It never occurs to the experts that higher prices have something to do with the locked-in effect, and that home sellers have to move to where it’s much cheaper to make it worth moving. For those who pay cash for their next home, having a 3% mortgage didn’t keep them from moving today – or any day.

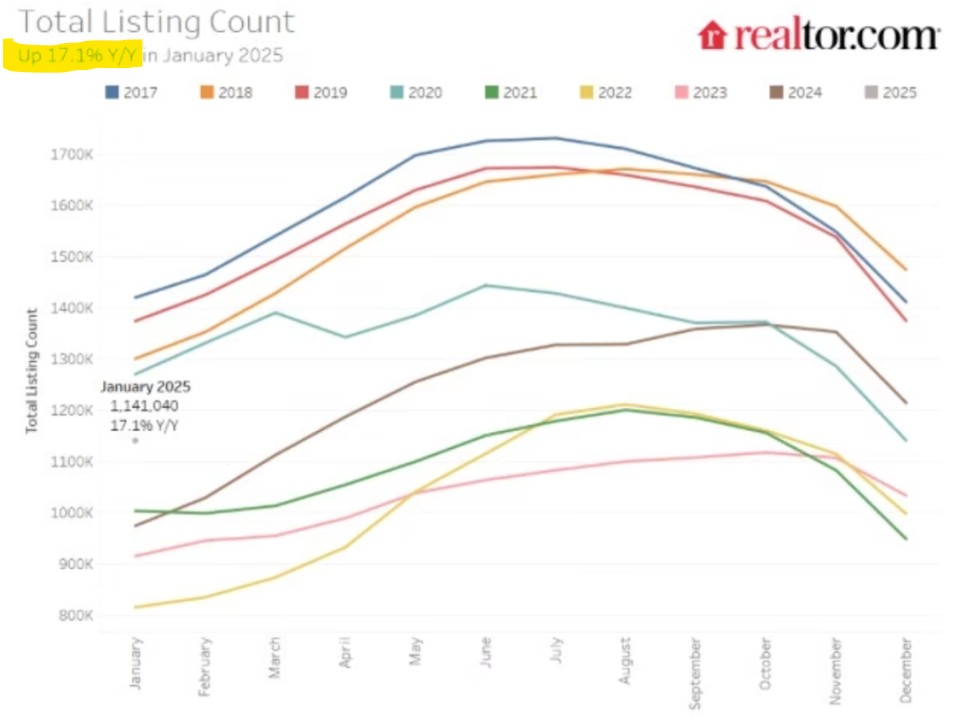

I think my +15% to +20% inventory prediction is looking pretty good:

Some segments of the U.S. residential real estate market started to thaw in January after December’s deep freeze, with a growing number of homeowners listing their homes for sale in a sign that the stubborn “lock-in” effect is finally beginning to ease.

The “lock-in effect” refers to homeowners’ reluctance to sell because they have a low mortgage rate and would have to take out a mortgage at a higher rate when they buy a new home.

Even though the 30-year fixed mortgage rates continue to be high, hovering at just below 7%, homeowners seem to have accepted this new normal and are not letting it stop them.

“While rates remain elevated, it is possible that we might be seeing that chiseling effect starting as sellers may grow tired of waiting for significant changes in rates,” says Realtor.com® Chief Economist Danielle Hale in her January monthly housing report.

“Further, while the lock-in effect remains a factor for many sellers, the strength of the effect is gradually waning,” Hale adds.

Realtor.com projects that home sales will rise by 1.5% in 2025, thanks in large part to the passage of time and slowly decreasing mortgage rates chipping away at the lock-in effect that has been hampering home sales for months.

The latest available data shows that newly listed homes were up 10.8% year-over-year, making it the busiest January in terms of new listing activity since 2021.

What’s more, freshly listed homes shot up 37.5% compared with December, marking the largest month-over-month spike in five years.

“Time and natural turnover could be leading some sellers to make a move this year despite higher rates,” explains Hale.

Looking at the big picture, overall home inventory across the U.S. was up 24.6% compared with the same time last year, a 15th consecutive month of growth. In terms of raw numbers, there were 829,376 active listings in January, plus 314,545 under-contract listings, also known as pending listings.

While home sellers are eager to sell, it seems that homebuyers are still hesitant to buy.

The average home lingered unsold for 73 days, making this January the slowest since 2020. Homes spent five days more on the market than last year and three days more than last month.

https://www.realtor.com/news/trends/mortgage-lock-in-effect-january-housing-report/