I attended a Webinar hosted by Interactive Brokers on Wednesday/Thursday morning.

I cannot remember that well because it takes place at 12 midnight Singapore time and lasted around 1.5 hours.

But I think it is quite an insightful presentation because I can detect how enthusiastic Nancy Nelson, the CPA at Interactive Broker wishes to help us make sense. Nancy has been in accounting for the past 40 years, and with Interactive Brokers for the past 15 years.

She try to explain the income tax considerations for Non-US Person. Unfortunately, she did not cover estate taxes (which she called a very complex topic. Nancy also tries to explain the purpose of the Form 1042S, which you should be inform that you receive, and the W-8BEN form that we filled up so frequently. This really help me understand the spirit behind those form so that i can interpret them better.

We don’t have to action upon the Form 1042S because as Singaporeans, we don’t need to reclaim back any income taxes due to our overseas investments. However, if you are living in a country with a Tax Treaty to the US, the Form 1042S may be useful for you to offset your home taxes.

It is also quite insightful to hear how different types of cash flows were covered.

Nancy help us understand that there is a difference between declaring and being taxed. Putting it in the form is a declaration but you would not be taxed. Conversely, if you choose not to declare, Nancy also explain the repucussions.

I listened to the Webinar again and provide the following notes. If you have any tax questions, Nancy may be able to help you. You can email the questions to [email protected].

I like to thank the folks at Interactive Brokers for taking care of their non-US, international clients with such support. It is the little things like this that tells us whether a service company wishes to form a deeper relationship with us with webinars that are very applicable to a niche group of their clients.

It is one of the reason why their the preferred custodian for my income portfolio Daedalus. If you are looking for a low-cost broker that lets you trade many, many exchanges around the world, that have been operating for a long time, with near spot currency exchange, do check Interactive Brokers out.

US Person Versus a Non-US Person

Whether you are based overseas or in the US, you will be subjected to a US world-wide taxation rules. This means that if a US person decides to retire and go live in Spain, he would still need to file US taxes.

If you are a legal resident of US:

- Doing a job on a work visa.

- Green card holder.

You are also considered as a US person and you are liable to US taxes. This webinar does not apply to you.

Special situations:

- Foreign student in the US on a student visa.

- Employee of a foreign government (Embassy, World Bank, UN)

- Entertainers and athletes, earning income 30 days or less.

You will remain as a non-US person. If you are entertainers and athletes that earn 30 days or more, you pay income tax for that year.

It is good to track:

- How long you work in the US.

- How much you earn.

What We Need to Know about the Tax Cuts and Jobs Act (TCJA)

TCJA is a change in tax rules in 2017. The last change prior to this change was in 1986.

TCJA is set to expire at the end of 2025.

Nancy thinks that this will affect the US Person it remains to be seen if this will affect the non-US Person. Perhaps tax treaties will be amended or created. The highest potential is the current 30% withholding tax for non-US Person if you are living in a non-treaty country.

In the past this withholding tax used to be 35% or higher.

Whatever congress do has to be revenue neutral which means that if they reduce revenue at one place, they have to increase revenue at another place. Withholding tax is something that affect the US people less and therefore may be a higher potential target.

The rates with countries that the US have with tax treaties are harder to change and potentially less likely.

Nancy think that those cross-border workers such as US workers to Canada/Mexico and vice versa may also be affected but not a topic for today.

The Webinar Focus Only on Investment Income and Not Other Taxes such as Estate Taxes (Form 1042S)

The webinar is more focus on the income that is presented in a Form 1042S.

For Interactive Brokers clients, you would have received this form 1042S automatically.

You can go to your Side Bar on your Mobile Application, under Statements & Tax, Download Tax Forms,

Why We Need to Fill Our W-8BEN Form

When we first open our brokerage accounts, individuals like us are told to fill up a W-8BEN form if we wish to invest in US securities. There are different forms if we are partnerships, associations, corporations and trusts. Nancy thinks that the other forms can be tricky to fill out correctly.

The W-8BEN form tells Interactive Brokers, or any other US Institutions your status. It establishes your tax home country, whether you are in a tax treaty country and eligible for treaty benefits.

This form is for Interactive Brokers to satisfy their compliance to the Know Your Customer (KYC) rule.

The W8-BEN form also tells FATCA ( Foreign Account Tax Compliance Act) who to share the information with. You would need to keep the form updated.

Your W-8BEN form stays with Interactive Brokers. This form is not sent to the Internal Revenue Service (IRS). Your information is for IBKR to know more about you and not for the IRS.

FATCA – What If You Decide not to Declare

This next slide show the true intentions of FATCA:

FATCA is 15 years old and most likely not going away soon.

Nancy describes what happens if you decided not to reveal so much information. If you do not declare your tax status, the US tax authorities will put a withholding tax (currently 30%) on everything.

For example, if you reside in Spain which is a treaty country. not declaring will give you 30% tax instead of 15% tax.

If you make a capital gain on your securities, normally you won’t be taxed if you declare your status, but if you do not, they will tax you 30% on the proceeds from the sale.

What is Subjected to US Tax Withholding

Savings Interests:

- Interests earned from bank account. You can consider interest earn on money from a US bank.

Investment Interests:

- From corporate bonds.

- US Treasuries.

- Commercial paper.

- Interests earned from an investment account. Your IBKR is considered as an investment account and therefore not subjected to withholding taxes.

Investment interest is NOT subjected to withholding tax while savings interest is.

Payments in lieu occurs if you are part of a stock loan program. Someone borrows a stock and instead of getting a dividend, you will get a payments in lieu. Thus, it is a different form of dividends.

Stock loan fees are payments you get for loaning out your stocks. This is generated by Interactive Brokers and not by their customers but are subjected to withholding.

The Withholding Tax Rate

They will not hold withholding on gains or proceeds from sale if you properly declared in your W-8BEN.

Here is the link to the list of Countries with Tax Treaties with the US.

Most treaty countries are 15%.

Direct business income arises if you have provided seed money to your cousin’s business in the US and your cousin have paid you something back. This is tax as business income at 37% and should be filed by your cousin.

When Apple pays you a dividend, it is credited to your account by Interactive Brokers. You will see the dividends coming in and at the same time the tax withholding going out. You get a net payment.

Reclassified payments: This occurs more for mutual funds (unit trust) and less with corporate payments. If a dividend is reclassified as a return on capital, the withholding tax will be refunded to you.

Once they issue you the Form 1042S, Interactive Brokers cannot refund you the withholding tax anymore.

Institutions remit the withholding taxes on a Tuesday if they received the dividends on a Friday as an example.

Business Income such as Rental Properties

More About Your Form 1042S

Form 1042S is a form that will go to the IRS.

Unique form identifier is meaningless to us but something for IBKR and IRS.

Here are the codes under 1 Income Codes:

Some of the stuff here like 01 – interest (investment) is not subjected to withholding but it is here to identify what this is. There is another section that will explain that this income is not subjected to withholding.

30 – interest -original issue discount: Related to preferred stocks. Zero coupon bonds also go here.

31 – short-term original issue discount: Short term treasury bonds.

54: This is what Interactive Brokers declared if you didn’t declare your status (and most likely everything will be taxed at 30%).

06: These will be all our dividends from stocks.

34: Loan out stocks and you get a substitute payment.

52 and 53: Same as 54 if you did not declared properly.

09 – Capital Gains: If you have capital gains from your mutual funds in the US, that is not subjected to withholding taxes. Nancy shared that particularly short term capital gains were subjected to withholding tax on and off in the past 15 years. This is potentially where a change may occur.

14: REITs, MLP income payments here.

IRC 1446: Covers business income earned in the US by a non-US Person.

Gambling winnings are subjected to Withholding Taxes!

36: These are long term capital gains and these are NOT subjected to withholding taxes.

37: Return of capital is also not subjected to withholding taxes.

04: If you go to the US, you may be exempted under this.

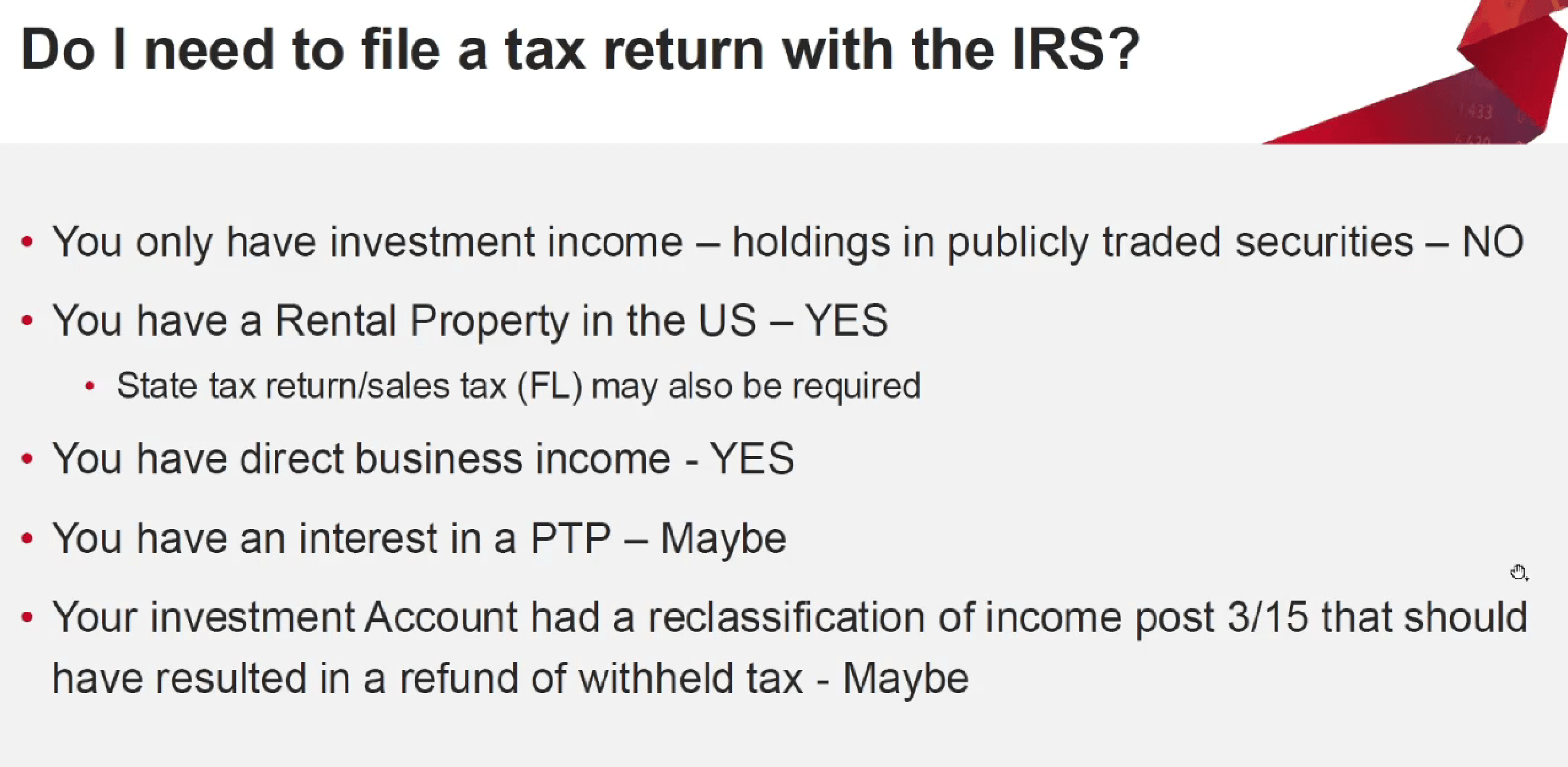

Do You Need to File Taxes?

I think this is the slide that would clarify the questions of many. If you are only holding public traded securities then you do not have to take action and file taxes.

When IBKR prepared the Form 1042S, they are already uploaded to the IRS.

For Non-US Person Staying in Tax Treaty Countries

If you are staying in a tax treaty country, the Form 1042S will be useful to get refunds from the taxes you pay in your home country.

Withholding Taxes on ADR Stocks

Case Study: Shell which is domiciled in Netherlands. The dividend withholding tax in Netherlands is 15%.

When a Shell ADR pays a dividend in the US, that tax is withheld in Netherlands before that ADR dividend payment ever reaches the US.

IBKR never sees the withholding taxes paid to Netherlands. So if the dividends paid out is $100, IBKR will see $85.

If You Trade Options

The 1042S form will likely show investment interest for which there is no withholding. You are not earning any dividends so that may not be too applicable.

My Comprehensive Interactive Brokers How-to Guides

Interactive Brokers is a great low-cost, financially strong brokerage platform that can be the standard broker for holding your long-term investments. You can access 150 global exchanges, including exchanges such as Singapore, the US, Hong Kong, London, European and Canada.

You will enjoy cheap commissions and zero minimum recurring platform fees or maintenance fees. Convert your funds to different currencies at near-spot rates, paying a flat US$2 fee.

To get started or become familiar with Interactive Brokers, check out my past articles on how to invest with Interactive Brokers. I hope the guides make your life and investing experience easier and brighter.

An Easy Step-By-Step Guide to Setup Interactive Brokers (IBKR)

How to Fund & Withdraw Funds from Your Interactive Brokers Account

How to Convert Currencies in Interactive Brokers

How to Buy and Sell Stocks and Securities on Interactive Brokers

How Competitive are Interactive Brokers Commissions Pricing?

How Safe is it to Custodized Your Money at Interactive Brokers? The things they do better than other brokers.

How Safe is it to Custodized Your Money at Interactive Brokers (2)? Financial strength of IB during recent banking crisis and during Great Financial Crisis

Interactive Brokers have Eliminated the US$10 monthly inactivity fee. More details here.

How to Transfer your shares from Standard Chartered Online Trading to Interactive Brokers

How to trade after-hours and premarket

Create Customized Reports and automatically send them to your email

What is the PortfolioAnalyst Report and Automatically Send the PortfolioAnalyst Report to Your Email

Send Money from TransferWise to Interactive Brokers

Interactive Brokers’ Fluid Interest Income on Cash

Introducing IMPACT by Interactive Brokers