Introduction

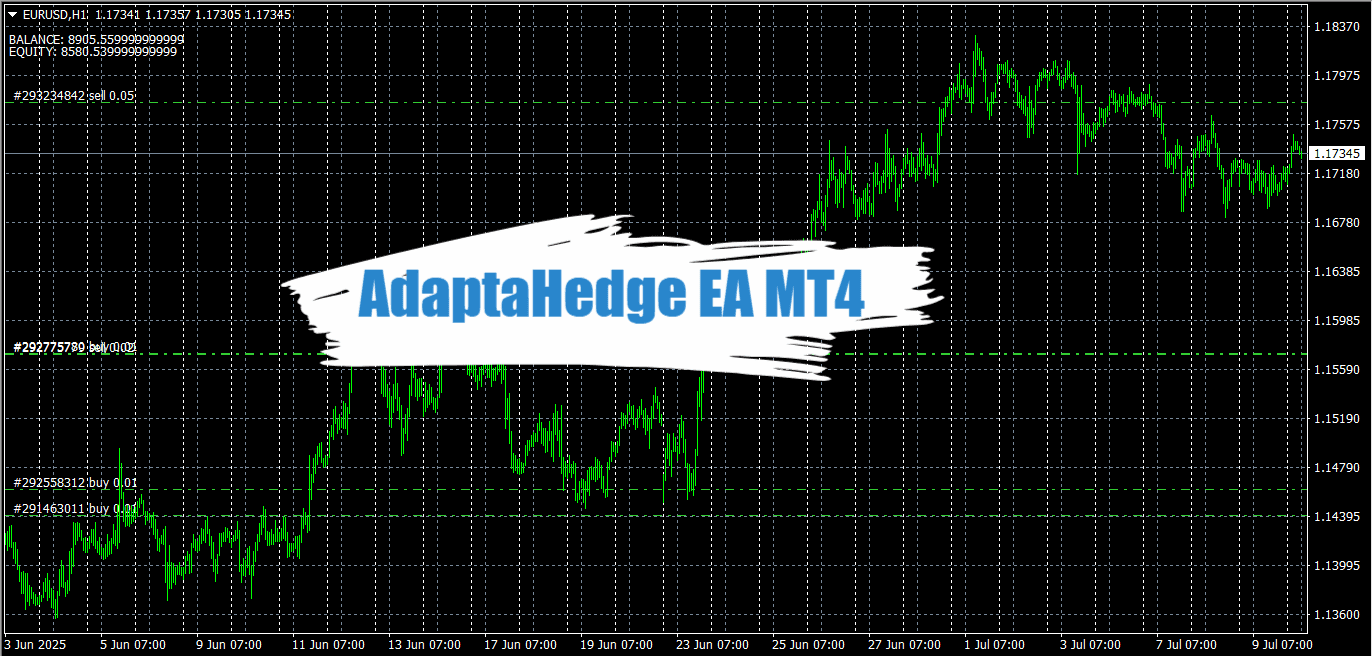

AdaptaHedge EA is a MetaTrader 4 Expert Advisor (EA) designed for algorithmic forex trading. Promising adaptive risk management, hedging capabilities, and dynamic lot scaling, it targets traders seeking automation in volatile pairs like EURUSD. This review unpacks its features, backtest results, and potential pitfalls—separating innovation from marketing claims.

Technical Specifications

Version: 1

Year of issue: 2025

Working pairs: XAU

Recommended timeframe: M15

Minimum Deposit: $500

Average of account: 1:30 To 1:1000

Best Brokers List

AdaptaHedge EA System works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

Key Features Breakdown

1. Dynamic Lot Scaling

-

Mechanism: Uses linear auto-lot scaling (

AUTO_LINEAR), increasing position sizes based on account growth. -

Range: Starts at 0.01 lots (accessible with $20) and caps at 100 lots to prevent excessive exposure.

-

Risk Control:

BaseBalanceparameter sets equity thresholds for lot adjustments.

2. Trailing Stop & Hedging Logic

-

Trailing Stop: Activates at 50 points profit, trails by 75 points to lock gains during volatility.

-

Hedging:

Second Close Hedge(600 points) closes opposing trades in choppy markets, reducing grid strategy risks. -

Stop Loss: Fixed 1,000-point hard stop per trade for capital protection.

3. Entry Precision & Indicators

-

Dual Confirmation: Combines two MAs (

MA1=3,MA2=9) to filter signals and avoid false entries. -

Grid Flexibility:

Distanceparameter (25–100 points) spaces entries for trend or range strategies.

4. Trade Management

-

Lock Target(100 points): Likely a breakeven/partial-close tool to secure profits early. -

Magic Numbers: Segregates buy/sell trades (MagicBuy=1111,MagicSell=2222) for multi-strategy accounts.

Backtest Performance Analysis

*Test Conditions: EURUSD H1, Jan-May 2025, MT4 Build 1441*

| Metric | $500 Deposit | $1,000 Deposit |

|---|---|---|

| Net Profit | $873,000 | $1,098,373 |

| Gross Profit | $5,388,418 | $5,388,418 |

| Max Drawdown | 10.64% | 8.28% |

| Total Trades | 2,440 | 2,440 |

| Win Rate | 37.34% | 37.34% |

| Avg. Win/Loss | $5,915 / -$2,806 | $5,915 / -$2,806 |

| Largest Loss | -$101,573 | -$101,573 |

Critical Red Flags

Advantages of AdaptaHedge EA

✅ Adaptive Risk Management: Auto-lot scaling aligns position sizes with account growth.

✅ Volatility-Tailored Tools: Trailing stops and hedging excel in intraday swings.

✅ Low Entry Barrier: 0.01-lot support enables testing on $20 accounts.

✅ Reduced False Signals: Indicator filters lower overtrading vs. price-action EAs.

Disadvantages of AdaptaHedge EA

⚠️ Extreme Risk of Ruin: The -$101k loss trade could annihilate small accounts if repeated.

⚠️ Backtest Reliability Issues: “Mismatched charts” and crude modeling (quality: 63%) undermine results.

⚠️ Hedging Complexity: Requires understanding margin dynamics; may increase costs in ranging markets.

⚠️ Profit Sustainability: 1,098% returns are statistically anomalous and likely non-replicable live.

Conclusion:

AdaptaHedge EA showcases intriguing ideas: dynamic lot scaling, hybrid hedging, and rigorous stop management. However, its astronomical backtest profits ($1M from $1k) and massive single-trade losses reveal classic over-optimization hallmarks. While suitable for advanced traders testing small accounts, its risk-reward profile demands rigorous forward testing. The EA’s promise of “set-and-forget” profits remains unproven—approach as a high-risk experimental tool, not a turnkey solution.

Download AdaptaHedge EA

Please try for at least a week an ICMarket demo account. Also, familiarize yourself with and understand how this free forex Tool works before using it on a live account.