Introduction: What Is the Mean Cumulative Volume Indicator?

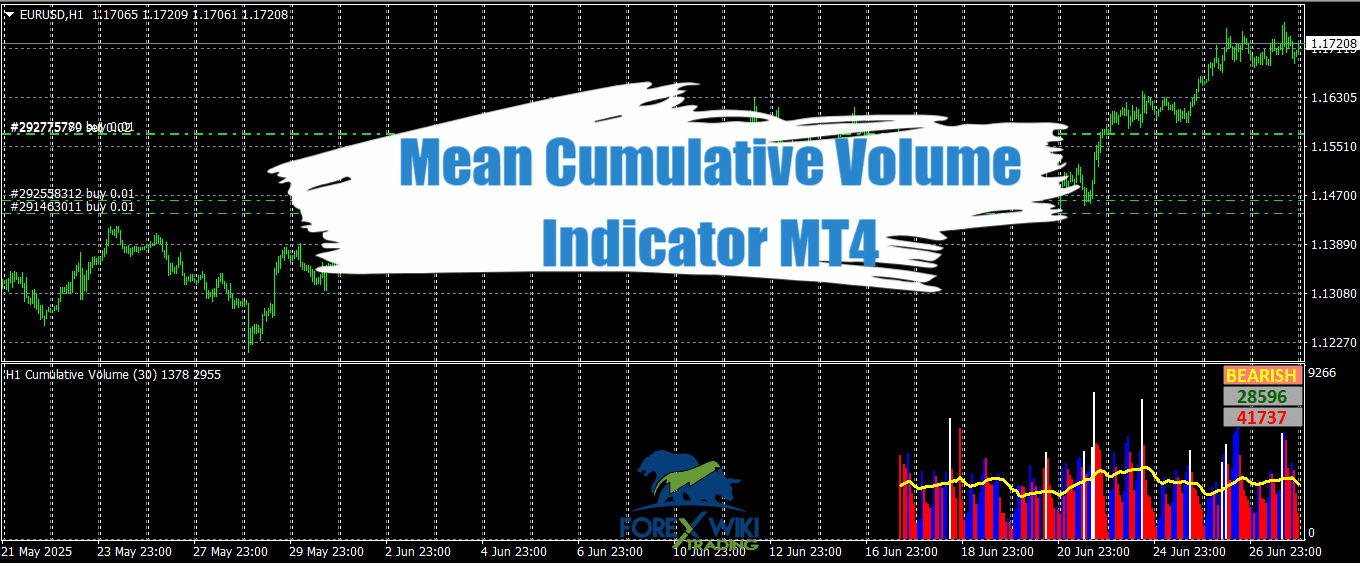

The Mean Cumulative Volume Indicator (MCVI) is a technical analysis tool measuring the total trading volume of a currency pair over a specific period. Unlike simple volume bars, it aggregates volume data cumulatively, highlighting sustained market interest. Traders use it to confirm trends, spot reversals, and filter false signals.

Technical Specifications

Version: 1

Year of issue: 2025

Working pairs: Any

Recommended timeframe: Any

Minimum Deposit: Any

Average of account: 1:30 To 1:1000

Best Brokers List

Mean Cumulative Volume Indicator System works with any broker and any type of account, but we recommend our clients use one of the top forex brokers listed below:

How the MCVI Works: The Mechanics

The MCVI calculates:

-

Mean Cumulative Volume Sum: Adds each period’s volume to a running total.

-

Normalization: Divides this sum by the total number of periods.

-

Signal Line: Plots a line where values above 0 signal bullish momentum, and below 0 indicates bearish pressure.

Example from data:

Mean Cumulative Volume 146.00000 18.00000 0.00000

This suggests a net bullish bias (146 > 0), supported by 18 periods of data.

Interpreting Buy/Sell Signals

-

BUY Signal: MCVI > 0 (e.g.,

+117065in EURUSD data). -

SELL Signal: MCVI -17209 in EURUSD data).

Real-World Case:

In the provided EURUSD chart:

Advantages of the Mean Cumulative Volume Indicator

-

Trend Confirmation:

-

Noise Reduction:

-

Divergence Detection:

Limitations and Risks

Best Practices for Traders

-

Pair with Price Action: Use MCVI to confirm support/resistance breaks.

-

Adjust Settings: Shorten the

VolumeMaPeriod(default: 30) for day trading; lengthen for swings. -

Customize Alerts: Set notifications for MCVI crossovers of 0 (e.g., via Telegram bots like

free_fx_pro).

Conclusion: Is the Mean Cumulative Volume Indicator Worth Using?

The Mean Cumulative Volume Indicator shines as a trend-confirmation tool, especially for intraday forex traders. Its ability to quantify volume-driven momentum adds depth to technical strategies. However, its lagging calculations and vulnerability to range-bound markets necessitate cautious use. While not a holy grail, the MCVI—when layered with price analysis and risk management—can sharpen a trader’s edge.