I have been on the record for being in favour of activist investors because they, on average, manage to unlock growth potential in targeted companies. The problem is that activist hedge funds typically target larger companies with sufficient liquidity, while it is often the smaller companies that suffer from poor management and a lack of growth. This is where a separate class of activists can help.

Smaller companies are typically much closer held and often former executives and directors or the founders of the company remain significant shareholders. When these companies get into trouble or stop performing, these former insiders, or ‘quasi insiders’ to use the term coined by Jonathan Cohn and his collaborators, can become activist investors.

On average (or rather median, because that is the statistic I am quoting), these quasi insiders own 11.3% of the targeted company at the time the campaign starts while activist hedge funds on average hold a 7.9% stake. Quasi insiders thus already have substantial ownership in the targeted company. But these companies tend to be much smaller with a median market cap of $84m vs. $321m for companies targeted by activist hedge funds.

There are other important differences between campaigns by quasi insiders and hedge funds. Most importantly, quasi insiders only step in when things have got really bad. Hedge funds typically target companies with low profitability and declining share prices, but the threshold for quasi insiders is much lower. Companies targeted by quasi insiders have been loss-making for quite some time and experienced double-digit share price declines while activist hedge funds target companies that have low but on average still positive earnings and have seen their share price move sideways.

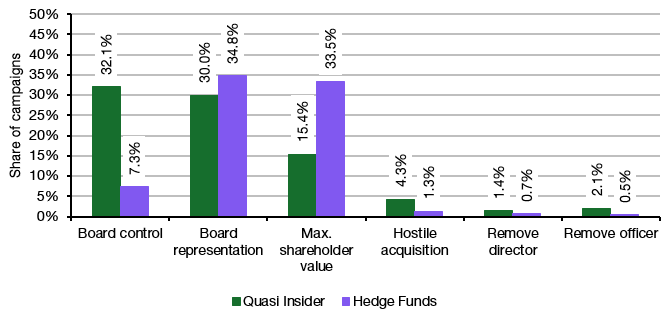

However, when quasi insiders get involved, they are aiming much higher than hedge funds. The chart below shows that they are much more likely to aim for full board control or a hostile takeover than hedge funds. On a relative basis, they are also more likely than hedge funds to aim for the ouster of the current CEO or a director. Hedge funds, meanwhile, tend to aim for improvements in company growth and shareholder value without taking control.

Aims of quasi insiders and activist hedge funds

Source: Cohn et al. (2024)

This tells me that small companies with significant shareholding from former directors, founders or CEOs should keep an open dialogue with these quasi insiders at all times. Not only does that flatter their egos, but it helps the company tap into the experience and expertise of these former insiders. And it reduces the risk of a potential hostile attack. Because when they attack, they have a pretty high probability of success. 43.6% of all campaigns by quasi insiders are successful and more than 50% of the campaigns aiming for board control are successful.