The True Cost of Homeownership: PITI, Insurance, and Home Values

Those localized disaster impacts pale compared to the financial burden hitting virtually every American homeowner. Most analysts overlook that the fastest-growing expense in your monthly housing payment isn’t your mortgage interest or even your property taxes. It’s your homeowner’s insurance—and the numbers are staggering.

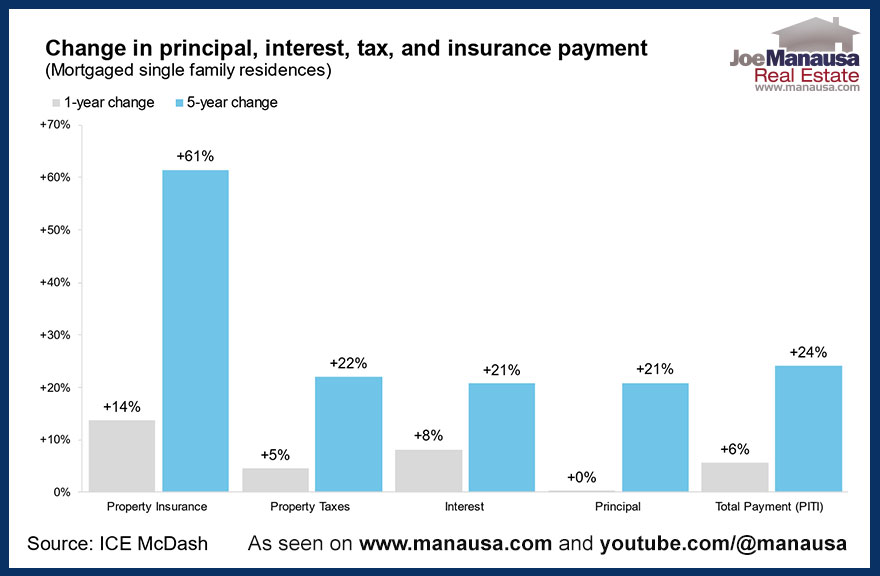

When we break down the components of PITI (Principal, Interest, Taxes, and Insurance), the average total mortgage payment increased by 6% last year. Property insurance premiums jumped by a record $276 in 2024 alone, representing a 14% annual increase and bringing the average annual premium for mortgaged single-family homes to $2,290.

This represents a concerning multi-year pattern. Since 2020, property insurance premiums have skyrocketed by $872 – a 61% increase in just half a decade, while all other housing payment components increased by only 21-22%. This additional expense is an unexpected weight on homeowners struggling with high housing costs.

These trends are particularly pronounced in Western states, where increases have outpaced national averages. Seattle and Salt Lake City experienced 22% increases in 2024, with Los Angeles at 20%. In the South, the burden is equally heavy in dollar terms, with Dallas homeowners facing a $606 annual increase and Houston close behind at $515.

Several factors drive these dramatic increases. The average annual insurance premium per $1,000 of coverage has jumped to approximately $5.40 in 2024, compared to just $4.66 between 2014 and 2022. Homeowners are attempting to manage these costs by accepting higher deductibles, with new borrowers in 2024 taking deductibles averaging $390 (19%) higher than typical mortgage holders.

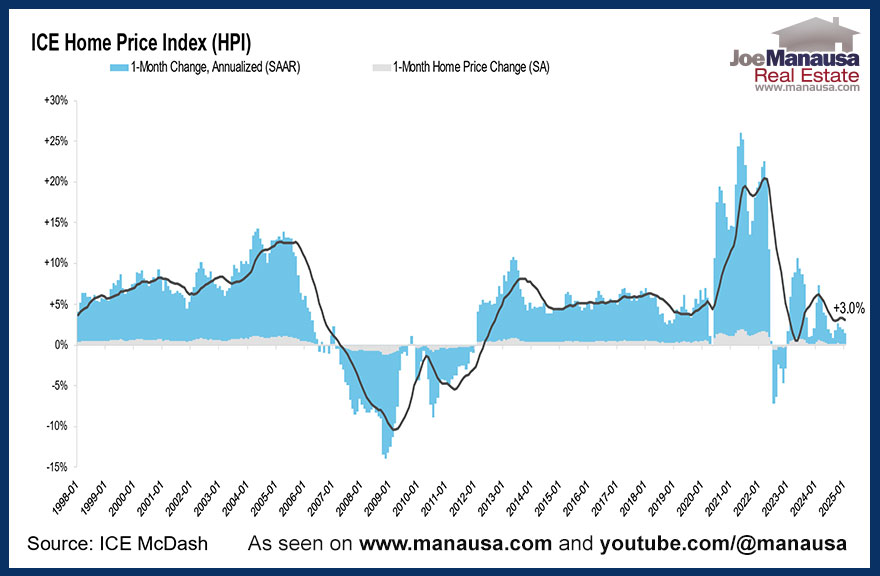

In contrast to these increasing costs, the overall market shows signs of cooling.

The ICE Home Price Index indicates annual home price growth has slowed to 3.0% in January, down from 3.4% in December – a moderation rather than collapse.

For potential homebuyers, there is at least one positive development – inventory levels have improved substantially. The national deficit has shrunk from -40% a year ago to -25% today, indicating better supply conditions across nearly every major market.