Fads come and go. So too do talking points and topics of discussion.

If you regularly consume news and media, you’ll notice that the “hot-button issues” eventually fade away and that mass hysteria can turn to calm.

Over the years, we’ve seen a lot of these hot-button topics, issues, and buzz-words come and go in the real estate world.

Remember when “foreign buyers” were responsible for every problem in the real estate market?

How about all the chaos that “shadow flipping” caused, all the articles written about it, and how the notion simply faded out of our minds completely?

I’m not here today to douse water on a smoldering fire, nor am I going to create a classic “everything is fine, nothing to see here” type argument, but I will ask the following question in hopes that you’ll provide both subjective and objective answers:

Was too much made of the “mortgage renewal cliff”?

I’m all ears.

For those not in the know, perhaps a brief refresher?

Well, in simplest terms, there was this thing called the COVID-19 pandemic that, um, “tinkered” with the economy just a wee bit.

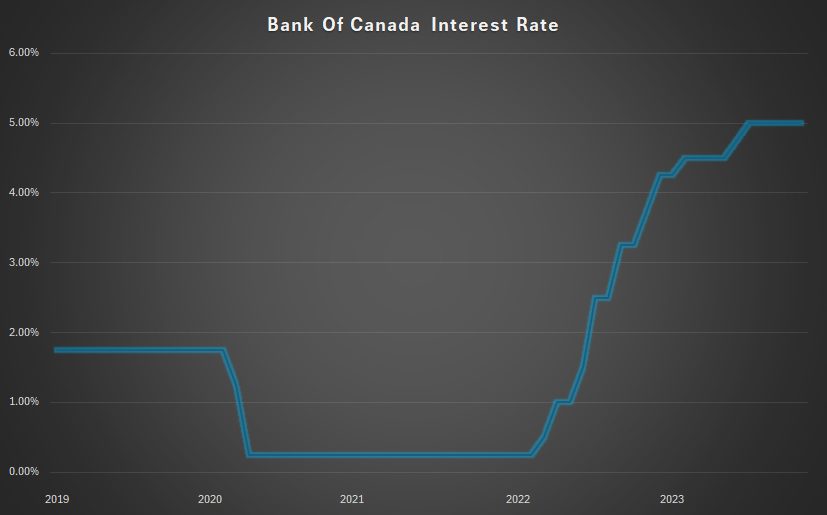

In response to a worldwide crisis, the likes of which our planet had never seen, central banks absolutely slashed interest rates. In Canada, our overnight lending rate went from 1.75% to 0.25% virtually overnight.

In April of 2020, that 0.25% overnight lending rate led to some of the lowest mortgage rates we had seen in our lifetimes.

And the Bank of Canada didn’t increase interest rates for almost two years; it was March of 2022 that we saw the first rate hike.

Here’s a look at the overnight lending rate from 2019 through the height of rates in 2023:

Here’s a fun game: what is the lowest five-year fixed-rate mortgage that anybody you know was able to secure?

A client of mine had a five-year fixed-rate of 1.29%.

That’s absurd.

I mean, 1.49% is absurd, and 1.79% is absurd, and based on today’s prevailing rates, we could suggest that 2.99% is absurd. For anybody who’s first foray into the real estate market began during the last twelve months, it’s tough to comprehend these rock-bottom rates.

And perhaps that’s part of the reason for the hysteria about the “mortgage renewal cliff.”

Unprecedented times can lead to unprecedented consequences.

The thinking essentially went like this:

For people who secured five-year, fixed-rate mortgages in 2020 and 2021, a financial reckoning would arrive in 2025 and 2026.

Just imagine purchasing a $1,500,000 home in 2020 and obtaining a 1.89%, five-year, fixed-rate mortgage that resulted in a $4,365.32 per month payment (on a 30-year amortization with 20% down).

Now, imagine the worst-case scenario: prevailing interest rates are 7% upon renewal in 2025.

Suddenly, that manageable $4,365.32 per month mortgage payment increases to $7,903.24.

That’s an 81% increase overnight.

This is why so many people worried about the “mortgage renewal cliff” as interest rates began to increase in March of 2022.

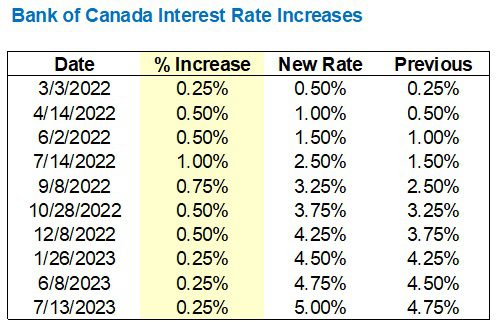

The rate of increases by the Bank of Canada was unprecedented.

From March of 2022 through July of 2023, there were ten interest rate increases as follows:

And while borrowers who signed mortgage commitments in 2020 and 2021 continued to benefit from historically-low interest rates, economists and the media began to opine on what these drastic actions by the Bank of Canada meant.

At first, the discussions were about those variable-rate holders:

“Canadians’ High Mortgage Debt A ‘Ticking Time Bomb’ As Renewals Loom”

Financial Post

May 31, 2023

But over time, and as the variable-rate holders began to absorb the cost of increasing interest rates, the discussion turned to those fixed-rate mortgage holders who would be renewing en masse in 2025 and 2026.

Here’s one of the first articles on the subject in a major Canadian newspaper which uses either the term “mortgage renewal shock” or “mortgage renewal cliff,” with this one using the former:

“Canada’s Economy Faces $900 Billion Mortgage Renewal Shock”

The Globe & Mail

November 2nd, 2023

Between 2024 and 2026, an estimated $900-billion worth of Canadian mortgages – almost 60 per cent of all outstanding mortgages at chartered banks – are due to renew and could face a sharp increase in payments, according to a report released this week by Darko Mihelic, an analyst who covers the banking sector for RBC Capital Markets. Those payment increases range from a weighted average of 32 per cent next year to 48 per cent in 2026.

The focus of the report is the impact the payment shocks will have on the retail operations at Canada’s big banks, but the economic fallout is obvious if the current interest rate environment persists.

The biggest shock awaits fixed-payment, variable-rate mortgages set to renew in 2026. A five-year variable mortgage renewing that October would see payments jump 76 per cent if mortgage rates stayed around 6 per cent. A one-percentage-point drop to 5 per cent would ease the payment shock, but only to 63 per cent. “Interest rates would need to decline significantly to ‘save’ this cohort,” the report says. Even if the Bank of Canada were to slash its benchmark rate to 0.25 per cent by that year, payments for variable-rate mortgages as a whole would still shoot up 20 per cent.

In my “worst-case” scenario above, I noted the potential for an 81% increase in mortgage payments. This article touts a potential 76% increase and an “easing” to only a 63% increase if mortgage rates declined from 6% to 5%.

The word “shock” turned into “crisis” not long after:

“David Rosenberg: Canada’s Menacing Mortgage Math Means Crisis Looming”

Financial Post

November 14, 2023

From the article:

The macroeconomic math relating to Canada’s looming wall of mortgage renewals should be terrifying for the Bank of Canada. A large increase in average monthly mortgage payments will arise from the nearly $1 trillion in renewals due by 2026, triggering, in turn, a large demand shock and putting stress on the housing market in particular and the economy in general. The central bank will need to ease aggressively before the shock strikes to avoid turning a slowdown into a crisis, positioning Government of Canada bonds for outperformance in 2024.

As this article was written by David Rosenberg, there’s a “call to action,” so to speak.

Like Benjamin Tal has for the last couple of years, David Rosenberg was among many economists who suggested that the Bank of Canada needed to act faster and more aggressively.

“…to avoid turning a slowdown into a crisis” is quite telling, and the sub-headling to the article read, “Bank of Canada will need to cut rates to prevent slowdown from becoming a meltdown.”

Later in the article:

This looming “mortgage renewal cliff” is common knowledge in Canada, but nobody has followed the macroeconomic math through to its full conclusion. We triangulated various data sources to trace the impact of mortgage renewals through the system. While perfect accuracy is impossible, the broad direction and magnitude of the impact are both knowable and alarming.

Combining the data from the Bank of Canada’s most recent Financial Stability Review with Canada Mortgage and Housing Corp. (CMHC) data on average balances, we confirm that around two-thirds of mortgages (by value) will renew by 2026. The distribution is somewhat backloaded, with a bit more than half coming in 2024 and 2025, and the remainder in 2026. We can use the rise in average monthly mortgage payments that has already happened since the beginning of the hiking cycle to get a sense of how this will affect consumers.

In February 2022, the average monthly mortgage payment was $1,460. It’s now above $1,900, an increase of more than 30 per cent, according to the latest CMHC data. Since that figure includes a sizable number of floating-rate mortgages that fixed their interest rate in early or mid-2022 (partway into the hiking cycle), that’s a conservative starting point for assessing the impact of coming renewals (who will face even higher rates). Based on the share of households due to renew, we calculate the average monthly mortgage payment will rise by a further 15 per cent by the end of 2024, 30 per cent by the end of 2025 and 45 per cent by the end of 2026.

Here they even quote the term “mortgage renewal cliff” and describe it as “common knowledge.”

Common knowledge is one thing, but certainty is another.

Surely there was common knowledge of a potential mortgage renewal cliff, but were we to simply take this as a given?

The media blitz continued into 2024:

“Why Banks Are Bracing For A Mortgage Renewal Cliff”

CBC

June 6, 2024

This is a 15-minute video that’s worth viewing if you have time, but here’s the description:

Canada’s Big Six banks are adding billions of dollars to their emergency funds as mortgage renewals approach for more than three-quarters of homeowners. Andrew Chang explains why the banks are preparing for more delinquencies, and who’s most at risk.

But by the fall of 2024, the narrative changed.

Significantly, I might add.

Here’s the first article I can find to that effect:

“Rate Cuts To Smooth Over The ‘Mortgage Renewal Cliff’ Awaiting Pandemic Homebuyers”

The Globe & Mail

October 4, 2024

From the article:

A rapid decline in borrowing costs would shrink the gap between the exceptionally low mortgage rates that many homeowners secured in 2020 and 2021, during the early stages of the COVID-19 pandemic, and the higher rates available that many of those borrowers will have to sign up for in 2025 and 2026 when their loans roll into a new term.

“Now that we’re in the midst of a relatively rapid rate-cutting cycle, we believe mortgage renewals will be much more manageable,” Royce Mendes, managing director and head of macro strategy at Desjardins Securities, said via e-mail.

Ah, I see.

“Much more manageable,” you say?

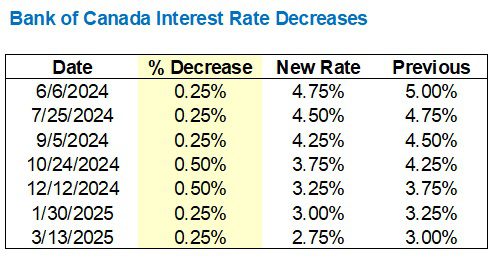

Well, by the time this article was written, the Bank of Canada had already cut the lending rate three times and there were rumours of “jumbo” cuts on the horizon.

In fact, only twenty days after this article was written, we saw the first of two successive “jumbo cuts” of fifty basis points.

The narrative continued from there:

“Canada Retreats From The Edge Of The Mortgage Renewal Cliff”

Financial Post

November 29, 2024

The sub-title reads, “Lower interest rates and actions of diligent homeowners mean ‘renewal shock is not as worrisome’

“We anticipated that consumers could withstand the sticker shock of renewing historically low-rate mortgages at decade-high rates,” TD Economics said in the report. “A year later, things have gone better than expected.”

TD Bank is now estimating that “aggregate payments,” which represents the “balance of Canadian mortgages outstanding at mid-2024” will fall by 1.2 per cent in 2025, instead of rising by 0.5 per cent, as previously predicted by TD.

The bank called that a “significant easing.”

Oh, well, that certainly sounds different than the tune sung one year ago!

And to what do we attribute this change in outlook?

Is it simply the Bank of Canada cutting interest rates?

Not exactly.

From the article:

The big bank estimates that 14 per cent of variable mortgages at the end of 2022, representing $520 billion, were switched to either fixed-rate mortgages or were prepaid, meaning homeowners increased payments or paid a lump sum.

“The renewal shock is not as worrisome,” said Maria Solovieva, an economist with TD Economics, who also noted that among those renewing are people who signed up for short-term deals and will likely now renew at a lower interest rate.

Oh, wow, credit people for actually being financially responsible! Who would have thought?

Then along came 2025 and even more interest rate cuts:

Seven interest rate cuts from 5.00% to 2.75% is hardly in line with the ten interest rate increases, from 0.25% to 5.00%, but it most certainly helps us “retreat” from the mortgage renewal cliff or crisis that has been discussed over the last two years.

As it stands now, it’s exceptionally important to note the following:

Fixed-rate mortgages are now available in the low-4% and even high-3% range. This is less than the rates at which borrowers were being stress-tested in 2020 and 2021, which were between 4.79% – 5.25%.

Say what you want about the stress test being able to predict a borrower’s ability to service a higher mortgage in the future versus the borrower’s actual ability to do so, but the point can’t be denied: these borrowers were tested and approved for these market conditions.

Not only that, banks have been much more aggressive when it comes to retaining existing business than ever before.

Once upon a time (and I would say it’s almost always been the norm…) banks treated existing clients worse than new clients simply because the banks expected to retain existing clients and felt they needed to offer better terms and better service to attract new business.

This is why I’ve always told people to work with a mortgage broker who can “shop” them to all the major lenders and surely secure better terms than their existing bank will give them, whether they’re already a mortgage-holder or whether they’re buying their first home, but feel the bank will treat them well because they’ve had their chequing account with the bank since they were 14-years-old.

So here we are in 2025 with banks doing this crazy thing: providing better terms to existing clients.

Gasp!

Egad!

Combine this with the Bank of Canada’s rate coming down from a high of 5.00% to 2.75%, and I have to ask again:

“Is the mortgage renewal cliff fact or fiction in 2025?”

So then what’s all the fuss about?

Searching Google for “mortgage renewal cliff” or “mortgage renewal crisis” results in very few articles in 2025.

Searching “mortgage renewal shock” nets us more and it also tells us that we’re no longer in a “crisis” nor are we about to fall off a “cliff.”

Take this one with a grain of salt because it’s written by an online mortgage news site, but it doesn’t s

“Mortgage Renewal Crisis Fading And Presenting Opportunity For Borrowers & Brokers”

Canadian Mortgage Professional

January 15, 2025

From the article:

It’s long been flagged as one of the most prominent coming trends in Canada’s mortgage market – and the wave of mortgage renewals slated for 2025 and 2026 is about to begin, with scores of borrowers refinancing at higher rates than they originally took out.

That burst of renewals was first viewed as a big looming challenge for the national financial system: in May last year, Canada’s banking regulator, the Office of the Superintendent of Financial Institutions (OSFI), said many homeowners were liable to face “payment shock” with 76% of mortgages outstanding as of February 2024 up for renewal by the end of 2026.

But a flurry of interest rate cuts throughout last year by the Bank of Canada, and a slide in fixed rates, saw the threat posed by the so-called “mortgage cliff” fade, with the potential jump in payments now expected to be significantly more manageable for most homeowners.

There’s that word again: manageable.

And there’s a new term that’s replacing “crisis” and “cliff.” Something called the “mortgage renewal wave.”

Instead of the media discussing the oncoming armageddon, some news sources are simply referring to the fact that a “wave” of borrowers will be renewing.

If you choose to see the positive aspect of this, it could mean that competition for an uncanny number of renewing borrowers could result in better terms and services.

Again, from an online mortgage source:

“RBC Says It’s Reay For Competitive Spring Mortgage Market And Upcoming Renewal Wave”

Canadian Mortgage Trends

March 1, 2025

So is it truly, “All good, nothing to see here”?

No.

There are a still a lot of people who will feel the financial pain in 2025 and 2026. Just not as many as initially feared and not enough to necessitate a “crisis” or a “cliff.”

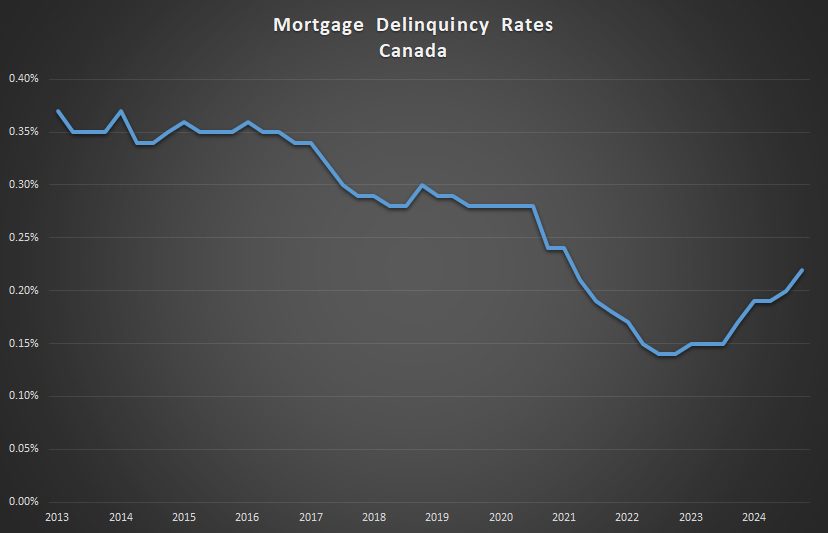

I’d be remiss if I didn’t mention the “rising delinquencies” that the media has reported on lately.

Equifax Canada reported in 2024’s Q4 that delinquency rates were up 90.2%.

That’s a big number, right?

But it’s 90.2% over the same period in 2023.

The absolute figure is still very low: only 0.22% of mortgages are in arrears.

And if we look at this in a historical context, it’s still exceptionally low:

Delinquencies were up in a time period when rates skyrocketed?

No kidding.

But hardly a crisis, no?

Alright. Perhaps now I’m giving vibes of “everything is fine, nothing to see here,” but you tell me I’m wrong.

I’m all ears…