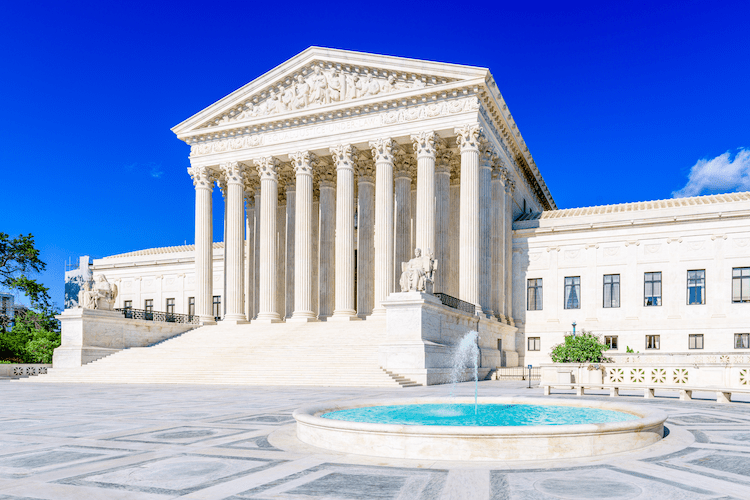

Last week, the U.S. Supreme Court heard its final oral arguments of 2024. The justices considered four cases, which involved issues ranging from trademark infringement damages to wire fraud.

Below is a brief summary of the legal questions before the Court:

Feliciano v. Department of Transportation: The case involves how Americans who serve as both federal civilian employees and members of the Armed Services’ reserve components are paid. To eliminate the financial burden that reservists face when called to active duty at pay rates below their federal civilian salaries, Congress enacted the differential pay statute, 5 U.S.C. § 5538, which requires that the government make up the difference. Federal civilian employees are entitled to differential pay when performing active duty “pursuant to a call or order to active duty under a provision of law referred to in section 101(a)(13)(B) of title 10.” That section, Section 101(a)(13)(B), enumerates several statutory authorities and includes a catchall provision: “any other provision of law during a war or during a national emergency declared by the President or Congress.”

In Adams v. DHS, 3 F.4th 1375, 1379 (Fed. Cir. 2021), the Federal Circuit Court of Appeals held that reservists relying on Section 101(a)(13)(B)’s catchall provision to claim differential pay must show that they were “directly called to serve in a contingency operation.” Under that demanding, fact-intensive standard, the Federal Circuit has rejected claims for differential pay even by reservists like petitioner whose activation orders expressly invoked a presidential emergency declaration. The question before the Court is: “Whether a federal civilian employee called or ordered to active duty under a provision of law during a national emergency is entitled to differential pay even if the duty is not directly connected to the national emergency.”

Kousisis v. United States: The case seeks to resolve a circuit split over the validity of the fraudulent inducement theory of mail and wire fraud. The justices have agreed consider three questions: “(1) Whether deception to induce a commercial exchange can constitute mail or wire fraud, even if inflicting economic harm on the alleged victim was not the object of the scheme; (2) whether a sovereign’s statutory, regulatory, or policy interest is a property interest when compliance is a material term of payment for goods or services; and (3) whether all contract rights are ‘property.’”

Seven County Infrastructure Coalition v. Eagle County, Colorado: The case involves how to interpret the Court’s prior decision in Department of Transportation v. Public Citizen, 541 U.S. 752, 770 (2004), in which the justices held that when an agency can’t prevent an environmental effect “due to its limited statutory authority over the relevant actions,” the National Environmental Policy Act does not require it to study that effect. Five circuits read Public Citizen to mean that an agency’s environmental review can stop where its regulatory authority stops. However, two circuits disagree and require review of any impact that can be called reasonably foreseeable. In this case, the Surface Transportation Board relied on Public Citizen to cabin its environmental review of a new rail line in Utah. However, the D.C. Circuit rejected that approach, ruling that the Board “cannot avoid” environmental review “on the ground that it lacks authority to prevent, control, or mitigate” distant environmental effects. As a result, it ordered the Board to study the local effects of oil wells and refineries that lie outside the Board’s regulatory authority. The Court will now determine “[w]hether the National Environmental Policy Act requires an agency to study environmental impacts beyond the proximate effects of the action over which the agency has regulatory authority.”

Dewberry Group, Inc. v. Dewberry Engineers, Inc.: The case involves the remedies available for federal trademark-law claims under the Lanham Act. The Lanham Act authorizes a court to order disgorgement of a “defendant’s profits,” “subject to the principles of equity.” While courts have traditionally limited profit-disgorgement recoveries to a defendant’s own profits, the Fourth Circuit Court of Appeals departed from that principle in this case. The justices must now decide “[w]hether an award of the ‘defendant’s profits’ under the Lanham Act can include an order for the defendant to disgorge the distinct profits of legally separate non-party corporate affiliates.”