Real estate is changing fast, and so must you. Inman Connect San Diego is where you turn uncertainty into strategy — with real talk, real tools and the connections that matter. If you’re serious about staying ahead of the game, this is where you need to be. Register now!

The Trump administration is using its tight control over mortgage giants Fannie Mae and Freddie Mac to go after another political opponent, this time suggesting that California Democratic Sen. Adam Schiff committed mortgage fraud when purchasing and refinancing a home he owns in Maryland by claiming it as his primary residence.

The Federal Housing Finance Agency (FHFA), Fannie and Freddie’s regulator, has sent a criminal referral to the U.S. Justice Department requesting further investigation, the New York Post reported Tuesday, citing an anonymous senior administration official.

Trump himself claimed on Truth Social that Schiff “has engaged in a sustained pattern of possible mortgage fraud” and that “CROOKED Adam Schiff … needs to be brought to justice.”

Schiff denied the allegations, which first surfaced nearly two years ago, calling them a “baseless attempt at political retribution [that] won’t stop me from holding Trump accountable.”

“Since I led his first impeachment, Trump has repeatedly called for me to be arrested for treason,” Schiff said on the social media platform X. “So in a way, I guess this is a bit of a letdown.”

A spokesperson for Schiff told Inman in a statement the allegations are “baseless” and “have been previously debunked.”

When Schiff was running for Senate in 2023, CNN reported on property records showing he claimed a Maryland property as his primary residence when he purchased it in 2003, and also when he refinanced the property in 2009, 2010, 2011, and 2012.

A spokesperson for Schiff told CNN at the time that he listed both his California and Maryland addresses as primary residences for loan purposes “because they are both occupied throughout the year and to distinguish them from a vacation property.”

CNN reported in 2023 that “multiple real estate law experts” told the publication that “ambiguous language of the law means Schiff is likely legally in the clear in regard to his taxes and mortgage.”

Schiff’s spokesperson told Inman Tuesday that the lenders who provided the mortgages for both homes “were well aware of then-Representative Schiff’s Congressional service and of his intended year-round use of both homes, neither of which were vacation homes. He has always been completely transparent about this.”

Trump is “trying to desperately smear” Schiff to distract the public from controversy surrounding the Justice Department’s decision not to release records in Jeffrey Epstein’s sex trafficking investigation, the spokesperson said.

Schiff is a longtime Trump critic who was the lead prosecutor making the case for Trump’s impeachment in the Senate in 2018, and was the 25th Democrat to be censured by the Republican-led House in 2023 over the comments he made about Trump’s alleged ties to Russia, PBS reported at the time.

Letitia James also claims ‘political retribution’

The Trump administration’s pick to oversee mortgage giants Fannie Mae and Freddie Mac, FHFA Director Bill Pulte, in April sent a criminal referral letter to the U.S. Department of Justice suggesting that New York Attorney General Letitia James had made misrepresentations about two properties she owns in order to receive better loan terms.

James — who won a $486 million civil fraud judgment against Trump that is under appeal — has denied the allegations, calling them baseless.

In an April 24 letter to Attorney General Pam Bondi demanding the investigation be closed, James’ attorney said the accusations were disproven long ago and amount to “political retribution.”

Pulte cherry-picked documents when filing the criminal referral and ignored other records “which refute the allegations of impropriety, and make clear that a mistake on one line had no significance,” James’ attorney, Abbe Lowell, alleged in a letter to Bondi published by the Associated Press.

“U.S. Federal Housing Director William Pulte is the latest administration officer to carry out the all-too-familiar playbook of the President: Praise the judicial system and those who serve it when he wins; criticize it when he loses, and attack those — attorneys and judges, alike — who are doing their jobs to protect and uphold the rule of law,” Lowell wrote.

Pulte, who appointed himself the chair of Fannie and Freddie in March, has claimed fraud is “rampant” among loans guaranteed by the mortgage giants.

The FHFA director announced in May that Fannie Mae had awarded a contract to controversial Silicon Valley data analytics company Palantir Technologies to help it detect fraud.

A longtime government contractor, Palantir’s business has taken off under Trump, with new defense contracts helping the company grow Q1 revenue from federal contracts by 45 percent from a year ago, to $373 million.

But Palantir has also come under scrutiny as it wins business that raises privacy concerns, such as an Immigration and Customs Enforcement (ICE) contract to build a platform that tracks the movements of immigrants.

A senior IRS official told CNN in April that employees at the agencies are concerned that Palantir is being used to mine taxpayer data to track down immigrants and deport them.

Silicon Valley investor Paul Graham has accused Palantir of “building the infrastructure of the police state,” and demanded that the company make a public commitment that it will not build tools that could be used by the government to violate citizens’ rights, NPR reported in May.

Fannie Mae fraud findings

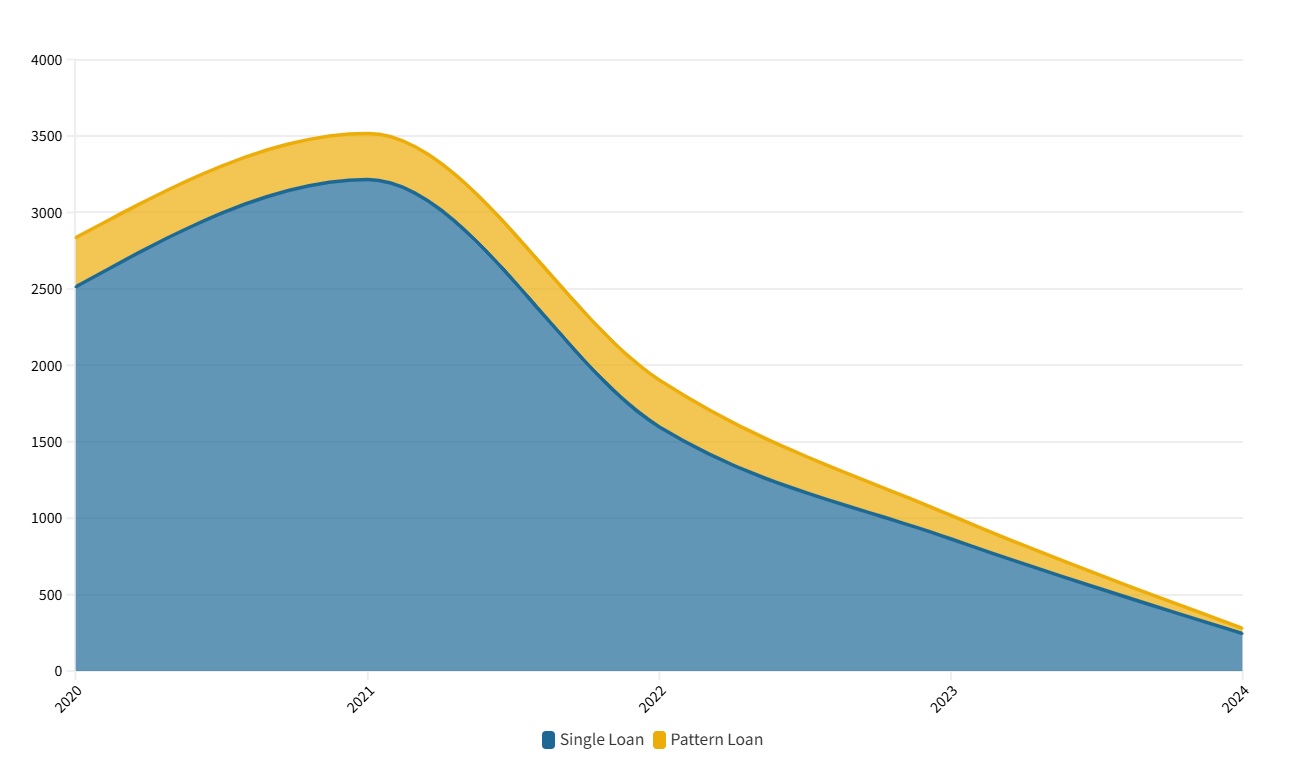

Fraud findings on Fannie Mae-backed mortgages, 2020-2024. Source: Fannie Mae.

Mortgage fraud can go undetected for many years and is often discovered only when a borrower stops paying their loan.

Fannie Mae’s Financial Crimes team has uncovered evidence of fraud in 3,517 single-family loans originated in 2021, including 3,215 single loans and 302 “pattern loans” — loans in which a common pattern of activity involving the same individual or company was discovered.

Fannie Mae provided backing for 4.8 million single-family loans in 2021 — 1.5 million purchase loans and 3.3 million refinancings.

As of May 8, Fannie Mae investigators had uncovered evidence of fraud in only 280 loans originated last year — 245 single loans and 35 “pattern loans.”

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.