Stock Market Outlook entering the Week of July 20th = Uptrend

- Average Directional Index: Uptrend

- Institutional Activity: Uptrend

- On Balance Volume: Uptrend

ANALYSIS

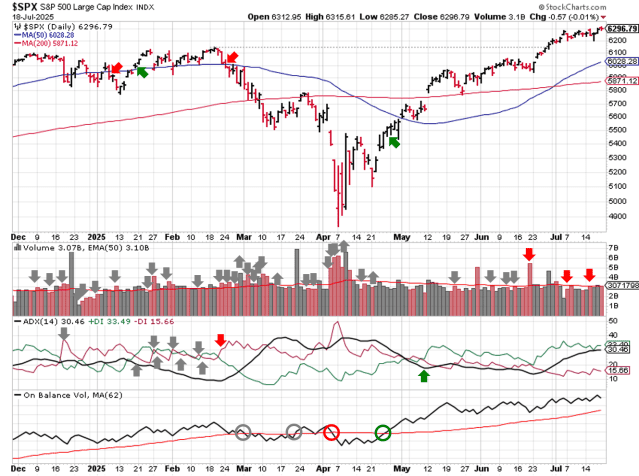

The stock market outlook shows an uptrend for U.S. equities.

The S&P500 ( $SPX ) gained 0.6% last week. The index sits ~5% above the 50-day moving average and ~7% above the 200-day moving average.

All three technical indicators remain bullish after a second week of consolidation.

S&P Sector Performance from Week 29 of 2025

PERFORMANCE COMPARISONS

Tech ( $XLK ) outperformed last week; Energy ( $XLE ) was the worst sector, losing the prior week’s gains. Healthcare ( $XLV ) fell back to bearish bias, joining Consumer Staples.

S&P Sector Performance from Week 29 of 2025

For sector styles, Large Cap Growth ( $IWF ) outperformed; Value underperformed, with Small caps down ( $IWN ) the most. No changes in bias last week.

Sector Style Performance from Week 29 of 2025

As far as asset classes are concerned, equities ( $SPY ) were the best, while Oil ( $USO ) was the worst. The most important event, macro-wise, was the U.S. Dollar moving to neutral bias. Continued dollar strength would be the first step towards a shift in the macro environment ( i.e. which assets/sectors provide the best returns ).

Asset Class Performance from Week 29 2025

COMMENTARY

June inflation data was mixed, retails sales were strong, and earnings season is off to a good start.

Headline and Core CPI increased in June, though the moves were not unexpected.

| CPI (y/y) | Actual | Prior |

Expected |

| Headline | +2.7% | +2.4% | +2.7% |

| Core | +2.9% | +2.8% | +3.0% |

Headline and Core PPI fell in June, although May data was revised higher again.

| PPI (y/y) | Actual | Prior |

Expected |

| Headline | +2.3% | +2.7%* | +2.7% |

| Core | +2.6% | +3.2%* | +2.7% |

A little more than 10% of the S&500 reported earnings last week, and most are exceeding forecasts. Those forecasts were lowered in response to tariffs, but still a good sign.

Federal Reserve Chairman Powell gives a speech before the market opens on Tuesday, so expect some volatility. We’ll also see existing home sales and the latest durable goods orders released during the week.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.