Well, gosh, folks, if I knew talking politics here on TRB was going to get you to click “reply” in the comments section with such passion, maybe I would just start every post with a political dig or two?

Nah.

I was actually going to try to comment less on politics in 2025, but it seems Thursday’s blog post got away from me…

How about discussing the ever-enthusiastic rental market to try to get us back on track?

Here’s an email that I received in December from a real estate agent, representing a prospective tenant, who was interested in one of our lease listings:

Hello David,

I hope this email finds you well!

I wanted to run my client’s profile by you before we book a showing on your lovely listing just so we can see if it’s a good fit.

My client, Karen, is currently suffering from some financial problems inflicted upon her by her ex-boyfriend. He had her take on some very poor investment decisions and it’s left her in a perilous position, none of which are her fault.

She is currently working with a well-known Toronto debt consolidation firm to assist her with her troubles.

While her credit score of 320 is considered poor by Equfiax standards, her father is going to act as a guarantor and his credit score is 760 and in the category considered excellent.

Karen is currently self-employed and does not show much income but again her father is going to act as guarantor and Karen will pay four months of rent up front.

She loves the condo and feels it’s a perfect fit for her and her dog Jasper.

Please let me know how you feel about the tenant profile and if you and your landlord would consider us.

Thank you.

Thoughts?

Well, I have many, as I’m sure you would as well.

But my first thought will probably be different than yours, considering I didn’t make you aware that this was a $3,995 rental in prime King West.

So armed with that knowledge, perhaps both you and I will now lead with the same initial thought:

“Why in the world is somebody with a 320 credit score, who is undergoing debt consolidation, trying to rent a four-thousand-dollar per month condo?”

Is this entitlement?

That would be my first instinct of course.

But it could also be naivety. The prospective tenant could just be financially illiterate and think that while trying to get her life and personal finances back on track, taking on a larger financial burden was completely rational.

In any event, this was me reading the email:

For those who were not born in the 1980’s, let’s just say that I knew the message was about to blow up in my face…

2024 was described by most as a “soft” rental market in Toronto, and via this quarterly feature here on TRB, we tracked the rental listings, leases, and absorption rate through the calendar year and watched inventory ramp up.

The trend was consistent throughout the first three quarters of 2024, but after looking back at the data from the fourth quarter, it seems like the trend reversed.

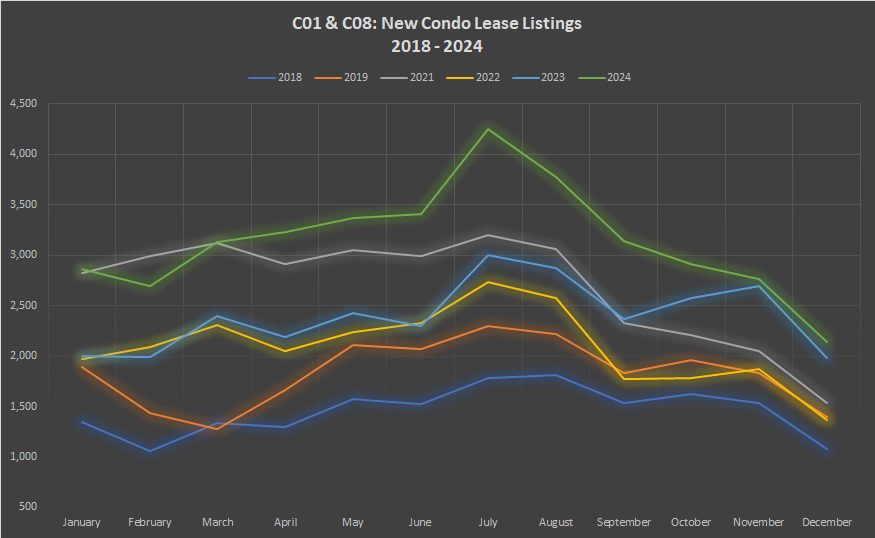

Here’s an updated look at new lease listings in the downtown condo market:

That’s definitely what I would call the “reversal” of a trend.

While new lease listings were still up on a year-over-year basis in all three of October, November, and December, the proportional increase dropped dramatically.

From January through September, the year-over-year increase averaged almost 40%.

From October through December, the year-over-year increase averaged only 7.7%.

The following chart highlights the dramatic change in year-over-year volume from Q2 to Q4:

Again, we’re still seeing more lease listings, but not at an “outlier” level like June, July, and August showed us.

By November and December, downtown lease listings were almost in line with 2023.

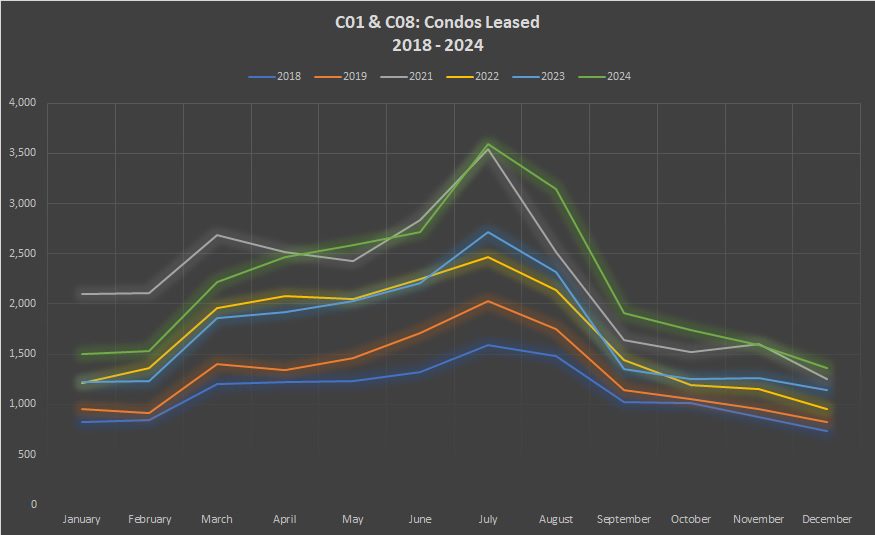

When it comes to condos leased, we also noted that through the first three-quarters of 2024, the number of leased units was up substantially on a year-over-year basis:

However, it’s worth noting the stark contrast between Q1 and Q4.

While we made the decision some time ago to delete the entirely of 2020’s data due to the pandemic, some of the effects remained by the time we hit January of 2021.

The following chart shows, specifically looking at January of 2021, just how many lease listings hit the market after a year of transiency due to COVID:

You could argue that all of 2021’s data shows the 2020 effect, but the outlier effect really only lasted three months.

By the time we get to April, you can see that 2021 listings are no longer wildly surpassing 2024.

In fact, 2024 listings eventually surpass that of 2021.

Now, you could argue that this is due to the market “normalizing” in late-2021 after COVID’s effects subsided, but it seems to me that, overall, there’s just more leasing activity in 2024 than in any previous year.

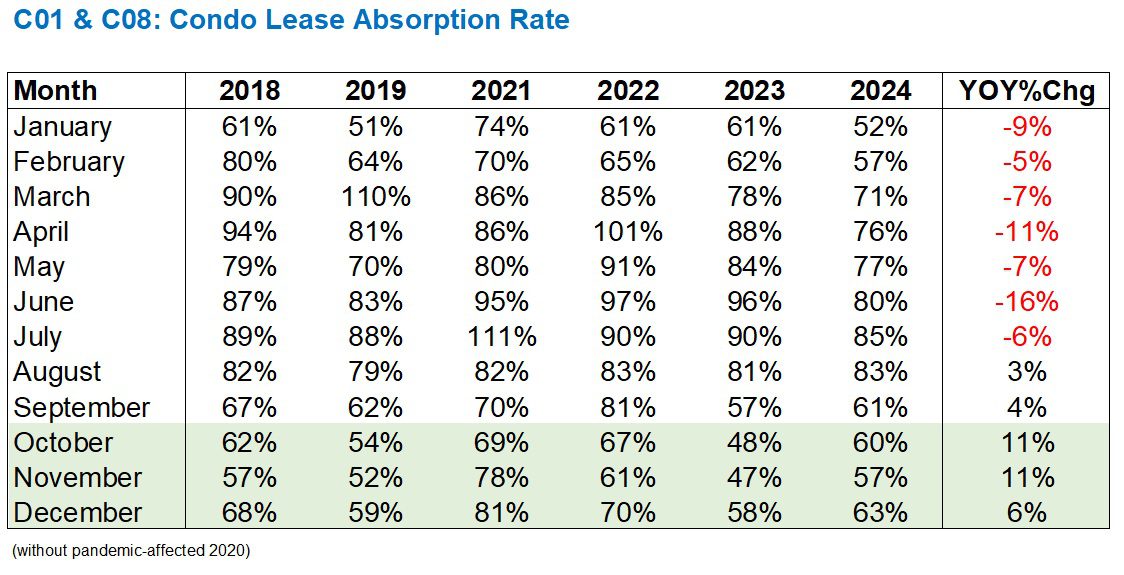

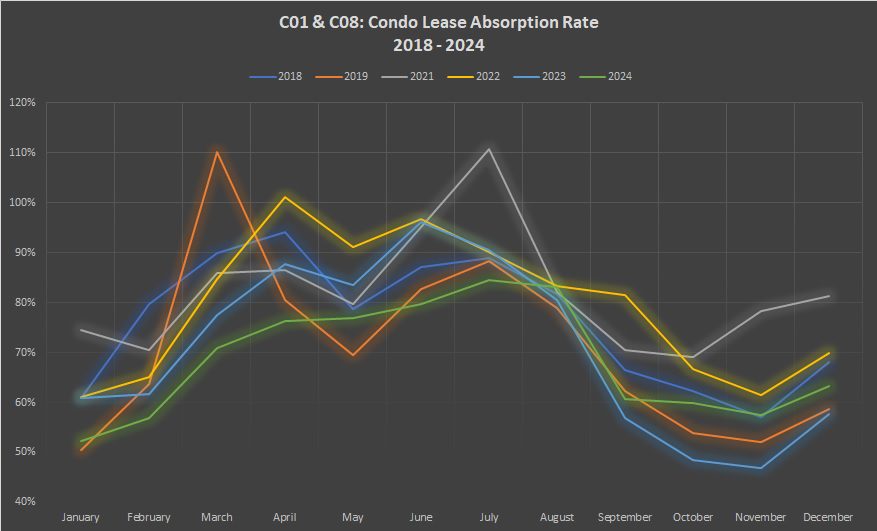

Either way, the number of listings and the number of leases are only put into context when they’re used as a ratio.

Hence: the absorption rate.

This is also where the prevailing trend in the first three quarters of 2024 changes dramatically on a year-over-year basis:

In the latter half of Q3, the absorption rate started to tighten on a year-over-year basis.

However, by Q4, the difference was significant.

As the following chart shows, Q1 saw an absorption rate that was the lowest in our seven-year period covered, whereas by Q4, the absorption rate was middle-of-the-pack:

Is this the literal definition of “all’s well that ends well”?

I suppose that depends on how Q1 of 2025 begins.

Just to take the temperature here really quickly, and because it’s Saturday night and I’m clearly not doing anything better with my time, I thought I’d check in on January thus far:

New Listings: 2,450

Leases: 1,304

Absorption Rate: 53.2%

That’s barely ahead of last January.

Many leases have yet to be posted, of course. So expect that figure to increase. But I had an itch to scratch, so, consider it itched.

We’ll take another look at the downtown rental market in April when the Q1 data is in the books!