Olympia Harbor – Southern Finger of Puget Sound.

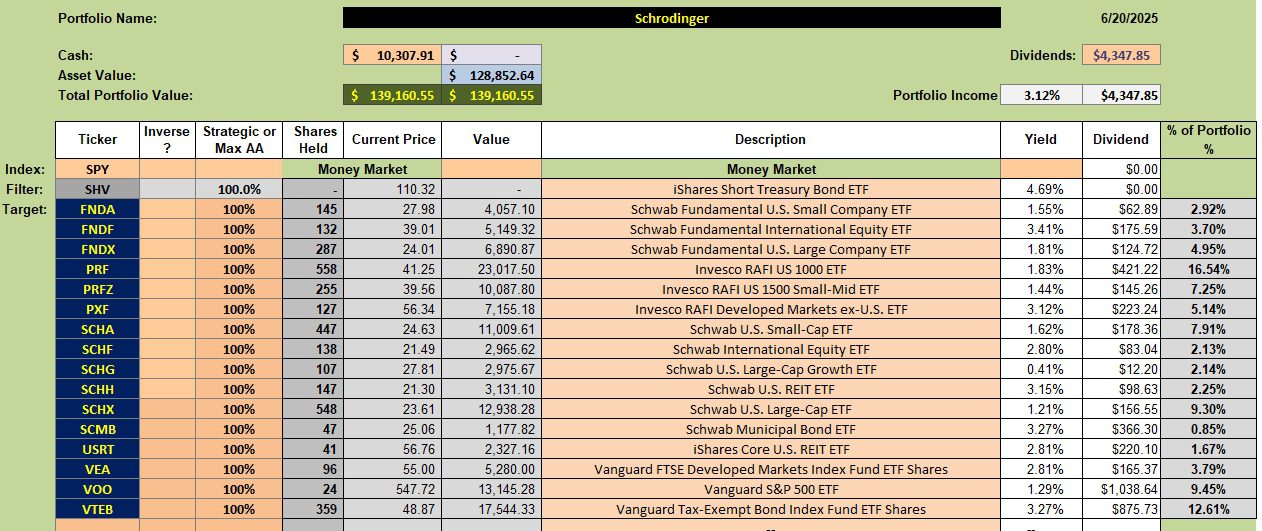

Welcome to the Summer of 2025. Since computers make all decisions related to the Schrodinger, the weekend is an appropriate time to update this portfolio. Since the last review no changes were made other than to pick up a few dividends. In the next Schrodinger portfolio review second quarter dividends will appear and the hope is the Schwab computers will being to invest some of the available cash.

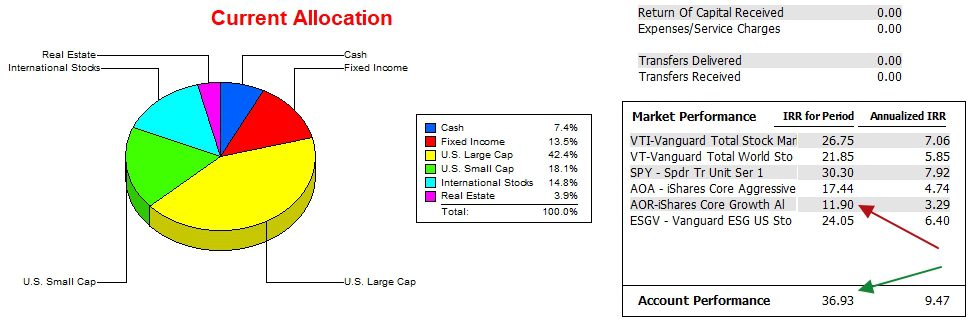

Schrodinger Asset Allocation

Below is the current asset allocation for the Schrodinger. I expect the Schwab computers will begin to build up shares that currently occupy small percentages such as SCMB and USRT.

Schrodinger Performance Data

Since 12/31/2021, or what I use as the launch date for portfolio comparisons, the Schrodinger continues to outperform all benchmarks. Of particular significance is the delta between the Schrodinger and the S&P 500 ETF, SPY.

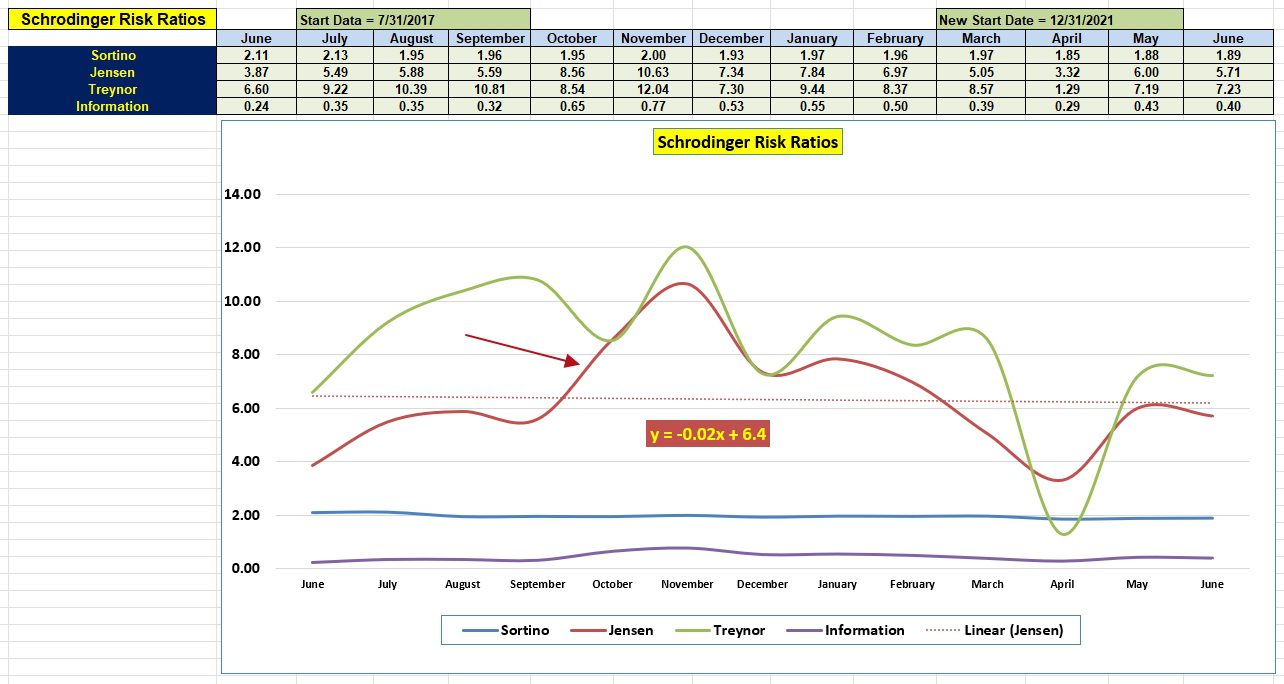

Schrodinger Risk Ratios

Based on the four risk factors, the Schrodinger is not all that risky. All current metrics are above where they were a year ago with exception of the Sortino Ratio.

When a portfolio is not holding excess cash, the Treynor Ratio carries more meaning as beta is not such a dominate factor.

Comments and Questions are always welcome. Post in the Comment section provided with each blog post.

If you find this investing information useful, pass on the link ( https://itawealth.com ) to your friends and family.

(Visited 32 times, 3 visits today)

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.