Ever wonder why handing over cash feels different than swiping a card? Or why tapping your phone to pay barely registers at all? It’s not just psychological. Spending money actually activates pain centers in your brain. And here’s the kicker: newer payment methods are specifically designed to reduce that pain, making it easier than ever to part with your money.

Key Takeaways:

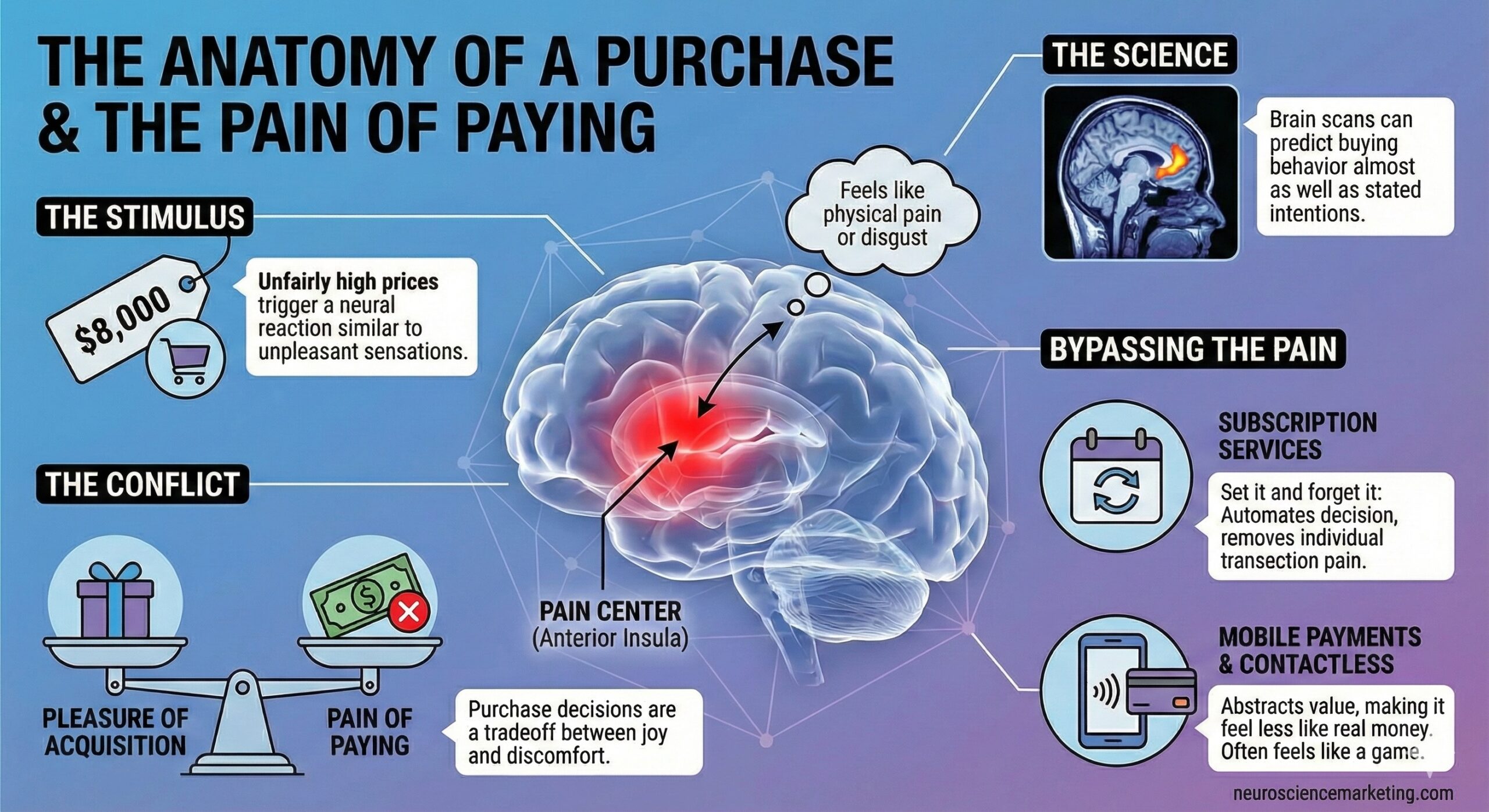

- Biological Basis: Spending money activates the anterior insula, the brain region associated with physical pain and disgust.

- Friction Increases Control: The more “friction” in a payment method (e.g., counting cash), the higher the pain and the lower the spending.

- The Tech Trap: Mobile payments, one click ordering, and subscriptions reduce this pain to near-zero, removing the brain’s natural “brakes” on spending.

What Is the Pain of Paying?

The Pain of Paying is a psychological phenomenon where the act of parting with money activates the anterior insula—the same brain region that processes physical pain and disgust. This activation increases when the price of the item seems unfairly high.

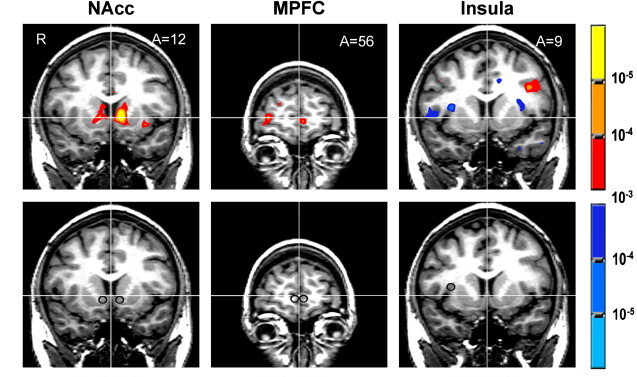

In 2007, a team of researchers from Stanford (Brian Knutson, G. Elliott Wimmer), Carnegie Mellon University (Scott Rick, George Loewenstein) and MIT (Drazen Prelec) ran a novel experiment. They gave subjects cash, put them in an fMRI machine to record their brain activity, and showed them products at various prices. Some deals were good, others were not so good. Ripoffs, you might say. The subjects could buy an item or keep their money. (You can read the full paper in Neuron.) The researchers found that purchase decisions involve a tradeoff between the potential pleasure of acquisition and the pain of paying. Prices perceived to be excessive were most likely to lead to activating the anterior insula and higher pain of paying.

Do Brain Scans Predict Buying Behavior?

Here’s the first big surprise: the brain scans predicted buying behavior almost as well as simply asking people what they intended to do. Without knowing anything about what the subject said they would do, just looking at their brain activity was nearly as predictive. Later research at the Temple University Center for Neural Decision Making confirmed the predictive ability of fMRI brain imaging.

Why does this matter? Because people don’t always tell you the truth about their purchase intentions—sometimes they don’t even know themselves. Brain scans cut through some of that uncertainty.

Is the Pain of Paying a Metaphor, Or Real Pain?

For years, behavioral economists talked about the “pain of paying” as a useful concept. Then in 2016, researchers proved it wasn’t just a metaphor. Nina Mazar and colleagues showed that paying activates the anterior insula—the part of your brain that processes actual emotional pain.

Even more interesting: when they primed subjects with pain-related words like “anguish” before showing prices, people’s willingness to pay dropped. The pain of paying is real, and it’s possible to manipulate it.

What Is an Example of the Pain of Paying?

When you go to purchase something and experience a visceral reaction caused by an outrageous price, you are feeling the pain of paying. Think, for example, of the price of a soft drink at a concert venue. When you get to the concession stand, your brain reacts to a price that is multiples of what the same drink would cost in a restaurant, or that is more than you’d pay for a carton of the same drink in a restaurant. If it were possible to scan your brain when you saw the concession’s price, it would show activity associated with pain.

How Does Context Affect the Pain of Paying?

I interviewed Loewenstein not long after the original study was published. One thing he emphasized was that this pain isn’t just about the dollar amount. It’s about context and perceived fairness.

You can spend hundreds on car accessories without flinching because it’s just a small add-on to a huge purchase. But a vending machine that eats your 75 cents? Infuriating.

Auto dealers figured this out long ago. The price of leather seats alone might be compared to, say, the cost of a leather sofa. But, if you bundle leather seats, premium sound, and navigation into a “luxury package,” the consumer can’t easily calculate if any individual item is fairly priced. The value is ambiguous.

The same principle explains why all-inclusive resorts and cruise lines are so popular. Pay once, then enjoy “free” drinks and meals for a week. The pain happens at booking; everything after feels like a gift.

How Do Credit Cards Reduce the Pain of Paying?

Loewenstein pointed out something that credit card companies have known for decades: plastic takes the pain out of purchasing. When you pull cash from your wallet, you feel it leaving. When you swipe a card, the pain gets pushed into the future, where it might be paid in small increments.

This makes a lot of sense, and it’s entirely consistent with real-world behavior. A credit card not only lets you buy something without having the money, it also tips the scale when your brain weighs the pain versus the benefit of the purchase. For people lacking financial discipline, that’s a dangerous combination.

How Has Technology Changed the Pain of Paying?

Since 2007, payment technology has evolved dramatically. And each innovation has found new ways to eliminate what little pain remained.

Contactless cards are less painful than traditional credit cards. A 2024 Dutch study found that contactless payments hurt the least of any card-based method—and users rated them as the least helpful for preventing overspending. People who use contactless payments more frequently experience even less pain, suggesting they actively seek out the path of least resistance.

Mobile payments take it a step further. When you pay with your phone, the transaction becomes nearly invisible. No wallet, no card, just a tap. Recent research published in PsyCh Journal identified why this works so well:

First, you never see money change hands in any form. Second, your phone does a hundred things—payments are just one of them. It’s not a dedicated spending device like a credit card, so the act of paying doesn’t feel as significant.

Here’s something surprising: for small purchases, researchers found mobile payments actually create a “pleasure of payment”—a positive feeling rather than pain. The transaction is so frictionless it feels almost fun.

Subscription services like Netflix and Amazon Prime exploit another angle entirely. By converting purchases into predictable monthly fees, they eliminate the pain of individual transactions. You never feel like you’re “buying” anything—you just have access.

One Click ordering. Amazon’s Buy with One Click feature is perhaps the ultimate expression of painless paying. One goes from wanting the product to having it shipped with one click. The customer doesn’t have to choose a payment method or even see the image of their card. It’s all been decided in the past.

| Payment Method | Pain Level | Psychological Mechanism | Spending Impact |

|---|---|---|---|

| Cash | High | Visual & physical loss of value; immediate feedback. | Acts as a natural brake on spending. |

| Credit Card | Medium | Decouples buying from paying (temporal separation). | Increases willingness to pay and reduces price sensitivity. |

| Contactless / Mobile | Low | “Invisible” transaction; device is multi-purpose, not just for spending. | High risk of overspending; feels like a “game.” |

| One-Click Ordering | Near Zero | Removes the decision phase entirely; bypasses “checkout” anxiety. | Impulse buying maximizes; converts desire to ownership instantly. |

| Subscription | None | Automates decision-making; purchase feels like “access” not “buying.” | “Set it and forget it” leads to recurring costs without review. |

Is the Pain of Paying the Same for Everyone?

Researchers developed the “tightwad-spendthrift scale” to measure individual differences in payment pain. Tightwads feel more pain when spending; spendthrifts feel less. This explains why some people agonize over every purchase while others spend freely. For more on this, see my 2024 conversation with Scott Rick, one of the original pain of paying researchers. His book, Tightwads and Spendthrifts, provides lots of insight on this phenomenon.

The interesting finding: tightwads are especially sensitive to payment methods that reduce pain. They’re the ones most likely to migrate from cash to cards to mobile wallets as options become available. Their brain is actively seeking relief from spending discomfort.

What Are the Business Implications of the Pain of Paying?

U.S. credit card debt recently topped $1.2 trillion. More than 40% of Americans don’t use cash for any purchases in a typical week. These trends aren’t coincidental.

For businesses, the lesson is clear: reduce payment friction and you’ll sell more. Amazon’s one-click purchasing reportedly boosted conversion rates by 5-10%. That’s not only because one-click is more convenient (though it is), it’s also because it reduces the pain of the transaction.

For consumers, the warning is equally clear: the easier it is to pay, the harder it is to control spending. The natural brake that cash provided—that moment of counting out bills—is disappearing. Purchases are increasingly painless.

The Bottom Line

The original 2007 research showed that buying something can cause pain centers in your brain to light up. Nearly two decades later, the science is even more solid. And, payment methods have become even more sophisticated at eliminating that discomfort.

Every innovation in payment technology, from credit cards to contactless to mobile wallets, has found new ways to reduce the pain we feel when spending money. For businesses, that’s opportunity. For consumers, it’s a trap that requires conscious effort to avoid.

The brain science isn’t going away. But understanding it gives you a fighting chance—whether you’re trying to close more sales or keep your budget intact.

[This article was published on December 14, 2025, and is a completely updated and revised version of an earlier article on this topic.]

Related