Stock Market Outlook entering the Week of May 11th = Uptrend

- ADX Directional Indicators: Neutral

- Institutional Activity (Price & Volume): Uptrend

- On Balance Volume Indicator: Uptrend

ANALYSIS

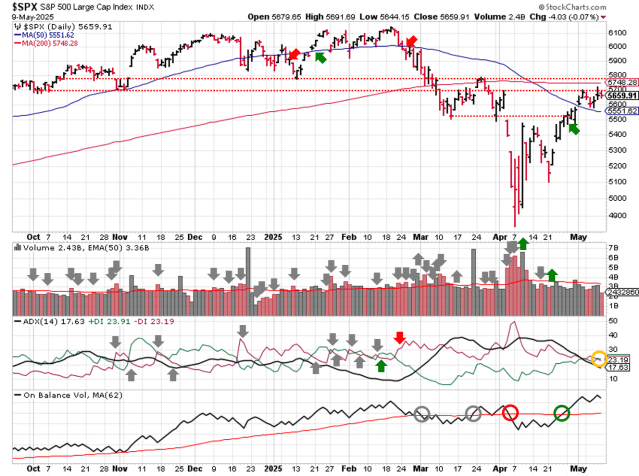

The stock market outlook stays in an uptrend, as equities took a breather and consolidated gains from the recent rally.

The S&P500 ( $SPX ) fell 0.5% last week. The index sits ~2% above the 50-day moving average and ~2% below the 200-day moving average, roughly the same position as last Sunday.

SPX Price & Volume Chart for May 11 2025

Institutional activity continues to show an uptrend; below average trading volume remains a concern, but at least there haven’t been any distribution days. On-Balance volume ( OBV ) also shows an bullish action. The Direction Indicator ( ADX ) is still stuck in neutral.

S&P Sector Performance for Week 20 of 2025

Industrials ( $XLI ) led the way again last week, rising 1%. They’ve been the strongest sector during the recent run-up. Healthcare ( $XLV ) was the worst sector, dropping more than 4%. Consumer Staples shifted back down to neutral bias.

Sector Style Performance for Week 20 of 2025

High Beta stocks ( $SPHB ) were the best style last week, while several sectors tied for worst performer, including Mega-cap growth, Quality, High Dividend, and Defensive ( $OEF, $QUAL, $SPHD, $POWA ). Small and Mid-cap Value ( $IWN, $IJJ ) improved to neutral trend; Mega-cap Growth and Quality ( $OEF, $QUAL ) fell back to neutral.

Asset Class Performance for Week 20 2025

Bitcoin ( $IBIT ) led assets higher. U.S. equities and bonds ( $SPY, $IEF ) were the worst performers. No change in bias as we enter the week.

COMMENTARY

Equities cooled off last week and managed to find support at the 50-day moving average; a welcome sight after the recent run-up. They’re not oversold, but aren’t overbought either, resting in between several support and resistance markers. Remember, look for tickers with a bullish bias that are breaking out on higher trading volumes.

The U.K. and U.S. announced their first trade since the so-called “Liberation Day” on April 2. While the actual “deal” won’t provide a huge impact economically, it did provide equity markets with a welcome signal that trade talks are progressing.

The U.S. and China also announced initial discussions in Switzerland, with progress made over the weekend and details set to hit the wire on Monday.

The FOMC decided to keep rates unchanged, dealing a blow to those hoping for rate cuts to stimulate a rally in equity markets. I mean the economy.

This week, we get the latest inflation data ( CPI & PPI ), as well as retails sales, housing starts and consumer sentiment.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.