iXBRL which promotes transparency and standardisation in financial disclosures, has become vital than ever with HMRC being one of the early adopters. While essential for compliance, traditional tagging methods are often time-consuming and cumbersome.

While iXBRL service providers have serviced their clients in quick turnarounds even less than 24 hours in many cases, Accounting Firms, CFOs and Finance pros are always pressed for time especially during the filing season. As regulatory demands increase and reporting cycles tighten, it’s time for AI to enter RegTech.

Why Traditional Digital Reporting is No Longer Enough

Manual iXBRL tagging presents three major challenges:

1. It’s time-consuming — requiring technical expertise and significant hours from service providers.

2. It can be a costly affair — depending upon the elements that need to be tagged regulatory updates.

3. Prone to error – While the delivered output is free of errors, initial drafts are mis-tagged, misunderstood and misinterpreted.

In an environment where accuracy and speed are non-negotiable, these limitations are costly.

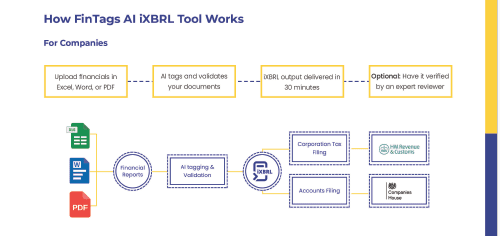

How AI Transforms iXBRL Tagging

AI-powered reporting tools will reshape the landscape. These solutions go beyond simple automation — they learn from historical data of past 5 years, apply contextual intelligence, and continuously update taxonomies in line with regulatory changes.

• Upto 85% information is accurately tagged

• Remaining 15% inconsistencies are offered as suggestion for confirmation from filers

iXBRL tagging becomes smarter and faster with AI. Tags are automated based on prior reports, inconsistencies are reflected upon in real time, and taxonomy management is centralised.

More importantly, AI frees inhouse finance teams from the mad pressure around filing season delivering the reports in 30 minutes — allowing them to focus on analysis, insight, and decision-making.

5 Reporting Risks AI Can Eliminate

For finance leaders evaluating digital reporting strategies, risk reduction is a critical driver for AI adoption.

1. Tagging Inconsistency

AI ensures standardisation across reporting periods and entities, reducing discrepancies.

2. Human Error

Pattern recognition and intelligent checks reduce the likelihood of mis-tagging or data entry mistakes.

3. Version Control Issues

Centralised AI-driven platforms prevent duplication and confusion across report versions.

4. Compliance Gaps

AI tools track regulatory changes and automatically incorporate taxonomy updates.

5. Inefficient Reporting Cycles

Automating repetitive tagging tasks significantly shortens the time-to-disclosure.

The Future of Reporting is Data-Driven

AI is not here to replace finance professionals — it’s here to elevate them.

By removing the manual burden of iXBRL tagging, AI enables finance teams to shift from compliance administrators to data strategists. Reporting becomes not just faster and more accurate, but a foundation for real-time insight and business intelligence.

In a world where stakeholders expect transparency and regulators demand precision, AI-powered reporting isn’t just a competitive advantage — it’s fast becoming a necessity.

Get Started

Finance teams that embrace AI-driven digital reporting are future-proofing their processes, reducing operational risk, and unlocking capacity for higher-value work.

The question is no longer if AI will reshape financial reporting — but when your organisation will take the next step. www.fintags.ai

Meet the FinTags team on stand 437 at Accountex London, taking place at Excel London on the 14-15 May, 2025.