If your insurance carrier offers a surprising single-digit renewal increase after years of double digit increases, you might think you’re getting a great deal. You’re not.

Insurance companies have spent years conditioning employers to believe that anything under 10 percent is a bargain. But behind the scenes, they are profiting from this belief. Employers who automatically renew without shopping the market are often overpaying—sometimes by thousands per employee each year.

The Hidden Cost of “Good” Insurance Renewals

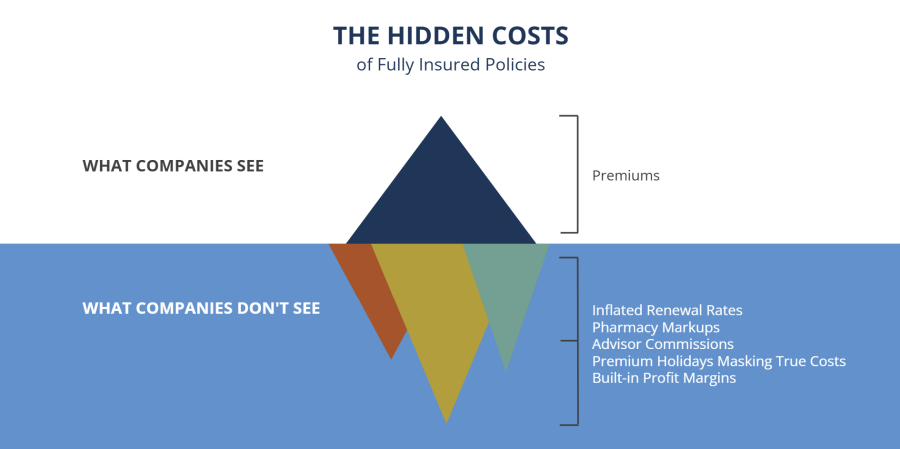

Carriers use specific strategies to discourage employers from looking elsewhere. They often:

- Inflate initial renewal rates, then lower them just enough to create temporary relief and prevent shopping.

- Offer short-term perks like premium holidays or wellness credits to keep businesses locked in.

- Create fear of disruption, making a switch seem more difficult than it is.

These tactics ensure that insurance companies maintain control over pricing while employers remain in the dark about their true options.

The No-Quote Trap: How Carriers Discourage Shopping Around

Carriers don’t want employers comparing options because competition drives prices down. Instead, they use strategies designed to make staying put seem like the best decision.

Common strategies include:

- Frame a low renewal as a win. Employers see a five percent increase and believe they avoided a major jump—without realizing they are still overpaying and that the loss resulting from the lower premium will be made up for in other areas of the plan.

- Create fear of disruption. Carriers highlight the effort required to switch plans, making the process seem overwhelming when, in reality, seamless transitions are possible.

- Build a false sense of loyalty. Insurance companies position themselves as trusted partners while continuing to raise costs year after year.

- Incentivize advisors to discourage shopping. Many advisors receive contingent commissions or other back-end bonuses from carriers for renewing business with the same provider. This means they have a financial interest in keeping employers from seeking alternative proposals, even if better options exist.

Employers who fall into this trap don’t realize they have lost control of their healthcare costs. What seems like a stable, predictable expense is actually a pricing model designed to maximize profits for the carrier—not savings for the employer.

The Hidden Incentives That Keep Employers Stuck

Beyond psychological tactics, insurance carriers offer short-term incentives to make renewing without shopping the market feel like a smart choice. These perks come with strings attached, ensuring that costs remain inflated.

Strings like these:

- Advisors’ commissions. Many advisors receive bonuses from carriers when they keep employers on the same plan, even if better options exist elsewhere.

- Premium holidays. Carriers waive one or two months of premiums if a company renews without seeking other proposals. This creates the illusion of savings while keeping long-term costs high.

- Wellness fund incentives. Some employers receive wellness credits for implementing programs like smoking cessation, but only if they agree not to explore competing offers. These funds are small compared to the potential savings of a more competitive plan.

Each of these incentives is carefully designed to keep businesses locked into the same overpriced system. Employers accept them, believing they are making a sound financial decision when they are actually allowing the carrier to maintain its hold on pricing.

The Merry-Go-Round Effect: Why Your Costs Will Always Rise

Employers who renew without questioning their rates often believe they are controlling costs. But insurance companies don’t eliminate increases—they delay them or move them elsewhere in the plan.

Carriers may recover the lost revenue by tightening claims processing, increasing deductibles, or shifting costs to employees in ways that aren’t immediately obvious.

A typical renewal cycle follows this pattern:

- Carrier proposes a 20 to 25 percent increase, knowing it will cause concern.

- A competitor offers a 5 percent increase or even a cost reduction.

- The original carrier suddenly matches that 5 percent to retain the business.

- The following year, the carrier recovers the deferred increase, pushing rates up 25 to 30 percent.

- Employers stay stuck in this cycle, believing they successfully avoided a major increase when they only postponed it.

By the time businesses realize what’s happening, they have spent years overpaying while seeing no meaningful reduction in healthcare costs.

The only way to break this cycle is to stop playing by the insurance company’s rules and take control of plan costs.

How to Break Free—A Smarter Way to Manage Healthcare Costs

Employers who take control of their healthcare strategy don’t wait for a renewal notice to dictate their next move. They make proactive decisions that reduce long-term costs without cutting benefits.

Here’s how they do it.

- Move from fully insured to self-funding through a stop-loss group captive program. Traditional insurance is built on high profit margins. Self-funded and captive models eliminate unnecessary markups, keeping more money in the employer’s hands.

- Gain full transparency over claims costs. Fully insured plans provide little to no insight into spending. A self-funded model gives employers access to real claims data, allowing them to identify cost drivers and implement targeted savings strategies.

- Cut out inflated pharmacy costs. Carriers profit from prescription drug markups and rebates, charging employers far more than necessary. Self-funded plans allow businesses to work with independent pharmacy benefit managers, securing medications at dramatically lower prices.

- Control your healthcare budget like any other business expense. Instead of accepting unpredictable renewal increases, self-funded employers make data-driven decisions that keep costs stable while maintaining high-quality benefits.

Employers who self-fund their healthcare plans don’t just reduce spending—they break free from a system designed to keep them overpaying. This approach is how the companies in the next section achieved their savings.

Proof That Breaking Free With Self-Funding Works

Businesses that switch to self-funding see immediate and long-term savings while maintaining strong employee benefits.

These companies eliminated unnecessary costs, gained transparency into their claims, and took control of their healthcare spending:

- A New Start Clinics reduced its healthcare costs by 36%, lowering per-employee expenses from $8,000 to $5,100 in just one year. By gaining full transparency into claims data, they implemented cost containment strategies that weren’t possible under their fully insured plan.

- United Food Bank saved over $100,000 in its first year of self-funding, using the savings to expand mental health and wellness benefits for employees. Instead of blindly accepting annual premium increases, they now have control over their healthcare costs.

- Totem Solutions cut its healthcare costs by 66%, reducing per-employee expenses from $10,000 to $3,400 after switching to self-funding. By leading by example, they proved that self-funding is a sustainable, cost-effective solution for businesses.

None of these savings would have been possible under a fully insured plan. These businesses took control, made data-driven decisions, and broke free from a system designed to keep costs high.

Are You Ready to Get Off the Merry-Go-Round?

Employers who continue renewing their insurance plans without questioning pricing are gambling with their financial future. The real risk isn’t making a change—it’s staying on a system that guarantees rising costs.

Every year you delay making a change, your costs climb higher. The incentives insurance carriers offer are designed to keep you from looking at better options. The only way to control healthcare spending is to stop accepting whatever the carrier offers and demand transparency.

Businesses that take action and switch to self-funding now won’t just save money next year—they will fundamentally change how they manage healthcare costs for the future.

Connect with a Roundstone rep today and find out how easy it is to get off the merry-go-round, once and for all.