Valuation and depreciation are essential tools for assessing the profitability of a business enterprise. These elements are critical in preparing the farm accounts that reveal the profitability of a farm business, specifically through the profit and loss statement.

Read Also: Required Husbandry Skills of Rabbit Production

Meaning and Importance of Farm Income Statement or Profit and Loss Statement

Farm income refers to profits and losses incurred through farm operations. A farm income statement, also known as a farm profit and loss statement, summarizes the income and expenditure over a specified accounting period, typically the calendar year from January to December for farmers.

The contents of this statement reveal enterprises with high expenditures and those with high accrued revenue. This information is valuable in identifying which components of the farm business require more investment and which areas of production need to be scaled back.

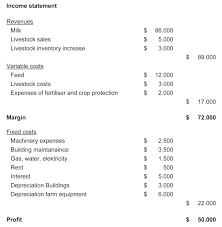

The farm income statement summarizes the income, expenses, and resulting profit or loss from farming operations during the calendar year. Table 1 illustrates the farm income statement of a farming enterprise, with income listed on the left-hand side and expenditure on the right-hand side.

There are two types of farm income and farm expenses: cash income and cash expenses, and non-cash income and non-cash expenses.

i. Cash income refers to cash receipts from sales of produce such as crops, animals, and by-products.

ii. Non-cash income refers to income not received directly in cash, also known as imputed income. Examples include unsold harvested crops, unsold animals (or the value of closing stock), supplies, the value of crops and animals consumed at home, and gifts.

iii. Cash expenses are expenditures made by farmers that involve cash payments or cheques.

iv. Non-cash expenses are expenditures that do not involve direct cash payments. Examples include net depreciation of equipment, unpaid wages for family labor, and decreases in inventory.

The first section on the right-hand side of the income statement lists cash farm income from all sources, while the lower part lists non-cash income. Similarly, the upper part of the expenditure section contains cash expenses, and the lower part contains non-cash expenses.

The difference between Gross Cash Farm Income and Total Cash Expenses is known as Net Cash Farm Income, representing the net farm income on a cash basis.

The difference between total income (the sum of cash income and non-cash income) and total expenditures (the sum of cash expenses and non-cash expenses) is referred to as Net Farm Income.

This “Net Farm Income” represents the return to the operators and family for unpaid labor, management, and equity capital (net worth). In other words, it is the return on all resources owned by the farm family that were not purchased or paid as wages. However, it does not include asset appreciation, debt forgiveness, or asset repossessions.

Read Also: Rabbit Record Keeping and Analysis

Other Definitions

i. Gross Cash Income: The total of all receipts from the sale of crops, livestock, and farm-related goods and services, as well as any direct payments from the government.

ii. Gross Farm Income: Similar to gross cash income but includes non-cash income, such as the value of self-produced food consumed at home.

iii. Net Cash Income: The gross cash income minus all cash expenses, such as for feed, seed, fertilizer, property taxes, interest on debt, wages, contract labor, and rent to non-operator landlords.

iv. Net Farm Income: The gross farm income minus both cash and non-cash expenses, such as capital consumption and farm household expenses.

v. Net Cash Income: A short-term measure of cash flow.

This article has introduced the basic concepts related to the farm profit and loss statement and explained how to prepare it. The profit and loss statement, as a crucial part of farm accounts, provides insight into the profitability of a farm business.

It includes both farm income and expenditure (cash and non-cash), with the difference between total income and total expenditure referred to as net farm income (NFI). A positive NFI indicates profit, while a negative NFI indicates loss.

Do you have any questions, suggestions, or contributions? If so, please feel free to use the comment box below to share your thoughts. We also encourage you to kindly share this information with others who might benefit from it. Since we can’t reach everyone at once, we truly appreciate your help in spreading the word. Thank you so much for your support and for sharing!

Read Also: Waste Recycling Industry Trends: What You Need to Know