“Democracy is the theory that the common people know what they want, and deserve to get it good and hard.”

– H. L. Menckken

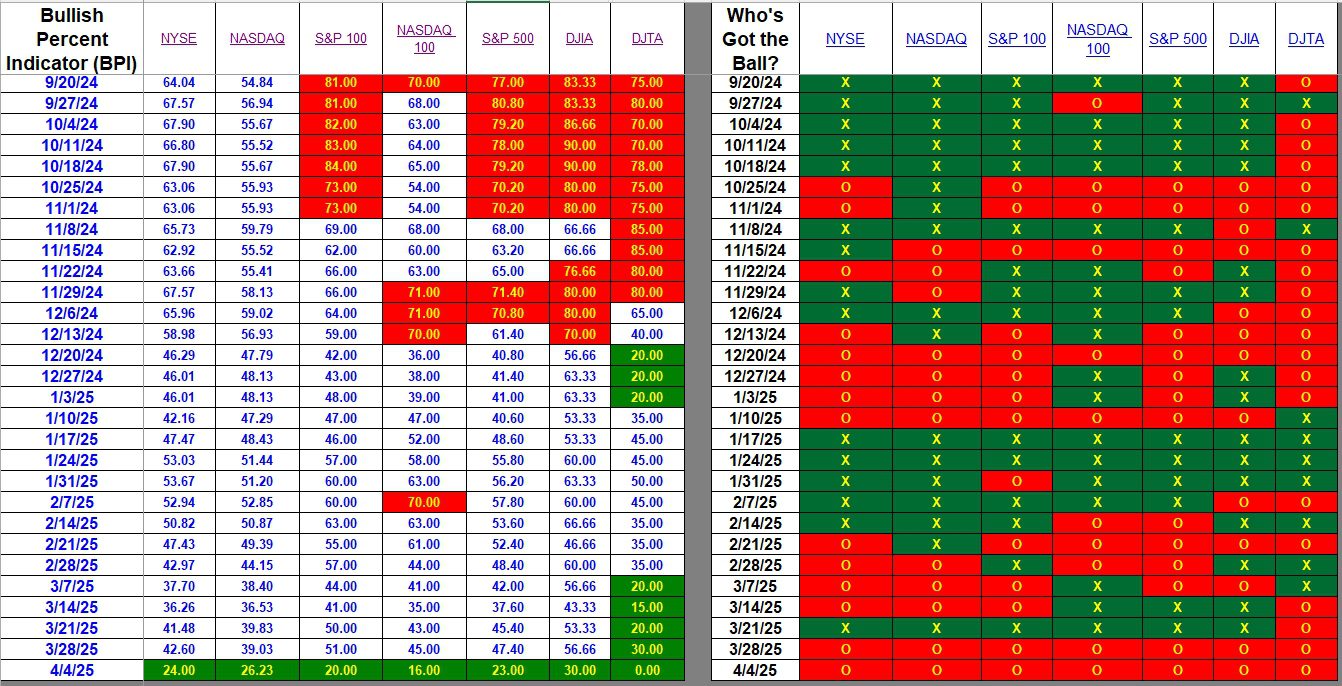

In all the years I’ve been tracking the Bullish Percent Indicators (BPI), as shown below, I never witnessed such a precipitous drop in prices as we experienced the last two trading days this week. No, I was not tracking BPI data in October of 1987. Prior market corrections contained some semblance of rational behavior. This debacle is self-inflicted and defies common sense reasoning.

Where does this leave us as investors? How does one negotiate chaos and uncertainty, something stock markets abhor? This is a real test for the Sector BPI investing model. While the three Sector BPI portfolios are not scheduled for reviews this coming week, I plan to update all as there are Buy signals flashing as readers will see in the following data tables.

Index BPI

All seven major indexes of the U.S. stock market are bearish. I have never seen one hit rock bottom as is the case for the Dow Jones Transportation Average (DJTA). Not one stock contained in this index is bullish. Nor do I recall all seven indexes positioned in the oversold zone at one time.

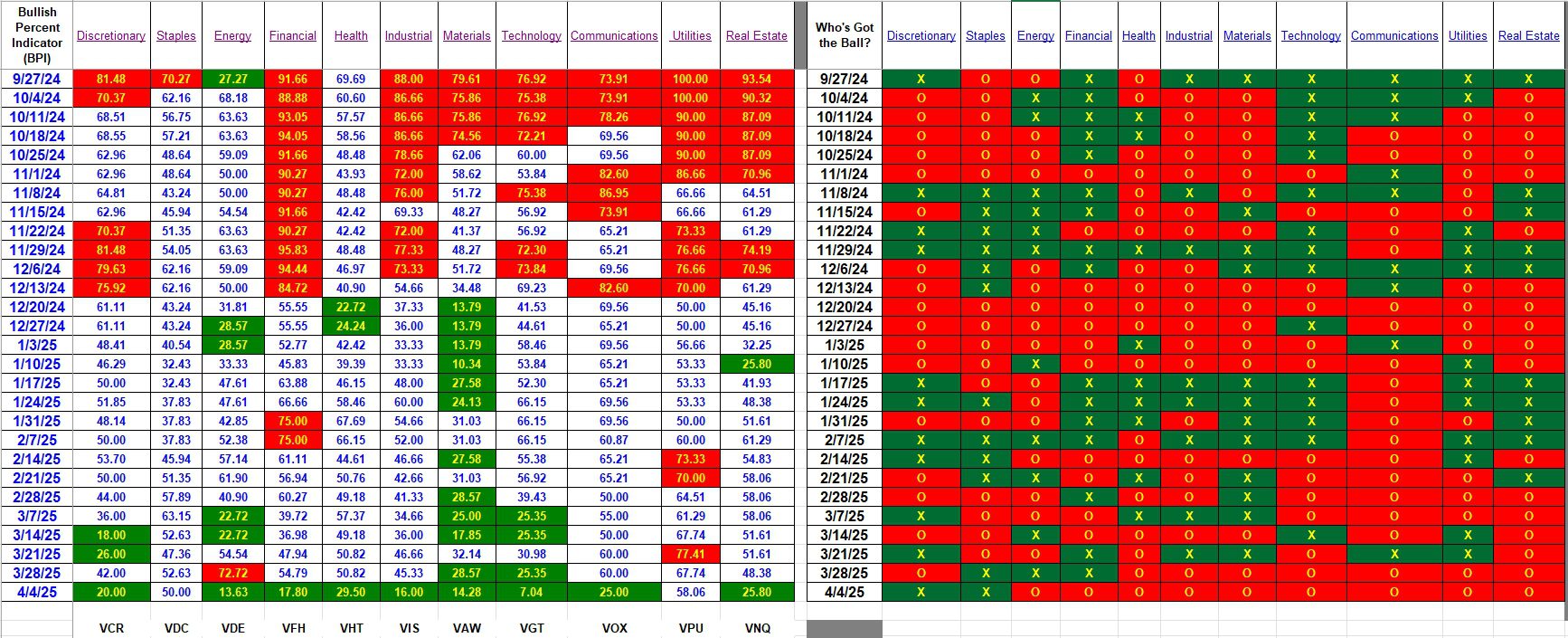

Sector BPI

Now we check the eleven sectors that make up the U.S. equities market. This is where we go for information and guidance for the Sector BPI investing model. Using the Carson Portfolio as an example, the Sector BPI portfolios already hold shares in seven of the eleven sectors.

Three more sectors dropped into the oversold zone this week and they are:

- Financial (VFH)

- Industrial (VIS)

- Communications (VOX)

It is important to separate a sector from the ETF that covers that sector. I use StockCharts to determine whether a sector is Bullish, Bearish, or Neutral. A bearish sector is when the percent of bearish stocks within that sector drop to 30% or below. In the following table, Discretionary is only 20% bullish or well below the 30% threshold. Therefore, Discretionary is considered oversold so we purchase shares of VCR. The percentage to hold is explained elsewhere on this blog.

To populate these three sectors shares of SHV will be sold. If insufficient cash is raised from this sale I will dip into VOO, painful as it may be to sell shares at lower prices. The argument is that sectors, when positioned in the oversold zone, will rise faster then the broad market when recovery arrives.

If you are a new reader and not familiar with the Sector BPI investing model, do a search for Sector BPI and follow the reviews of the Carson, Franklin, and McClintock.

(Visited 25 times, 1 visits today)

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.