Stock Market Outlook entering the Week of January 5th= Uptrend

- ADX Directional Indicators: Downtrend

- Institutional Activity (Price & Volume): Mixed

- On Balance Volume Indicator: Uptrend

ANALYSIS

Happy New Year! The stock market outlook starts 2025 in an uptrend, but is working off a December hangover.

The S&P500 ( $SPX ) lost 0.5% last week. The index is back at the 50-day moving average and ~7% above the 200-day moving average.

SPX Price & Volume Chart for Jan 05 2025

Still no change in the signal set, so no change in the overall outlook. The ADX highlights the bearish price action during the back-half of December and Institutions weren’t doing much of anything for the last two weeks, both of which weakened the longer-term bullish view from the On-Balance Volume level.

S&P Sector Performance for Week 01 of 2025

Energy ( $XLE ) was the strongest sector last week, one of two that finished higher. Consumer Discretionary ( $XLY ) led to the downside, dropping 3.3%. Sectors like Materials, Energy, and Real Estate have really struggled over the past 4 weeks, showing the importance of putting money to work when and where the trend is in your favor. Speaking of trends, Financials ( $XLF ) and the S&P500 ( $SPY ) fell from bullish to neutral bias.

Sector Style Performance for Week 01 of 2025

Another poor week across the investing styles; all finished in the red. High Dividend was the least bad, while Large Cap Growth led to the downside. High Beta shifted from Bullish to Neutral bias.

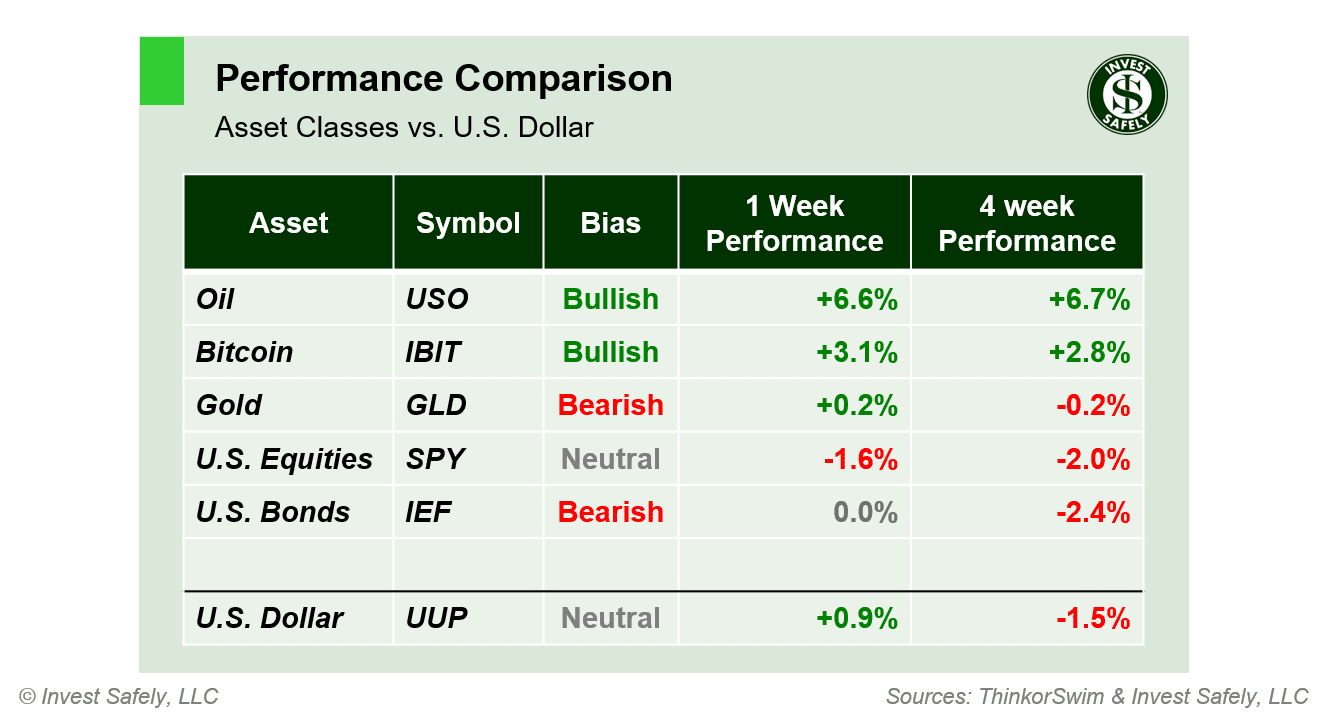

Asset Class Performance for Week 01 2025

Oil ( $USO ) led the way higher again last week; U.S. equities were the worst performer. And as mentioned above, the S&P500 shifted to a Neutral bias from Bullish. The dollar also shifted from Bullish to Neutral, but that move is an artifact of my data providers accounting for December’s dividend; the price action remains strong.

COMMENTARY

Equity indexes have entered an important phase, as they’re now testing support levels (i.e. the shift to Neutral Bias for the $SPY). Most sectors / styles developed a bearish bias. 4-week performance was poor at best and only a small sliver of the market managed to deliver any gains at all (Discretionary / Large Cap).

The good news? There will be better entry points in the future…just need to wait for the trends to turn positive.

On the Macroeconomic front, December Manufacturing PMI came in at 49.3; higher than November and expectations, but was still below 50.

This week is ISM services, JOLTS, and Non-Farm Payrolls. Also, the U.S. market is closed on Thursday (9th) for a National Day of Mourning in honor of President Jimmy Carter.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.