Environs of Edinburgh from the Castle

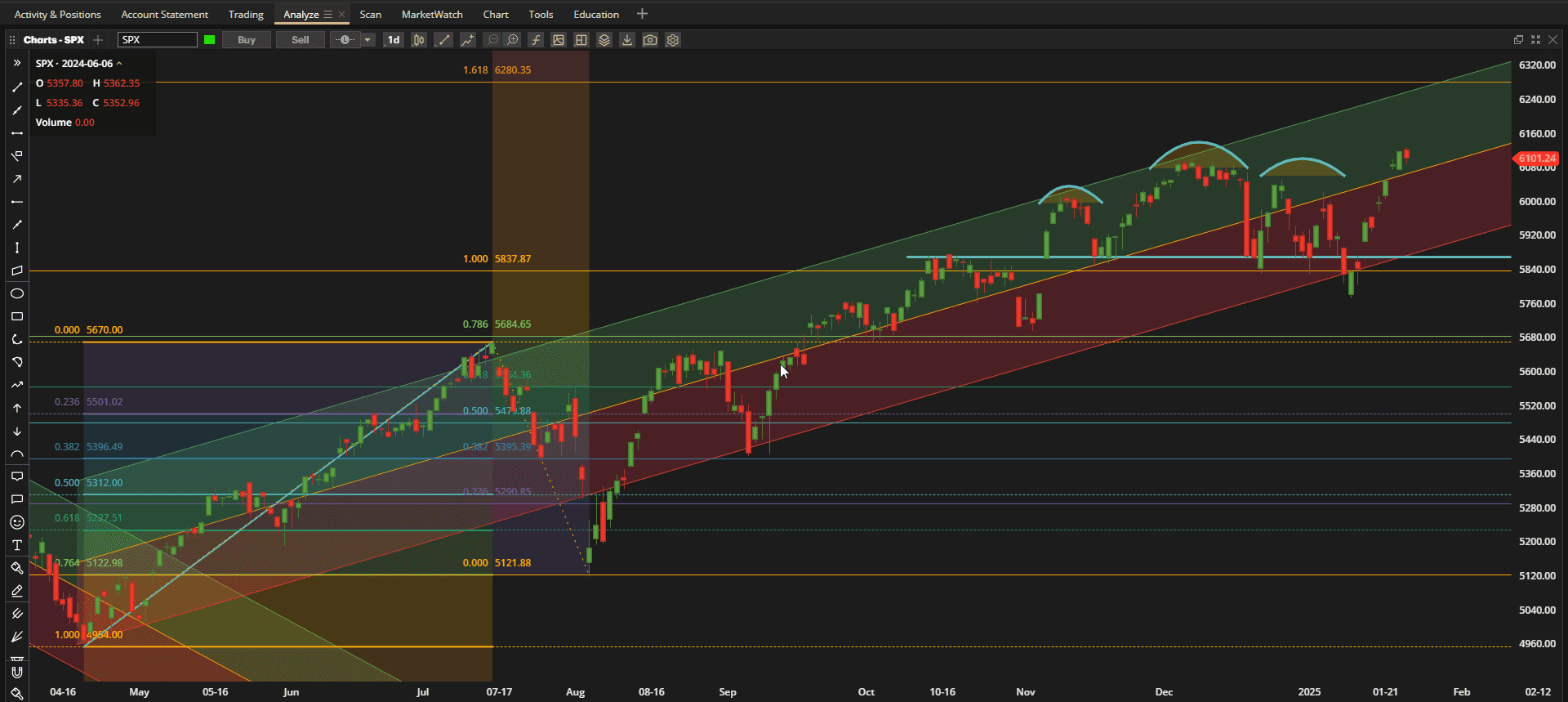

Another bullish week in US Equities with the SPX (S&P 500 Index) closing the week ~1.7% higher than last week’s Close despite weakness on Friday:

So much for the predictive powers of “Head and Shoulders” patterns – but wait – maybe it’s a “Double Top” with prices back at all-time highs and potential resistance. Meanwhile, back well within the boundaries of the uptrend channel – the “Head and Shoulders” was more like a head fake 🙂 .

So much for the predictive powers of “Head and Shoulders” patterns – but wait – maybe it’s a “Double Top” with prices back at all-time highs and potential resistance. Meanwhile, back well within the boundaries of the uptrend channel – the “Head and Shoulders” was more like a head fake 🙂 .

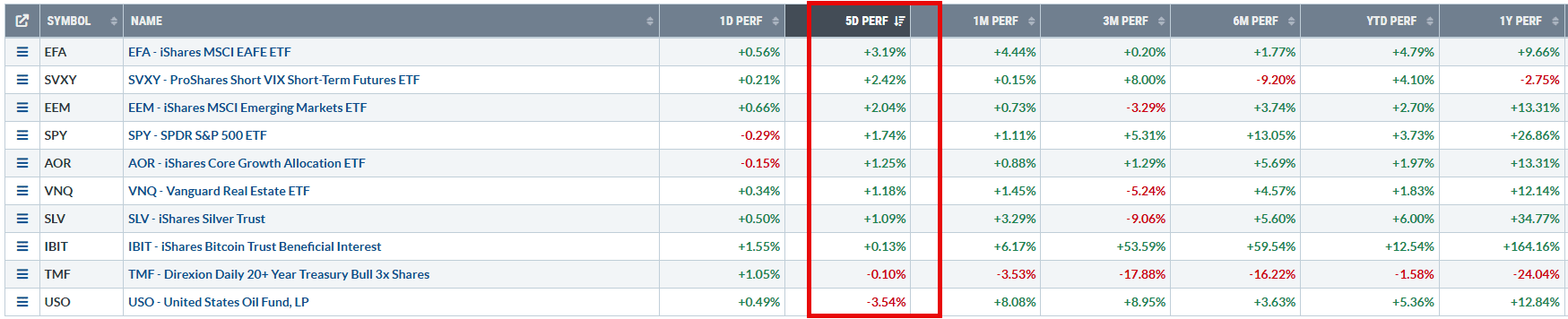

US Equities was not the strongest asset class however:

with International Equities (EFA and EEM) outperforming SPY. Volatility also dropped as equities gained strength (thus generating profits in SVXY, the inverse volatility ETF in the quiver). Oil was the big loser this week – so I shall be watching that closely next week.

with International Equities (EFA and EEM) outperforming SPY. Volatility also dropped as equities gained strength (thus generating profits in SVXY, the inverse volatility ETF in the quiver). Oil was the big loser this week – so I shall be watching that closely next week.

As I indicated last week I added 75 shares of BIL to the “risk-free” portion of the portfolio – so returns from this ~$50,000, over the 3 weeks since inception, now stands at $144.

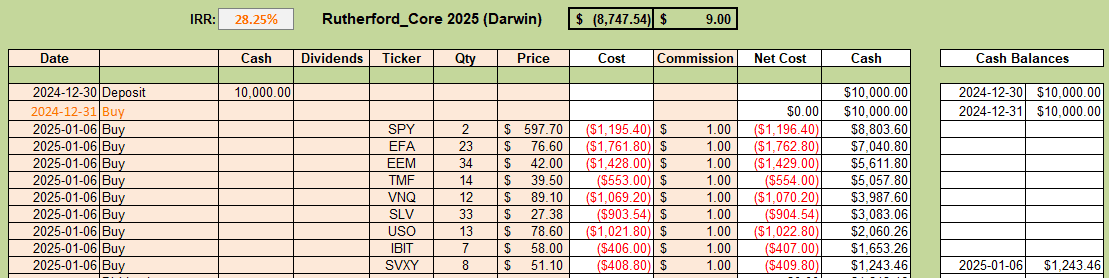

The Darwin Portion of the portfolio – a “Buy-And-Hold” allocation of funds in all assets in the “quiver” looks like this:

with a 28% IRR (not real until we have ~ 12 months of data) and 8.2% volatility. This volatility, like the IRR, will change and settle down over time – but it is reassuring to see that it will likely settle below the 10% target that I am aiming for.

with a 28% IRR (not real until we have ~ 12 months of data) and 8.2% volatility. This volatility, like the IRR, will change and settle down over time – but it is reassuring to see that it will likely settle below the 10% target that I am aiming for.

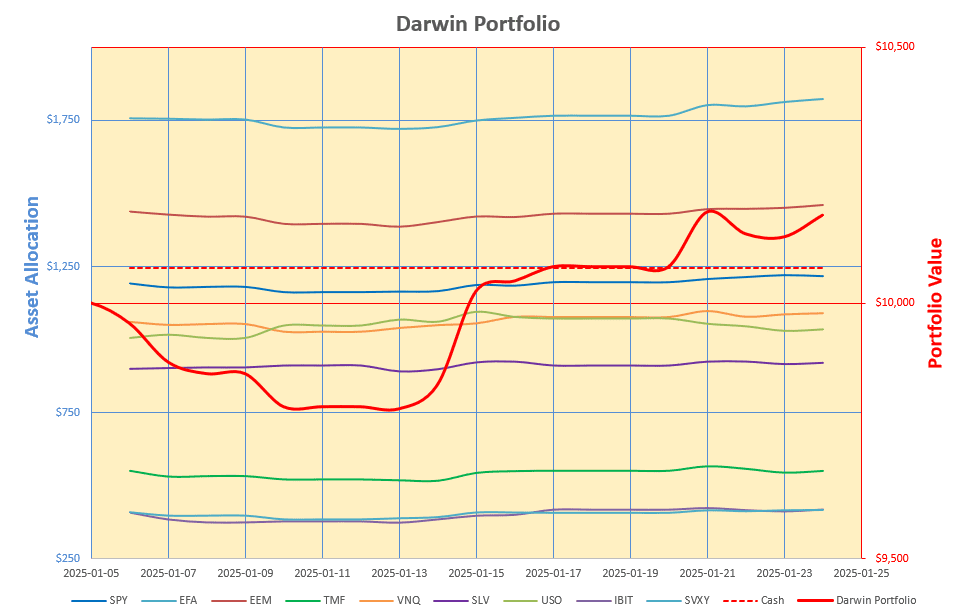

Graphically, performance looks like this:

with the ~$10,000 portfolio generating $172 since inception.

with the ~$10,000 portfolio generating $172 since inception.

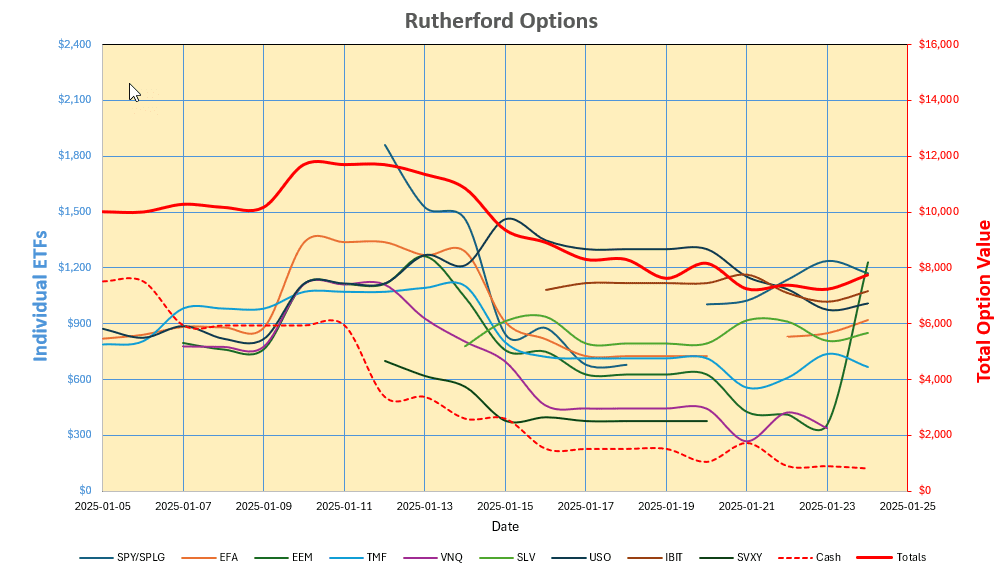

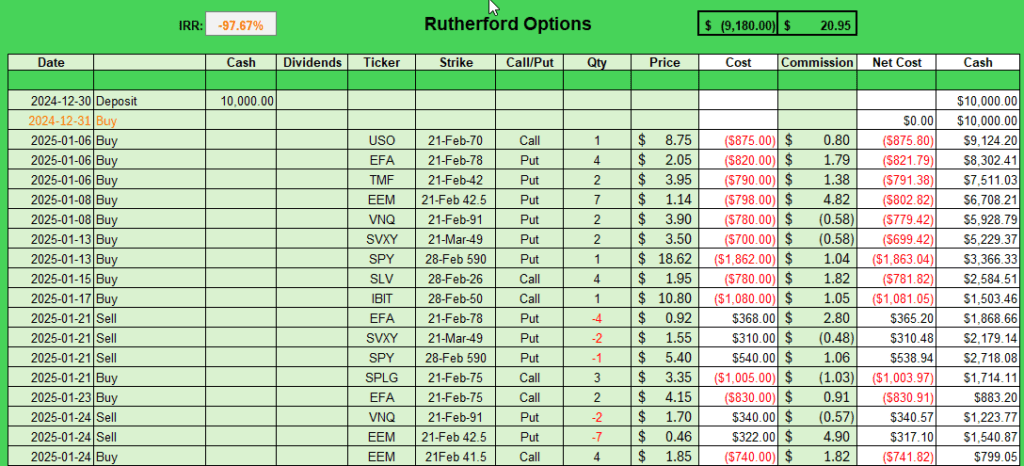

Then there’s the scary Options portion of the portfolio:

that has calmed down slightly (heavy red line) after a few adjustments (activities 21 Jan – 24 Jan) where I closed out of the short (Put) positions in EFA, SVXY, SPY, VNQ and EEM and reversed to long (Call) positions in SPLG (change from SPY), EFA and EEM. I am presently not holding any positions in SVXY or VNQ:

that has calmed down slightly (heavy red line) after a few adjustments (activities 21 Jan – 24 Jan) where I closed out of the short (Put) positions in EFA, SVXY, SPY, VNQ and EEM and reversed to long (Call) positions in SPLG (change from SPY), EFA and EEM. I am presently not holding any positions in SVXY or VNQ:

I am now closer to being where I am comfortable and, even with (measured) volatility at 106% and IRR at a horrible (unreal) -98%, and this portion of the portfolio being down ~$2,300, to date I am not too concerned. It would probably have been smarter to wait for entry set-ups for each ETF rather than populating the whole portfolio at the start – but I wanted to get the show going and suffered that “timing” luck that usually hits us when we do something like that. On the other hand, we can’t wait forever for the entry signals – as I have done for the Dirac Portfolio – and missed out on good profits over the past year. We have to “pull the trigger” sometime – and trust that we can adjust without too much harm if we are wrong.

I am now closer to being where I am comfortable and, even with (measured) volatility at 106% and IRR at a horrible (unreal) -98%, and this portion of the portfolio being down ~$2,300, to date I am not too concerned. It would probably have been smarter to wait for entry set-ups for each ETF rather than populating the whole portfolio at the start – but I wanted to get the show going and suffered that “timing” luck that usually hits us when we do something like that. On the other hand, we can’t wait forever for the entry signals – as I have done for the Dirac Portfolio – and missed out on good profits over the past year. We have to “pull the trigger” sometime – and trust that we can adjust without too much harm if we are wrong.

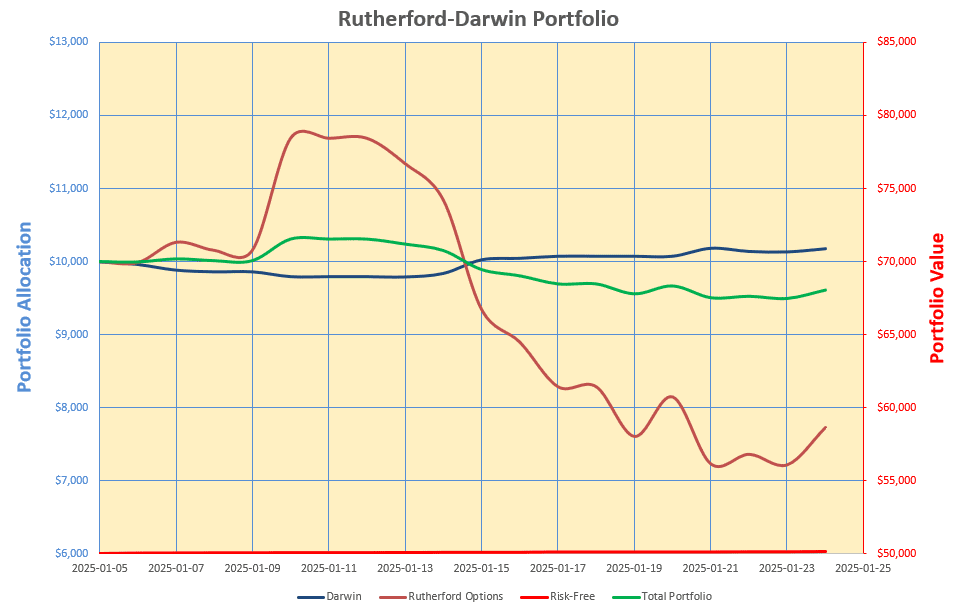

Putting everything together, performance of the total Rutherford-Darwin Portfolio looks like this:

with volatility at 13.2% after 3 weeks – a very acceptable level of overall volatility (green line).

with volatility at 13.2% after 3 weeks – a very acceptable level of overall volatility (green line).

(Visited 18 times, 2 visits today)

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.