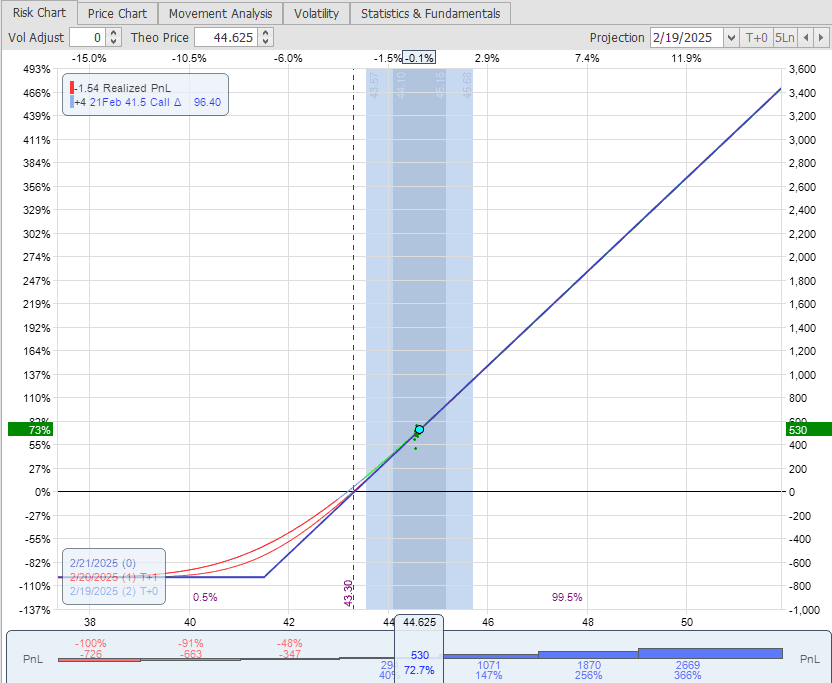

As recorded in my Updates I also rolled my Options on the equity ETFs (SPLG, EFA and EEM) up (in strike price) and out (in time to expiration) for credits. Below is how EEM looked before the adjustment:

with a current potential profit of $530 with ~$750 maximum risk at $41.50, to a position with only ~$650 risk at $42. The new expiration date here is 21 March (one month further out in time).

with a current potential profit of $530 with ~$750 maximum risk at $41.50, to a position with only ~$650 risk at $42. The new expiration date here is 21 March (one month further out in time).

This adjustment was made for a credit of $20 per contract – or $80 (4 contracts) of risk off the table.

This adjustment was made for a credit of $20 per contract – or $80 (4 contracts) of risk off the table.

Similar roll adjustments were made for SPLG and EFA:

The Internal Rate of Return (IRR) on these trades looks terrible at -78% – but it’s early days and I expect to turn this around at some point. I am still working on my “rules” for entry and exit on these ETFs since I would like to find trades with at least 30 days before requiring an adjustment. This is not easy to do and is obviously market behavior dependant. For anyone interested in what I am working on, you can get some idea from the following link since I don’t want to clutter this blog with an unnecessay amount of detail:

The Internal Rate of Return (IRR) on these trades looks terrible at -78% – but it’s early days and I expect to turn this around at some point. I am still working on my “rules” for entry and exit on these ETFs since I would like to find trades with at least 30 days before requiring an adjustment. This is not easy to do and is obviously market behavior dependant. For anyone interested in what I am working on, you can get some idea from the following link since I don’t want to clutter this blog with an unnecessay amount of detail:

(Visited 4 times, 4 visits today)

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.